Asian Growth Companies With Significant Insider Ownership In November 2025

Reviewed by Simply Wall St

As global markets navigate through a landscape of mixed economic signals, including the recent U.S.-China trade truce and steady interest rates in Japan and Europe, investors are keenly observing growth opportunities in Asia. In this environment, companies with significant insider ownership often attract attention due to their potential for aligned interests between management and shareholders, making them intriguing candidates for those seeking growth stocks.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 30% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.8% |

We're going to check out a few of the best picks from our screener tool.

Kotobuki Spirits (TSE:2222)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kotobuki Spirits Co., Ltd. is engaged in the production and sale of sweets both domestically in Japan and internationally, with a market cap of ¥302.24 billion.

Operations: Kotobuki Spirits generates revenue through the production and sale of sweets both within Japan and in international markets.

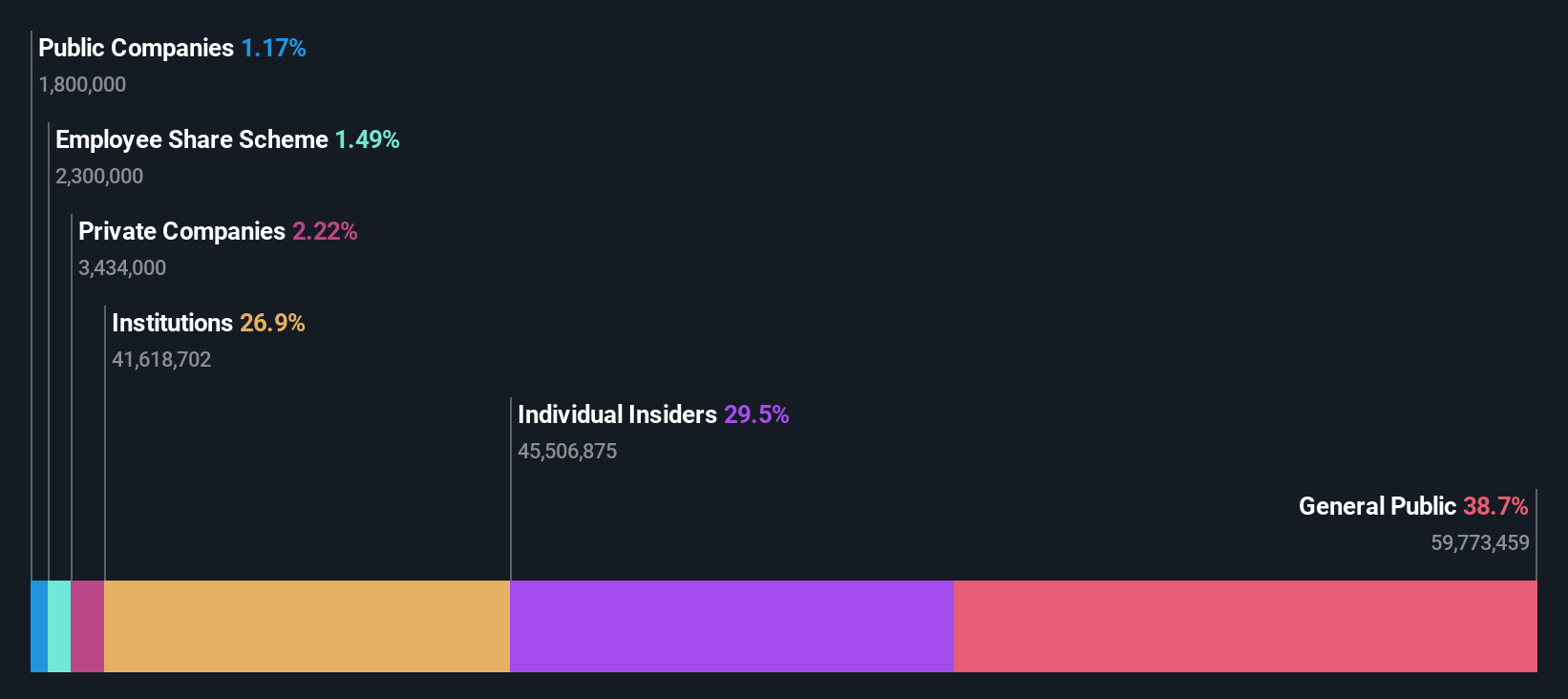

Insider Ownership: 29.5%

Kotobuki Spirits is positioned for growth with forecasted earnings and revenue increases of 10.8% and 7.6% per year, respectively, outpacing the JP market averages. The stock trades at a significant discount to its estimated fair value, with analysts anticipating a 28.5% price rise. Despite an unstable dividend history, insider ownership remains high without recent trading activity, suggesting confidence in its growth trajectory amidst robust return on equity forecasts of 25.3%.

- Click here to discover the nuances of Kotobuki Spirits with our detailed analytical future growth report.

- Our valuation report here indicates Kotobuki Spirits may be undervalued.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates globally in e-commerce, fintech, digital content, and communications services with a market cap of approximately ¥2.20 trillion.

Operations: The company's revenue is primarily derived from its Internet Services segment at ¥1.32 billion, followed by Fin Tech at ¥880.53 million and Mobile services at ¥468.73 million.

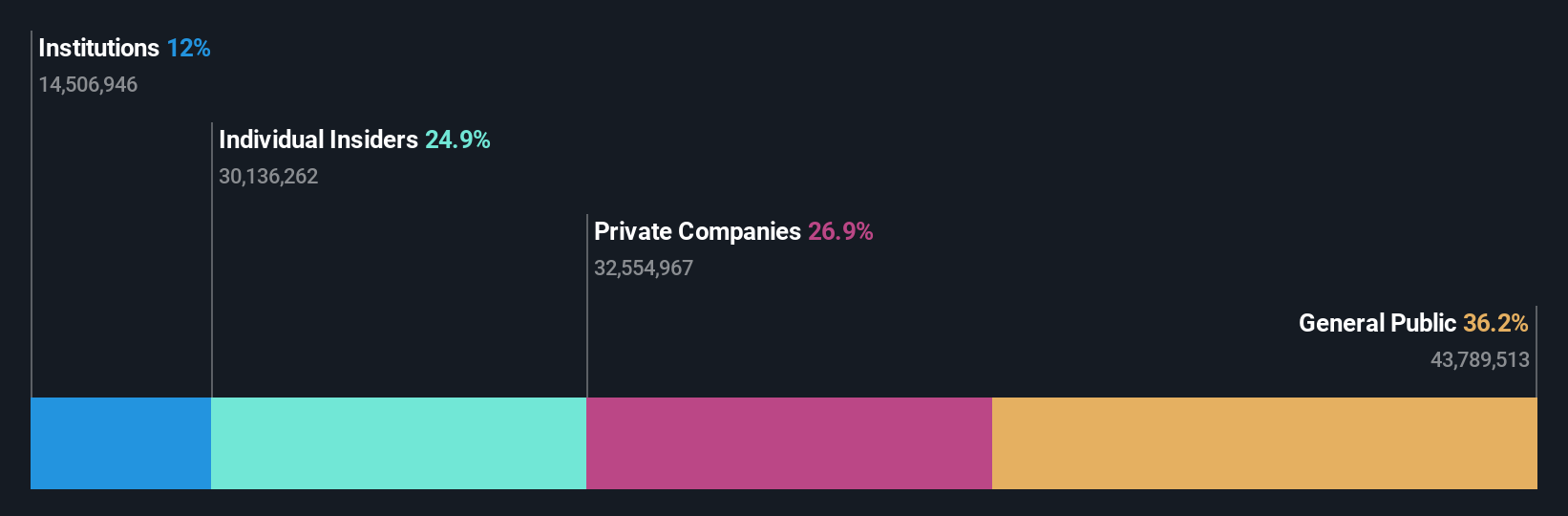

Insider Ownership: 12%

Rakuten Group is poised for growth, with earnings expected to increase by 77.05% annually and revenue projected to grow at 6.6% per year, outpacing the JP market average of 4.4%. Despite a low future return on equity forecast of 11.5%, its potential profitability within three years is above market expectations. Recent financial maneuvers include early bond redemptions totaling JPY 36 billion and a JPY 27 billion impairment loss in Q3, reflecting strategic restructuring efforts.

- Unlock comprehensive insights into our analysis of Rakuten Group stock in this growth report.

- Our comprehensive valuation report raises the possibility that Rakuten Group is priced lower than what may be justified by its financials.

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★★★

Overview: Chenbro Micom Co., Ltd. is involved in the R&D, design, manufacturing, processing, and trading of computer peripherals and systems globally with a market cap of NT$120.38 billion.

Operations: The company generates revenue primarily from computer peripherals, amounting to NT$17.73 billion.

Insider Ownership: 24.8%

Chenbro Micom demonstrates robust growth potential, with earnings and revenue expected to grow significantly faster than the Taiwan market at 27.9% and 28.4% annually, respectively. Recent financial results show substantial improvement, with Q2 sales reaching TWD 5.44 billion and net income of TWD 828.94 million, indicating strong operational performance. Despite high share price volatility recently, insider ownership remains stable without significant recent trading activity, supporting confidence in the company's strategic direction and long-term growth prospects.

- Take a closer look at Chenbro Micom's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Chenbro Micom's share price might be too optimistic.

Seize The Opportunity

- Get an in-depth perspective on all 623 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Contemplating Other Strategies? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kotobuki Spirits might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2222

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives