- China

- /

- Tech Hardware

- /

- SZSE:301606

Global High Growth Tech Stocks To Watch In Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience, with U.S. stocks advancing despite volatile geopolitical headlines and small-cap indices like the Russell 2000 outperforming their large-cap counterparts. As inflation trends lower than expected and business activity accelerates, investors are increasingly focused on high-growth sectors such as technology, where innovative companies can capitalize on expanding market opportunities and robust demand for digital solutions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 36.03% | 47.77% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi TechnologyLtd | 20.20% | 31.67% | ★★★★★★ |

| Shengyi Electronics | 23.62% | 31.31% | ★★★★★★ |

| KebNi | 23.66% | 69.18% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CD Projekt | 36.72% | 49.58% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Shenzhen Sunline Tech (SZSE:300348)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunline Tech Co., Ltd. provides banking software and technology services to financial institutions globally and has a market cap of CN¥11.72 billion.

Operations: The company specializes in delivering software solutions and technology services tailored for the banking and finance sector on a global scale. Its primary revenue streams are derived from offering these specialized services to financial institutions.

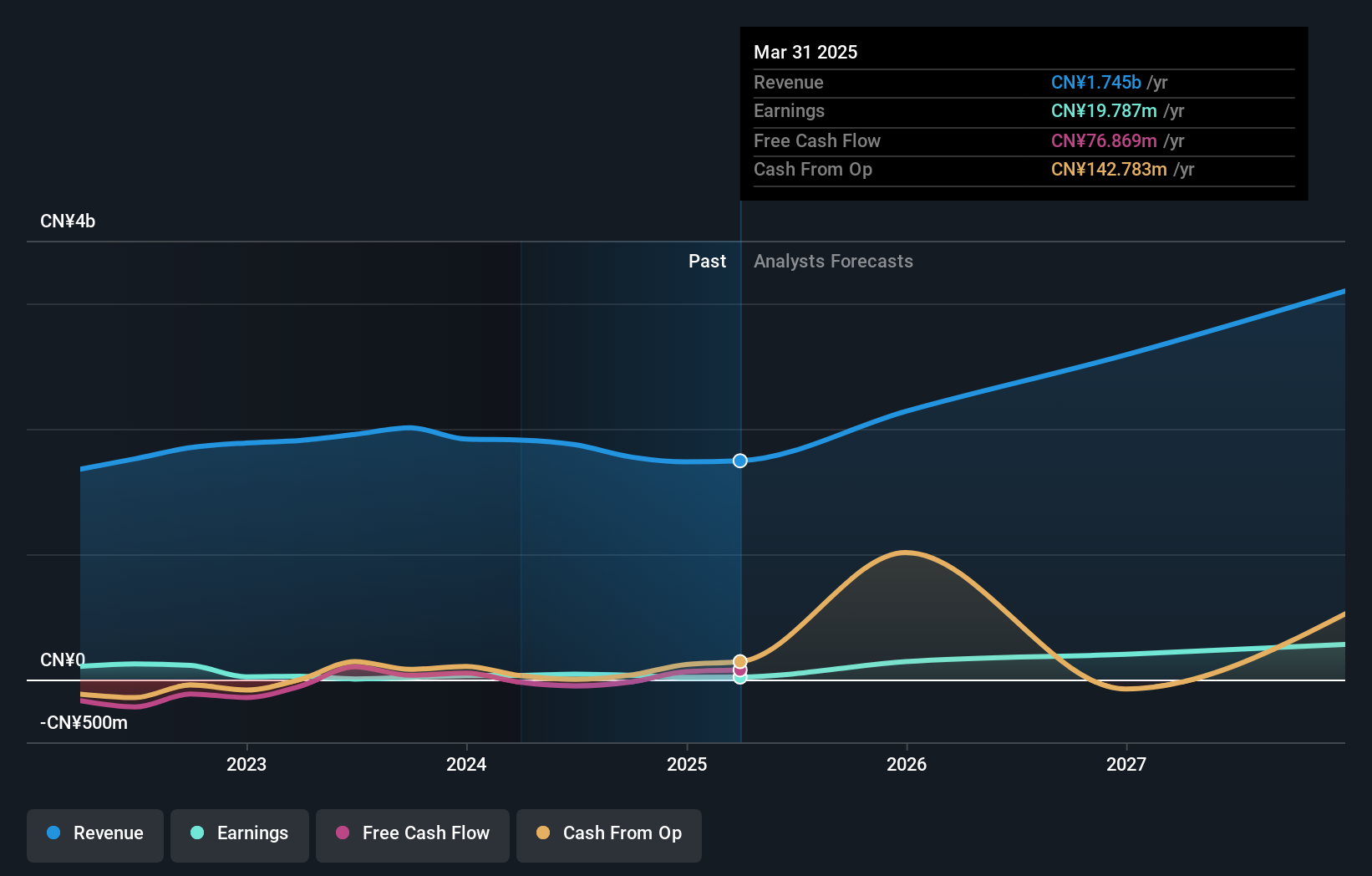

Shenzhen Sunline Tech, despite a challenging year with a net loss of CNY 11.39 million from revenues of CNY 1.09 billion, is poised for significant recovery with projected earnings growth at an impressive 75% annually. This outpaces the broader Chinese market's expectation of 26.4%, underscoring potential resilience and adaptability in its operations. The company's commitment to innovation is evident in its R&D spending trends, crucial for staying competitive in the fast-evolving tech landscape. However, recent financials reflect the impact of one-off losses totaling CNY 3.7 million, highlighting areas for strategic refinement to harness full growth potential and improve its modest profit margins currently at 0.2%.

- Unlock comprehensive insights into our analysis of Shenzhen Sunline Tech stock in this health report.

Understand Shenzhen Sunline Tech's track record by examining our Past report.

Ugreen Group (SZSE:301606)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ugreen Group Limited focuses on the research, development, design, production, and sale of 3C consumer electronic products both in China and internationally, with a market cap of CN¥24.62 billion.

Operations: The company generates revenue primarily from the sale of computer peripherals, amounting to CN¥8.23 billion.

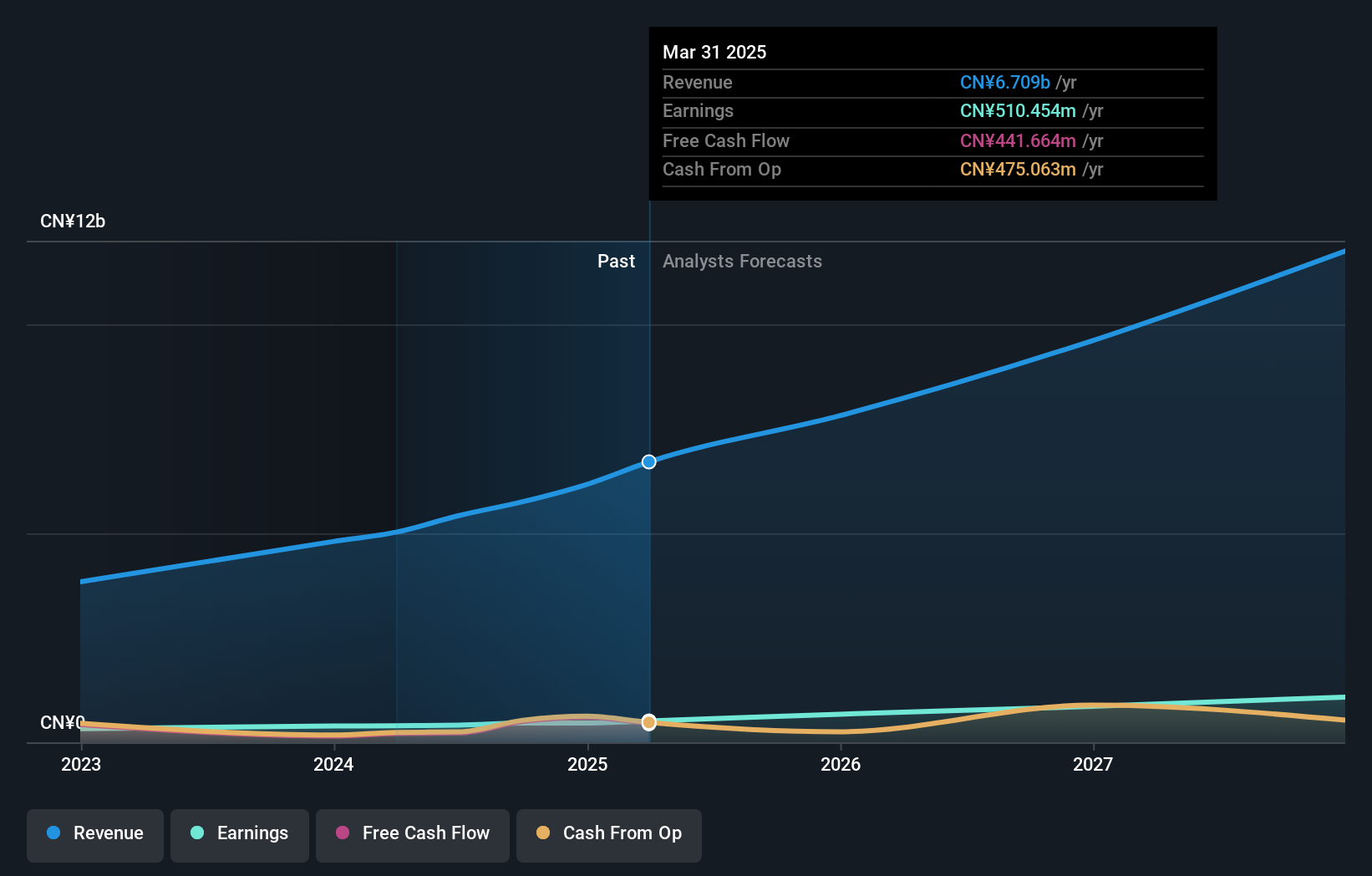

Ugreen Group has demonstrated robust financial growth, with a notable 47.7% increase in sales to CNY 6.36 billion and a 45% rise in net income to CNY 466.83 million over the nine months ending September 2025. This performance is underpinned by strategic product launches like the MagFlow Series, enhancing its competitive edge in wireless charging technology for high-demand consumer electronics. The company's commitment to R&D is evident from these innovations, positioning it well within the tech industry's rapidly evolving landscape where adaptability and advanced product offerings dictate market success.

- Click to explore a detailed breakdown of our findings in Ugreen Group's health report.

Review our historical performance report to gain insights into Ugreen Group's's past performance.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★☆☆

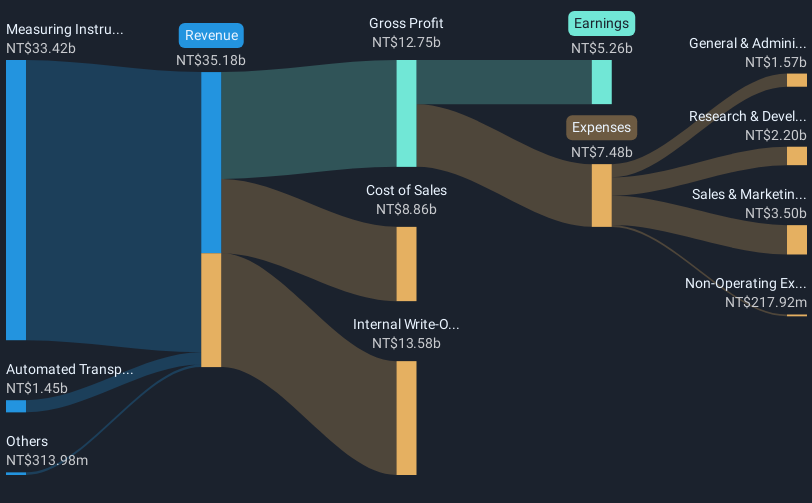

Overview: Chroma ATE Inc. is a company that designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals as well as various electronic testing systems and instruments across Taiwan, China, the United States, and internationally with a market cap of NT$293.18 billion.

Operations: The company generates revenue primarily from its Measuring Instruments Business, which accounts for NT$39.77 billion, and Automated Transport Engineering contributing NT$1.32 billion.

Chroma ATE has shown a robust performance with a 59.1% earnings growth over the past year, significantly outpacing the electronics industry's average. This surge is supported by substantial revenue increases, up 15.1% annually, and an impressive forecast of continued earnings growth at 19.2% per year, slightly above the Taiwan market's projection of 19%. The company's commitment to innovation was highlighted in its recent presentation at the Asia Technology & Internet Conference, showcasing its strategic focus on expanding its tech footprint in competitive markets.

Summing It All Up

- Unlock more gems! Our Global High Growth Tech and AI Stocks screener has unearthed 238 more companies for you to explore.Click here to unveil our expertly curated list of 241 Global High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301606

Ugreen Group

Engages in the research, development, design, production, and sale of 3C consumer electronic products in China and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives