- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

Top High Growth Tech Stocks in Asia to Watch

Reviewed by Simply Wall St

As global markets navigate a muted response to new U.S. tariffs and mixed economic signals, the Asian tech sector remains a focal point for investors seeking high growth opportunities. With market sentiment showing resilience in growth stocks, identifying promising tech companies involves evaluating their ability to innovate and adapt within this dynamic landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.41% | 29.66% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 26.95% | 29.93% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Staidson (Beijing) BioPharmaceuticals (SZSE:300204)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Staidson (Beijing) BioPharmaceuticals Co., Ltd. is a biotechnology company with a market cap of CN¥21.31 billion, focusing on the development and manufacturing of pharmaceutical products.

Operations: The company generates revenue primarily from its medicine manufacturing segment, which reported CN¥293.05 million.

Staidson (Beijing) BioPharmaceuticals Co., Ltd. has demonstrated a robust annual revenue growth rate of 29.9%, significantly outpacing the Chinese market's average of 12.5%. Despite current unprofitability, the firm is on a trajectory to reach profitability within three years, with earnings expected to surge by 117.38% annually. This growth is supported by substantial R&D investments, crucial for fostering innovation in biotechnology—a sector where rapid advancements are critical. However, investors should note the company's highly volatile share price and its recent Q1 earnings report showing a decrease in sales from CNY 94.98 million to CNY 63.21 million year-over-year, alongside a narrowed net loss from CNY 3.77 million to CNY 2.34 million, indicating potential stabilization in financial performance.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

Overview: E Ink Holdings Inc. specializes in the research, development, manufacturing, and sales of electronic paper display panels globally, with a market capitalization of approximately NT$257.58 billion.

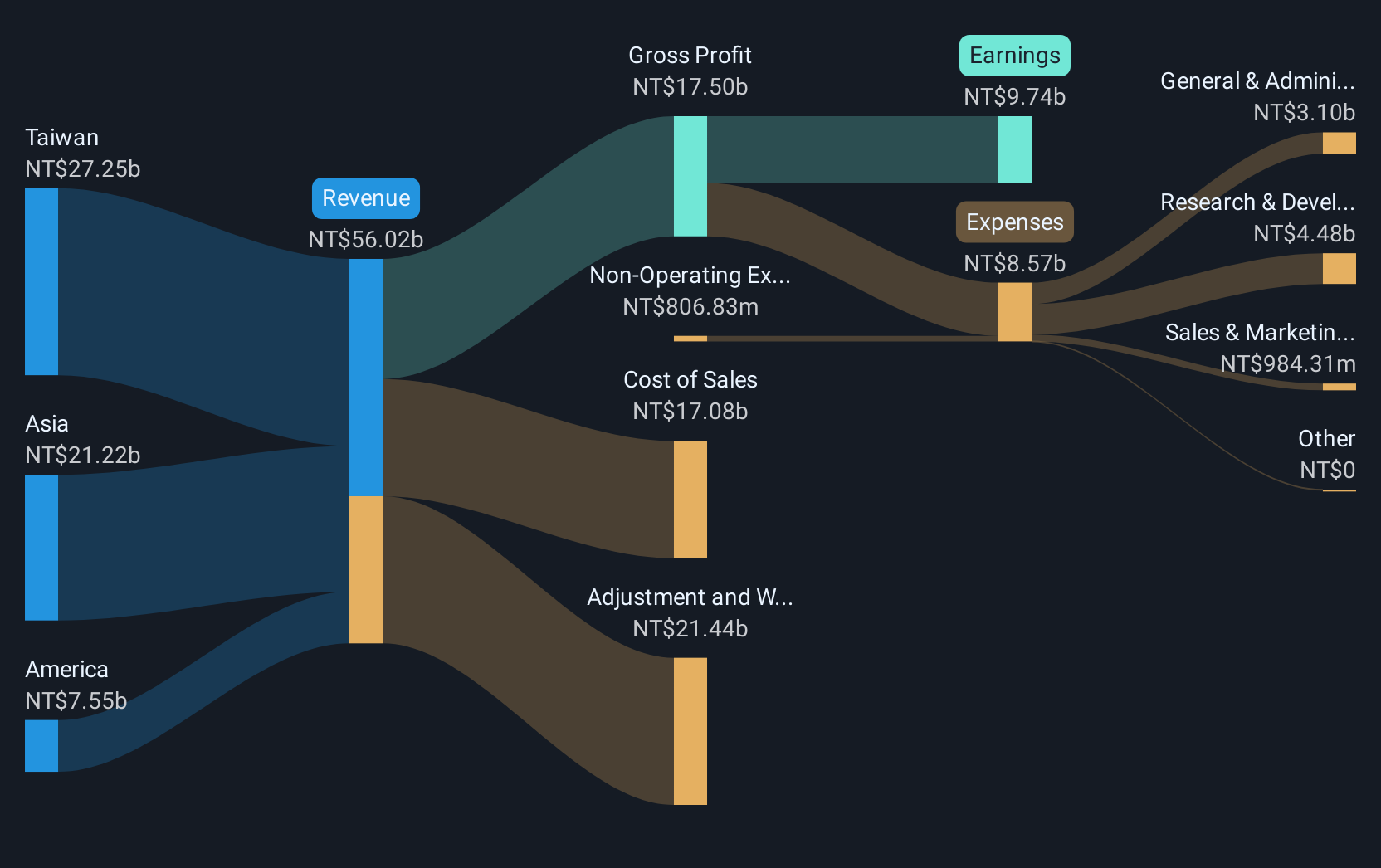

Operations: E Ink Holdings generates revenue primarily from electronic components and parts, totaling NT$34.58 billion. The company's focus on electronic paper display panels positions it within the global technology market.

E Ink Holdings, leveraging its innovative ePaper technology, announced significant strides in AI-enhanced devices and sustainable advertising solutions. The company's recent launch of an ePaper touchpad for laptops, integrating Intel technologies, underscores its commitment to energy-efficient and ergonomic product development. This aligns with E Ink's Q1 2025 earnings report showing a robust increase in sales to TWD 8.06 billion from TWD 5.64 billion year-over-year and a net income surge to TWD 2.20 billion from TWD 1.32 billion, reflecting a strong market adoption of its advanced display technologies. These developments not only enhance user interaction but also position E Ink at the forefront of the high-growth tech sector in Asia by merging sustainability with cutting-edge technology.

- Navigate through the intricacies of E Ink Holdings with our comprehensive health report here.

Examine E Ink Holdings' past performance report to understand how it has performed in the past.

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: King Slide Works Co., Ltd. and its subsidiaries specialize in designing, manufacturing, and selling rail kits for computer and network communications equipment, as well as furniture accessories like wooden kitchen components, slides, and molds across Taiwan, the United States, China, and globally; the company has a market cap of NT$213.47 billion.

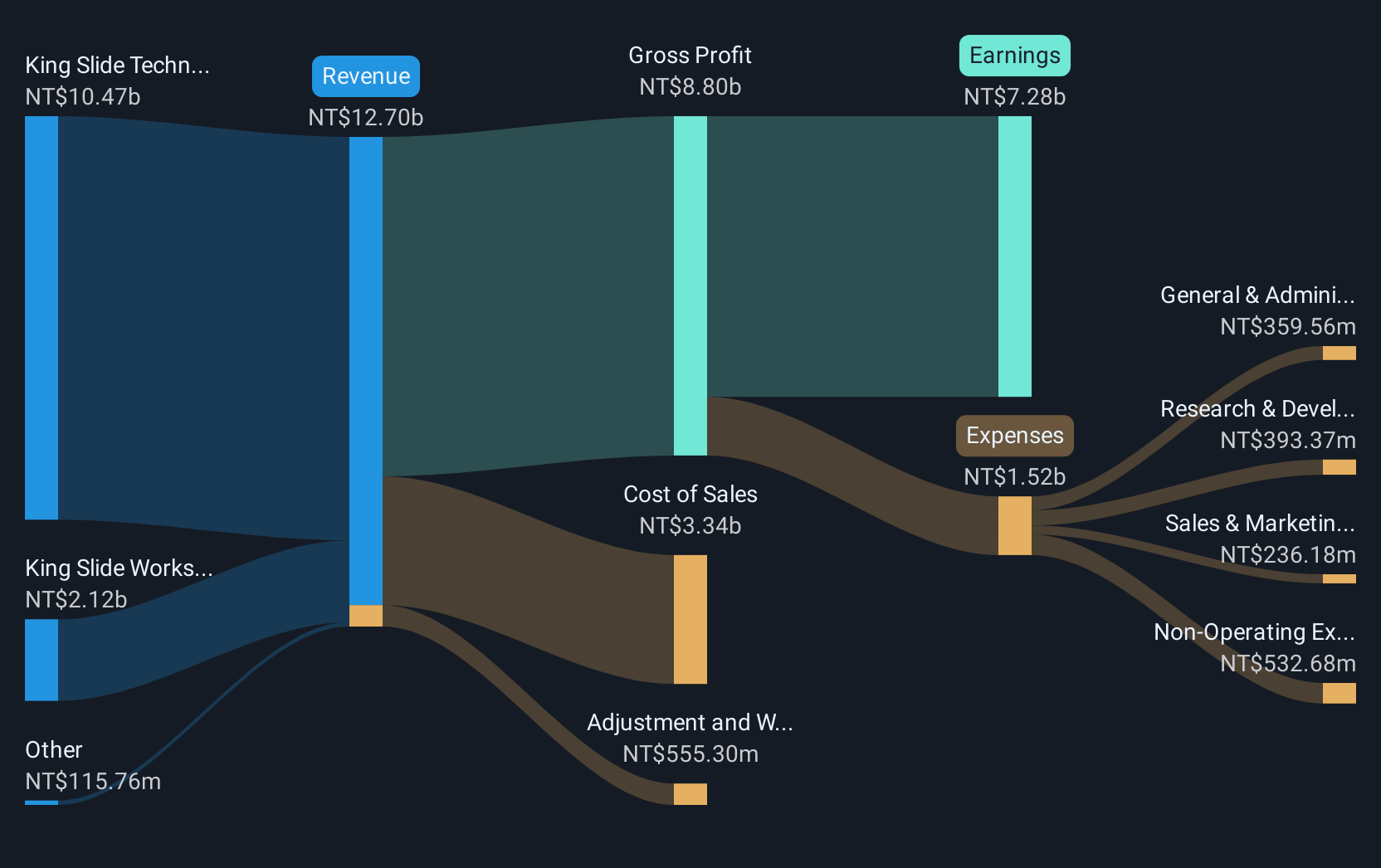

Operations: King Slide Works Co., Ltd. generates revenue primarily from King Slide Technology Co., Ltd. with NT$10.47 billion, while the parent company contributes NT$2.12 billion to the total revenue stream.

King Slide Works has demonstrated a robust growth trajectory, with its Q1 2025 revenue soaring to TWD 3.95 billion from TWD 1.94 billion in the previous year—an impressive increase that underscores its expanding market presence in high-tech industries. This surge is mirrored in net income, which more than doubled to TWD 2.51 billion, up from TWD 1.39 billion, reflecting efficient operational management and strong demand for its innovative products. The company's substantial investment in R&D, pivotal for maintaining technological leadership and fueling future growth, positions it well amidst Asia's competitive tech landscape.

- Click to explore a detailed breakdown of our findings in King Slide Works' health report.

Gain insights into King Slide Works' past trends and performance with our Past report.

Turning Ideas Into Actions

- Dive into all 478 of the Asian High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives