- South Korea

- /

- Insurance

- /

- KOSE:A005830

3 Asian Dividend Stocks Yielding Up To 4.8%

Reviewed by Simply Wall St

As the Asian markets navigate a landscape marked by mixed economic signals and evolving trade dynamics, investors are increasingly eyeing dividend stocks as a stable income source amid uncertainty. In this context, identifying stocks that offer robust dividend yields can be particularly appealing, especially those with strong fundamentals and resilience to market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.46% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.77% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.96% | ★★★★★★ |

| SIGMAXYZ Holdings (TSE:6088) | 3.71% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.94% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.95% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.44% | ★★★★★★ |

Click here to see the full list of 1042 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

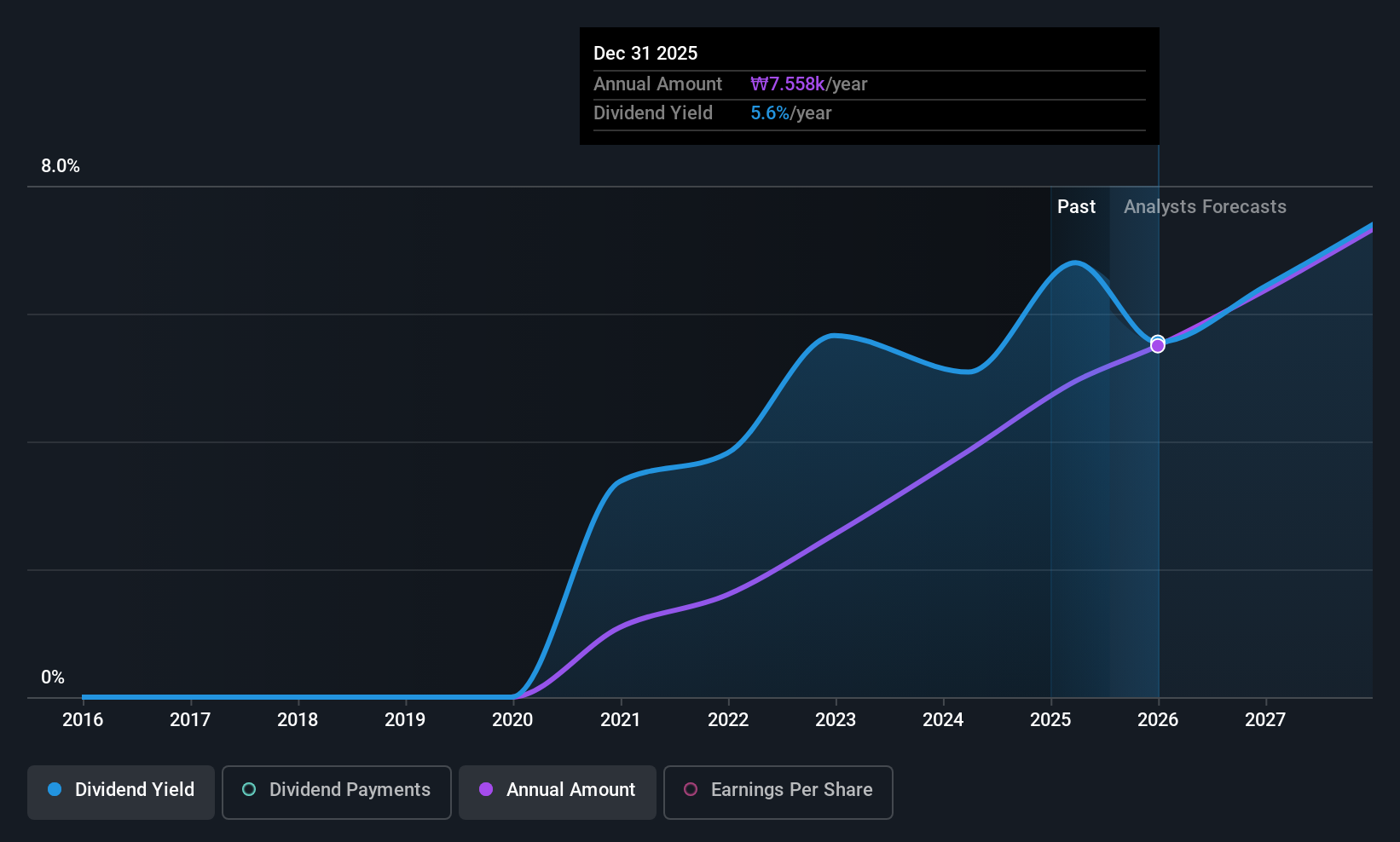

DB Insurance (KOSE:A005830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. offers a range of insurance products and services in South Korea, with a market cap of ₩8.35 trillion.

Operations: DB Insurance Co., Ltd.'s revenue is primarily derived from the Non-Life Insurance Sector at ₩22.37 billion, followed by the Life Insurance Sector at ₩1.86 billion, and the Installment Finance Sector contributing ₩44.27 million.

Dividend Yield: 4.9%

DB Insurance offers a compelling dividend profile, trading at 78.6% below its estimated fair value and providing a dividend yield in the top 25% of the KR market. Its dividends are well-covered by both earnings and cash flows, with a payout ratio of 23.4%. Although it has only been paying dividends for six years, these payments have been reliable and stable. Recent conference presentations highlight ongoing investor engagement in Asia.

- Take a closer look at DB Insurance's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that DB Insurance is trading behind its estimated value.

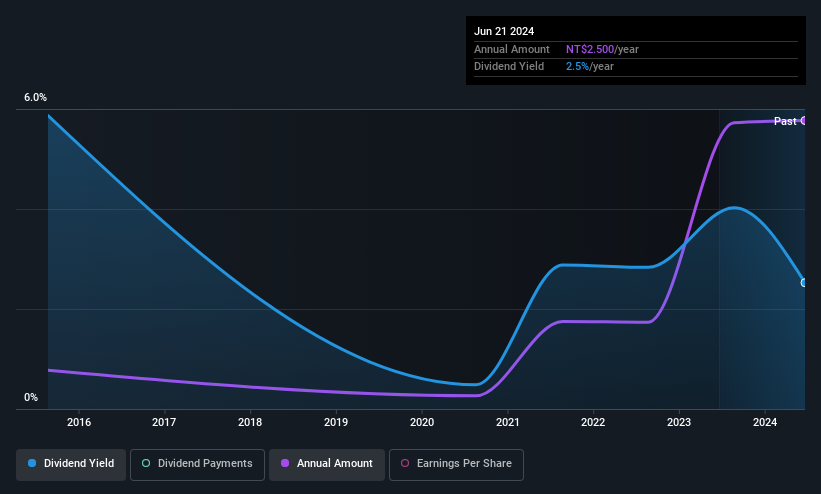

Powertip Image (TPEX:6498)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Powertip Image Corp, along with its subsidiaries, manufactures and sells electronic components and optical instruments in Mainland China, Taiwan, and internationally, with a market cap of NT$4.62 billion.

Operations: Powertip Image Corp generates revenue of NT$1.15 billion from its electronic component and optical instrument manufacturing operations.

Dividend Yield: 3%

Powertip Image's dividends are well-covered by earnings and cash flows, with payout ratios of 47.2% and 36.2% respectively, though they have been volatile over the past decade. Trading at 40% below estimated fair value, its dividend yield of 3.04% is lower than Taiwan's top quartile payers. Recent earnings showed strong growth, with Q2 sales reaching TWD 303.29 million and net income rising to TWD 42.86 million from the previous year’s figures.

- Unlock comprehensive insights into our analysis of Powertip Image stock in this dividend report.

- Upon reviewing our latest valuation report, Powertip Image's share price might be too pessimistic.

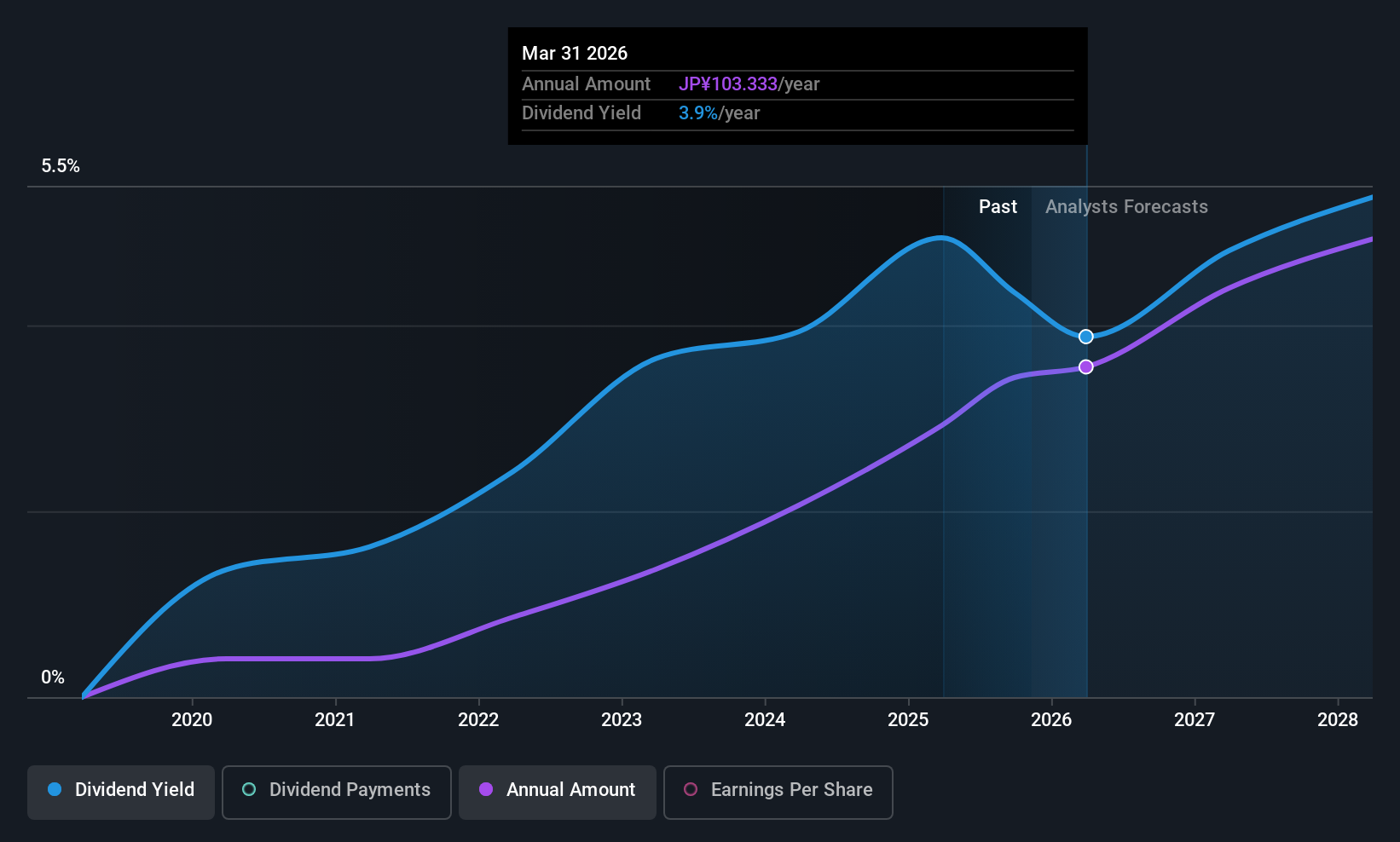

Ishihara Sangyo KaishaLtd (TSE:4028)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ishihara Sangyo Kaisha, Ltd. is engaged in the manufacturing and sale of organic and inorganic chemicals across Japan, Asia, the United States, Europe, and other international markets with a market capitalization of ¥98.97 billion.

Operations: Ishihara Sangyo Kaisha, Ltd.'s revenue is derived from its Organic Chemicals Business, which generates ¥75.03 billion, and its Inorganic Chemicals Business, contributing ¥71.06 billion.

Dividend Yield: 3.9%

Ishihara Sangyo Kaisha's dividends are well-supported by earnings and cash flows, with payout ratios of 31.6% and 44.9%, respectively. The company offers a competitive dividend yield within Japan's top quartile, despite only having a six-year dividend history. Recent financial guidance revisions indicate improved profitability, with net income expected to reach ¥2.4 billion for the fiscal year ending March 2026. Additionally, the launch of LUSHADE® BLACK could enhance future revenue streams across diverse industries globally.

- Click to explore a detailed breakdown of our findings in Ishihara Sangyo KaishaLtd's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ishihara Sangyo KaishaLtd shares in the market.

Summing It All Up

- Gain an insight into the universe of 1042 Top Asian Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005830

DB Insurance

Provides various insurance products and services in South Korea.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives