- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6274

3 Asian Stocks Trading At Estimated Discounts Of Up To 49.3%

Reviewed by Simply Wall St

As Asian markets continue to navigate a landscape marked by global economic uncertainties and evolving trade dynamics, investors are increasingly on the lookout for opportunities that may offer value amidst the volatility. In this context, identifying stocks that are trading at significant discounts can be appealing, as they present potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥871.00 | ¥1701.61 | 48.8% |

| Taiwan Union Technology (TPEX:6274) | NT$440.00 | NT$867.34 | 49.3% |

| Samyang Foods (KOSE:A003230) | ₩1445000.00 | ₩2799114.46 | 48.4% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.18 | CN¥26.01 | 49.3% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.26 | CN¥20.12 | 49% |

| JINS HOLDINGS (TSE:3046) | ¥6130.00 | ¥12257.63 | 50% |

| China Ruyi Holdings (SEHK:136) | HK$2.44 | HK$4.82 | 49.3% |

| China Beststudy Education Group (SEHK:3978) | HK$4.78 | HK$9.28 | 48.5% |

| Beijing Roborock Technology (SHSE:688169) | CN¥152.18 | CN¥300.79 | 49.4% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.03 | CN¥56.05 | 50% |

Let's review some notable picks from our screened stocks.

Dongfeng Motor Group (SEHK:489)

Overview: Dongfeng Motor Group Company Limited is involved in the research, development, manufacture, and sale of commercial and passenger vehicles, engines, and auto parts in China with a market cap of approximately HK$75.92 billion.

Operations: Dongfeng Motor Group generates revenue primarily through the sale of commercial and passenger vehicles, engines, and auto parts in China.

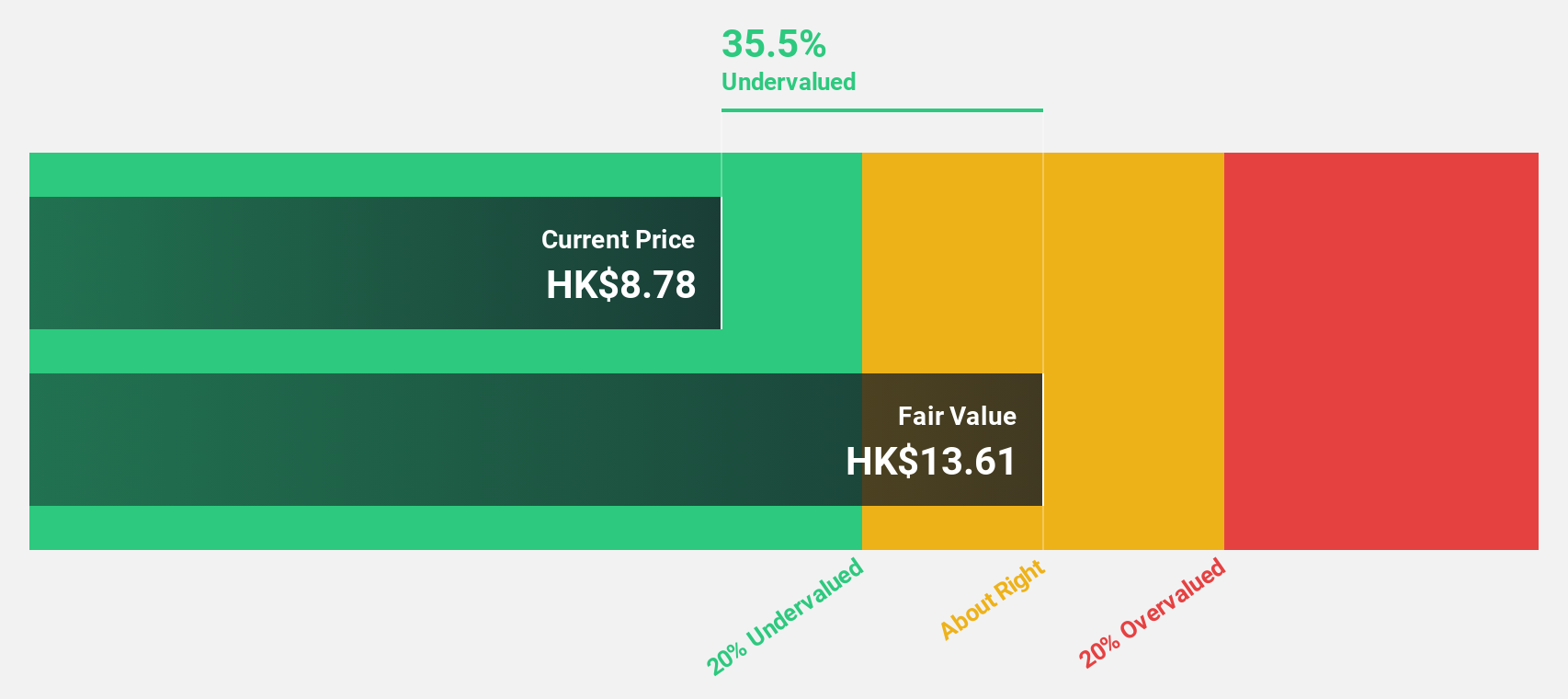

Estimated Discount To Fair Value: 39.5%

Dongfeng Motor Group is trading at a significant discount to its estimated fair value of HK$15.2, with current prices around HK$9.2, indicating it is highly undervalued based on discounted cash flow analysis. Despite reporting a net loss of CNY 1.88 billion for the nine months ended September 2025, the company shows potential for profitability and above-average market growth over the next three years, driven by strong new energy vehicle sales and strategic joint ventures in intelligent off-road vehicles manufacturing.

- The growth report we've compiled suggests that Dongfeng Motor Group's future prospects could be on the up.

- Click here to discover the nuances of Dongfeng Motor Group with our detailed financial health report.

Taiwan Union Technology (TPEX:6274)

Overview: Taiwan Union Technology Corporation manufactures and sells copper clad laminates both in Asia and internationally, with a market cap of NT$124.38 billion.

Operations: The company's revenue segments include the production and sale of copper clad laminates across Asian markets and internationally.

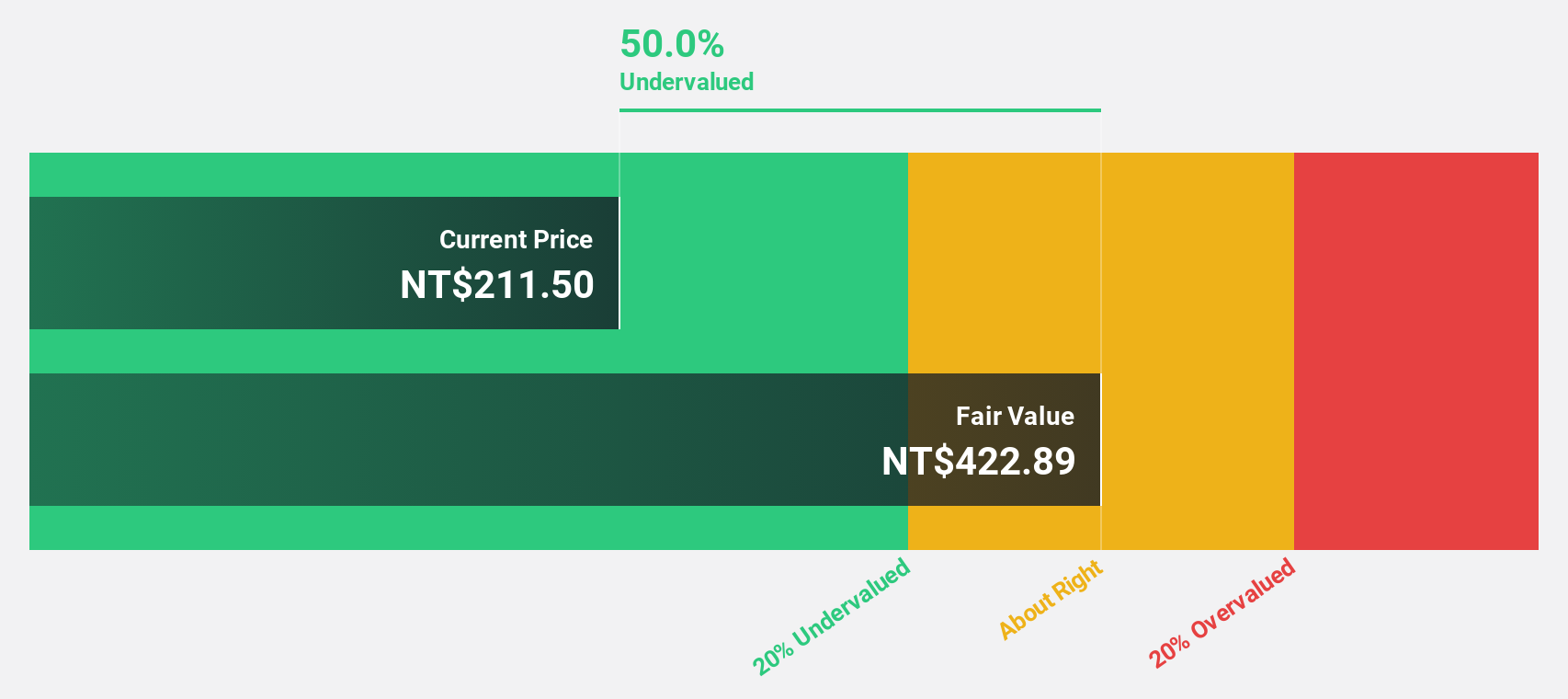

Estimated Discount To Fair Value: 49.3%

Taiwan Union Technology is trading at NT$440, significantly below its estimated fair value of NT$867.34, highlighting its undervaluation based on cash flows. The company's earnings are projected to grow substantially over the next three years, outpacing the Taiwan market average. Recent earnings reports show strong performance with third-quarter revenue increasing to TWD 8.06 billion from TWD 6.62 billion a year ago, and net income rising to TWD 1 billion from TWD 754 million.

- Our comprehensive growth report raises the possibility that Taiwan Union Technology is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Taiwan Union Technology stock in this financial health report.

Winbond Electronics (TWSE:2344)

Overview: Winbond Electronics Corporation designs, develops, manufactures, and markets very large scale integration integrated circuits for various microelectronic applications worldwide, with a market cap of NT$261 billion.

Operations: Winbond Electronics generates revenue from three primary segments: Logical Products (NT$30.46 billion), Flash Memory Product (NT$28.30 billion), and Customized Memory Solution Products (NT$20.87 billion).

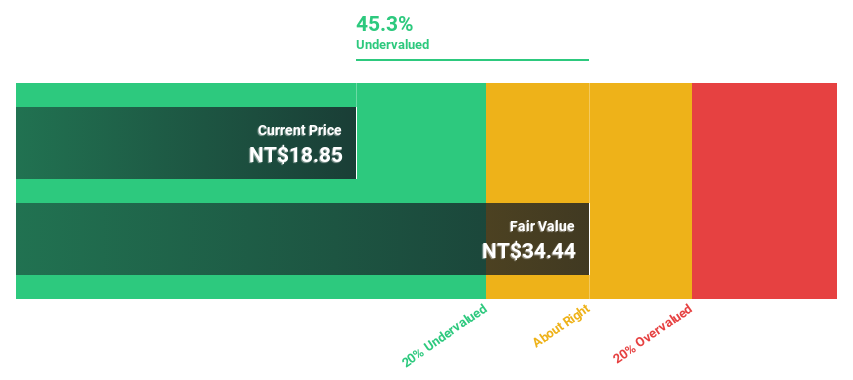

Estimated Discount To Fair Value: 31.5%

Winbond Electronics is trading at NT$58, notably below its estimated fair value of NT$84.72, underscoring its undervaluation based on cash flows. Despite a volatile share price recently, the company reported a significant turnaround with third-quarter net income reaching TWD 2.94 billion from a previous loss. Earnings are forecast to grow by 92.15% annually, and revenue growth is expected to surpass market averages over the next three years.

- According our earnings growth report, there's an indication that Winbond Electronics might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Winbond Electronics.

Turning Ideas Into Actions

- Embark on your investment journey to our 270 Undervalued Asian Stocks Based On Cash Flows selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Union Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6274

Taiwan Union Technology

Manufactures and sells copper clad laminates in Asia and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026