As global markets grapple with a mix of economic challenges, including a record U.S. government shutdown and fluctuating consumer sentiment, investors are increasingly turning their attention to stable income sources like dividend stocks. In this environment, selecting dividend stocks that offer consistent payouts and have resilient business models can be particularly appealing for those looking to navigate market volatility while securing potential income streams.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.77% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 4.04% | ★★★★★★ |

| NCD (TSE:4783) | 4.77% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.87% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.41% | ★★★★★★ |

Click here to see the full list of 1336 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

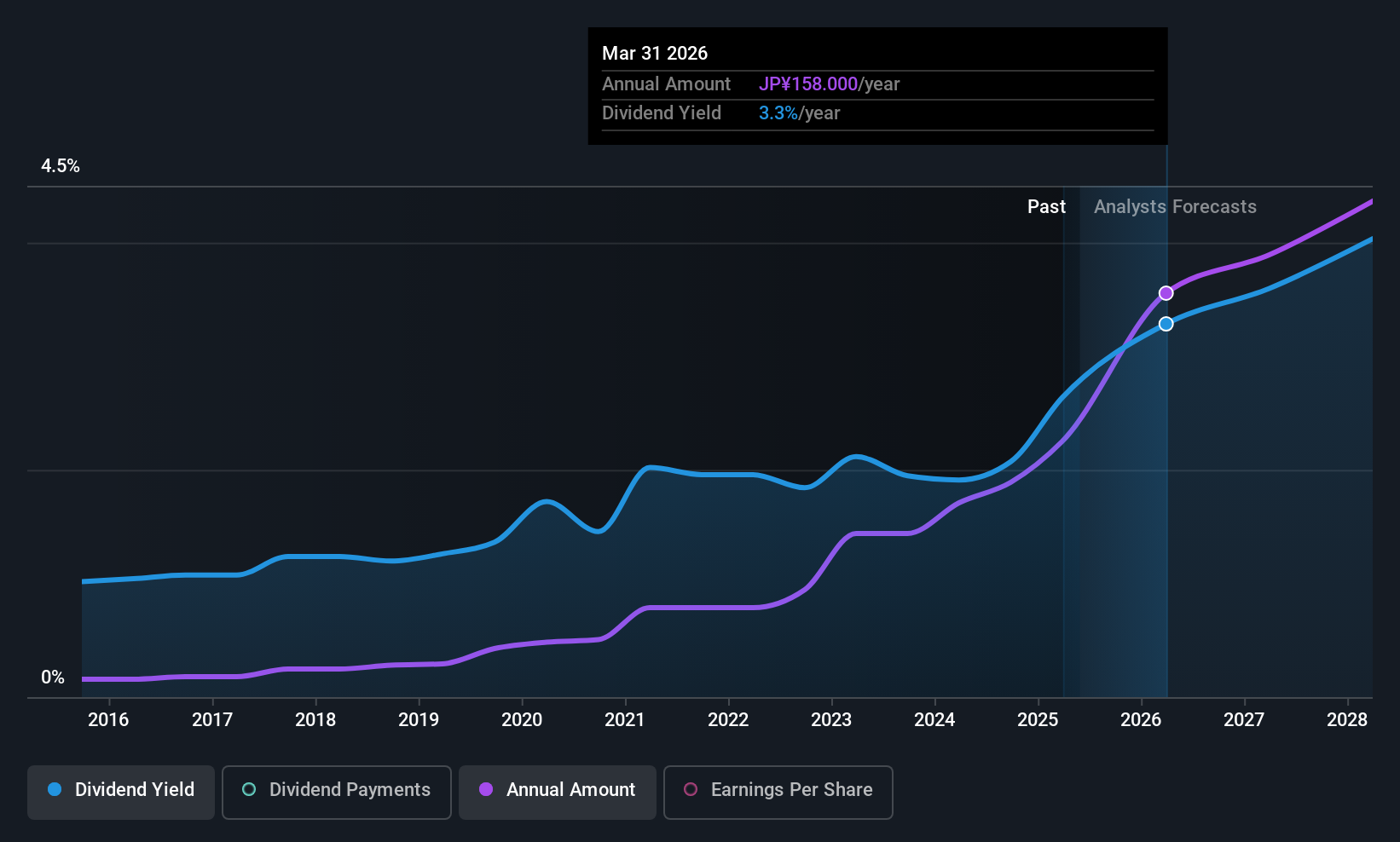

Business Engineering (TSE:4828)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Business Engineering Corporation designs, develops, and implements corporate information systems using ERP package products from global developers, with a market cap of ¥81.43 billion.

Operations: Business Engineering Corporation generates revenue primarily from designing, developing, and implementing corporate information systems utilizing ERP package products created by international developers.

Dividend Yield: 3.2%

Business Engineering's dividend is well-supported by earnings, with a payout ratio of 39.1%, and has shown consistent growth over the past decade. The recent board meeting considered increasing the dividend forecast, which could enhance its appeal to income investors. Although the current yield of 3.16% is below Japan's top-tier payers, its dividends are reliably covered by cash flows (74.4% cash payout ratio) and have been stable historically, offering potential for steady income streams.

- Get an in-depth perspective on Business Engineering's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Business Engineering shares in the market.

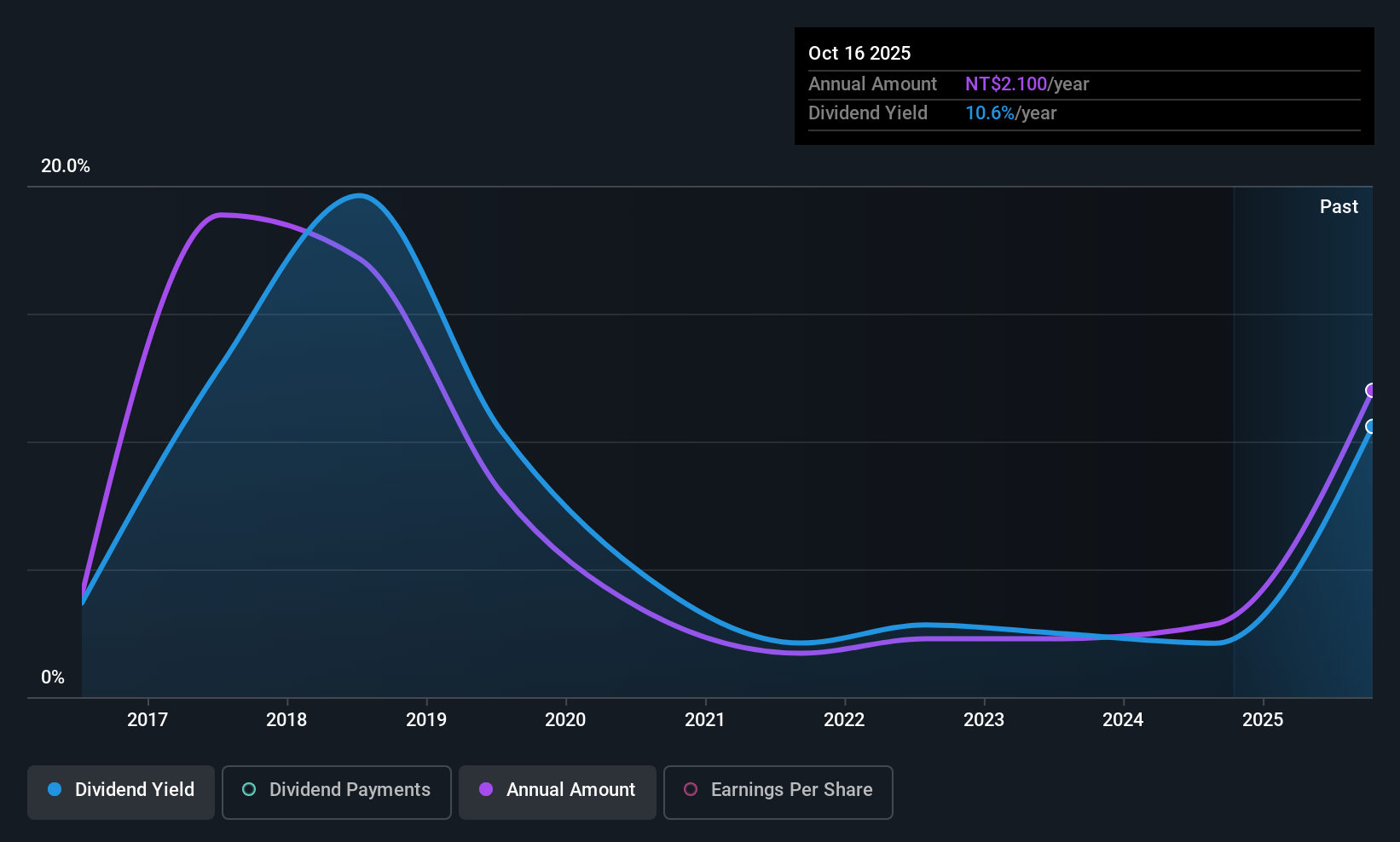

Chyang Sheng Texing (TWSE:1463)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chyang Sheng Texing Co., Ltd. operates in Asia, offering dyeing and finishing products and services for both natural and man-made fibers, with a market cap of NT$3.18 billion.

Operations: Chyang Sheng Texing Co., Ltd. generates revenue from providing dyeing and finishing solutions for natural and synthetic fibers across Asia.

Dividend Yield: 11.3%

Chyang Sheng Texing's dividend yield of 11.26% ranks among the top in Taiwan, but its sustainability is questionable due to a lack of free cash flow coverage and high non-cash earnings. Despite a reasonable payout ratio of 61.5%, dividends have been volatile, with past annual drops over 20%. Recent earnings growth is significant, yet historical unreliability in payments may concern investors seeking stable income sources from dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Chyang Sheng Texing.

- According our valuation report, there's an indication that Chyang Sheng Texing's share price might be on the cheaper side.

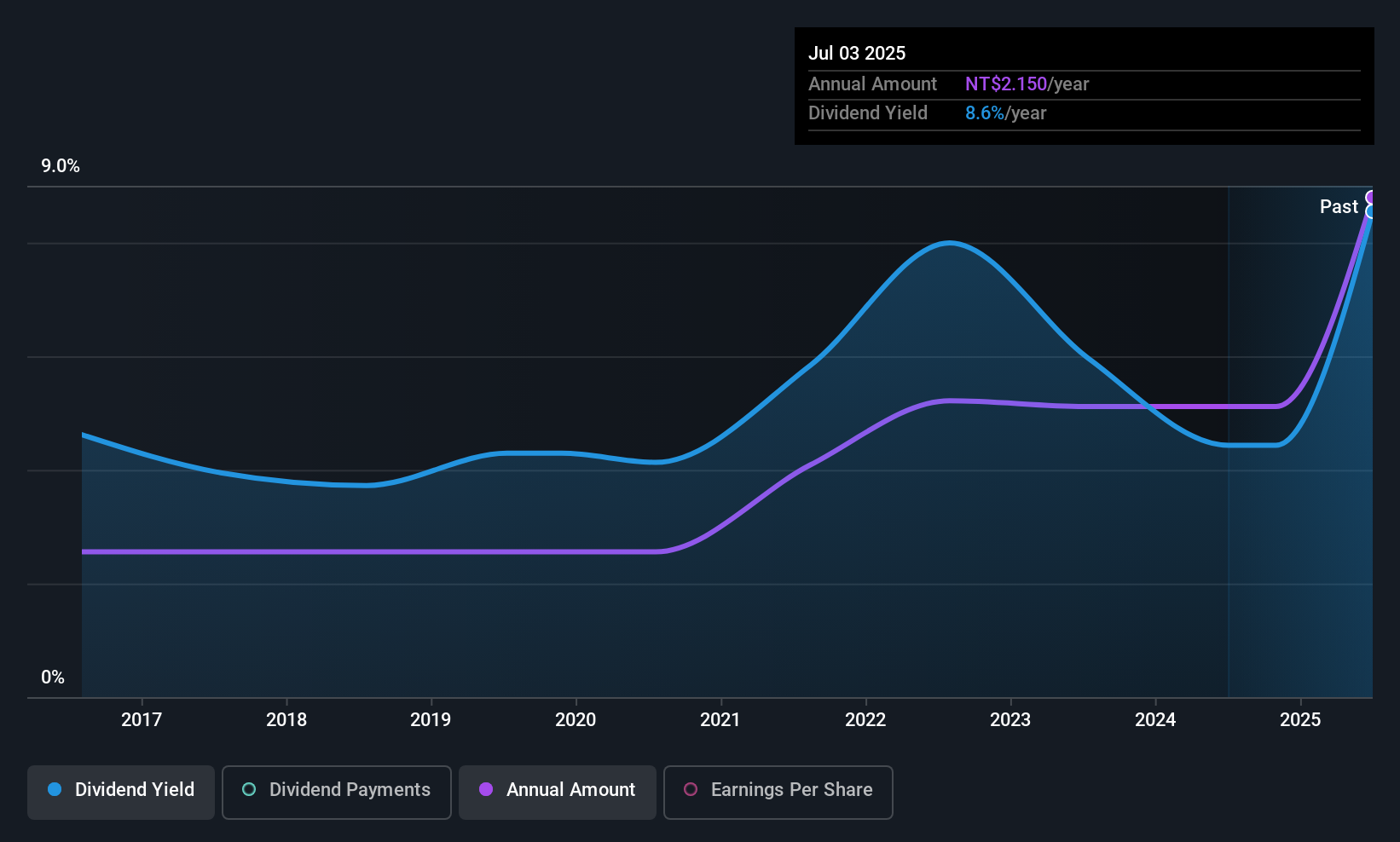

Chien Kuo Construction (TWSE:5515)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chien Kuo Construction Co., Ltd. operates in the construction industry across Taiwan and China, with a market capitalization of NT$5.50 billion.

Operations: Chien Kuo Construction Co., Ltd. generates revenue primarily from its construction activities, amounting to NT$6.76 billion.

Dividend Yield: 7.2%

Chien Kuo Construction's dividend yield of 7.18% places it in the top 25% of Taiwan's market, supported by a stable and growing dividend history over the past decade. However, with a payout ratio of 102%, dividends are not covered by earnings, raising sustainability concerns despite being well-covered by cash flows at a cash payout ratio of 41.7%. Profit margins have declined from last year, although earnings have shown consistent growth over five years.

- Take a closer look at Chien Kuo Construction's potential here in our dividend report.

- Our valuation report unveils the possibility Chien Kuo Construction's shares may be trading at a discount.

Next Steps

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1333 more companies for you to explore.Click here to unveil our expertly curated list of 1336 Top Global Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1463

Chyang Sheng Texing

Provides natural and man-made fiber dyeing and finishing products and services in Asia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives