- China

- /

- Paper and Forestry Products

- /

- SHSE:603607

Zhejiang Jinghua Laser TechnologyLtd And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced broad-based gains, with smaller-cap indexes outperforming their larger counterparts amid positive economic indicators such as a drop in U.S. initial jobless claims and encouraging home sales reports. This environment of cautious optimism presents an opportunity to explore lesser-known stocks that may offer strong potential for growth. Identifying a good stock often involves looking at companies with solid fundamentals and unique market positions, which can thrive even amid broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Jinghua Laser TechnologyLtd (SHSE:603607)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Jinghua Laser Technology Co., Ltd specializes in the development, manufacturing, and sale of laser holographic molded products with a market capitalization of approximately CN¥2.90 billion.

Operations: Zhejiang Jinghua Laser Technology Co., Ltd generates revenue primarily from the sale of laser holographic molded products. The company's financial performance is reflected in its market capitalization of approximately CN¥2.90 billion.

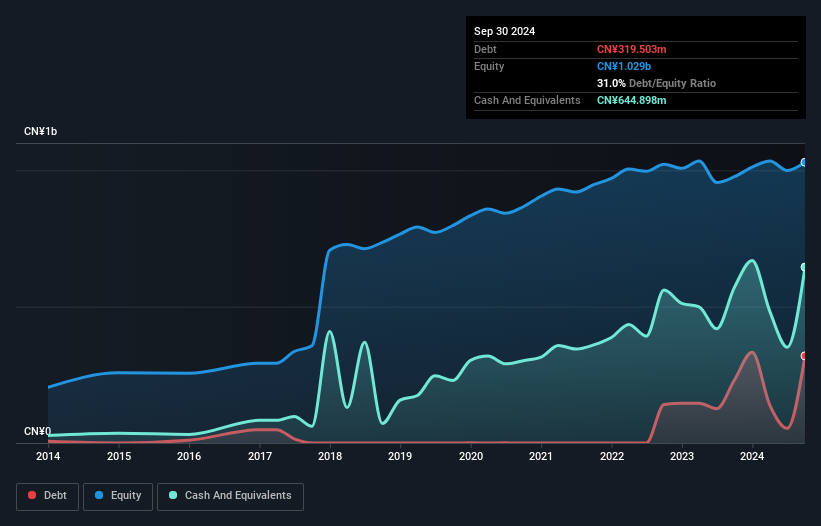

Jinghua Laser, a nimble player in the tech sector, has shown promising financial performance. Over the past year, earnings surged by 21%, outpacing the Forestry industry's 19% growth. Despite a debt-to-equity ratio climbing to 31% over five years, it holds more cash than total debt, indicating sound financial health. Its price-to-earnings ratio of 29.1x is attractively lower than the CN market average of 34.6x. Recent reports highlight a sales increase to CNY 630 million for nine months ending September 2024 from CNY 486 million last year, with net income rising to CNY 71 million from CNY 58 million.

Quanta Storage (TPEX:6188)

Simply Wall St Value Rating: ★★★★★★

Overview: Quanta Storage Inc. is engaged in the research, development, production, manufacturing, and sale of data storage and processing equipment, electronic components, optical instruments, and industrial robots across various international markets including Mainland China and the United States; it has a market cap of NT$26.39 billion.

Operations: Quanta Storage generates revenue primarily from the sale of data storage and processing equipment, electronic components, optical instruments, and industrial robots across several international markets. The company has a market capitalization of NT$26.39 billion.

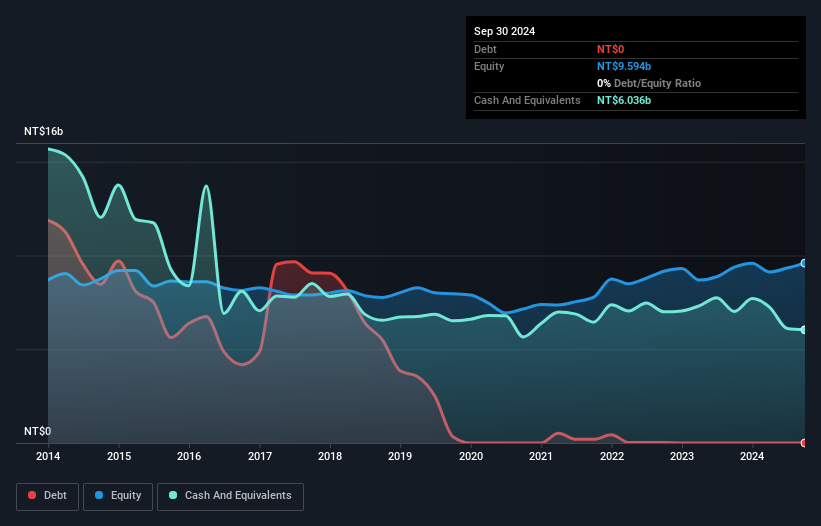

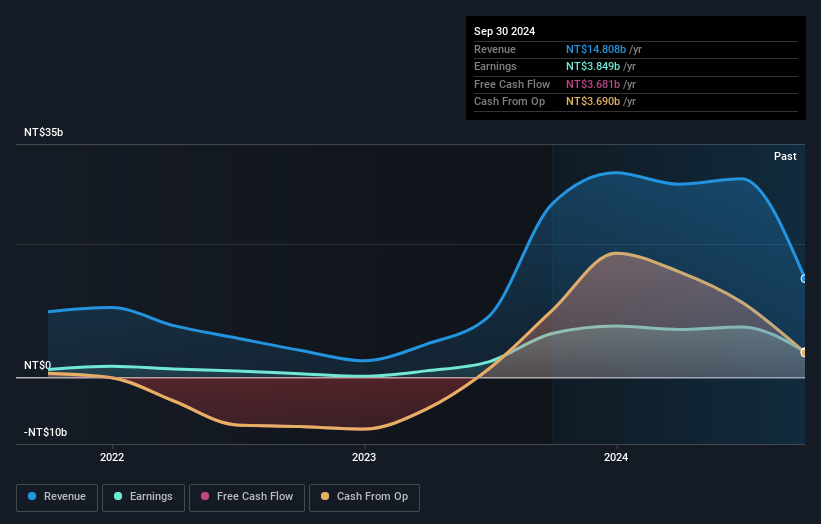

Quanta Storage, a tech player with a modest market cap, has faced challenges recently. The latest earnings report shows sales for the third quarter at TWD 1.7 billion, down from TWD 2.72 billion last year, while net income fell to TWD 102 million from TWD 342 million. Despite these setbacks, the company remains debt-free and boasts high-quality past earnings. Over nine months, sales reached TWD 5.77 billion compared to last year's TWD 7.6 billion; net income was also lower at TWD 454 million versus TWD 755 million previously. Earnings per share dropped but reflect ongoing operations stability amidst industry hurdles.

- Navigate through the intricacies of Quanta Storage with our comprehensive health report here.

Gain insights into Quanta Storage's historical performance by reviewing our past performance report.

Run Long Construction (TWSE:1808)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Run Long Construction Co., Ltd. operates in the construction, sale, and leasing of residential and commercial buildings in Taiwan with a market capitalization of NT$40.68 billion.

Operations: Run Long Construction generates revenue primarily from its Construction Industry Department, contributing NT$14.75 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability and cost management efficiency.

Run Long Construction's recent performance paints a challenging picture, with third-quarter sales at TWD 1.97 billion, a sharp contrast to TWD 16.94 billion the previous year. Net income also saw a significant drop, standing at TWD 443 million compared to last year's TWD 4.15 billion. Despite these hurdles, their price-to-earnings ratio of 10.7x remains below the TW market average of 21.2x, suggesting potential value for investors seeking opportunities in niche markets like construction. The company's net debt to equity ratio has improved from an alarming 360% five years ago to a more manageable 178%, indicating efforts towards financial stability amidst industry challenges and negative earnings growth of -41%.

- Unlock comprehensive insights into our analysis of Run Long Construction stock in this health report.

Understand Run Long Construction's track record by examining our Past report.

Make It Happen

- Discover the full array of 4632 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jinghua Laser TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603607

Zhejiang Jinghua Laser TechnologyLtd

Develops, manufactures, and sells laser holographic molded products.

Adequate balance sheet with acceptable track record.