- Japan

- /

- Hospitality

- /

- TSE:3395

3 Asian Stocks That May Be Trading At Estimated Discounts Of Up To 41.8%

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and economic uncertainties, Asian stock markets have shown resilience, with China's indices gaining strength from robust tech sector performance. In this environment, identifying undervalued stocks becomes crucial for investors seeking potential opportunities; such stocks may offer significant discounts relative to their intrinsic value despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.29 | CN¥52.38 | 49.8% |

| KG Mobilians (KOSDAQ:A046440) | ₩4515.00 | ₩8963.80 | 49.6% |

| Shenzhou International Group Holdings (SEHK:2313) | HK$58.45 | HK$114.86 | 49.1% |

| Power Wind Health Industry (TWSE:8462) | NT$113.00 | NT$225.40 | 49.9% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.40 | CN¥30.30 | 49.2% |

| Samyang Foods (KOSE:A003230) | ₩876000.00 | ₩1721951.23 | 49.1% |

| Food & Life Companies (TSE:3563) | ¥4074.00 | ¥8138.83 | 49.9% |

| LITALICO (TSE:7366) | ¥1095.00 | ¥2155.51 | 49.2% |

| Sung Kwang BendLtd (KOSDAQ:A014620) | ₩27950.00 | ₩55879.77 | 50% |

| BalnibarbiLtd (TSE:3418) | ¥1062.00 | ¥2092.38 | 49.2% |

Let's review some notable picks from our screened stocks.

Hangzhou Zhongtai Cryogenic Technology (SZSE:300435)

Overview: Hangzhou Zhongtai Cryogenic Technology Corporation specializes in the development, design, manufacture, and sale of cryogenic equipment in China with a market cap of CN¥4.69 billion.

Operations: Revenue Segments (in millions of CN¥):

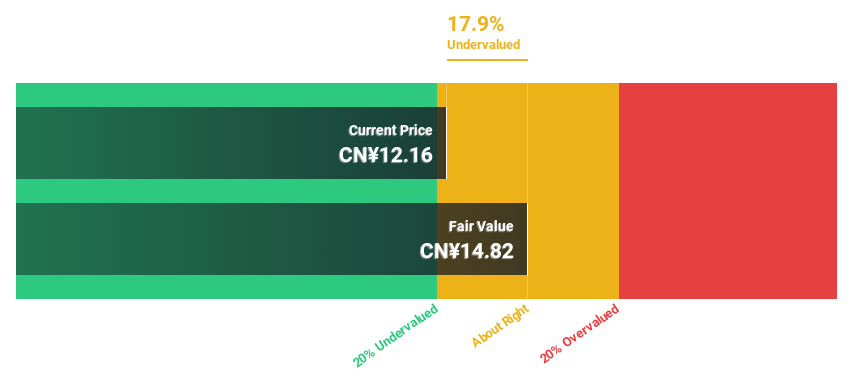

Estimated Discount To Fair Value: 17.6%

Hangzhou Zhongtai Cryogenic Technology is trading at CN¥12.29, below its estimated fair value of CN¥14.91, offering good relative value compared to peers and the industry. Despite a low forecasted return on equity (17.6%), earnings are expected to grow significantly at 47.54% annually, outpacing the Chinese market's growth rate of 25.4%. The company recently completed a buyback plan worth CN¥69.33 million, enhancing shareholder value despite an unstable dividend track record.

- Our earnings growth report unveils the potential for significant increases in Hangzhou Zhongtai Cryogenic Technology's future results.

- Unlock comprehensive insights into our analysis of Hangzhou Zhongtai Cryogenic Technology stock in this financial health report.

Saint Marc Holdings (TSE:3395)

Overview: Saint Marc Holdings Co., Ltd. operates restaurant and cafe businesses in Japan through its subsidiaries, with a market cap of ¥46.81 billion.

Operations: Saint Marc Holdings Co., Ltd. generates revenue through its subsidiaries in the restaurant and cafe sectors within Japan.

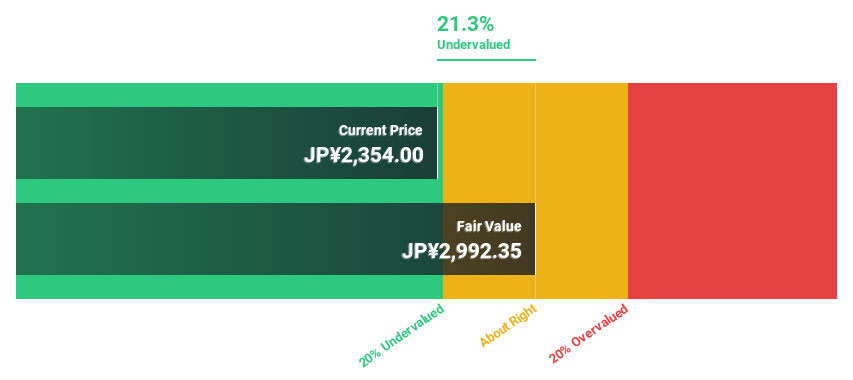

Estimated Discount To Fair Value: 22%

Saint Marc Holdings is trading at ¥2,344, significantly below its estimated fair value of ¥3,003.52. The company forecasts robust annual earnings growth of 22.1%, surpassing the Japanese market's average. Despite slower revenue growth projections at 13% per year, recent share buybacks totaling ¥6.50 billion aim to enhance capital efficiency and shareholder value by reducing outstanding shares by 14.13%. The stock offers a reliable dividend yield of 2.22%.

- Our expertly prepared growth report on Saint Marc Holdings implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Saint Marc Holdings with our comprehensive financial health report here.

Chung-Hsin Electric and Machinery Manufacturing (TWSE:1513)

Overview: Chung-Hsin Electric and Machinery Manufacturing Corp. operates in the electrical equipment industry, focusing on the production of transformers and switchgears, with a market cap of NT$76.33 billion.

Operations: The company's revenue segments include NT$18.87 billion from the Motor Energy Business, NT$5.06 billion from the Service Business, and NT$2.52 billion from Engineering and Other activities.

Estimated Discount To Fair Value: 41.8%

Chung-Hsin Electric and Machinery Manufacturing is trading at NT$154.5, well below its estimated fair value of NT$265.36, suggesting undervaluation based on cash flows. Earnings are projected to grow 19.42% annually, outpacing the Taiwanese market's 17.7%. Despite a high debt level, the company maintains a stable dividend yield of 2.33%. Analysts anticipate a price increase of 30%, while revenue growth is expected at 13.7% per year, surpassing the market average of 11.9%.

- Our growth report here indicates Chung-Hsin Electric and Machinery Manufacturing may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Chung-Hsin Electric and Machinery Manufacturing's balance sheet health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 292 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3395

Saint Marc Holdings

Through its subsidiaries, engages in the restaurant and cafe business in Japan.

Good value with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives