Three Undiscovered Gems In The Middle East To Enhance Your Portfolio

Reviewed by Simply Wall St

As most Gulf markets retreat due to weak oil prices and the broader impact of potential shifts in U.S. monetary policy, investors are increasingly cautious about their portfolios. In this environment, identifying promising stocks that can withstand economic pressures becomes crucial for enhancing investment resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | NA | 41.94% | 8.07% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Gen Ilac Ve Saglik Urunleri Sanayi Ve Ticaret Anonim Sirketi (IBSE:GENIL)

Simply Wall St Value Rating: ★★★★★★

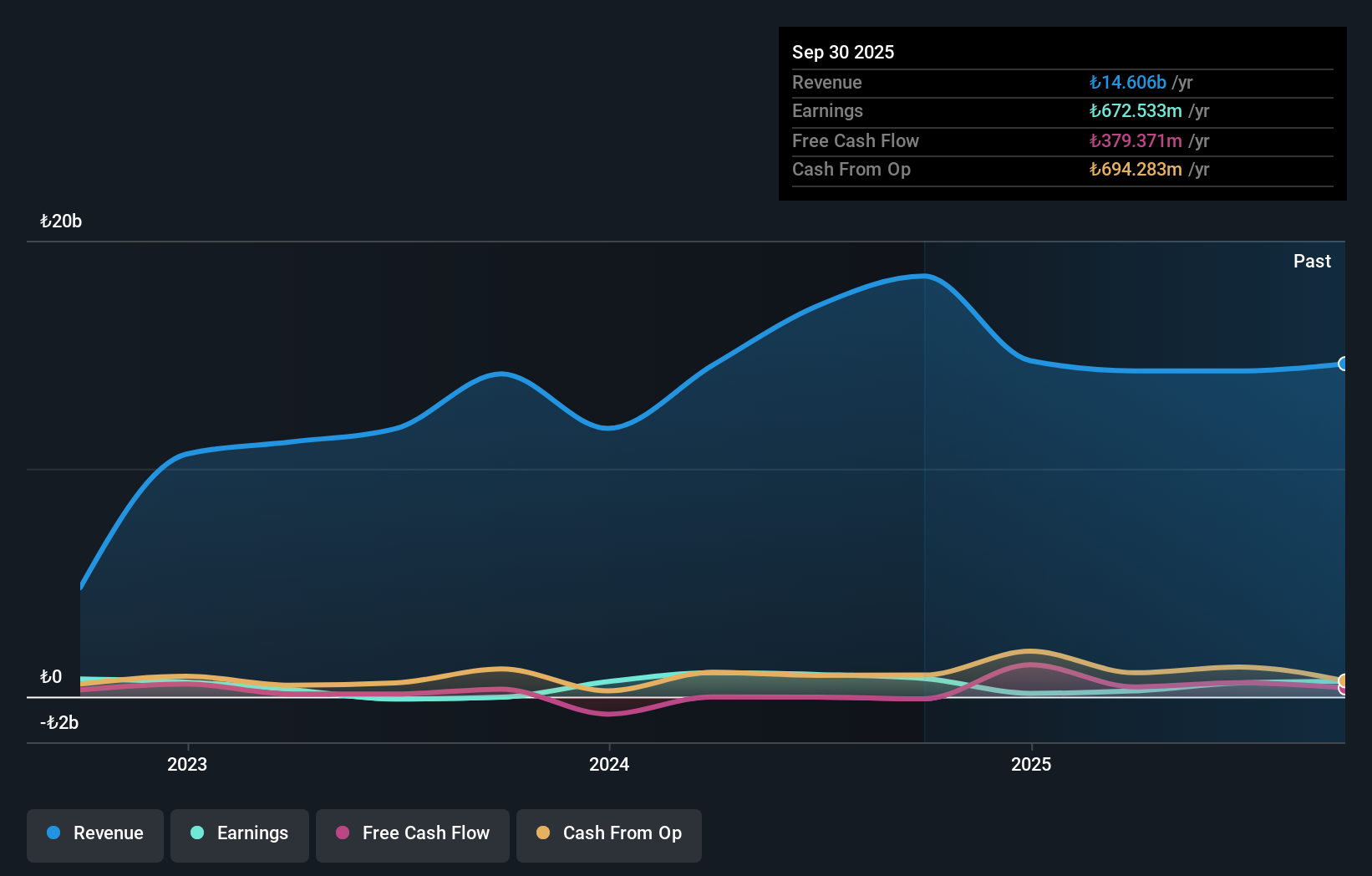

Overview: Gen Ilac Ve Saglik Urunleri Sanayi Ve Ticaret Anonim Sirketi is a pharmaceutical company that manufactures and supplies products for treating rare diseases and disorders globally, with a market cap of TRY56.34 billion.

Operations: The primary revenue stream for Gen Ilac comes from the buying and selling of human medicines and health products, generating TRY14.61 billion. The company's financial performance is highlighted by a focus on this core segment.

Gen Ilac, a nimble player in the pharmaceuticals sector, has seen its net debt to equity ratio improve from 30.3% to 23.9% over five years, indicating prudent financial management. Despite a challenging year with earnings growth at -15.4%, it remains profitable and free cash flow positive, suggesting resilience amidst industry pressures. The company's interest coverage is robust at 7.4 times EBIT, providing confidence in its ability to manage debt obligations effectively. Recent earnings show an uptick in quarterly sales to TRY 5,351 million from TRY 5,035 million last year and net income rising significantly for the nine months period compared to previous figures.

Lydia Yesil Enerji Kaynaklari (IBSE:LYDYE)

Simply Wall St Value Rating: ★★★★★☆

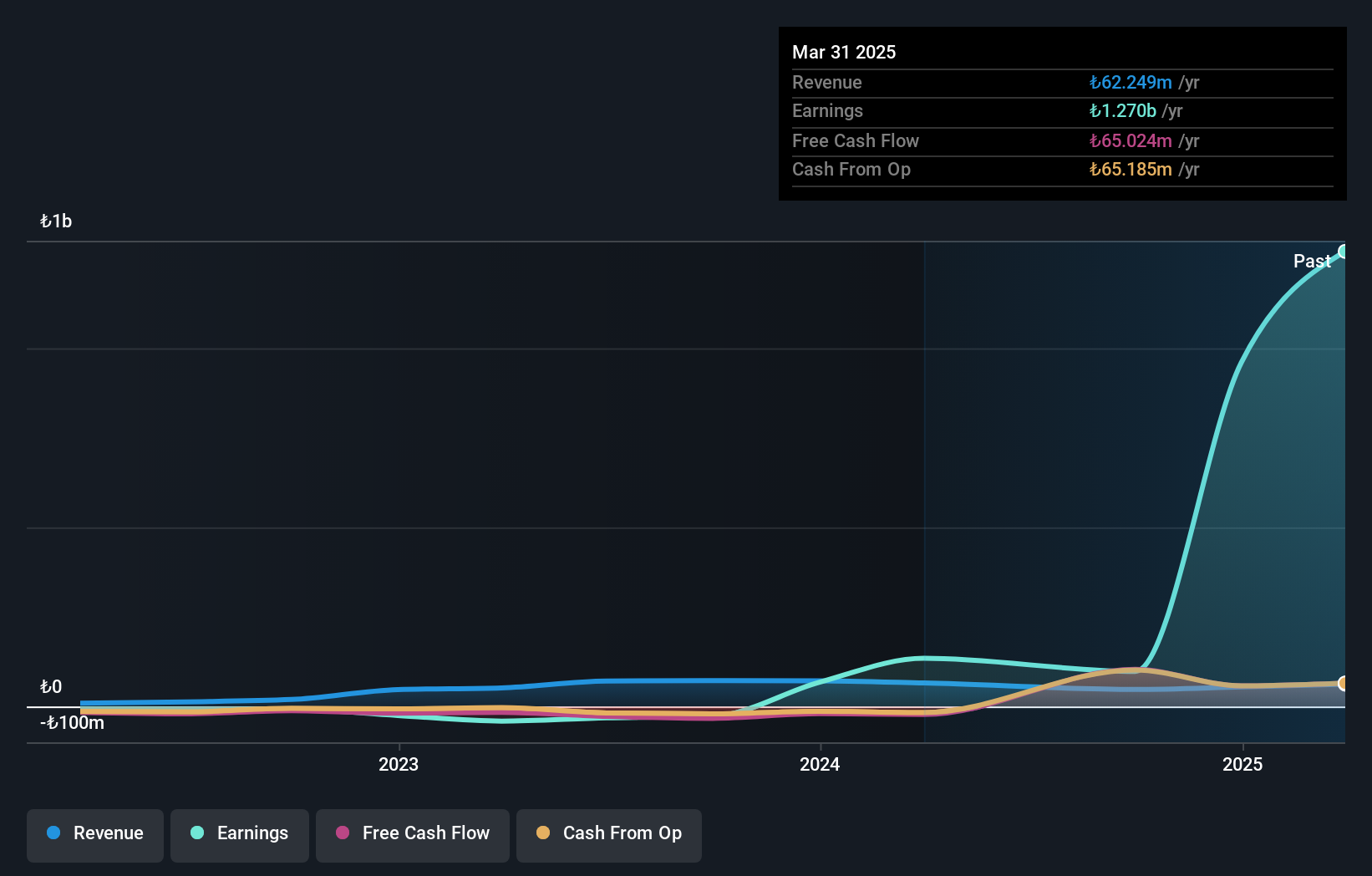

Overview: Lydia Yesil Enerji Kaynaklari A.S. focuses on the production and sale of electricity and heat energy in Turkey, with a market capitalization of TRY25.76 billion.

Operations: Lydia Yesil Enerji Kaynaklari generates revenue primarily from its electricity and heat energy production and sales in Turkey. The company has a market capitalization of TRY25.76 billion, with its financial performance influenced by various operational costs associated with energy production.

Lydia Yesil Enerji Kaynaklari, a small player in the renewable energy sector, has seen its earnings skyrocket by 968% over the past year, outpacing the industry average. Despite this impressive growth, revenue remains modest at TRY 43 million. The company is debt-free and showcases high-quality earnings with significant non-cash components. However, its share price has been highly volatile recently. In Q3 2025, sales dropped to TRY 15.54 million from TRY 44.92 million a year ago, while net losses widened to TRY 125.81 million compared to TRY 52.25 million previously—highlighting challenges despite robust profit growth earlier in the year.

Pera Yatirim Holding Anonim Sirketi (IBSE:TEHOL)

Simply Wall St Value Rating: ★★★★★★

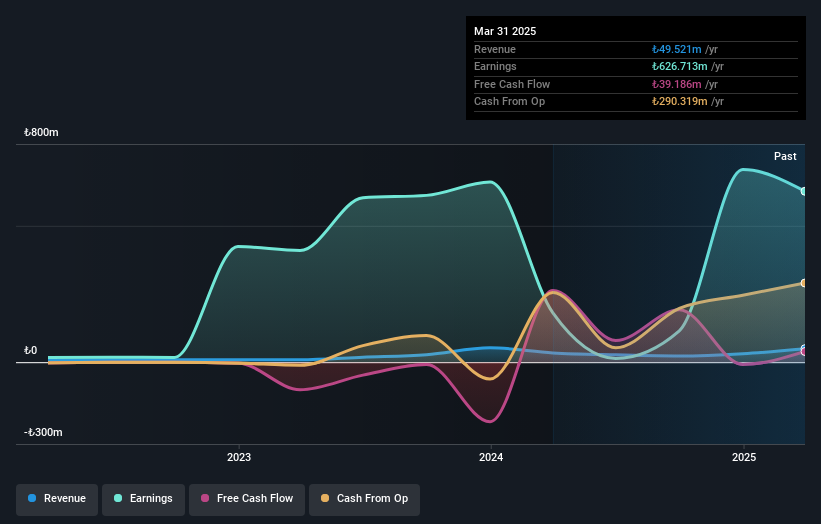

Overview: Pera Yatirim Holding Anonim Sirketi operates as a publicly owned real estate investment trust, with a market capitalization of TRY27.44 billion.

Operations: Pera Yatirim generates revenue primarily through creating and developing a real estate portfolio, amounting to TRY77.19 million.

Pera Yatirim Holding, recently added to the S&P Global BMI Index, shows a compelling profile with notable earnings growth of 173% over the past year, outpacing its REITs industry peers. The company has successfully reduced its debt to equity ratio from 54.4% to 11.4% across five years and maintains more cash than total debt, indicating financial prudence. Despite a volatile share price in recent months and limited revenue at TRY77M, Pera Yatirim's price-to-earnings ratio of 18.7x remains below the industry average of 19.1x, suggesting potential value for investors seeking opportunities in emerging markets like the Middle East.

Key Takeaways

- Gain an insight into the universe of 188 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TEHOL

Pera Yatirim Holding Anonim Sirketi

PERA Gayrimenkul Yatirim Ortakligi AS is a publicly owned real estate investment trust.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success