- Thailand

- /

- Healthcare Services

- /

- SET:THG

November 2024's Top Growth Stocks Backed By Insiders

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, growth stocks have faced challenges, with major indices like the Nasdaq Composite experiencing fluctuations amidst cautious corporate reports. In this environment, companies with high insider ownership can offer unique insights into potential resilience and confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

Here's a peek at a few of the choices from the screener.

MTAR Technologies (NSEI:MTARTECH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MTAR Technologies Limited is a precision engineering solutions company that develops, manufactures, and sells high precision, heavy equipment, components, and machines both in India and internationally with a market cap of ₹51.10 billion.

Operations: MTAR Technologies generates revenue of ₹5.80 billion from its operations in manufacturing high precision and heavy equipment, components, and machines.

Insider Ownership: 36.4%

Revenue Growth Forecast: 26.8% p.a.

MTAR Technologies is experiencing significant growth prospects, with earnings expected to grow over 51% annually, outpacing the Indian market. Despite a decline in profit margins from last year, revenue is forecasted to increase by 26.8% per year. Recent financials show mixed results; Q2 revenue rose to INR 1.92 billion from INR 1.68 billion last year, but net income decreased slightly. A recent defense contract worth INR 154 million underscores its strategic positioning in advanced technology sectors.

- Dive into the specifics of MTAR Technologies here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that MTAR Technologies is priced higher than what may be justified by its financials.

Thonburi Healthcare Group (SET:THG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thonburi Healthcare Group Public Company Limited, along with its subsidiaries, operates private hospitals in Thailand and has a market capitalization of approximately THB15.68 billion.

Operations: The company's revenue segments include Hospital Operations (THB8.44 billion), Hospital Management (THB773.28 million), Healthcare Solution Provider (THB381.29 million), and Development and Sales of Hospital Operation Software (THB36.84 million).

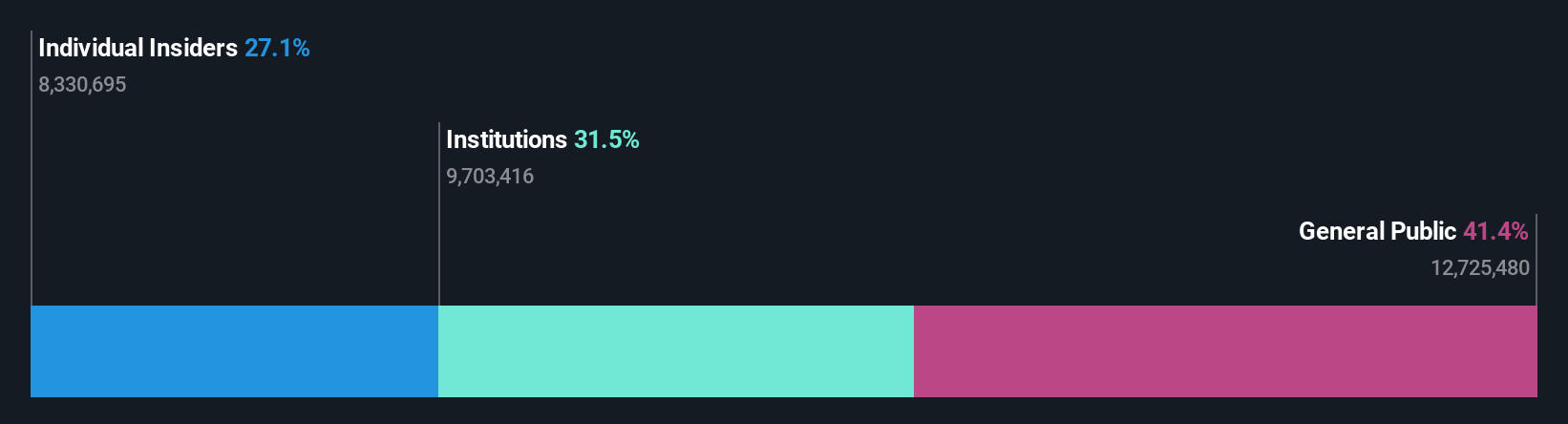

Insider Ownership: 38.3%

Revenue Growth Forecast: 10.5% p.a.

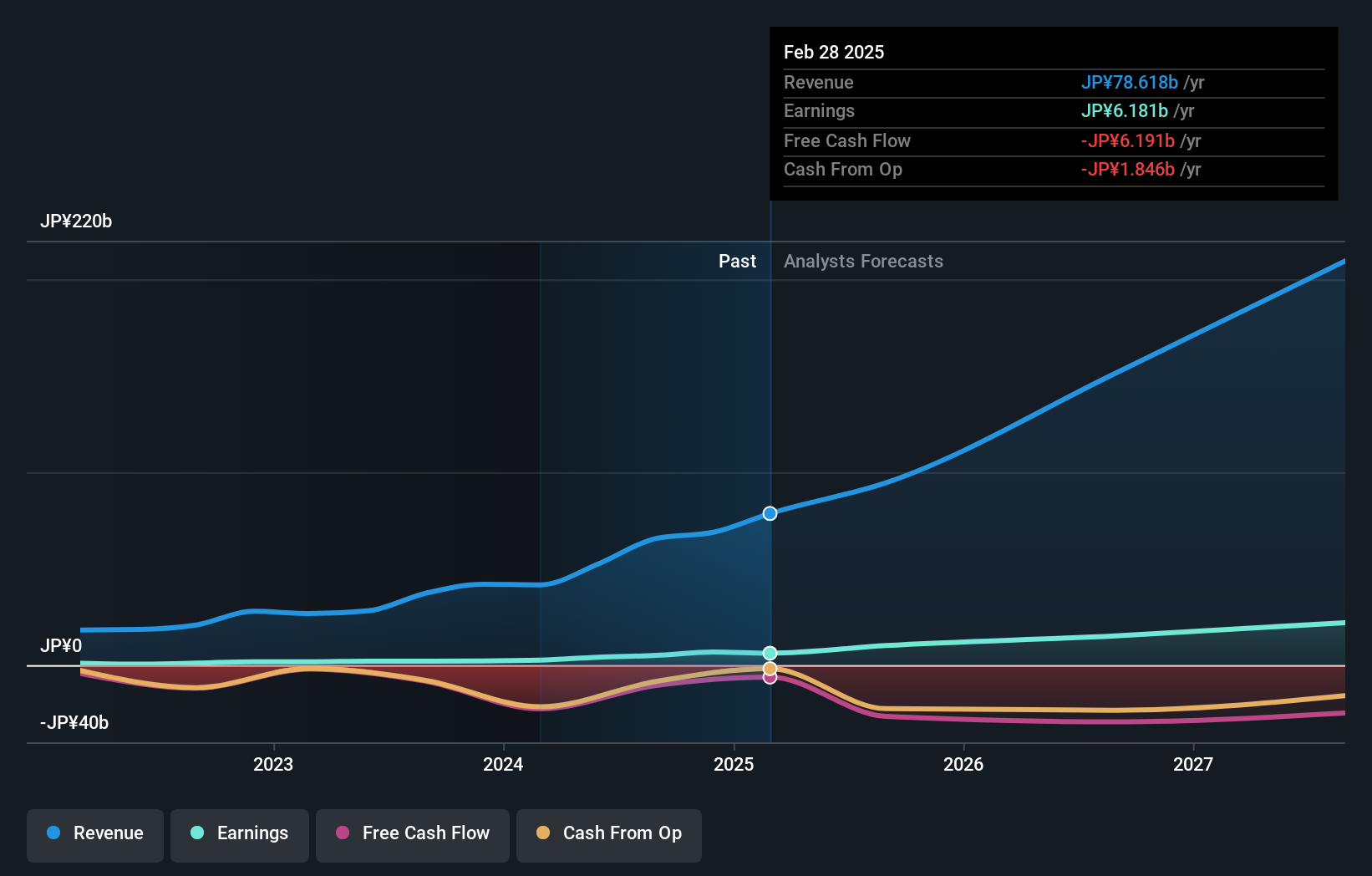

Thonburi Healthcare Group is poised for significant earnings growth, with forecasts indicating an 83.5% annual increase, surpassing the Thai market average. Despite a volatile share price and recent executive changes, the company trades at a good value compared to peers. However, profit margins have declined sharply over the past year due to large one-off items. Recent financials show decreased sales and net income, highlighting challenges in sustaining its dividend from current earnings levels.

- Delve into the full analysis future growth report here for a deeper understanding of Thonburi Healthcare Group.

- Our comprehensive valuation report raises the possibility that Thonburi Healthcare Group is priced lower than what may be justified by its financials.

Kasumigaseki CapitalLtd (TSE:3498)

Simply Wall St Growth Rating: ★★★★★★

Overview: Kasumigaseki Capital Co., Ltd. operates in the real estate consulting sector in Japan with a market capitalization of ¥140.72 billion.

Operations: The company's revenue is primarily derived from its Real Estate Consulting Business, amounting to ¥65.69 billion.

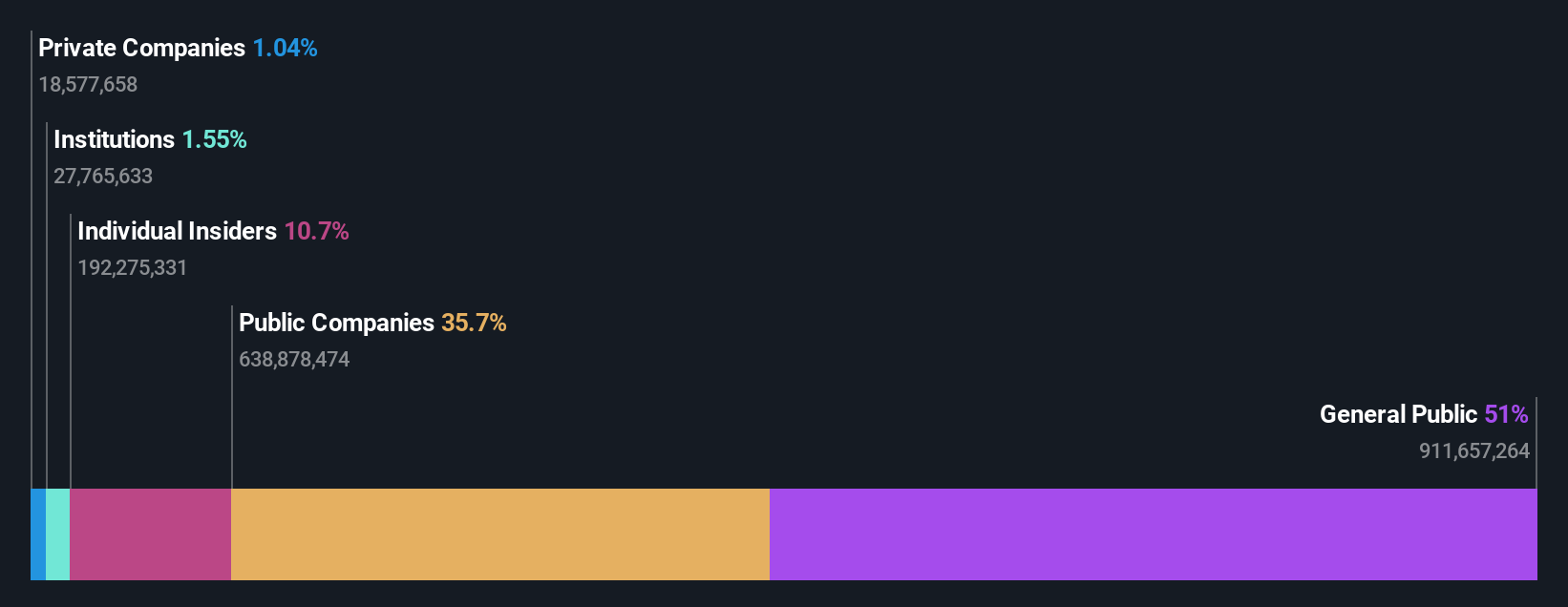

Insider Ownership: 34.4%

Revenue Growth Forecast: 31.7% p.a.

Kasumigaseki Capital Ltd. is projected to achieve substantial earnings growth of 39.8% annually, outpacing the JP market average. Despite trading at a 22.7% discount to its estimated fair value, the company faces challenges with high debt levels and past shareholder dilution. Recent expansion into luxury hospitality through seven x seven Ishigaki highlights strategic diversification efforts, although its volatile share price may concern some investors seeking stability in growth stocks with significant insider ownership.

- Click here to discover the nuances of Kasumigaseki CapitalLtd with our detailed analytical future growth report.

- According our valuation report, there's an indication that Kasumigaseki CapitalLtd's share price might be on the expensive side.

Make It Happen

- Explore the 1537 names from our Fast Growing Companies With High Insider Ownership screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Thonburi Healthcare Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:THG

Moderate with reasonable growth potential.