- Hong Kong

- /

- Capital Markets

- /

- SEHK:1973

Asian Penny Stocks With Market Caps Over US$20M

Reviewed by Simply Wall St

Amidst a backdrop of cautious investor sentiment and evolving economic conditions, Asian markets have shown resilience with some indices recording gains. Penny stocks, though often considered a niche investment area, continue to offer intriguing opportunities for growth, particularly when they are backed by strong financial health. These smaller or newer companies can present unique prospects for investors seeking potential long-term success in under-the-radar firms.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.90 | THB3.85B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.00 | HK$2.44B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.57 | HK$971.08M | ✅ 4 ⚠️ 1 View Analysis > |

| Chongqing Zaisheng Technology (SHSE:603601) | CN¥4.92 | CN¥5.03B | ✅ 3 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.53 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.88 | THB2.93B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.23 | SGD12.71B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.98 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.86 | THB9.82B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 987 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Polaris (Catalist:5BI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Polaris Ltd. is an investment holding company involved in the distribution and sale of smart mobile devices and lifestyle electronics across Singapore, Indonesia, the Philippines, Korea, and South Africa with a market cap of SGD34.11 million.

Operations: The company's revenue is primarily derived from consumer electronics sales at SGD7.87 million and pre-loved luxury goods sales totaling SGD14.93 million.

Market Cap: SGD34.11M

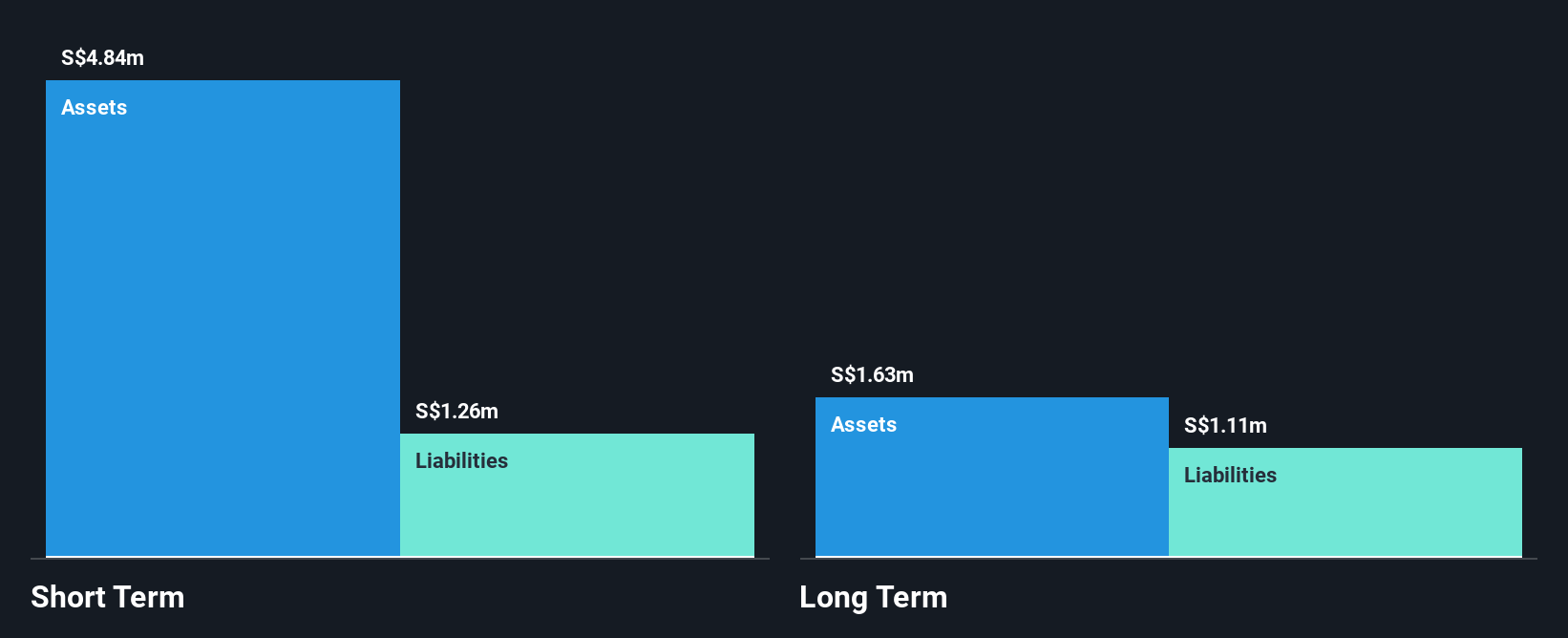

Polaris Ltd., with a market cap of SGD34.11 million, reported half-year sales of SGD11.23 million, slightly down from last year. Despite being unprofitable, the company turned a net income of SGD0.209 million from a previous loss and maintains more cash than debt, suggesting financial stability. The seasoned management team and board provide experienced leadership, while short-term assets comfortably cover liabilities. Although earnings have declined over the past five years and share price remains volatile, Polaris has maintained a sufficient cash runway for over three years due to positive free cash flow growth despite ongoing profitability challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Polaris.

- Evaluate Polaris' historical performance by accessing our past performance report.

Karrie International Holdings (SEHK:1050)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Karrie International Holdings Limited is an investment holding company that manufactures and sells metal, plastic, and electronic products across Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe with a market cap of HK$4.61 billion.

Operations: The company's revenue is primarily derived from its Metal and Plastic Business, generating HK$2.04 billion, and its Electronic Manufacturing Services Business, contributing HK$1.20 billion.

Market Cap: HK$4.61B

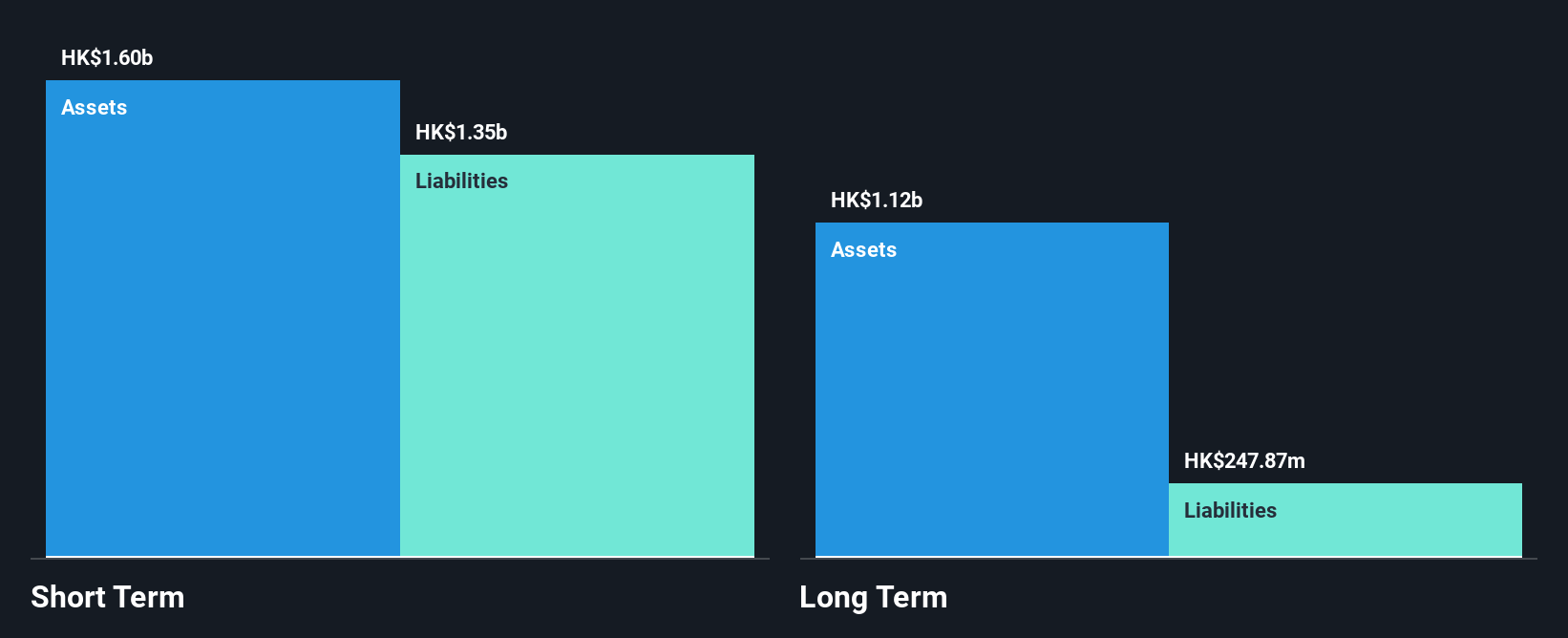

Karrie International Holdings, with a market cap of HK$4.61 billion, has shown earnings growth of 20.5% over the past year, surpassing its five-year average decline. The company's short-term assets exceed both short and long-term liabilities, indicating solid financial footing despite a high net debt to equity ratio of 41.2%. Recent amendments to company bylaws aim to modernize governance practices and align with regulatory standards. However, the dividend yield is not well covered by free cash flows and was recently decreased at their AGM on September 5, 2025, reflecting potential cash flow constraints amidst volatile share prices.

- Dive into the specifics of Karrie International Holdings here with our thorough balance sheet health report.

- Gain insights into Karrie International Holdings' historical outcomes by reviewing our past performance report.

Tian Tu Capital (SEHK:1973)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian Tu Capital Co., Ltd. is a private equity and venture capital firm that invests in small and medium-sized companies across various stages, with a market cap of HK$2.26 billion.

Operations: The company generates revenue primarily from its asset management segment, totaling CN¥198.78 million.

Market Cap: HK$2.26B

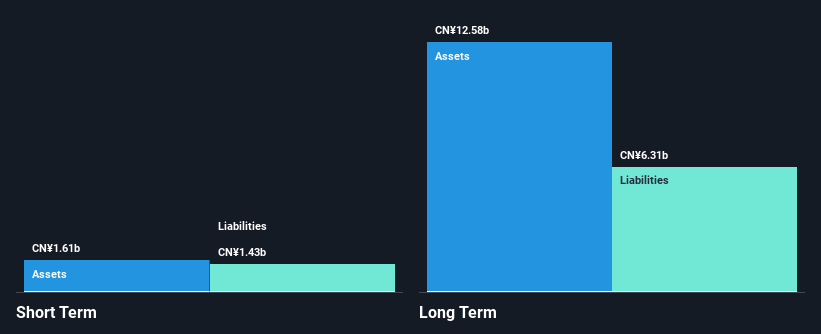

Tian Tu Capital, with a market cap of HK$2.26 billion, recently reported a significant turnaround with CN¥112.62 million in revenue for the first half of 2025 compared to negative revenue last year. This improvement is attributed to increased fair value in its investment portfolio. While the company has more cash than debt and reduced its debt-to-equity ratio from 37.1% to 12.4% over five years, it remains unprofitable with negative return on equity and insufficient EBIT coverage for interest payments. Short-term assets cover short-term liabilities but fall short against long-term obligations, indicating mixed financial health amidst volatility stability.

- Unlock comprehensive insights into our analysis of Tian Tu Capital stock in this financial health report.

- Review our historical performance report to gain insights into Tian Tu Capital's track record.

Make It Happen

- Discover the full array of 987 Asian Penny Stocks right here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tian Tu Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1973

Tian Tu Capital

A private equity and venture capital firm specializing in investments in small and medium sized companies in early-stage, growth capital, late stage, mature and Pre-IPO stages.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.