- Singapore

- /

- Real Estate

- /

- SGX:H78

Is Hongkong Land (SGX:H78) Using Vision 2035 Buybacks to Reinforce Value or Mask Headwinds?

Reviewed by Sasha Jovanovic

- Hongkong Land Holdings recently continued its Strategic Vision 2035 pivot by recycling capital through major asset disposals, repurchasing and cancelling 230,000 shares on 1 December 2025, while managing weaker guidance amid softer Hong Kong office and Mainland China residential conditions.

- This combination of portfolio reshaping, debt reduction, and ongoing buybacks highlights management’s emphasis on balance sheet strength and value-focused capital allocation.

- Next, we’ll examine how this renewed share buyback push under Vision 2035 could influence Hongkong Land’s investment narrative and risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hongkong Land Holdings Investment Narrative Recap

To own Hongkong Land, you need to believe that its ultra premium Hong Kong and regional assets can sustain long term value, even as it exits weaker businesses and faces a soft office and China residential backdrop. The latest buyback and asset recycling moves reinforce balance sheet repair and capital discipline, but they do not materially change the near term catalyst of Hong Kong office stabilization or the key risk from ongoing China project disposals at pressured prices.

The 1 December 2025 repurchase and cancellation of 230,000 shares fits into a broader 2025 buyback program that has coincided with strong recent share price performance. This is particularly relevant as investors weigh a still cautious earnings outlook for 2025 against efforts to tighten the share base, reduce debt and focus on ultra premium investment properties, all while the China residential exit and office demand trends remain central to the story.

But investors should also be aware that Hongkong Land’s concentrated Central Hong Kong exposure means...

Read the full narrative on Hongkong Land Holdings (it's free!)

Hongkong Land Holdings' narrative projects $2.1 billion revenue and $929.4 million earnings by 2028. This requires 6.0% yearly revenue growth and a $1,260.4 million earnings increase from $-331.0 million today.

Uncover how Hongkong Land Holdings' forecasts yield a $6.86 fair value, a 3% upside to its current price.

Exploring Other Perspectives

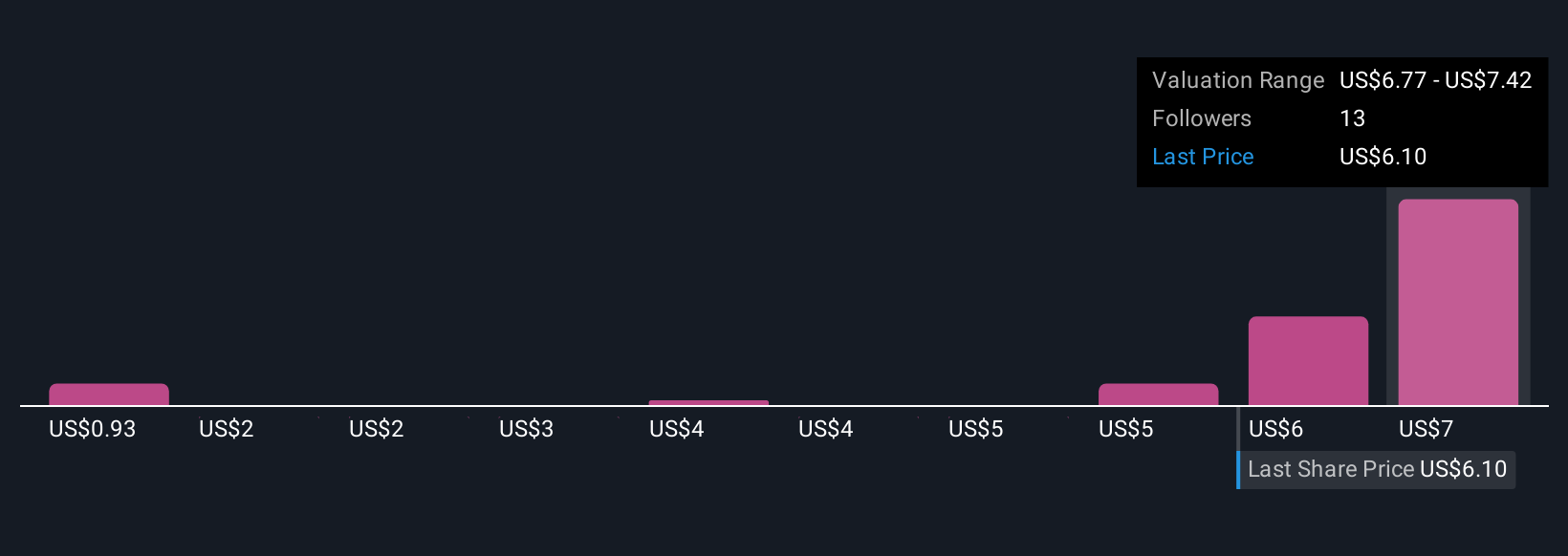

Eight members of the Simply Wall St Community currently see fair value anywhere between US$0.93 and US$7.42, underscoring very different expectations. Set against this, the concentration of ultra premium assets in Central Hong Kong keeps local office demand, vacancy and political risks front and centre for the company’s performance.

Explore 8 other fair value estimates on Hongkong Land Holdings - why the stock might be worth less than half the current price!

Build Your Own Hongkong Land Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hongkong Land Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hongkong Land Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hongkong Land Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hongkong Land Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H78

Hongkong Land Holdings

Engages in the investment, development, and management of properties in Hong Kong, Macau, Mainland China, Southeast Asia, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026