- Singapore

- /

- Real Estate

- /

- SGX:H78

Hongkong Land (SGX:H78): Reassessing Valuation After Buybacks, Asset Sales and a Sharper Focus on Premium Mixed-Use Assets

Reviewed by Simply Wall St

Hongkong Land Holdings (SGX:H78) is back on traders radar after stepping up share buybacks and recycling capital from asset sales, all while its share price still trades at a steep discount to underlying assets.

See our latest analysis for Hongkong Land Holdings.

The combination of stepped up buybacks, capital recycling and a still wide discount to asset value is now clearly feeding into the price action. A roughly 9.5% one month share price return, a near 51% year to date share price gain and a powerful five year total shareholder return of about 103% suggest that momentum is rebuilding as investors reassess both risk and upside.

If Hongkong Land’s rerating has you thinking about where else disciplined capital allocation might be rewarded, it could be worth exploring fast growing stocks with high insider ownership as a starting list of ideas.

So after this powerful rerating and management’s clear push to unlock value, is Hongkong Land still trading at an attractive discount for new buyers, or are markets already pricing in most of the future upside?

Most Popular Narrative: 2.6% Undervalued

With Hongkong Land’s fair value estimate sitting just above the last close, the prevailing narrative implies modest upside still anchored in improving economics.

Substantial investment and repositioning of marquee assets, such as "Tomorrow's CENTRAL" and the West Bund Central development, positions the company to benefit from strong demand for premium, high-quality, ESG-compliant integrated developments among blue-chip tenants and global luxury brands, supporting future rental income and net margin expansion.

Want to see how capital recycling, richer margins and shrinking share count combine into that valuation call? The narrative stitches together an aggressive profit rebound with a future earnings multiple usually reserved for sector standouts. Curious which assumptions make that price target add up, and how sensitive it is to even small changes in those levers? Dive in to unpack the full playbook behind this fair value story.

Result: Fair Value of $6.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that bullish script could quickly fray if China exits crystallize larger losses or hybrid work keeps central office vacancies and rents under sustained pressure.

Find out about the key risks to this Hongkong Land Holdings narrative.

Another Lens on Value

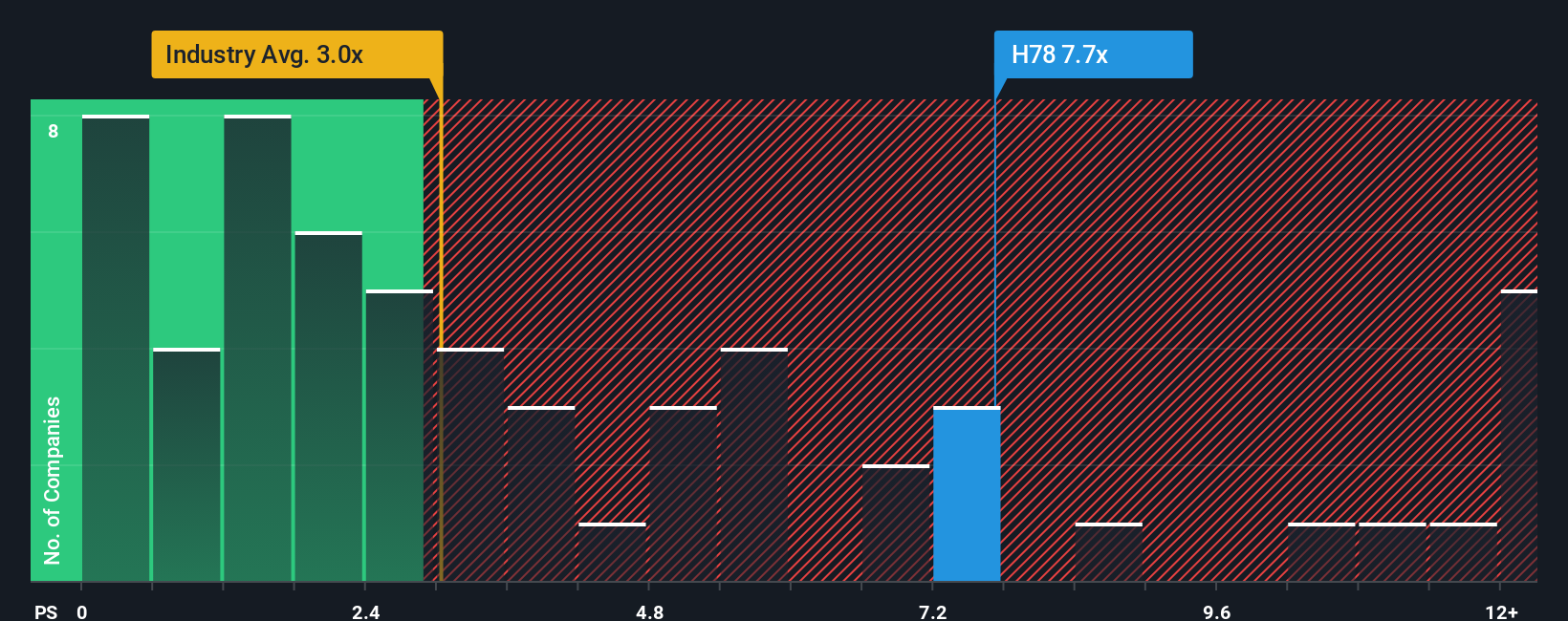

Look past the upbeat narrative and the picture turns trickier. On a simple price to sales basis, Hongkong Land trades at about 8.1 times sales, far richer than both the Singapore real estate average of 3.2 times and peers at 5 times, while its fair ratio sits nearer 4.2 times. That premium could compress quickly if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hongkong Land Holdings Narrative

If the story here does not quite fit your view, you can dig into the numbers yourself and shape a fresh perspective in minutes, Do it your way.

A great starting point for your Hongkong Land Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single opportunity, use the Simply Wall Street Screener to uncover fresh stocks that fit your strategy before the market catches on.

- Capture potential income streams by reviewing these 15 dividend stocks with yields > 3% that balance yield with solid underlying businesses.

- Position yourself ahead of major technological shifts by scanning these 26 AI penny stocks shaping the next wave of innovation.

- Strengthen your portfolio’s value core by targeting these 906 undervalued stocks based on cash flows where prices still lag behind fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hongkong Land Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H78

Hongkong Land Holdings

Engages in the investment, development, and management of properties in Hong Kong, Macau, Mainland China, Southeast Asia, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026