- Singapore

- /

- Real Estate

- /

- SGX:H13

How Investors May Respond To Ho Bee Land (SGX:H13) Expanding Into Australia With Major Land Acquisitions

Reviewed by Sasha Jovanovic

- Ho Bee Land Limited recently announced the acquisition of five residential development sites in Australia, covering projects expected to yield approximately 1,079 residential lots across Queensland and Victoria.

- This expansion aligns with Australian government infrastructure initiatives, which could enhance property values and bring improved amenities to these key regions.

- We'll explore how Ho Bee Land's entry into Australia through these land acquisitions could influence its future investment positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ho Bee Land's Investment Narrative?

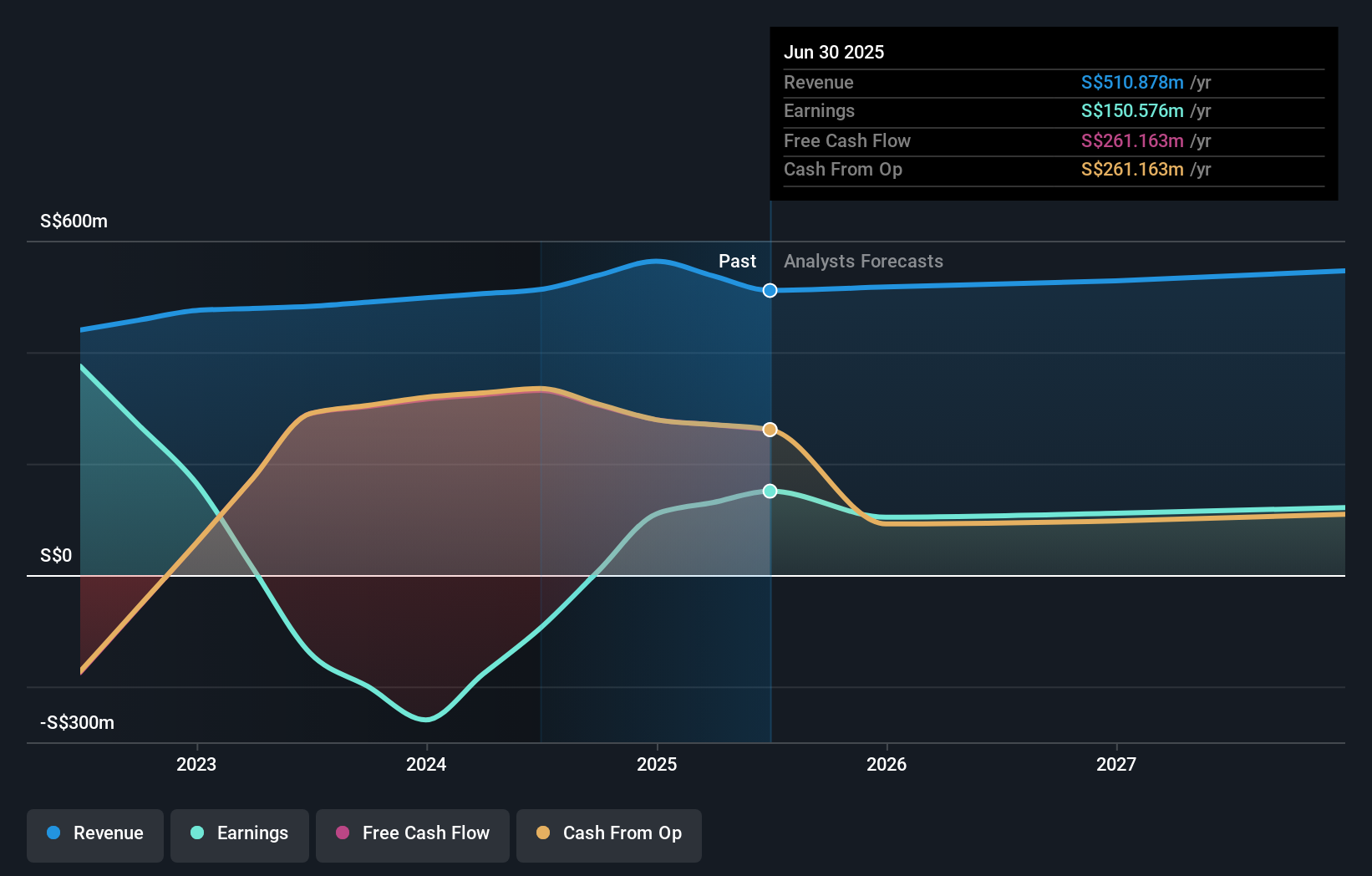

For shareholders, the investment thesis behind Ho Bee Land often centers on its value credentials and ability to transform one-off profits into sustained income, against a backdrop of slow growth and a relatively low return on equity. The recent move into Australia, acquiring five residential sites with the potential for over a thousand new lots, could act as a meaningful catalyst, especially when set against the company’s sluggish revenue forecasts and recent underperformance compared to both the industry and market. Previously, key risks included a heavy reliance on non-recurring income and a less-experienced management team, but these acquisitions point to a shift toward recurring property development revenue and geographic diversification. Still, execution risk looms large, with the board’s overhaul and entrance into a new market potentially introducing fresh uncertainties for earnings stability and future cash flows. On the flipside, investors should keep the management changes and integration risk firmly in mind.

Despite retreating, Ho Bee Land's shares might still be trading 46% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Ho Bee Land - why the stock might be worth as much as 84% more than the current price!

Build Your Own Ho Bee Land Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ho Bee Land research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ho Bee Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ho Bee Land's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ho Bee Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H13

Undervalued with low risk.

Market Insights

Community Narratives