- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3833

Asian Penny Stocks To Monitor In December 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by dovish signals from central banks and mixed economic data, investors are increasingly looking toward smaller-cap opportunities in Asia. Penny stocks, though often seen as a niche investment, continue to attract interest for their potential to deliver significant growth when backed by robust financials. This article will explore several Asian penny stocks that stand out for their resilience and growth potential amidst current market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.87 | HK$2.35B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.44 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.11 | SGD449.87M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.28 | SGD12.91B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.45 | SGD168.58M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Xinjiang Xinxin Mining Industry (SEHK:3833)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xinjiang Xinxin Mining Industry Co., Ltd. operates in mining, ore processing, smelting, refining, and selling of nickel, copper, and other nonferrous metals with a market capitalization of approximately HK$4.75 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: HK$4.75B

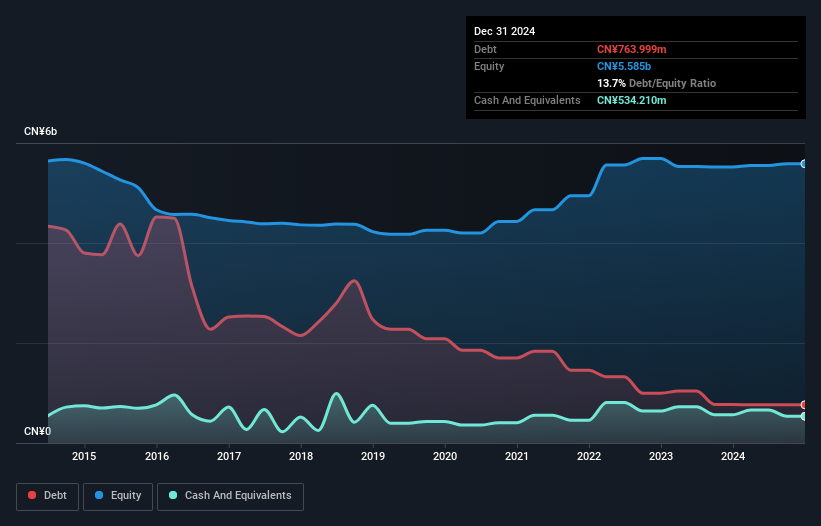

Xinjiang Xinxin Mining Industry's financial health reveals mixed indicators for potential investors. The company maintains a satisfactory net debt to equity ratio of 16% and has experienced management and board teams, with average tenures of 2.1 and 4.3 years respectively. However, its earnings have declined by an average of 10.5% annually over the past five years, with recent negative growth contrasting sharply against industry averages. Despite having sufficient short-term assets to cover liabilities, its operating cash flow covers only 14.4% of debt obligations, indicating potential liquidity challenges amidst high share price volatility in recent months.

- Get an in-depth perspective on Xinjiang Xinxin Mining Industry's performance by reading our balance sheet health report here.

- Examine Xinjiang Xinxin Mining Industry's past performance report to understand how it has performed in prior years.

FIT Hon Teng (SEHK:6088)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$35.33 billion.

Operations: The company's revenue is primarily derived from Consumer Products, which generated $671.57 million, and Intermediate Products, contributing $4.13 billion.

Market Cap: HK$35.33B

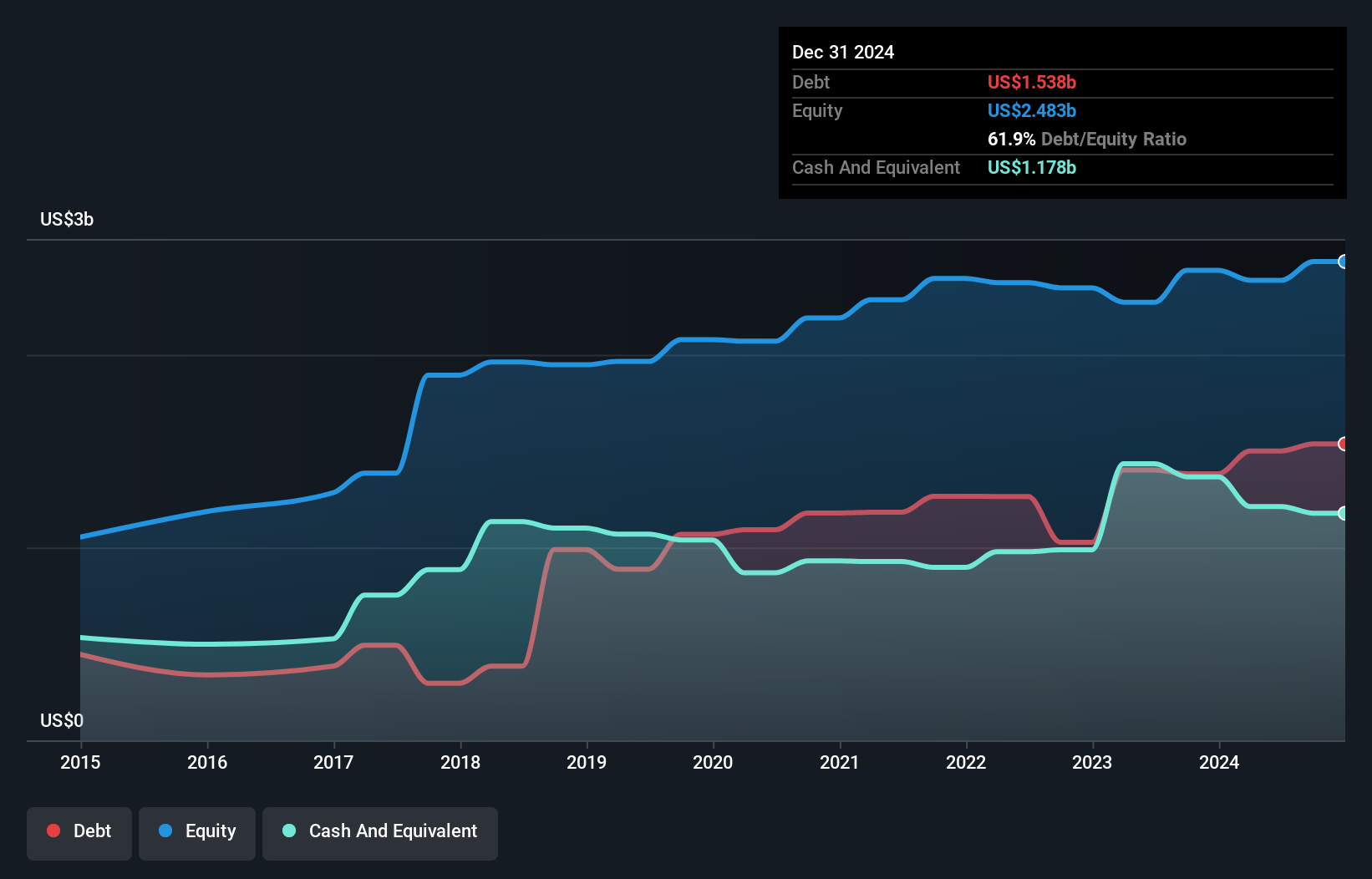

FIT Hon Teng Limited presents a complex picture for investors interested in penny stocks. The company has shown consistent profit growth over the past five years, with earnings increasing by 11.3% annually. Its short-term and long-term liabilities are well-covered by assets, indicating sound financial health. However, recent earnings have declined by 10.4%, underperforming the industry average of 7.2%. Volatility remains high compared to most Hong Kong stocks, while its net debt to equity ratio has increased over time but remains at a satisfactory level of 20.6%. The management and board exhibit significant experience with tenures averaging over six years each.

- Click here and access our complete financial health analysis report to understand the dynamics of FIT Hon Teng.

- Gain insights into FIT Hon Teng's future direction by reviewing our growth report.

Low Keng Huat (Singapore) (SGX:F1E)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Low Keng Huat (Singapore) Limited is an investment holding company involved in property development, hotel, and investment businesses across Singapore, Australia, and Malaysia with a market cap of SGD528.25 million.

Operations: The company's revenue is derived from property development (SGD197.27 million), hotels (SGD49.62 million), and investments including construction (SGD47.87 million).

Market Cap: SGD528.25M

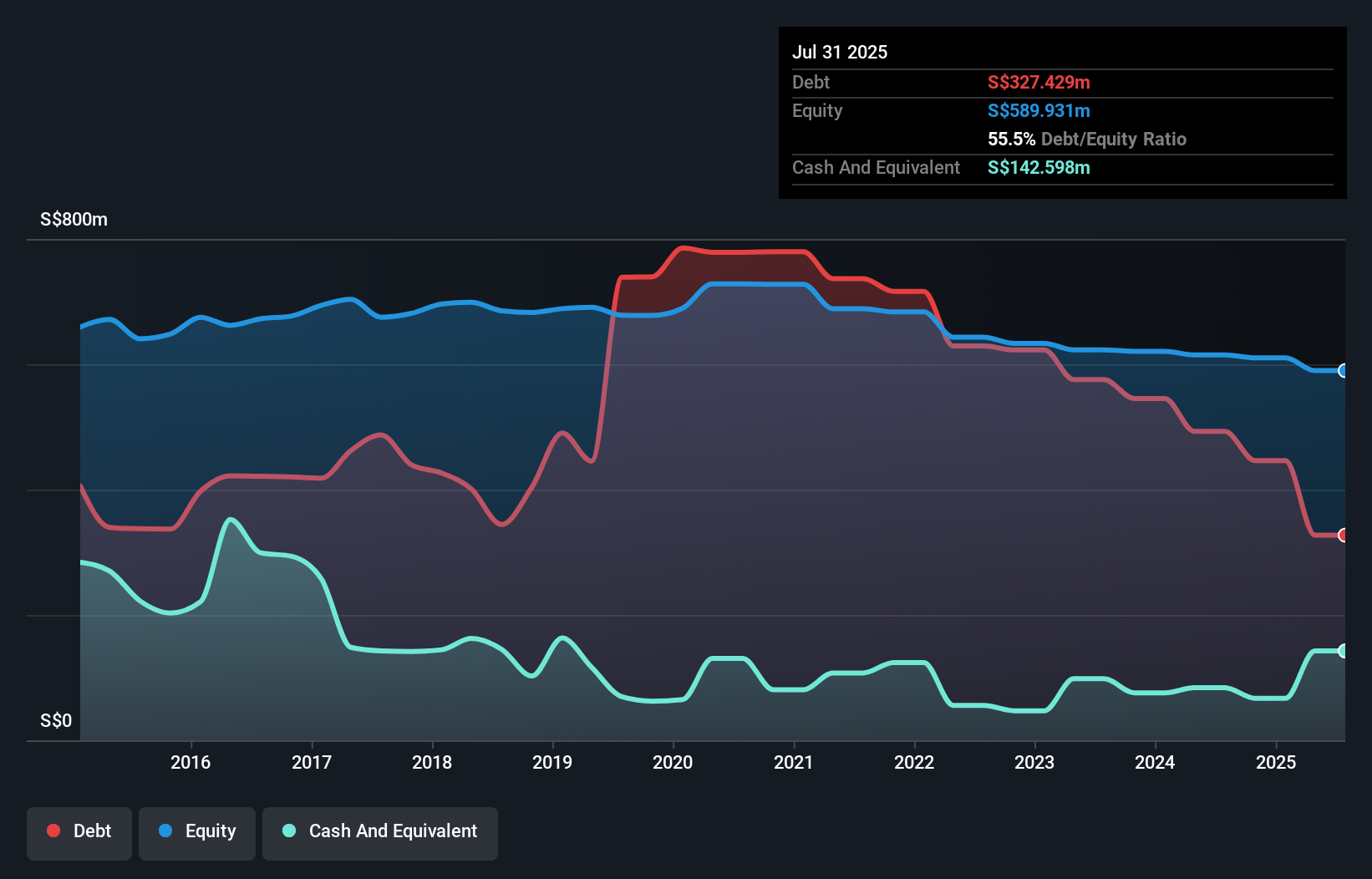

Low Keng Huat (Singapore) Limited, with a market cap of SGD528.25 million, faces challenges as it remains unprofitable and has seen increasing losses over the past five years. Despite stable weekly volatility and a seasoned management team with an average tenure of 6.8 years, the company struggles with declining earnings, reporting a net loss of SGD10.17 million for the half year ended July 31, 2025. Its short-term assets exceed both short- and long-term liabilities, suggesting financial stability in asset management. Recent developments include Consistent Record Sdn Bhd's proposal to acquire full ownership through a tender offer valued at SGD250 million.

- Dive into the specifics of Low Keng Huat (Singapore) here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Low Keng Huat (Singapore)'s track record.

Make It Happen

- Navigate through the entire inventory of 955 Asian Penny Stocks here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3833

Xinjiang Xinxin Mining Industry

Engages in mining, ore processing, smelting, refining, and selling of nickel, copper, and other nonferrous metals.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026