The market has climbed by 1.7% over the past week, with every sector up, and is up 9.5% over the last 12 months. In this favorable environment, identifying strong dividend stocks can provide a steady income stream while capitalizing on forecasted earnings growth of 10.0% annually.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.99% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.76% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.27% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.36% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.20% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.10% | ★★★★★☆ |

| Genting Singapore (SGX:G13) | 4.71% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.17% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.69% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.64% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Delfi (SGX:P34)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited is an investment holding company that manufactures, markets, distributes, and sells chocolate and consumer products primarily in Indonesia, the Philippines, Malaysia, Singapore, and internationally with a market cap of SGD513.37 million.

Operations: Delfi Limited generates revenue of $349.57 million from Indonesia and $183.30 million from its Regional Markets segment.

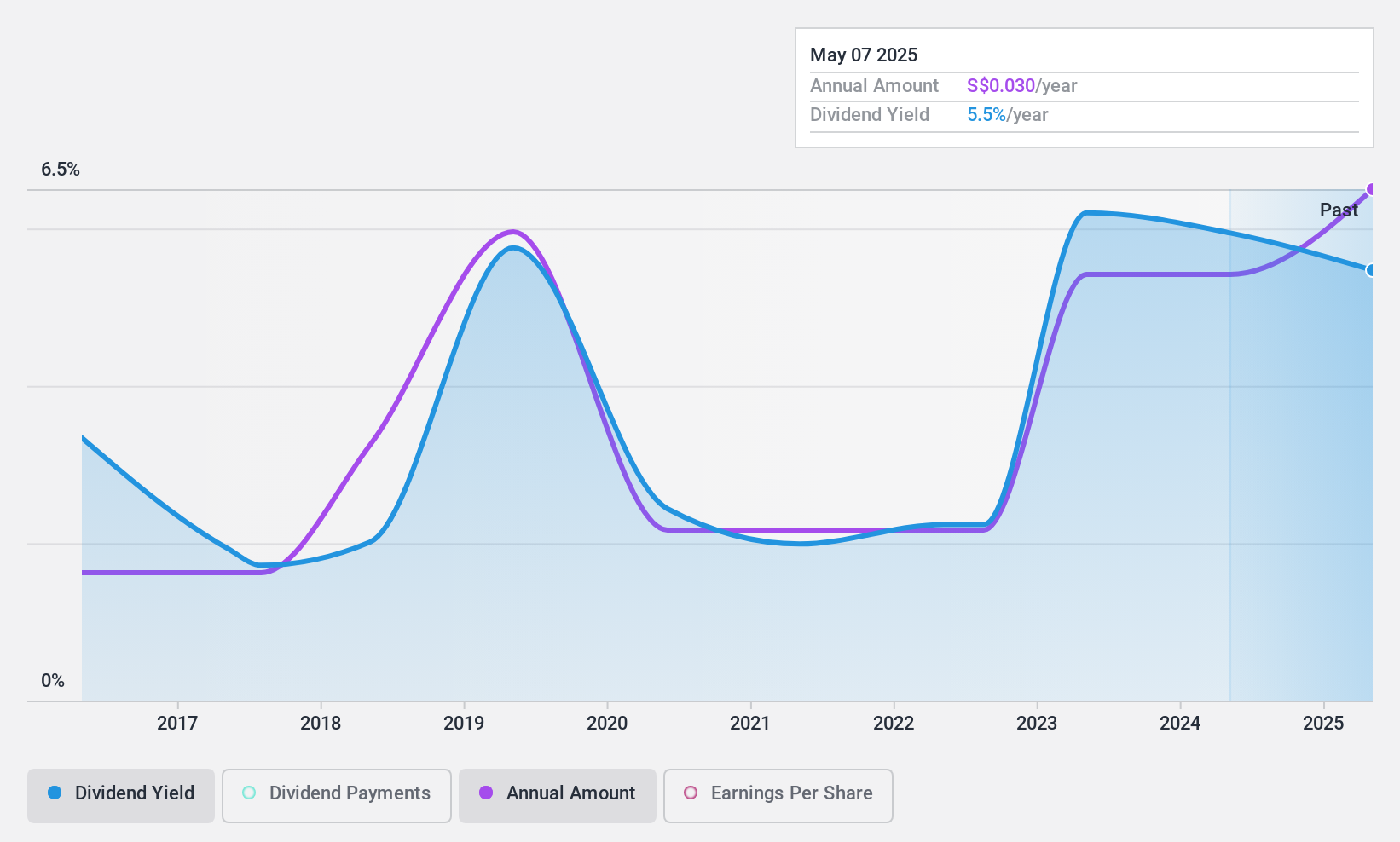

Dividend Yield: 6.6%

Delfi's dividend payments have been volatile over the past decade and are not well covered by free cash flows, with a high cash payout ratio of 750.7%. Despite having a reasonable earnings payout ratio of 57.2%, recent interim dividends decreased slightly to S$0.0272 per share for H1 2024 from S$0.0273 in H1 2023. Additionally, Delfi reported declining sales (US$260.81 million) and net income (US$19.57 million) for the same period, indicating potential challenges ahead for sustaining dividend payouts.

- Click here to discover the nuances of Delfi with our detailed analytical dividend report.

- Our valuation report unveils the possibility Delfi's shares may be trading at a discount.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market cap of SGD400.50 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue primarily from Rubber Chemicals (CN¥4.39 billion), Heating Power (CN¥202.99 million), and Waste Treatment (CN¥25.06 million).

Dividend Yield: 5.8%

China Sunsine Chemical Holdings has a low payout ratio of 21.1%, indicating dividends are well-covered by earnings. Despite this, the company's dividend payments have been volatile over the past decade. Recent earnings for H1 2024 showed stable sales (CNY 1.75 billion) and a slight decline in net income (CNY 188.8 million). While trading at good value, its dividend yield (5.78%) is slightly below the top tier in Singapore's market.

- Click here and access our complete dividend analysis report to understand the dynamics of China Sunsine Chemical Holdings.

- The analysis detailed in our China Sunsine Chemical Holdings valuation report hints at an deflated share price compared to its estimated value.

United Overseas Bank (SGX:U11)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited, along with its subsidiaries, offers a range of banking products and services globally and has a market cap of SGD55.09 billion.

Operations: United Overseas Bank Limited generates revenue from Group Retail (SGD5.11 billion), Global Markets (SGD400 million), and Group Wholesale Banking (SGD6.69 billion).

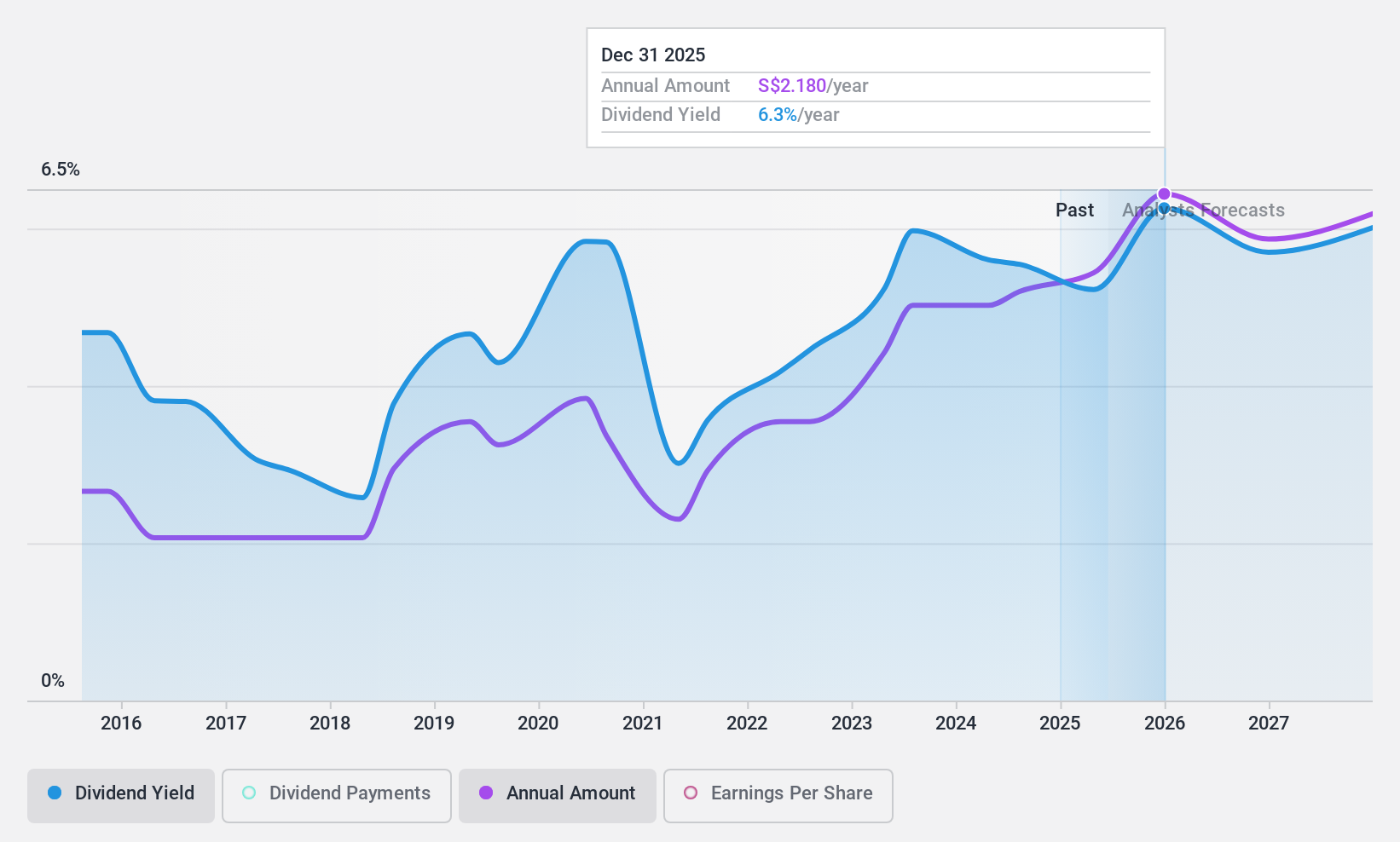

Dividend Yield: 5.3%

United Overseas Bank's dividend payments have been volatile over the past decade, but recent increases show a commitment to rewarding shareholders. The current payout ratio of 51.9% indicates dividends are well-covered by earnings, with forecasts suggesting this will continue. Despite trading at 52.9% below estimated fair value, its dividend yield (5.34%) is lower than the top tier in Singapore's market. Recent earnings were stable (SGD 2.91 billion for H1 2024).

- Delve into the full analysis dividend report here for a deeper understanding of United Overseas Bank.

- In light of our recent valuation report, it seems possible that United Overseas Bank is trading behind its estimated value.

Seize The Opportunity

- Click here to access our complete index of 19 Top SGX Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P34

Delfi

An investment holding company, manufactures, markets, distributes, and sells chocolate, chocolate confectionery, and consumer products in Indonesia, Philippines, Malaysia, Singapore, and internationally.

Flawless balance sheet average dividend payer.