- Singapore

- /

- Capital Markets

- /

- SGX:YF8

Yangzijiang Financial Holding (SGX:YF8): Assessing Valuation After Sweeping Leadership Changes and Strategic Spin-Off Plans

Reviewed by Simply Wall St

Yangzijiang Financial Holding (SGX:YF8) is making headlines after a sweeping board and management reshuffle, timed with its plans to spin off the maritime fund and investments business. The entire leadership slate, from Executive Chairman to CEO and CFO, has shifted.

See our latest analysis for Yangzijiang Financial Holding.

The sweeping changes at Yangzijiang Financial Holding come right after a rollercoaster for investors, with the share price plunging over 50% in just one week. Despite sharp volatility recently, the company still boasts an impressive 1-year total shareholder return of nearly 37%, and over 71% cumulative return over three years. This signals that momentum has shifted, but long-term holders have seen substantial gains.

If this kind of dramatic boardroom shake-up has you curious about what else is brewing in the market, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a significant discount to analyst price targets and fresh leadership at the helm, investors are now asking if this massive overhaul is a rare buying opportunity or if the future growth is already priced in.

Price-to-Earnings of 5.4x: Is it justified?

Yangzijiang Financial Holding currently trades at a price-to-earnings (P/E) ratio of just 5.4x. This is dramatically lower than both the industry and peer average ratios, suggesting the market is applying a heavy discount to the company's earnings when compared to its rivals.

The price-to-earnings ratio is a widely used metric for valuing companies. It captures what investors are willing to pay for every dollar of current earnings. For diversified financials like Yangzijiang, a lower P/E can imply the market has muted expectations for future growth or is pricing in above-average risk. Conversely, such a steep discount might signal a potential value play if fundamentals remain intact.

Compared to its industry, where the average P/E stands at 20.6x, Yangzijiang’s 5.4x looks extremely cheap. Even among its peers, the prevailing average is 18.6x. Furthermore, the estimated fair P/E for Yangzijiang is 20.9x, pointing to significant room for rerating if sentiment or fundamentals improve toward the sector mean.

Explore the SWS fair ratio for Yangzijiang Financial Holding

Result: Price-to-Earnings of 5.4x (UNDERVALUED)

However, slowing annual revenue growth and declining net income could signal deeper challenges that may weigh on any swift recovery in sentiment.

Find out about the key risks to this Yangzijiang Financial Holding narrative.

Another View: What Does Our DCF Model Say?

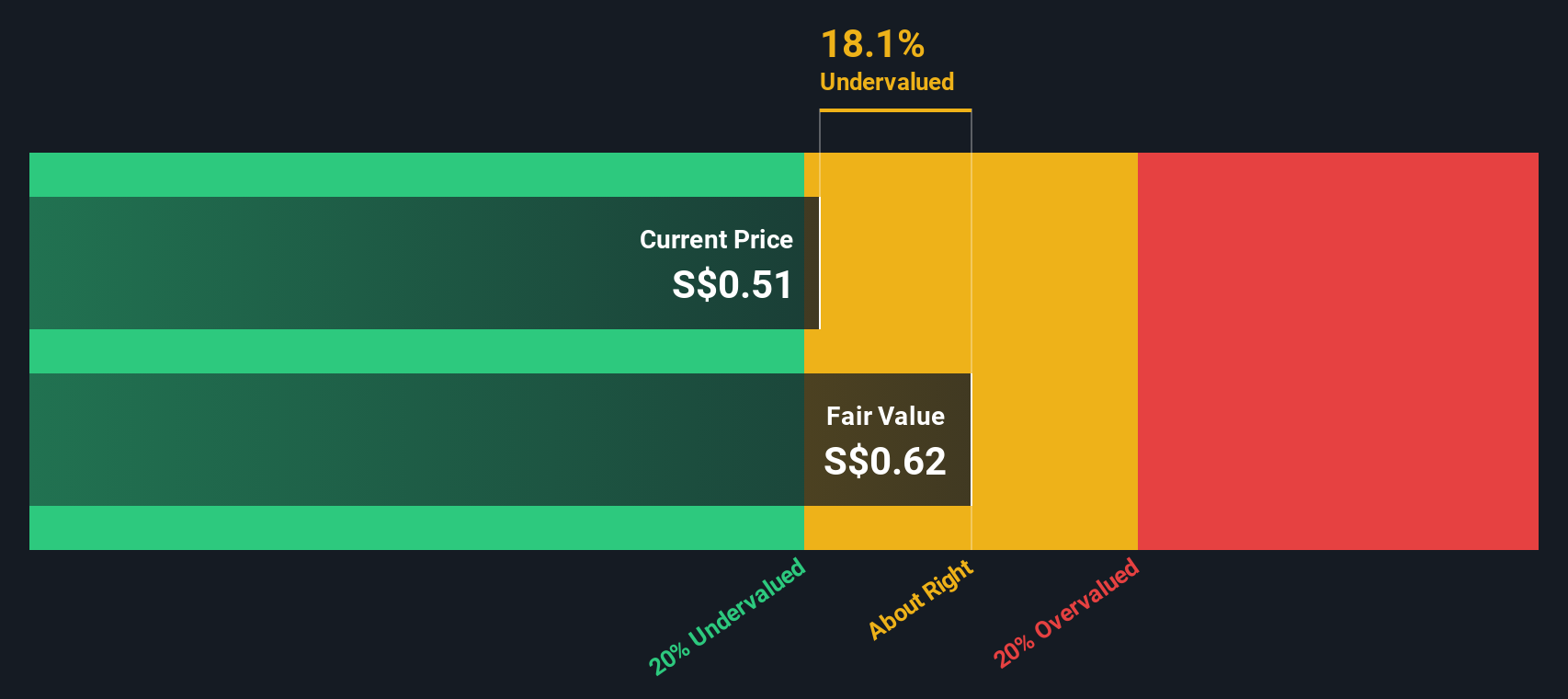

While the current price-to-earnings valuation looks extremely cheap, our SWS DCF model offers another perspective. According to this model, Yangzijiang Financial Holding is trading at about 17% below its estimated fair value. This suggests some undervaluation, but not as dramatic as the multiple suggests. Do these two methods point to opportunity or indicate potential value traps ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Yangzijiang Financial Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Yangzijiang Financial Holding Narrative

If our view does not match your own, why not dig into the details yourself and see if your perspective leads you elsewhere? You can build your own view and Do it your way

A great starting point for your Yangzijiang Financial Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Capitalize on today’s momentum by targeting areas with explosive growth potential, high yields, and market megatrends. See what others could miss if you only look at familiar names.

- Catalyze your wealth-building journey with high-yield players by tapping into these 16 dividend stocks with yields > 3% that provide strong income potential and financial durability.

- Unleash your advantage in precision medicine and digital health by targeting these 32 healthcare AI stocks transforming care with artificial intelligence innovation.

- Amplify your gains by seeking out value-packed opportunities from these 868 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:YF8

Yangzijiang Financial Holding

An investment holding company, engages in the investment-related activities in the People's Republic of China and Singapore.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives