- Singapore

- /

- Food and Staples Retail

- /

- SGX:D01

DFI Retail Group (SGX:D01) Valuation After New Three‑Year Dividend and Profit Growth Roadmap

Reviewed by Simply Wall St

DFI Retail Group Holdings (SGX:D01) just laid out a fresh three year roadmap, lifting its dividend payout target to 70% and tying that commitment to ambitious profit growth and capital efficiency goals through 2028.

See our latest analysis for DFI Retail Group Holdings.

The roadmap has clearly caught investors’ attention, with the latest share price at $4.10 after a 19.19% 7‑day share price return and a striking 103.53% one‑year total shareholder return, suggesting momentum is firmly building behind the turnaround story.

If this kind of rebound has you curious about what else is setting up for a reset, it is worth exploring fast growing stocks with high insider ownership.

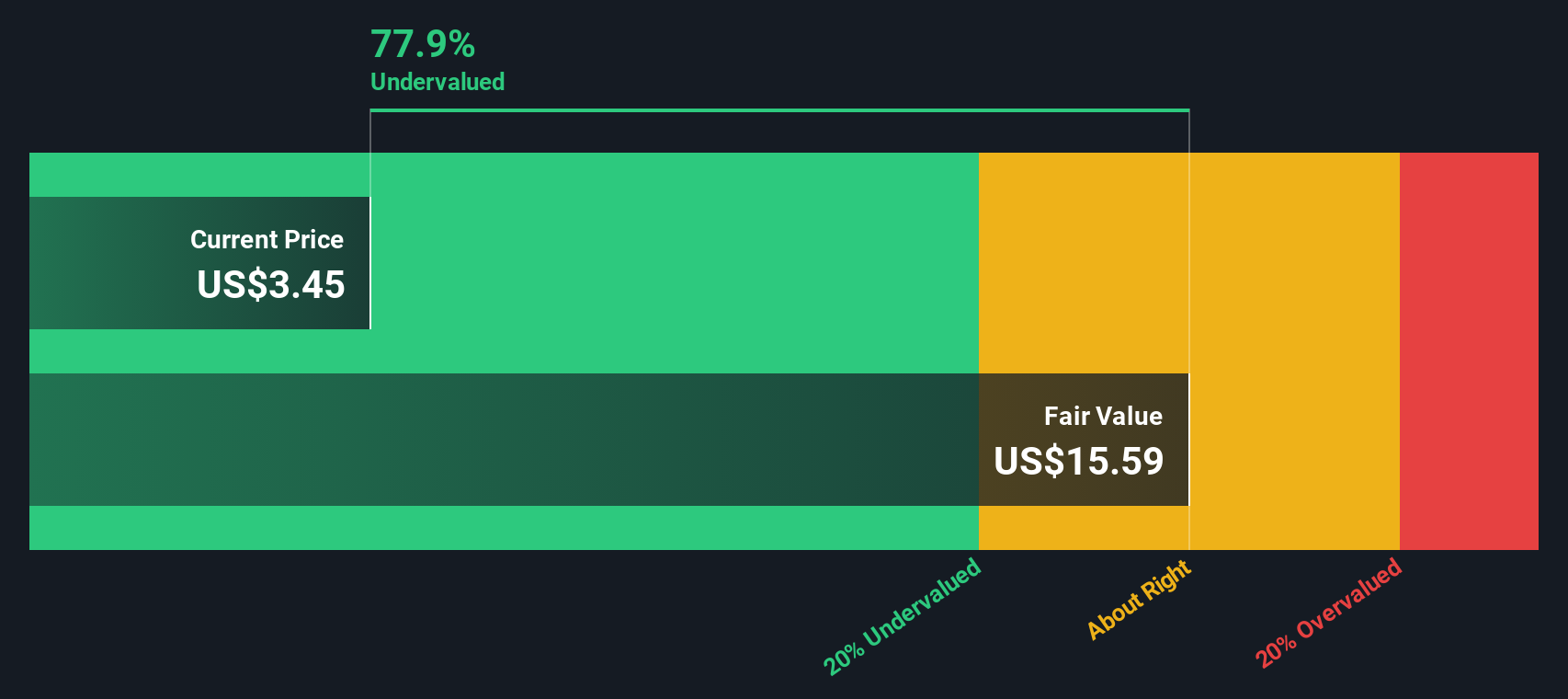

Yet with the shares already near analyst targets despite still recovering from past losses, investors now face a key question: Is DFI Retail genuinely undervalued, or are markets already pricing in the full turnaround and future growth?

Most Popular Narrative: 6.3% Overvalued

Against the last close of $4.10, the most followed narrative points to a lower fair value, framing DFI Retail’s recent surge as slightly ahead of fundamentals.

The analysts have a consensus price target of $3.709 for DFI Retail Group Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.3, and the most bearish reporting a price target of just $2.57.

Curious how flat revenues can still justify a sharply higher profit base and premium earnings multiple for a traditional retailer? Discover the profit transformation playbook behind this valuation call and see which assumptions really carry the narrative.

Result: Fair Value of $3.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cigarette volume declines and intensifying online price competition could blunt margin gains and derail the upbeat profit and valuation narrative.

Find out about the key risks to this DFI Retail Group Holdings narrative.

Another View: Deep Value on Cash Flows

While the consensus narrative points to modest overvaluation around $3.86, our DCF model paints a very different picture, implying a fair value near $14.28, or roughly 71% above the current price. If cash flows really recover as forecast, is the market underestimating just how far this turnaround could run?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DFI Retail Group Holdings Narrative

If you are not fully convinced by these views or would rather dive into the numbers yourself, you can build a custom thesis in minutes: Do it your way.

A great starting point for your DFI Retail Group Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single turnaround story. Use the Simply Wall St Screener to uncover more targeted opportunities before other investors catch on.

- Capitalize on mispriced potential by scanning these 906 undervalued stocks based on cash flows that the market may be overlooking today.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks transforming how care is delivered and monetized.

- Amplify your income strategy by targeting these 15 dividend stocks with yields > 3% that can strengthen total returns through reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:D01

DFI Retail Group Holdings

Operates as a retailer in Hong Kong, Mainland China, Macau, Taiwan, Singapore, Cambodia, Malaysia, Indonesia, and Brunei.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026