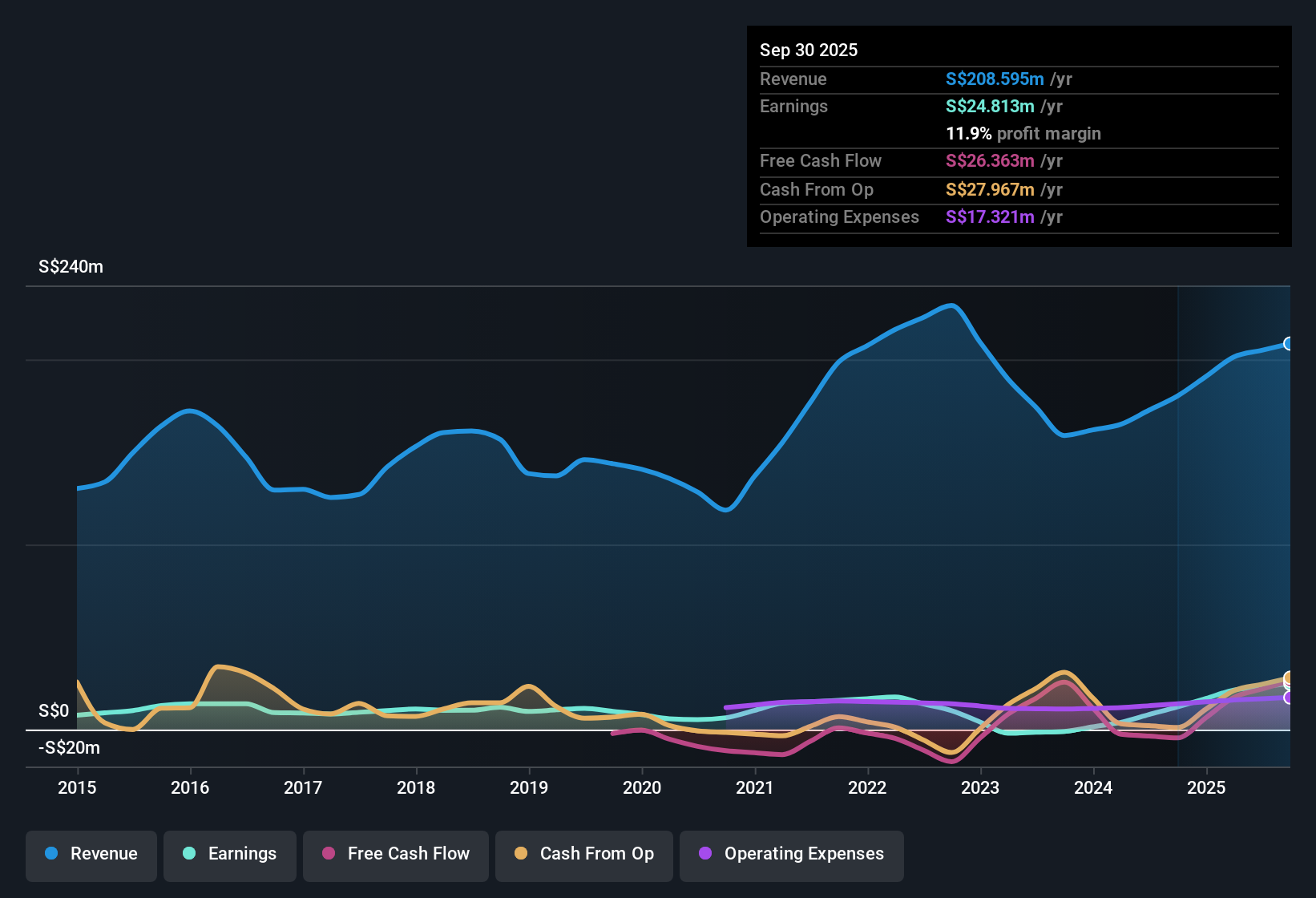

Nam Lee (SGX:G0I): Profit Margins Double to 11.9%, Reinforcing Bullish Narratives

Reviewed by Simply Wall St

Nam Lee Pressed Metal Industries (SGX:G0I) just posted FY 2025 first-half results, with revenue at SGD99.5 million and EPS of SGD0.048. Looking back, the company has seen revenue climb from SGD78.5 million in the first half of FY 2024 to over SGD101.8 million in the second half, with EPS advancing from SGD0.0106 to SGD0.0399 across the same period. Expanding profit margins set a confident tone for investors as the company demonstrates clear earnings momentum.

See our full analysis for Nam Lee Pressed Metal Industries.Next, we will compare these standout results against community narratives and widely held investor expectations to see which themes get reinforced and which might get called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Hit 11.9%, Doubling Last Year’s Level

- Net profit margins climbed to 11.9% over the past twelve months, up from 6.8% a year ago. This gain of more than five percentage points marks the highest profitability level in recent results.

- What stands out from the general market analysis is that operational resilience, driven by a diversified product range and stable infrastructure demand, strongly supports the idea that margin expansion is not a one-off.

- There was 104% earnings growth in the last year, far surpassing the historical five-year average of 8.4%, which provides further support to this view.

- Margins now stand out in a sector where rising input costs and competition are common challenges, highlighting management’s strong control over costs.

Valuation Still Well Below DCF Fair Value

- The current share price is SGD0.55, which is 62.7% below the latest DCF fair value estimate of SGD1.47. This is a notable discount even as profitability improves.

- Prevailing market commentary highlights this gap and notes that industry-specific risks, such as sector cyclicality and price competition, continue to challenge a full rerating.

- The Price-to-Earnings ratio stands at just 5.4x, significantly below the peer average of 18.9x, which offers a notable value angle for investors focused on earnings yield.

- Despite this, the sharp undervaluation persists due to continued caution about the company’s exposure to regional construction cycles and broader macroeconomic headwinds.

Dividend Consistency Remains in Question

- An unstable dividend track record is highlighted as the principal risk in the recent financial review, even as core profits and earnings have increased.

- General narrative analysis points out that while some investors seek stable income and are interested in the company’s long operating history, ongoing concerns about dividend reliability lessen the stock’s appeal.

- Although recurring profits support the case for ongoing dividends, the absence of a confirmed upward trend in payouts remains a constraint for income-focused holders.

- This issue contrasts with the company’s otherwise robust fundamentals and could explain why valuation multiples have not converged with industry norms.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nam Lee Pressed Metal Industries's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite improving earnings and expanding margins, Nam Lee Pressed Metal Industries faces uncertainty due to its inconsistent dividend history. This limits its appeal for income-focused investors.

If consistent income is a top priority, find stronger options with reliable yields among these 1922 dividend stocks with yields > 3% to help protect your portfolio from dividend disappointments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nam Lee Pressed Metal Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:G0I

Nam Lee Pressed Metal Industries

Engages in the design, fabrication, supply, and installation of steel and aluminum products in Singapore and Malaysia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.