Global Market Insights: CNMC Goldmine Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets face challenges such as a record federal government shutdown and concerns over AI spending, investors are increasingly cautious about growth-oriented stocks. Amidst these broader market dynamics, the allure of penny stocks remains strong for those seeking opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, it continues to signify potential value in firms with solid financials and promising growth prospects. This article explores three penny stocks that demonstrate financial strength and could offer intriguing investment opportunities.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.50 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (NasdaqGS:LX) | $4.14 | $698.29M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$462.61M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.52 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.16 | SGD470.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.25 | MYR501.94M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.665 | $386.58M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.59B | ✅ 5 ⚠️ 0 View Analysis > |

Click here to see the full list of 3,589 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

CNMC Goldmine Holdings (Catalist:5TP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CNMC Goldmine Holdings Limited is an investment holding company focused on the exploration and mining of gold deposits in Malaysia, with a market cap of SGD470.14 million.

Operations: The company's revenue is derived from its mining operations, amounting to $88.33 million.

Market Cap: SGD470.14M

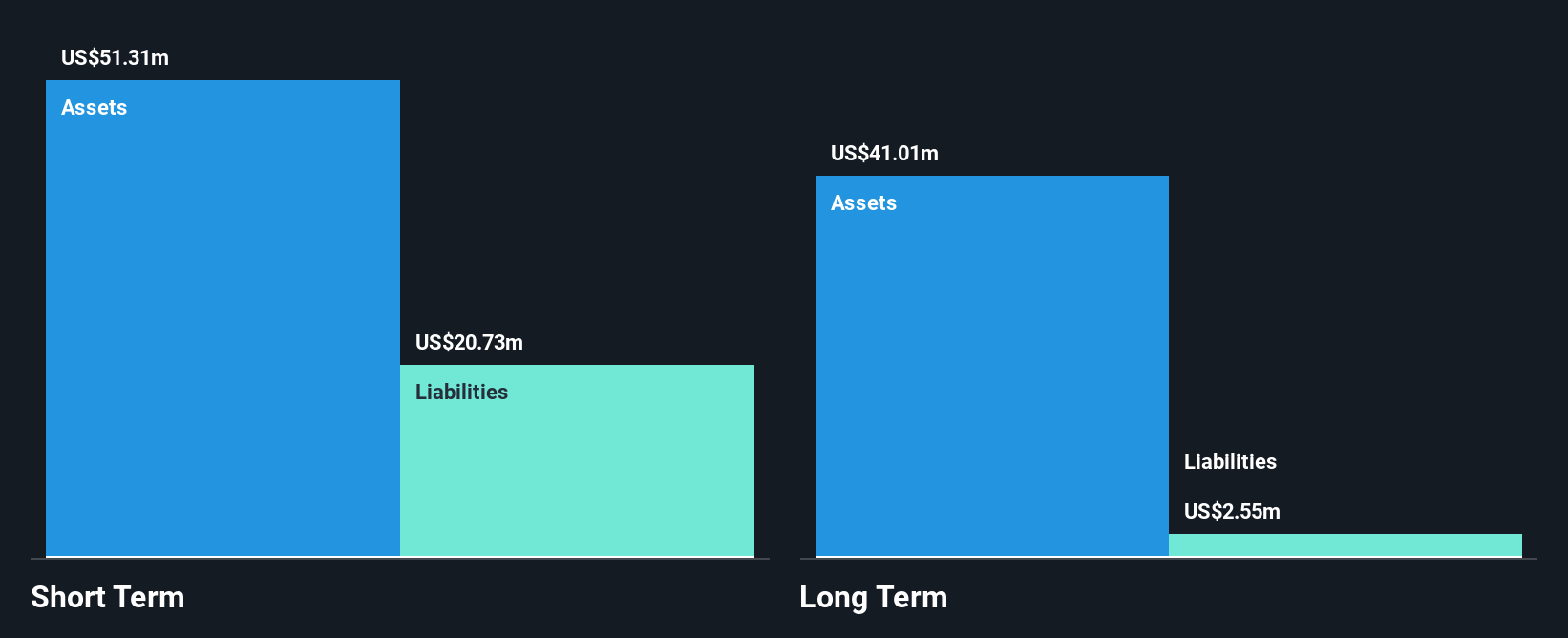

CNMC Goldmine Holdings has shown significant financial growth with earnings increasing by a very large 210.3% over the past year, surpassing industry averages. The company maintains a strong balance sheet, with short-term assets of $51.3M exceeding both short and long-term liabilities, and more cash than total debt. Its net profit margin improved to 24%, reflecting operational efficiency gains. However, the stock has experienced high volatility recently and there was notable insider selling in the past quarter. Despite these challenges, CNMC trades at a substantial discount to its estimated fair value while maintaining high-quality earnings and robust return on equity at 37.8%.

- Dive into the specifics of CNMC Goldmine Holdings here with our thorough balance sheet health report.

- Assess CNMC Goldmine Holdings' future earnings estimates with our detailed growth reports.

Nam Cheong (SGX:1MZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nam Cheong Limited is an investment holding company engaged in shipbuilding and vessel chartering, with a market cap of SGD331.19 million.

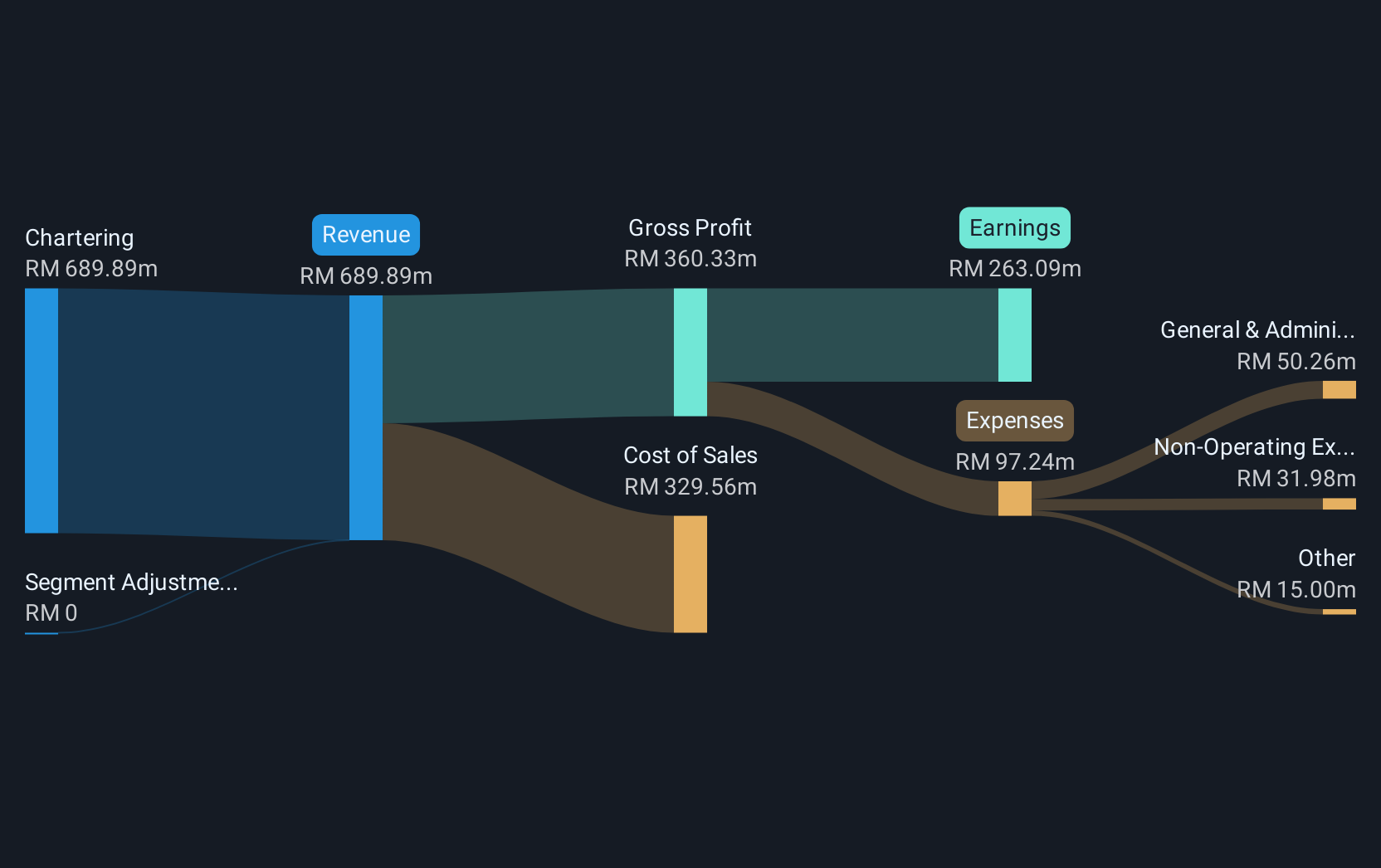

Operations: The company generates revenue of MYR650.94 million from its chartering operations.

Market Cap: SGD331.19M

Nam Cheong Limited, with a market cap of SGD331.19 million, has shown resilience despite recent setbacks. The company reported MYR278.23 million in sales for the first half of 2025, though net income dropped significantly from MYR623.82 million to MYR79.59 million year-over-year due to unforeseen contract cancellations. Its financial position remains stable with short-term assets exceeding both short and long-term liabilities and operating cash flow covering debt well at 45.8%. Though its net profit margin declined to 37%, the company is actively seeking new opportunities for asset deployment, maintaining operational resilience amidst challenges in its chartering operations.

- Jump into the full analysis health report here for a deeper understanding of Nam Cheong.

- Understand Nam Cheong's track record by examining our performance history report.

HARBIN GLORIA PHARMACEUTICALS (SZSE:002437)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HARBIN GLORIA PHARMACEUTICALS Co., LTD is involved in the research, development, production, and sale of pharmaceutical products in China with a market capitalization of CN¥7.73 billion.

Operations: The company does not report specific revenue segments.

Market Cap: CN¥7.73B

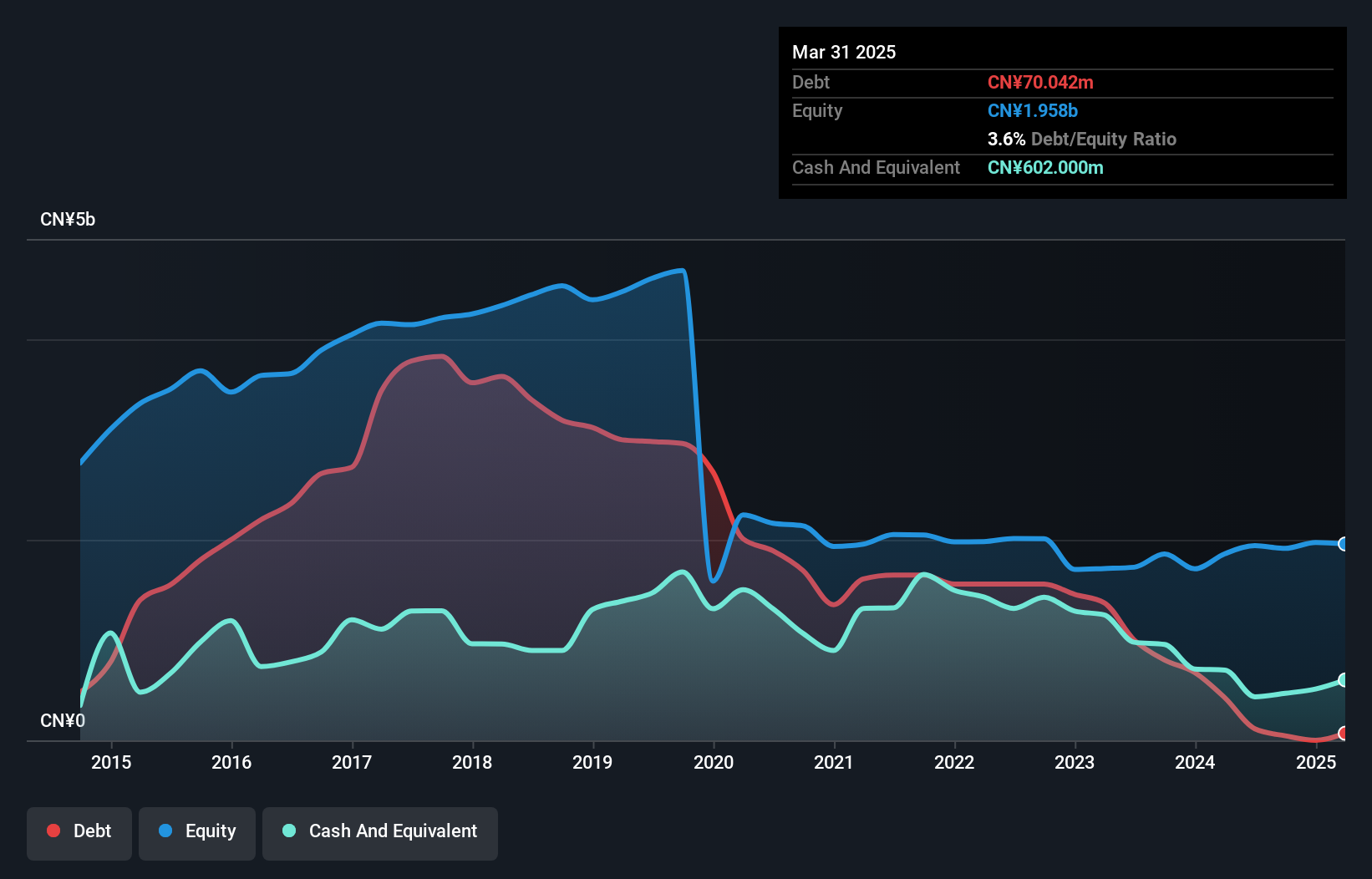

HARBIN GLORIA PHARMACEUTICALS, with a market cap of CN¥7.73 billion, has demonstrated financial stability despite a decline in sales to CN¥1,665 million for the nine months ending September 2025 from CN¥1,857.51 million the previous year. The company’s net income increased to CN¥243.76 million from CN¥183.49 million, reflecting improved profit margins and earnings growth of 265.4% over the past year—far exceeding industry averages. With more cash than debt and short-term assets covering liabilities comfortably, its financial health is robust though its board lacks seasoned experience with an average tenure of just one year.

- Click to explore a detailed breakdown of our findings in HARBIN GLORIA PHARMACEUTICALS' financial health report.

- Explore HARBIN GLORIA PHARMACEUTICALS' analyst forecasts in our growth report.

Turning Ideas Into Actions

- Unlock more gems! Our Global Penny Stocks screener has unearthed 3,586 more companies for you to explore.Click here to unveil our expertly curated list of 3,589 Global Penny Stocks.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HARBIN GLORIA PHARMACEUTICALS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002437

HARBIN GLORIA PHARMACEUTICALS

Engages in the research, development, production, and sale of pharmaceutical products in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives