- Sweden

- /

- Wireless Telecom

- /

- OM:TEL2 B

A Fresh Look at Tele2 (OM:TEL2 B) Valuation Following Key Executive Changes

Reviewed by Simply Wall St

Tele2 (OM:TEL2 B) is making headlines after announcing Nicholas Högberg as its new Executive Vice President, Chief Commercial Officer and Deputy CEO Sweden. Högberg’s extensive leadership in telecom and technology could steer strategy in new directions.

See our latest analysis for Tele2.

The momentum around Tele2 is unmistakable, with its 36% year-to-date share price return pointing to renewed investor confidence and signaling that the market is optimistic about the company’s trajectory. Over the past year, shareholders have enjoyed a total return of 41%. The five-year total return of 113% highlights strong long-term value creation, especially following key executive changes and an uptick in earnings growth.

If management shake-ups like Tele2’s have you rethinking your next move, this might be the perfect time to discover fast growing stocks with high insider ownership.

But after such a strong rally, are investors looking at meaningful upside from here, or has Tele2’s recent growth and leadership shakeup already been fully reflected in the price? Could there still be a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 5.7% Undervalued

With Tele2’s last close at SEK151.90 and the most popular narrative placing fair value at SEK161.02, the company is trading below what consensus deems justified. The narrative highlights catalysts and bold expectations shaping this gap and sets the stage for how Tele2 could close it.

“Ongoing 5G investments and rollout position Tele2 to capture a growing share of value-added and premium services, both in consumer (enhanced mobile and broadband) and business offerings (network slicing, high-capacity solutions), with medium-term expectations for improved ARPU and earnings as network usage intensifies.”

Want to discover the assumptions driving Tele2’s value? There is a future-focused playbook underlying this price, built on bolder profit margin and growth projections than you might expect. Could their transformation, tech investments, or financial re-engineering surprise you? The full narrative unpacks the numbers and the strategic thinking shaping this valuation.

Result: Fair Value of $161.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including fierce competition in Swedish broadband and the possibility that cost-saving opportunities may diminish more quickly than hoped.

Find out about the key risks to this Tele2 narrative.

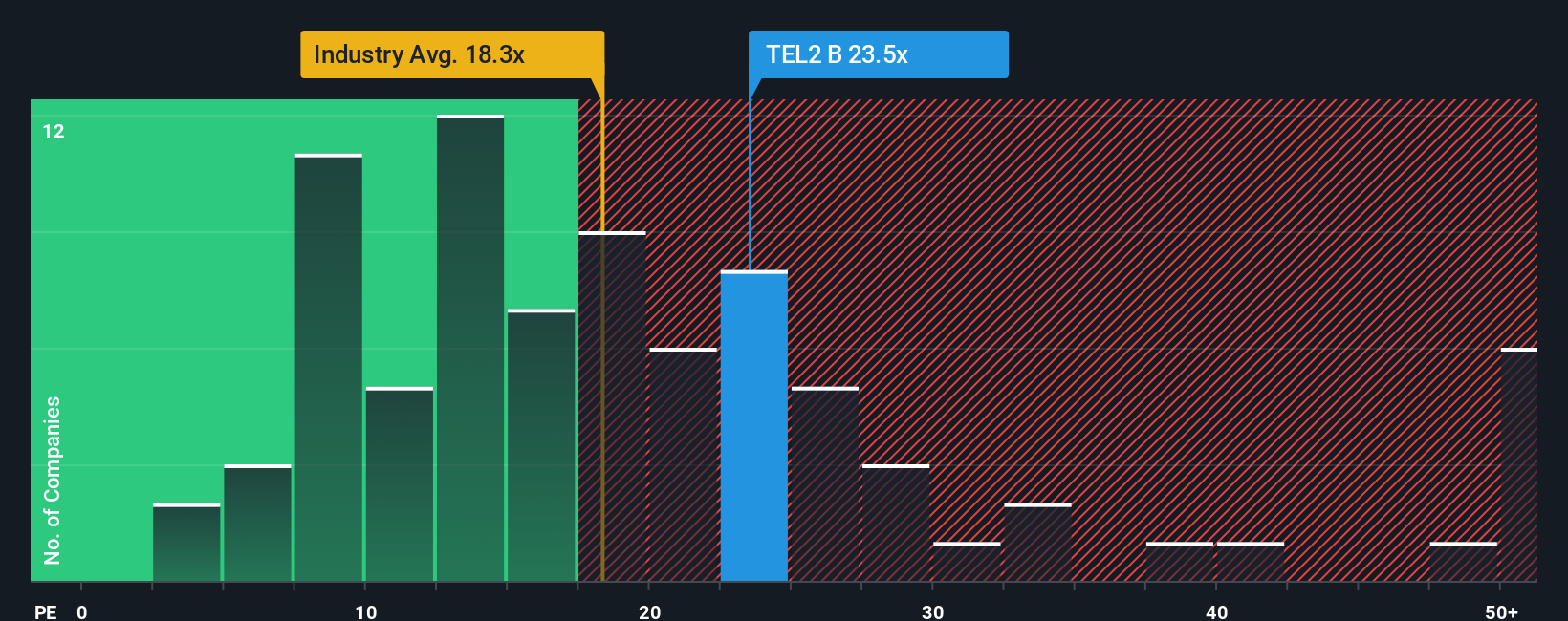

Another View: Market Ratios Tell Their Own Story

Looking beyond the narrative and fair value estimates, Tele2’s current price-to-earnings ratio is 24.3x. This is higher than both the industry average of 18.5x and peers at 22.8x. It sits just below the fair ratio of 25.1x, suggesting investors are already paying up for perceived stability and growth. Does this premium reflect lasting strength, or are the risks understated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tele2 Narrative

If you see the story differently or want to challenge the consensus with your own research, you can easily craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Tele2 research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Opportunities?

Smart investors know that real growth often comes from branching out. Step ahead of the crowd and scan the market for your next standout idea using the tools below.

- Capitalize on the latest tech breakthroughs by tapping into the momentum of artificial intelligence with these 25 AI penny stocks before these trends go mainstream.

- Secure your portfolio with stable returns by targeting these 16 dividend stocks with yields > 3%, offering strong yields that stand out in today’s market climate.

- Get ahead of value-driven opportunities and pinpoint these 876 undervalued stocks based on cash flows that could be poised for outsized gains as investor sentiment shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tele2 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TEL2 B

Tele2

Provides fixed and mobile connectivity and entertainment services in Sweden, Lithuania, Latvia, and Estonia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives