- Sweden

- /

- Communications

- /

- OM:HMS

HMS Networks (OM:HMS) Valuation: Assessing Potential After Launch of New Industrial Ethernet Switches

Reviewed by Simply Wall St

HMS Networks (OM:HMS) has introduced its latest unmanaged industrial Ethernet switches: the N-Tron NT110-FX2, NT111-FX3, and NT112-FX4. These switches are designed to provide reliability in demanding industrial settings. The products bring new capabilities to sectors such as utilities, energy, and transportation.

See our latest analysis for HMS Networks.

While HMS Networks has rolled out innovations like its latest industrial Ethernet switches, the share price has seen some swings, down nearly 11% over the past month. The company still reports a robust 19.5% total shareholder return for the year and has almost doubled its value over five years. After a period of steady growth, recent momentum has slowed slightly, yet the long-term performance signals underlying market confidence in the company’s strategy and expanding industrial footprint.

If sector expansion and tech developments interest you, it’s a good moment to discover fast growing stocks with high insider ownership and see what other compelling companies are gaining traction.

Given the company’s recent innovation streak and mixed share price moves, investors might wonder if HMS Networks is undervalued at today’s levels or if the market is already factoring in future growth prospects and potential gains.

Most Popular Narrative: 5.1% Undervalued

HMS Networks’ most widely followed narrative points to a fair value about 5% above the last close, suggesting modest upside from current levels. This bullish stance is anchored on expectations for operational improvements, enhanced integration of acquisitions, and stable profit margins.

The integration of recent acquisitions, such as Red Lion and PEAK-System, is performing well. This could enhance earnings through increased market share and synergies. These acquisitions may have a positive impact on earnings as they are integrated and contribute to the bottom line.

Earnings acceleration. Revenue optimism. Margin expansion. However, the narrative’s valuation depends on ambitious financial projections and aggressive profit targets that have not yet been detailed. Discover what’s driving analyst forecasts and the key number that sets this price target apart.

Result: Fair Value of $496.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions or continued declines in organic sales growth could quickly challenge the consensus outlook and reduce optimism around HMS Networks’ valuation.

Find out about the key risks to this HMS Networks narrative.

Another View: Multiples Raise a Red Flag

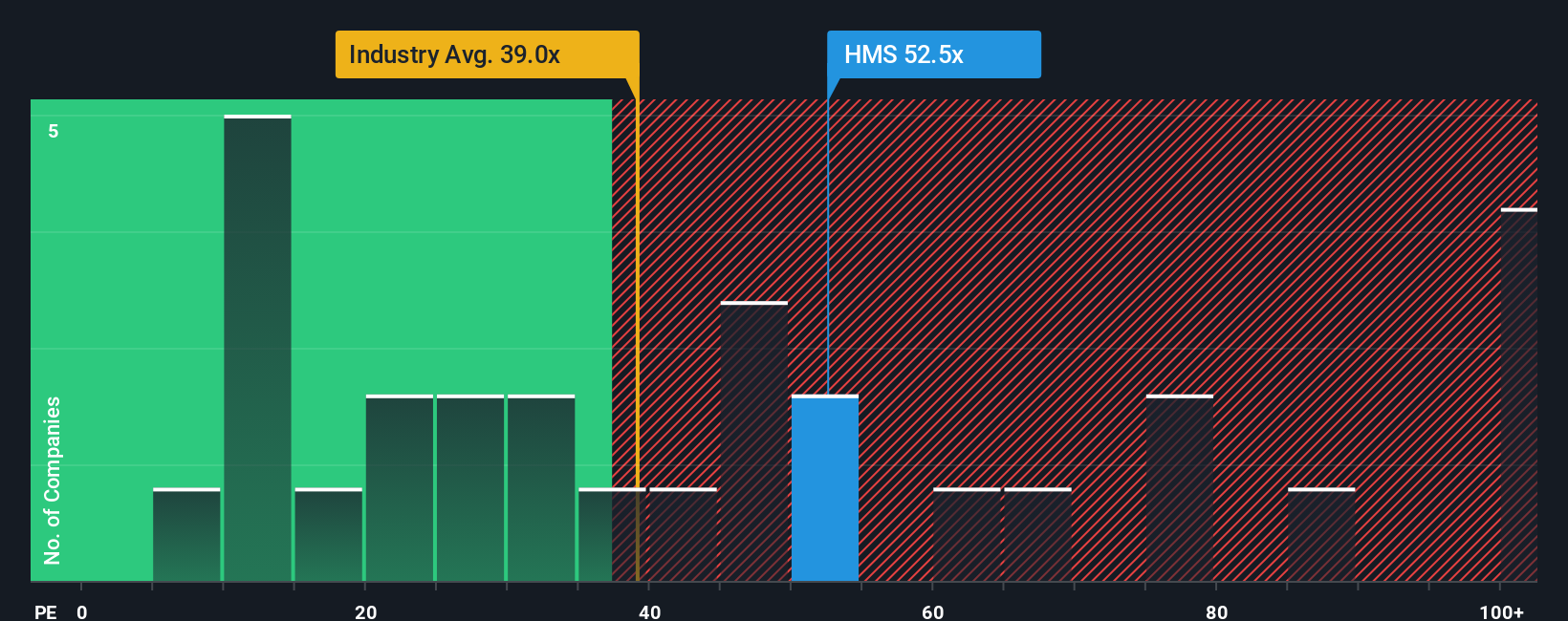

Looking at HMS Networks through the lens of market multiples tells a different story. The company is currently priced at 54 times earnings, much higher than the industry average of 38.9 and its peer average of 35.9. Even against the fair ratio of 33, HMS appears expensive. This gap could highlight valuation risks. Will the market reward such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HMS Networks Narrative

If you see the data differently or want to dig into the numbers on your own, you can shape a personal view in just a few minutes. Do it your way.

A great starting point for your HMS Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep ahead of the market by tapping into fresh opportunities. Use the Simply Wall St Screener to identify stocks that align with your goals and discover what others might be overlooking.

- Explore the growth potential of the digital revolution by scanning these 25 AI penny stocks for companies using artificial intelligence to transform their industries from within.

- Enhance income investing by browsing these 15 dividend stocks with yields > 3% for options offering consistent high yields and strong fundamentals, supporting the construction of a resilient portfolio.

- Stay at the forefront of finance with these 81 cryptocurrency and blockchain stocks, which highlights innovative stocks involved in digital assets and advancements in blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HMS Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HMS

HMS Networks

Engages in the provision of products that enable industrial equipment to communicate and share information worldwide.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026