- Sweden

- /

- Communications

- /

- OM:ERIC B

How Investors May Respond To Telefonaktiebolaget LM Ericsson (OM:ERIC B) Securing Telia 5G Network Upgrade Deal

Reviewed by Sasha Jovanovic

- On November 6, 2025, Telia Company announced the extension of its Radio Access Network partnership with Ericsson across Sweden, Norway, Lithuania, and Estonia, under a new four-year deal to deliver enhanced 5G capabilities for both commercial and mission-critical use cases.

- This collaboration features the introduction of advanced network upgrades, including public sector and defense applications, highlighting Ericsson's technology integration into essential national infrastructure across multiple countries.

- We’ll examine how this major contract win with Telia could strengthen Ericsson’s profile in high-value enterprise and public sector markets.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Telefonaktiebolaget LM Ericsson Investment Narrative Recap

To be a shareholder in Ericsson, you need to believe in the company's ability to lead large-scale 5G rollouts, support mission-critical communications, and capture enterprise and public sector contracts. The recent Telia partnership extension strengthens this view by reinforcing Ericsson’s reputation across Northern Europe, but it does not meaningfully alter the primary short-term catalyst: accelerating adoption of advanced 5G solutions. The largest risk remains margin and pricing pressure alongside intense competition from other major vendors, which this news does little to address.

Among recent developments, Ericsson’s five-year agreement with Vodafone to modernize networks in Ireland, Netherlands, and Portugal is highly relevant, as it also showcases Ericsson’s RAN expertise and supports the same key growth driver: increased enterprise demand for advanced, reliable 5G connectivity. Both deals highlight Ericsson’s role in shaping critical infrastructure, but sustaining profitability hinges on stabilizing software and services performance and outpacing competitive threats across all regions.

However, with expanding partnerships, investors should also keep an eye on the risk that intensifying competition could...

Read the full narrative on Telefonaktiebolaget LM Ericsson (it's free!)

Telefonaktiebolaget LM Ericsson is forecast to reach SEK242.3 billion in revenue and SEK18.2 billion in earnings by 2028. This outlook reflects a 0.5% annual revenue decline and an earnings increase of SEK0.9 billion from the current earnings of SEK17.3 billion.

Uncover how Telefonaktiebolaget LM Ericsson's forecasts yield a SEK87.22 fair value, a 7% downside to its current price.

Exploring Other Perspectives

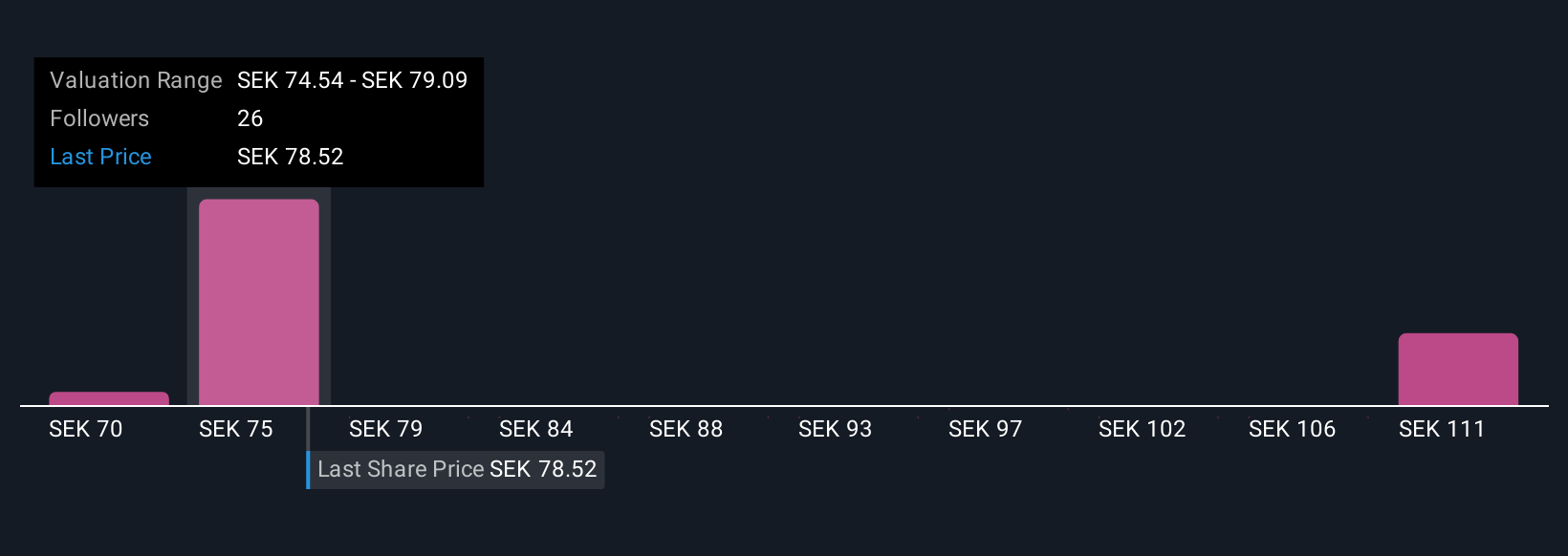

Simply Wall St Community members submitted five fair value estimates for Ericsson, ranging widely from SEK71.08 to SEK139.25 a share. While some see significant upside, the ongoing threat of margin pressure from fierce competition could weigh on returns, so explore more viewpoints to challenge your assumptions.

Explore 5 other fair value estimates on Telefonaktiebolaget LM Ericsson - why the stock might be worth as much as 48% more than the current price!

Build Your Own Telefonaktiebolaget LM Ericsson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telefonaktiebolaget LM Ericsson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telefonaktiebolaget LM Ericsson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telefonaktiebolaget LM Ericsson's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefonaktiebolaget LM Ericsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions to communications service providers, enterprises, and the public sector.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives