- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXENS

European Stocks Trading Below Estimated Value In June 2025

Reviewed by Simply Wall St

As geopolitical tensions and trade uncertainties weigh on global markets, European indices have not been immune, with the STOXX Europe 600 Index recently experiencing a decline of 1.57%. In this climate of volatility, identifying stocks trading below their estimated value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN518.00 | PLN1020.91 | 49.3% |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.32 | RON8.45 | 48.8% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK363.99 | 49.6% |

| Lectra (ENXTPA:LSS) | €23.40 | €46.49 | 49.7% |

| Just Eat Takeaway.com (ENXTAM:TKWY) | €19.50 | €38.90 | 49.9% |

| I.CO.P.. Società Benefit (BIT:ICOP) | €12.30 | €24.06 | 48.9% |

| dormakaba Holding (SWX:DOKA) | CHF709.00 | CHF1398.19 | 49.3% |

| CTT Systems (OM:CTT) | SEK208.50 | SEK407.46 | 48.8% |

| BigBen Interactive (ENXTPA:BIG) | €1.082 | €2.11 | 48.7% |

| Absolent Air Care Group (OM:ABSO) | SEK209.00 | SEK416.07 | 49.8% |

Let's explore several standout options from the results in the screener.

Exosens (ENXTPA:EXENS)

Overview: Exosens develops, manufactures, and sells electro-optical technologies for amplification, detection, and imaging across various regions including Europe, North America, Asia, Oceania, Africa, and internationally with a market cap of €2.12 billion.

Operations: The company's revenue is primarily derived from its amplification segment, which accounts for €280.20 million, and its detection and imaging segment, contributing €117.50 million.

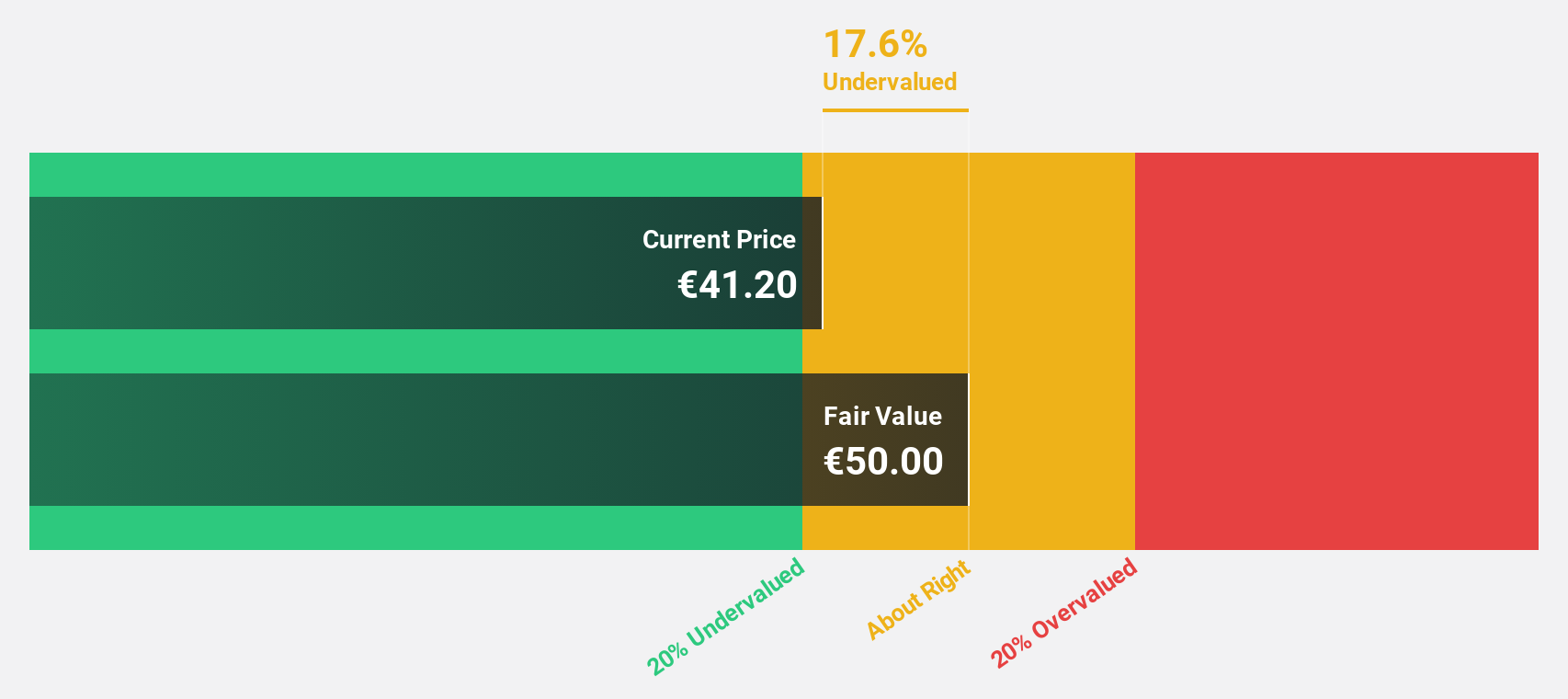

Estimated Discount To Fair Value: 14.0%

Exosens is trading at €41.85, below its estimated fair value of €48.66, offering a 14% discount. While revenue growth is projected at 10.9% annually—outpacing the French market—it remains modest compared to higher benchmarks. Earnings are expected to grow significantly by 25.3% annually, surpassing market averages but with a forecasted low return on equity of 16.6%. Recent events include an annual dividend announcement of €0.10 per share payable on May 30, 2025.

- In light of our recent growth report, it seems possible that Exosens' financial performance will exceed current levels.

- Navigate through the intricacies of Exosens with our comprehensive financial health report here.

Etteplan Oyj (HLSE:ETTE)

Overview: Etteplan Oyj offers software and embedded solutions, industrial equipment and plant engineering, and technical communication services across Finland, Scandinavia, China, and Central Europe with a market cap of €273.96 million.

Operations: The company's revenue is derived from three main segments: Engineering Solutions (€193.36 million), Software and Embedded Solutions (€94.23 million), and Technical Communication Solutions (€70.87 million).

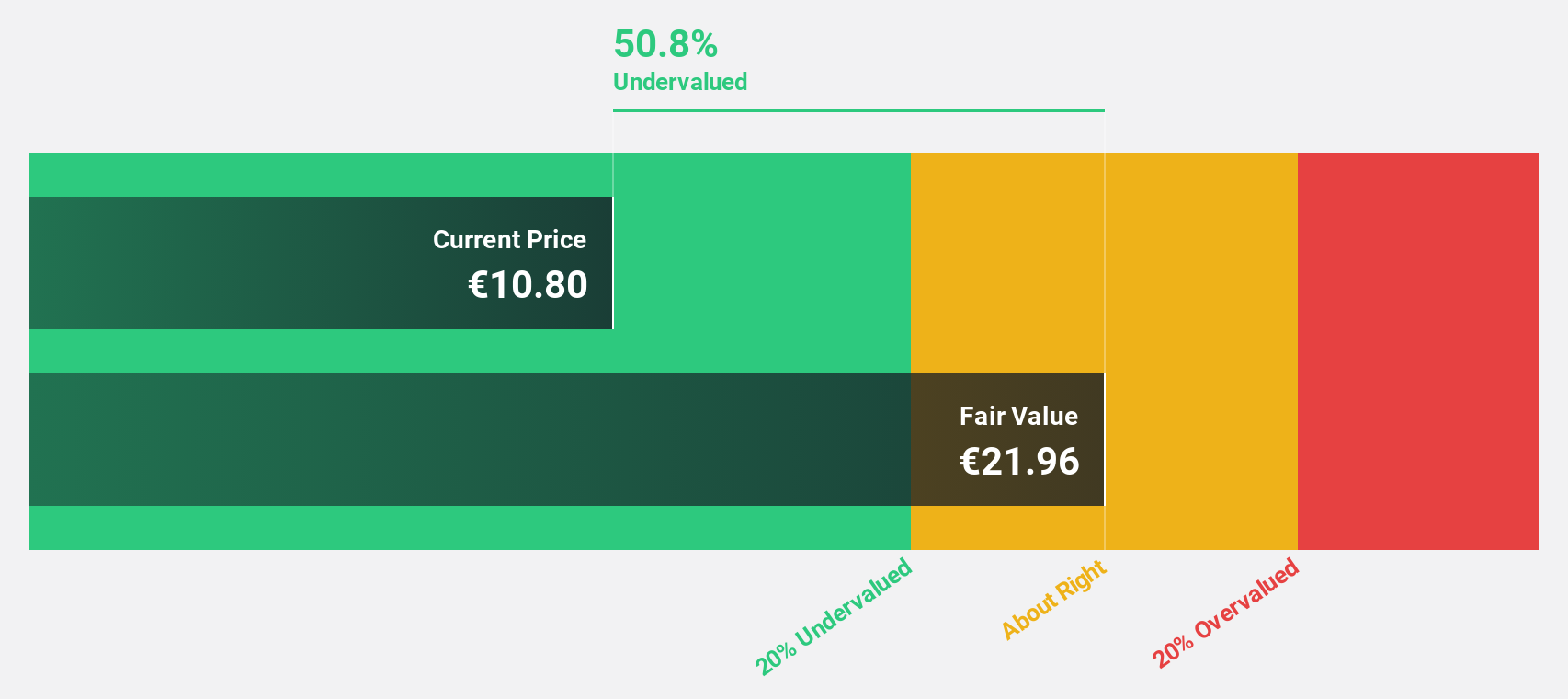

Estimated Discount To Fair Value: 47.1%

Etteplan Oyj, trading at €10.85, is significantly undervalued with an estimated fair value of €20.51. Despite a recent earnings guidance revision and declining profit margins, the company is projected to experience robust annual earnings growth of 27.4%, outpacing the Finnish market's average. However, Etteplan faces challenges with high debt levels and a forecasted low return on equity of 14.4% in three years, which investors should consider carefully.

- Insights from our recent growth report point to a promising forecast for Etteplan Oyj's business outlook.

- Take a closer look at Etteplan Oyj's balance sheet health here in our report.

Dynavox Group (OM:DYVOX)

Overview: Dynavox Group AB (publ) develops and sells assistive technology products for individuals with impaired communication skills, with a market cap of SEK11.75 billion.

Operations: The company's revenue is primarily derived from its computer hardware segment, which generates SEK2.13 billion.

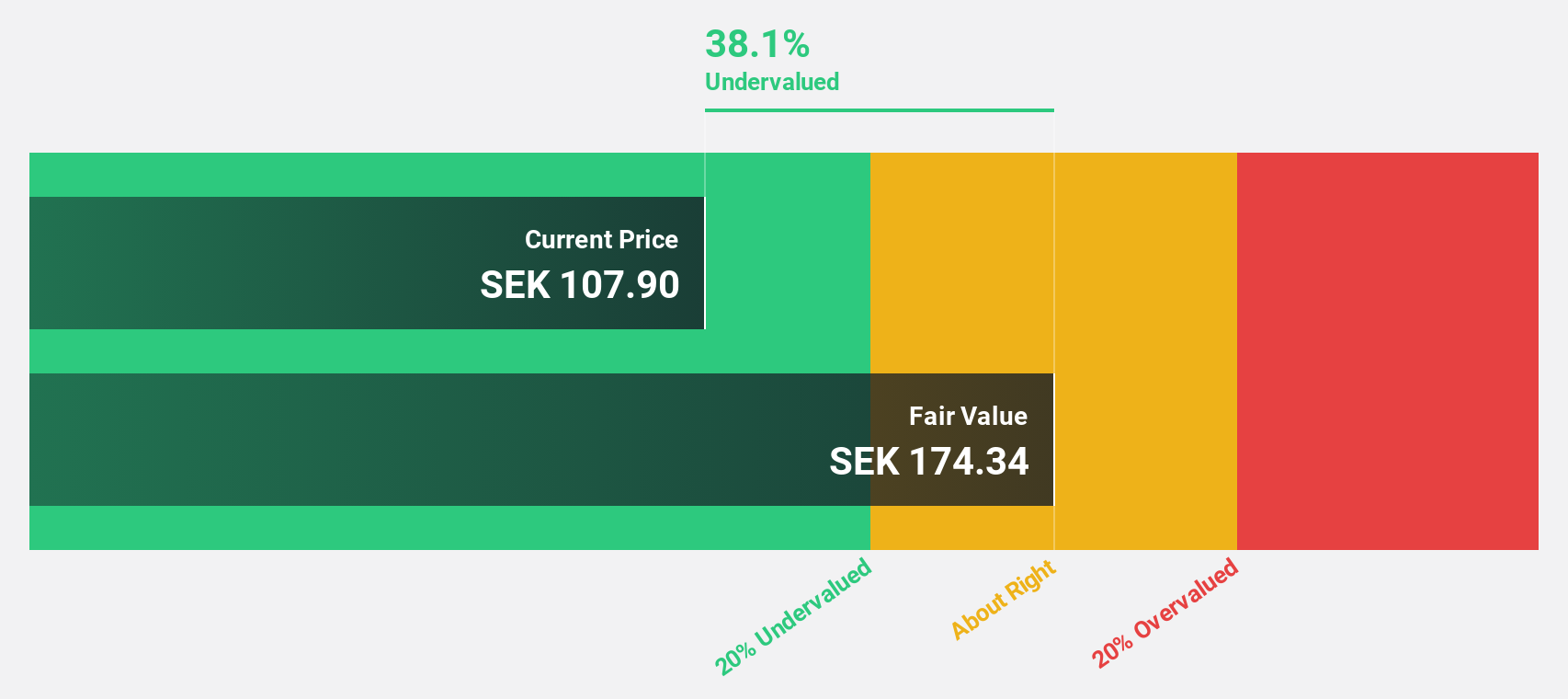

Estimated Discount To Fair Value: 37%

Dynavox Group, trading at SEK109.9, is undervalued with a fair value estimate of SEK174.31. Despite high debt and recent insider selling, the company's earnings are forecast to grow significantly at 33.1% annually, surpassing the Swedish market average of 15.9%. Recent Q1 results showed sales growth from SEK428 million to SEK581 million year-on-year and increased net income from SEK11 million to SEK24 million, enhancing its investment appeal despite share price volatility.

- Our growth report here indicates Dynavox Group may be poised for an improving outlook.

- Dive into the specifics of Dynavox Group here with our thorough financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 178 Undervalued European Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exosens might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXENS

Exosens

Engages in the development, manufacture, and sale of electro-optical technologies in the fields of amplification, and detection and imaging in France, rest of Europe, North America, Asia, Oceania, Africa, and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives