As European markets navigate a complex landscape of monetary policy decisions, with the pan-European STOXX Europe 600 Index ending the week slightly lower, investors are keenly assessing the impact of stable interest rates and mixed performances across major stock indexes like France's CAC 40 and Germany's DAX. In this environment, identifying high growth tech stocks involves looking for companies that can leverage innovation and adaptability to thrive despite broader economic uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| argenx | 21.47% | 26.13% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Bonesupport Holding | 25.30% | 59.70% | ★★★★★★ |

| Comet Holding | 10.37% | 35.47% | ★★★★★☆ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Aelis Farma | 108.74% | 130.33% | ★★★★★☆ |

| Yubico | 15.46% | 33.06% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Oryzon Genomics (BME:ORY)

Simply Wall St Growth Rating: ★★★★★☆

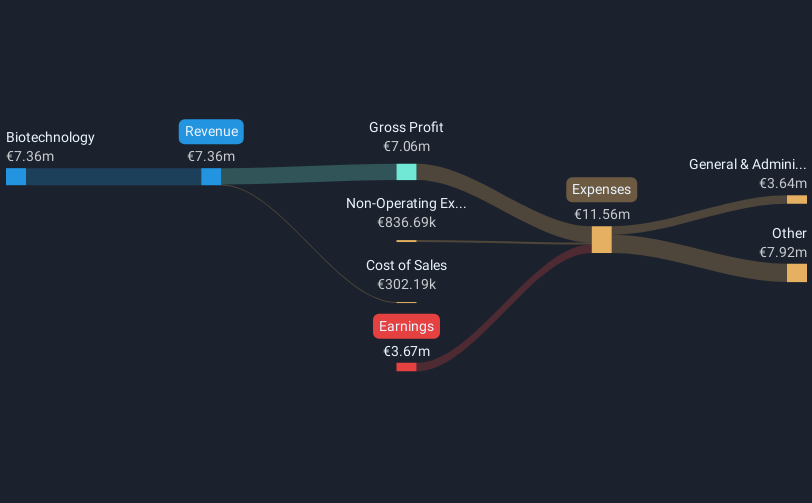

Overview: Oryzon Genomics S.A. is a clinical-stage biopharmaceutical company focused on developing epigenetics-based therapeutics for cancer and CNS disorders, with a market cap of approximately €283.87 million.

Operations: Oryzon Genomics generates revenue primarily from its biotechnology segment, amounting to €7.47 million. The company is engaged in the discovery and development of epigenetics-based therapeutics targeting cancer and CNS disorders.

Oryzon Genomics is making significant strides in the biotech sector, particularly with its recent EMA approval to initiate a Phase Ib trial for iadademstat in sickle cell disease—a market poised to grow from $3 billion to $8 billion by 2032. Despite a slight increase in sales to EUR 4.22 million from EUR 4.11 million year-over-year, the company faces challenges with a net loss widening from EUR 1.04 million to EUR 1.59 million. However, Oryzon's robust pipeline, including multiple oncology and psychiatric trials, underscores its potential in high-growth markets with unmet medical needs, aligning with an expected revenue surge of 56% annually and earnings growth forecast at nearly 59% per year.

- Dive into the specifics of Oryzon Genomics here with our thorough health report.

Understand Oryzon Genomics' track record by examining our Past report.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★☆

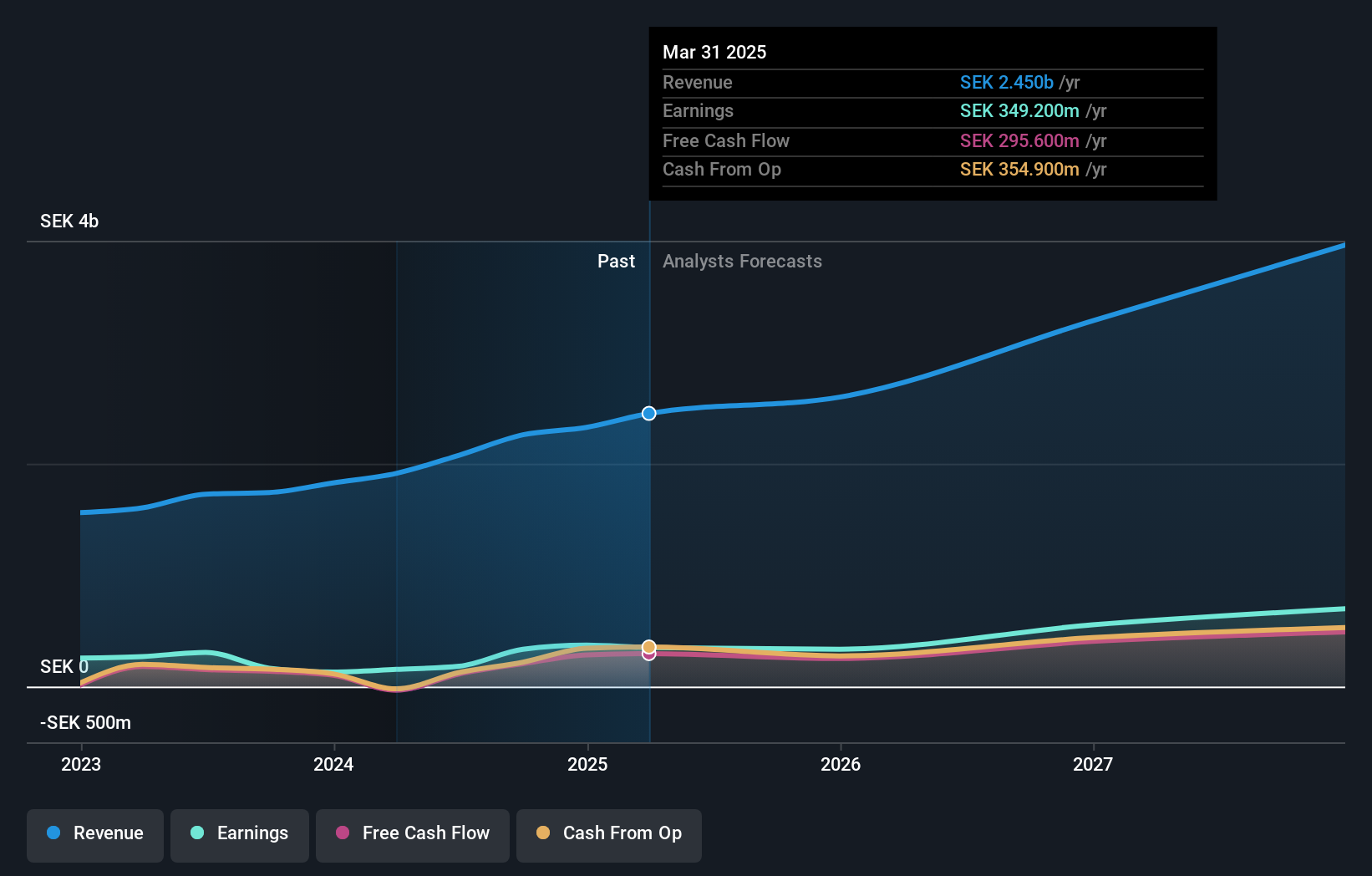

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK11.27 billion.

Operations: Yubico AB generates revenue primarily from its Security Software & Services segment, amounting to SEK2.34 billion.

Yubico, a leader in authentication security technology, has demonstrated robust financial performance with a 39.8% earnings growth over the past year, outpacing the software industry's average of 4.2%. Despite recent fluctuations—Q2 sales dropped to SEK 499.1 million from SEK 614.4 million year-over-year—the company's long-term outlook remains strong due to its innovative product offerings and strategic market positioning. With earnings forecasted to grow by 33.06% annually and revenue expected to increase at an annual rate of 15.5%, Yubico is well-positioned for sustained growth in the competitive tech landscape of Europe.

- Unlock comprehensive insights into our analysis of Yubico stock in this health report.

Review our historical performance report to gain insights into Yubico's's past performance.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Growth Rating: ★★★★★☆

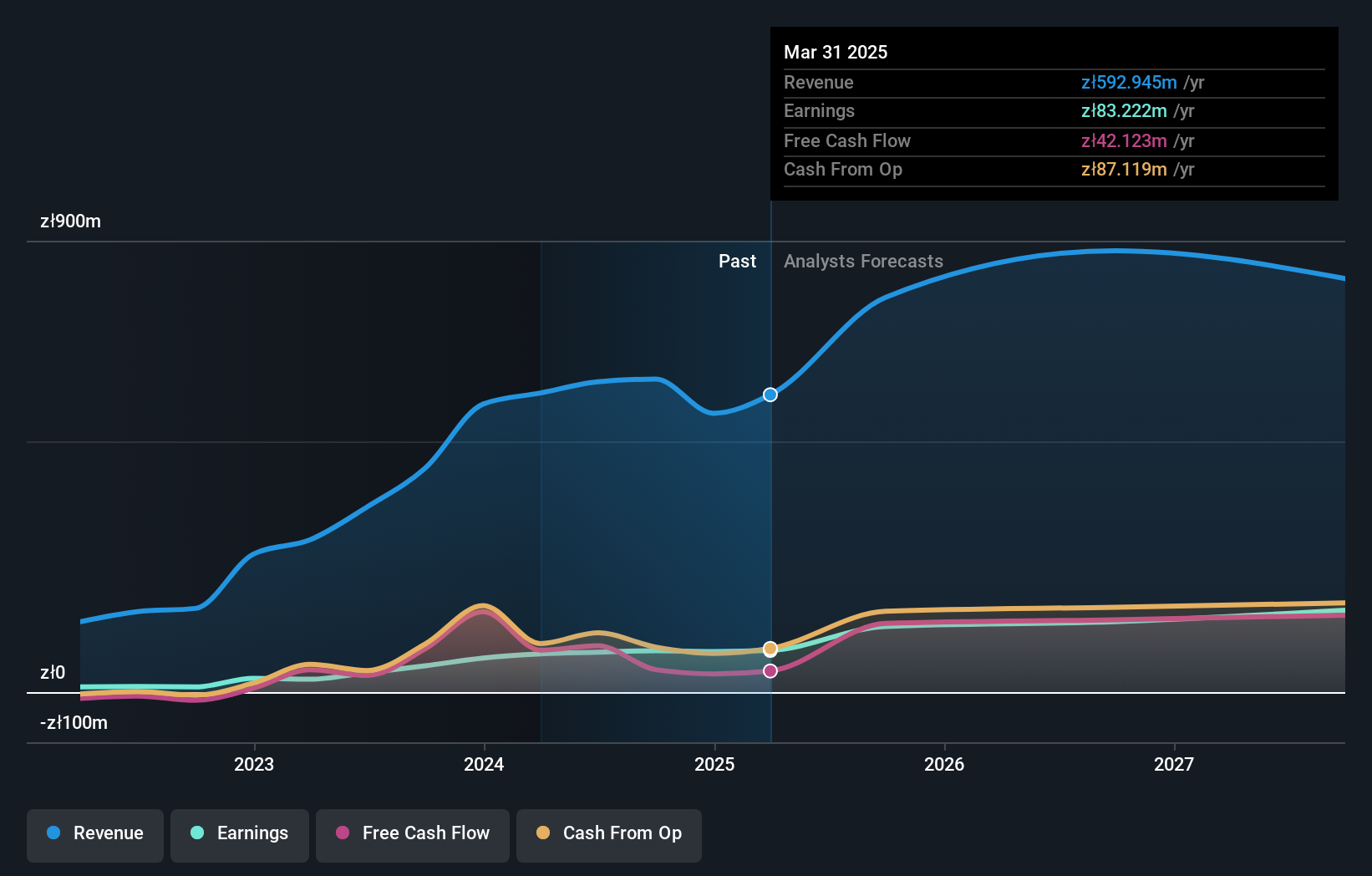

Overview: Synektik Spólka Akcyjna operates in Poland, offering products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications with a market cap of PLN2.14 billion.

Operations: The company generates revenue primarily from the Diagnostic and IT Equipment segment, contributing PLN57.92 billion, and the Production of Radio Pharmaceuticals segment, which adds PLN4.67 billion.

Synektik Spólka Akcyjna, a dynamic presence in Europe's tech landscape, recently showcased its financial agility with a third-quarter revenue jump to PLN 154.24 million from PLN 123.98 million year-over-year. The firm's commitment to innovation is evident in its R&D spending trends, which are crucial for sustaining its competitive edge in high-tech sectors. With an impressive annual earnings growth forecast of 21.9% and revenue growth predictions at 7.3%, Synektik is strategically poised for future expansions. This robust performance, coupled with a projected return on equity of 47.7% in three years, underscores its potential as a formidable player amidst evolving market demands.

Turning Ideas Into Actions

- Navigate through the entire inventory of 52 European High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives