The European market has recently shown positive momentum, with the pan-European STOXX Europe 600 Index climbing 2.35% and major indices in Germany, Italy, France, and the UK all posting gains. In this environment of cautious optimism where eurozone inflation remains near target levels and business sentiment shows mixed signals, identifying high-growth tech stocks requires a focus on companies that demonstrate robust innovation potential and resilience to economic fluctuations.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Paradox Interactive | 11.59% | 24.12% | ★★★★★☆ |

| Bonesupport Holding | 27.78% | 49.69% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 36.20% | 52.06% | ★★★★★★ |

| Comet Holding | 11.30% | 37.55% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 15.92% | 44.85% | ★★★★★☆ |

| Gapwaves | 41.49% | 89.60% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

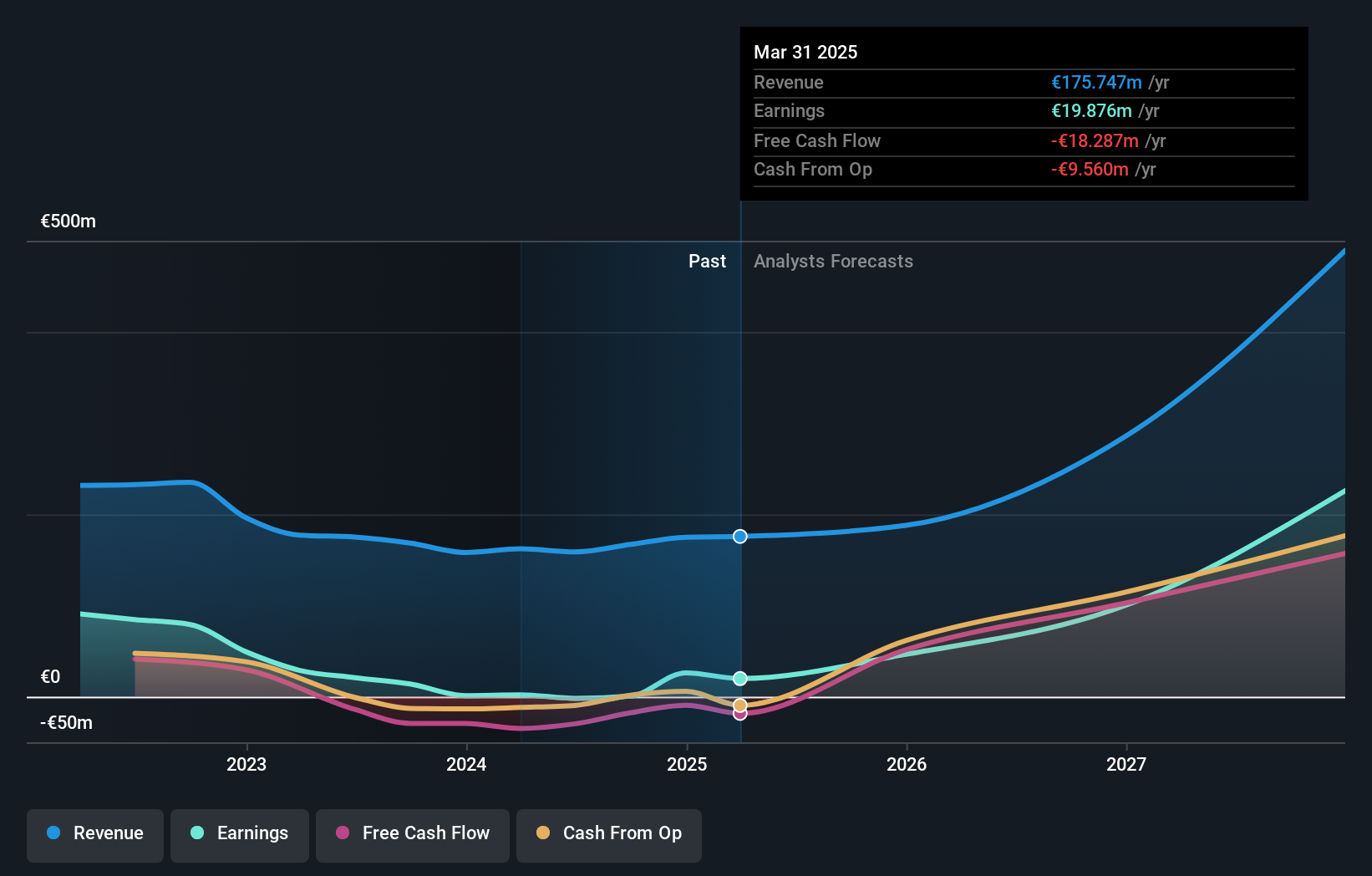

Overview: Pharma Mar, S.A. is a biopharmaceutical company specializing in the research, development, production, and commercialization of bio-active principles for oncology across various international markets with a market cap of €1.26 billion.

Operations: The company generates revenue primarily from its oncology segment, amounting to €179.94 million. It operates across multiple regions, including Spain, China, Germany, and the United States.

Pharma Mar, a standout in the biotech sector, has demonstrated remarkable financial performance with earnings skyrocketing by 5367% over the past year. This growth significantly outpaces the broader Spanish market's 7% earnings increase and even exceeds its industry's average. With an aggressive R&D strategy, Pharma Mar invested heavily in innovation, which is evident from its R&D expenses aligning closely with revenue growth at 21.7% annually. Looking ahead, projections suggest a sustained high trajectory with expected annual profit growth of 41.5%, positioning Pharma Mar well above many European peers in terms of expansion and market penetration.

- Unlock comprehensive insights into our analysis of Pharma Mar stock in this health report.

Review our historical performance report to gain insights into Pharma Mar's's past performance.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★☆☆

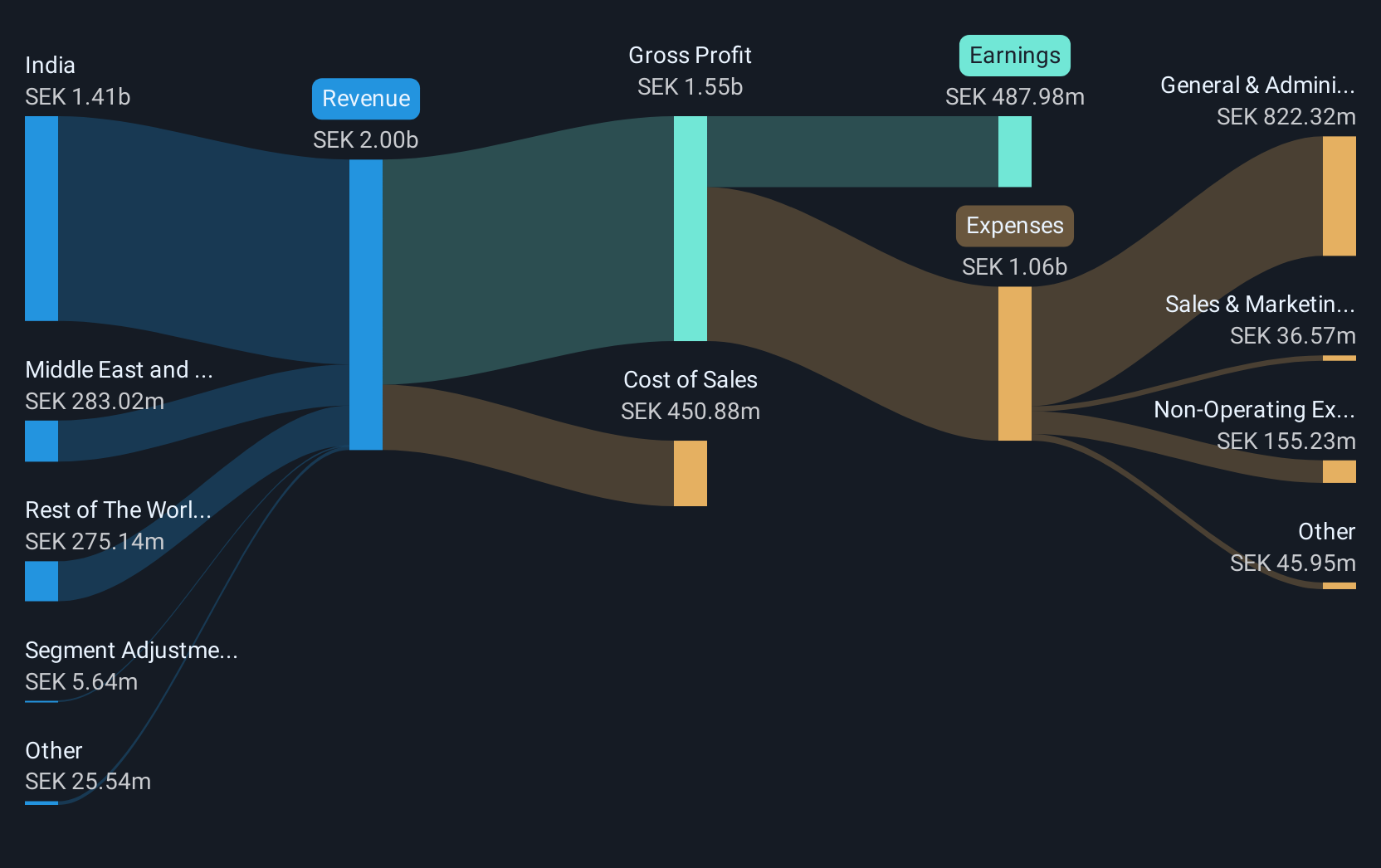

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of SEK8.16 billion.

Operations: The company generates revenue primarily through its communications software segment, amounting to SEK2.02 billion.

Truecaller, amid Europe's tech landscape, is enhancing its market presence through strategic partnerships and innovative solutions like the Verified Business Customer Experience Platform. This initiative has propelled a 13.2% annual revenue growth and an 18.3% increase in earnings projections, underscoring its robust financial health. Additionally, Truecaller's commitment to R&D is evident with significant investments aimed at refining user interactions and security features within its platforms, ensuring it stays ahead in the competitive communication technology sector. These efforts are complemented by recent launches such as adVantage, an AI-driven tool that optimizes engagement and boosts business outcomes by leveraging real-time data analytics.

- Click here to discover the nuances of Truecaller with our detailed analytical health report.

Explore historical data to track Truecaller's performance over time in our Past section.

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★☆

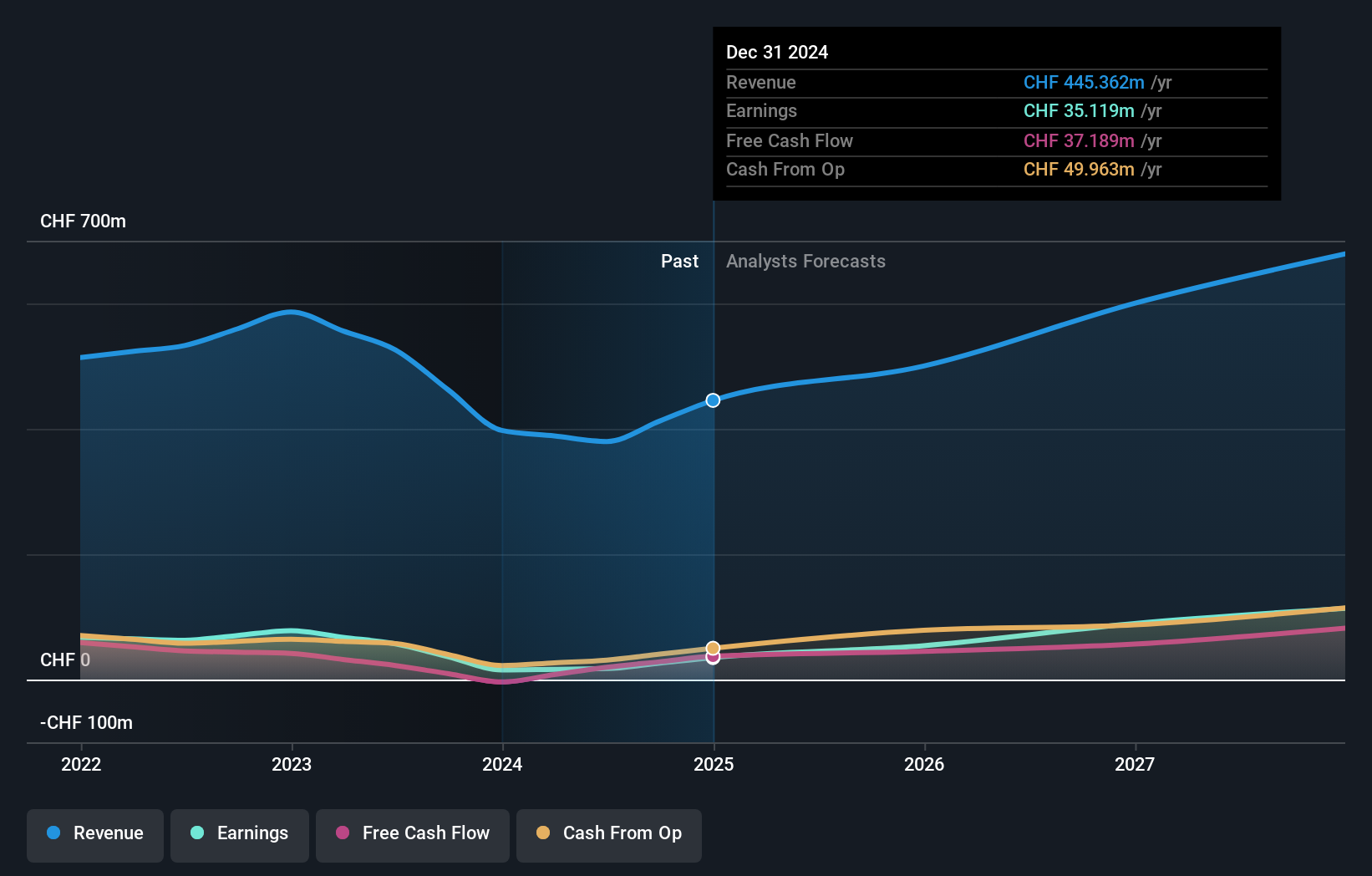

Overview: Comet Holding AG, with a market cap of CHF1.61 billion, operates internationally offering X-ray and radio frequency power technology solutions through its subsidiaries across Europe, North America, and Asia.

Operations: The company generates revenue primarily from its Plasma Control Technologies (CHF287.40 million), X-Ray Systems (CHF109.40 million), and Industrial X-Ray Modules (CHF96.50 million) segments.

Comet Holding, navigating the competitive European tech scene, has demonstrated robust growth with a notable 122.3% surge in earnings over the past year, significantly outpacing the industry's decline. This performance is anchored by an aggressive R&D strategy that allocates substantial resources to innovation—evidenced by its R&D expenses which are crucial for maintaining technological leadership. With revenue growth projected at 11.3% annually and earnings expected to rise by 37.6% per year, Comet is well-positioned to leverage its advancements in technology sectors like electronic components where it serves high-profile clients including TSMC. Despite a volatile share price recently, these financial and operational metrics underscore Comet’s potential in a rapidly evolving market landscape.

- Dive into the specifics of Comet Holding here with our thorough health report.

Evaluate Comet Holding's historical performance by accessing our past performance report.

Seize The Opportunity

- Delve into our full catalog of 50 European High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:COTN

Comet Holding

Provides X-ray and radio frequency (RF) power technology solutions in Europe, North America, Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026