Weekly Picks: 💸 A dividend-rich sleep-tech play few investors are watching, and 2 other picks.

Each week our analysts hand pick their favourite Narratives from the community. Narratives are a game-changing way for investors to make sound decisions on their stocks. A narrative always has 3 parts: a story, a forecast and a fair value . You can create one yourself in 3 minutes or you can select one from our thriving community .

This week’s picks cover:

-

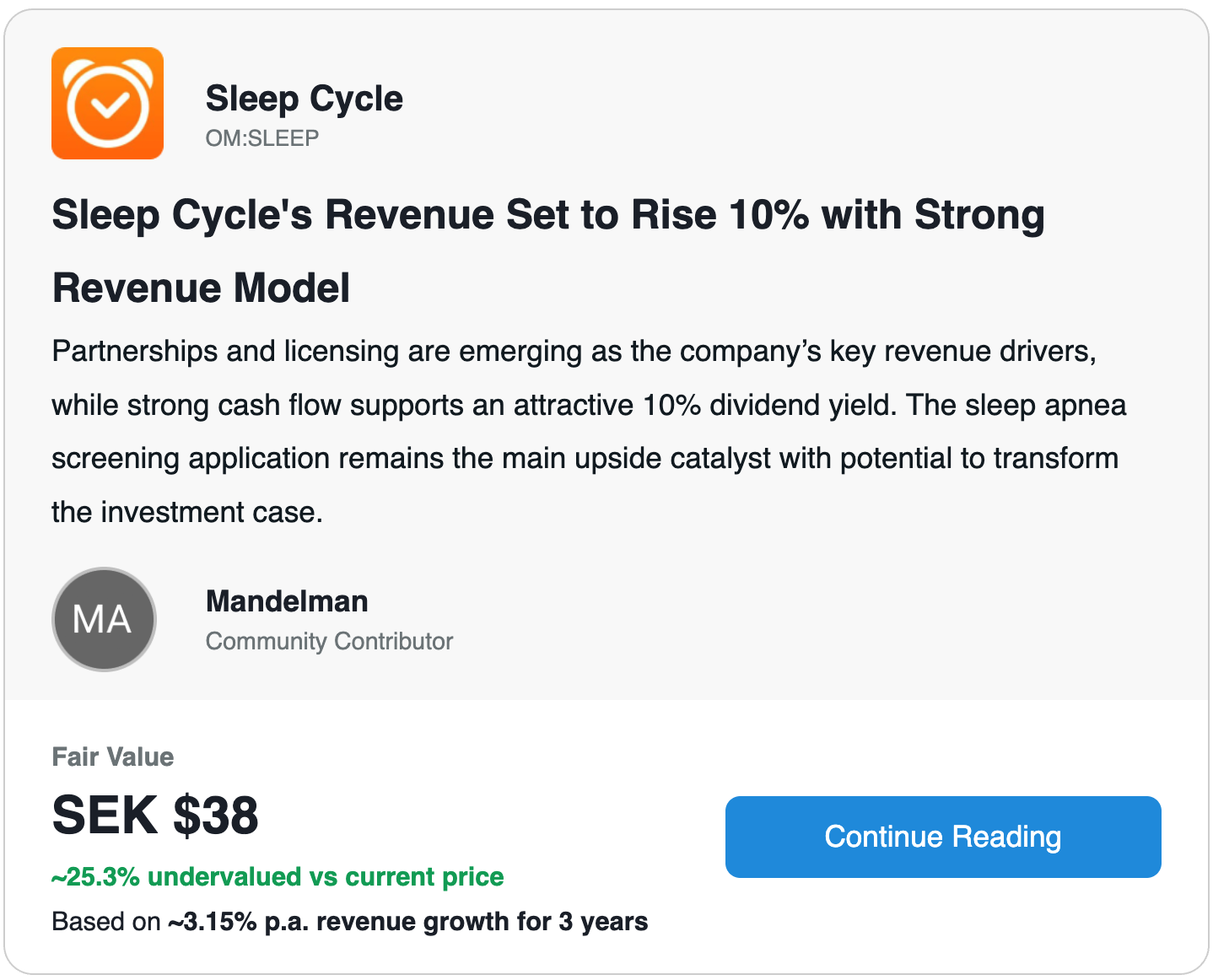

😴 The main catalyst behind Sleep Cycle’s upside potential.

-

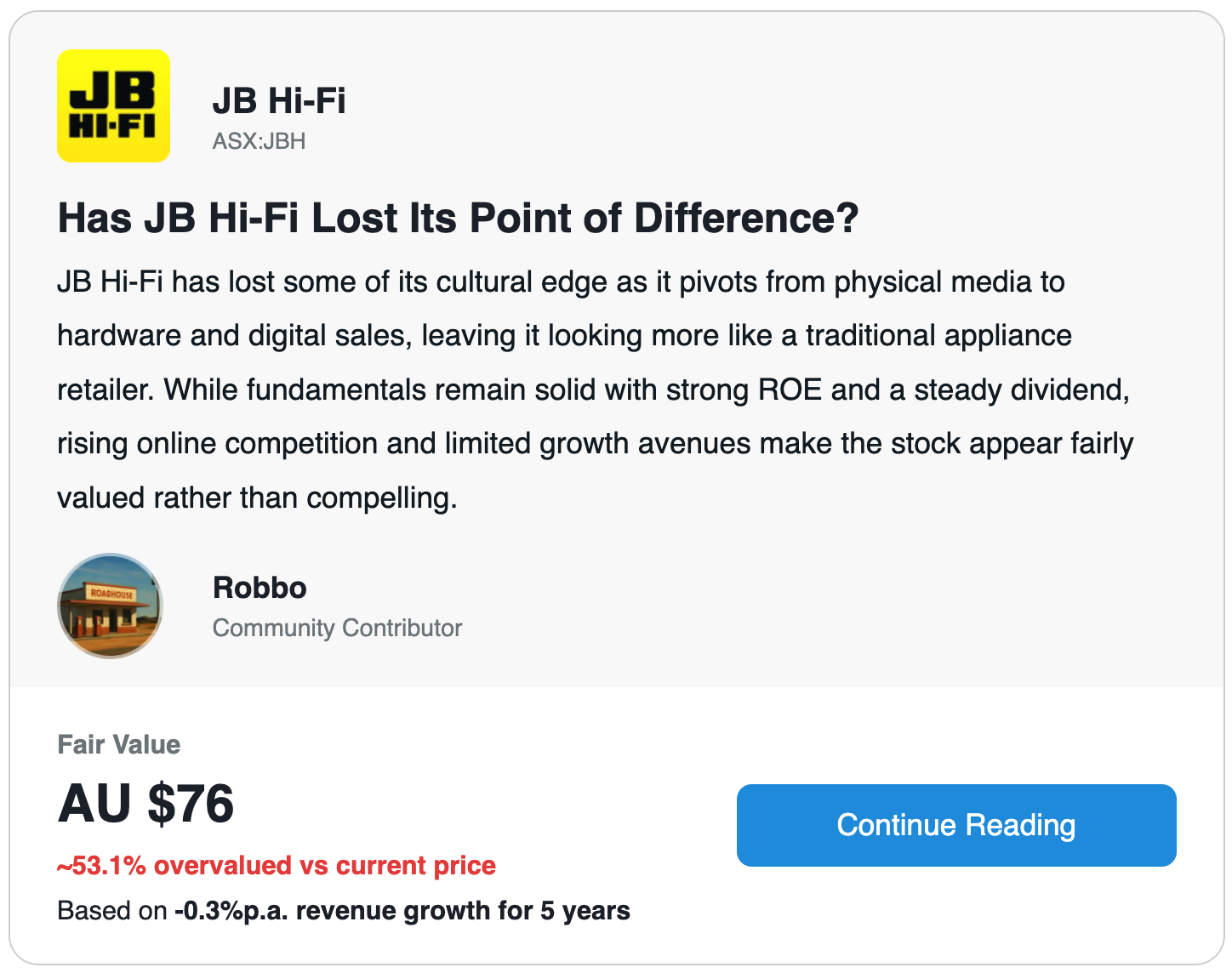

📱 Why JB Hi-Fi might have lost its point of difference.

-

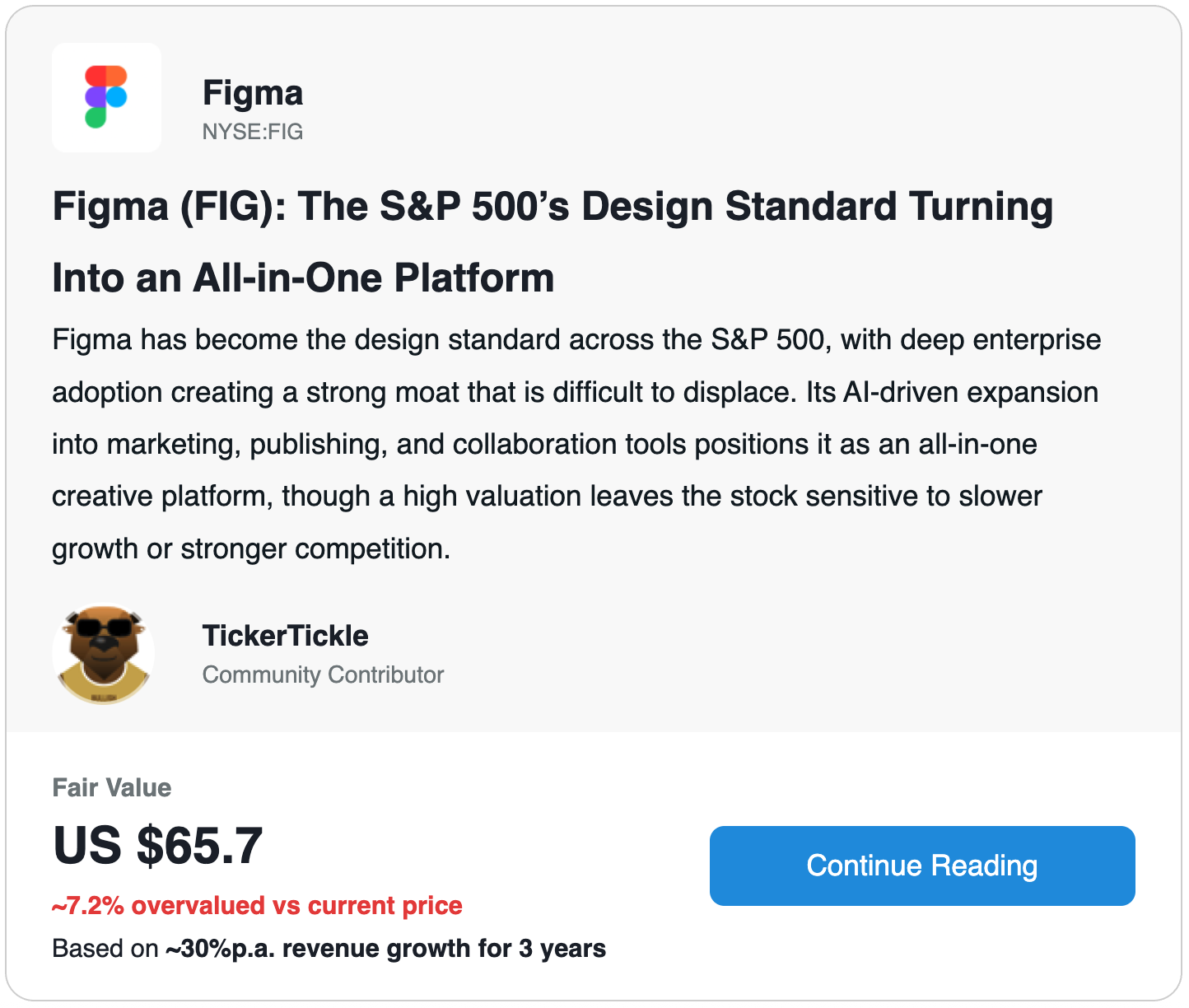

🎨 The bear, base and bull case for Figma .

💡 Why we like it: Mandelman takes a structured, methodical approach — starting with a Q1 update, revising growth assumptions, then layering in our narrative template, which we love to see. It’s a balanced narrative that acknowledges subscription headwinds yet justifies a buy stance on cash flow strength, dividends, and potential new growth drivers.

💡 Why we like it: Robbo starts with a cultural lens, contrasting JB Hi-Fi’s past “edgy” identity with its more corporate present, before layering in the fundamentals. By the end, it doesn’t oversell or dismiss the stock, but leaves us with a nuanced stance that mirrors the company’s own identity shift — steady, profitable, but no longer exciting.

💡 Why we like it: The bear/base/bull framing keeps the investment case clear and digestible, while the detail on integration, AI features, and Fortune 500 penetration gives credibility. It’s a balanced mix of personal experience, enthusiasm and discipline, exactly the kind of setup that helps readers weigh Figma’s potential against its risks.

What's next?

-

🔔 Know when to act: Set the narrative valuations as your own fair value to know when to buy, hold or sell the stock.

-

🤔 Get answers: Ask the author any questions in the comments section. Feel free to like as well to support their work.

-

✨ Discover more Narratives: There are hundreds of other insightful stock narratives on our Community page .

-

✍️ Build an audience: Have your narrative seen by millions of investors, simply meet our Featuring criteria to go into the running!

Disclaimer

TickerTickle is an employee of Simply Wall St, but has written a narrative in their capacity as an individual investor. Market_Jar is an investor relations firm working with Knightscope. Simply Wall St has no position in any of the companies mentioned. These narratives are general in nature and explore scenarios and estimates created by the authors. These narratives do not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company’s future performance and are exploratory in the ideas they cover. The fair value estimate’s are estimations only, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St receives fees from its partners for sponsored content in this email. This communication may contain links to third party information and products. Such content and links are not owned, operated or maintained by Simply Wall St nor are they affiliated or associated with Simply Wall St in any way. Simply Wall St is not responsible for the content, quality, accuracy or completeness of any third party material appearing on any links to third party’s content. The content is intended to highlight certain companies for your further investigation and does not constitute a recommendation to buy or sell any stock.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About OM:SLEEP

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.