- Finland

- /

- Consumer Durables

- /

- HLSE:FSKRS

3 Undervalued European Small Caps With Insider Action

Reviewed by Simply Wall St

As European markets continue to show resilience, with the STOXX Europe 600 Index and major single-country indexes posting gains, investors are increasingly focusing on small-cap stocks that might offer unique opportunities amid subdued inflation and economic reforms. In this environment, identifying small-cap companies with strong fundamentals and strategic insider actions can be crucial for navigating potential growth avenues in the evolving market landscape.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.1x | 0.7x | 44.62% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 34.50% | ★★★★★☆ |

| Eastnine | 11.8x | 7.4x | 48.62% | ★★★★★☆ |

| Senior | 23.6x | 0.7x | 30.68% | ★★★★★☆ |

| Eurocell | 16.2x | 0.3x | 40.75% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.9x | 37.47% | ★★★★☆☆ |

| Norbit | 29.4x | 4.9x | 13.85% | ★★★☆☆☆ |

| Kendrion | 29.4x | 0.7x | 40.61% | ★★★☆☆☆ |

| Kid | 18.3x | 1.4x | 1.86% | ★★★☆☆☆ |

| CVS Group | 45.9x | 1.3x | 26.44% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

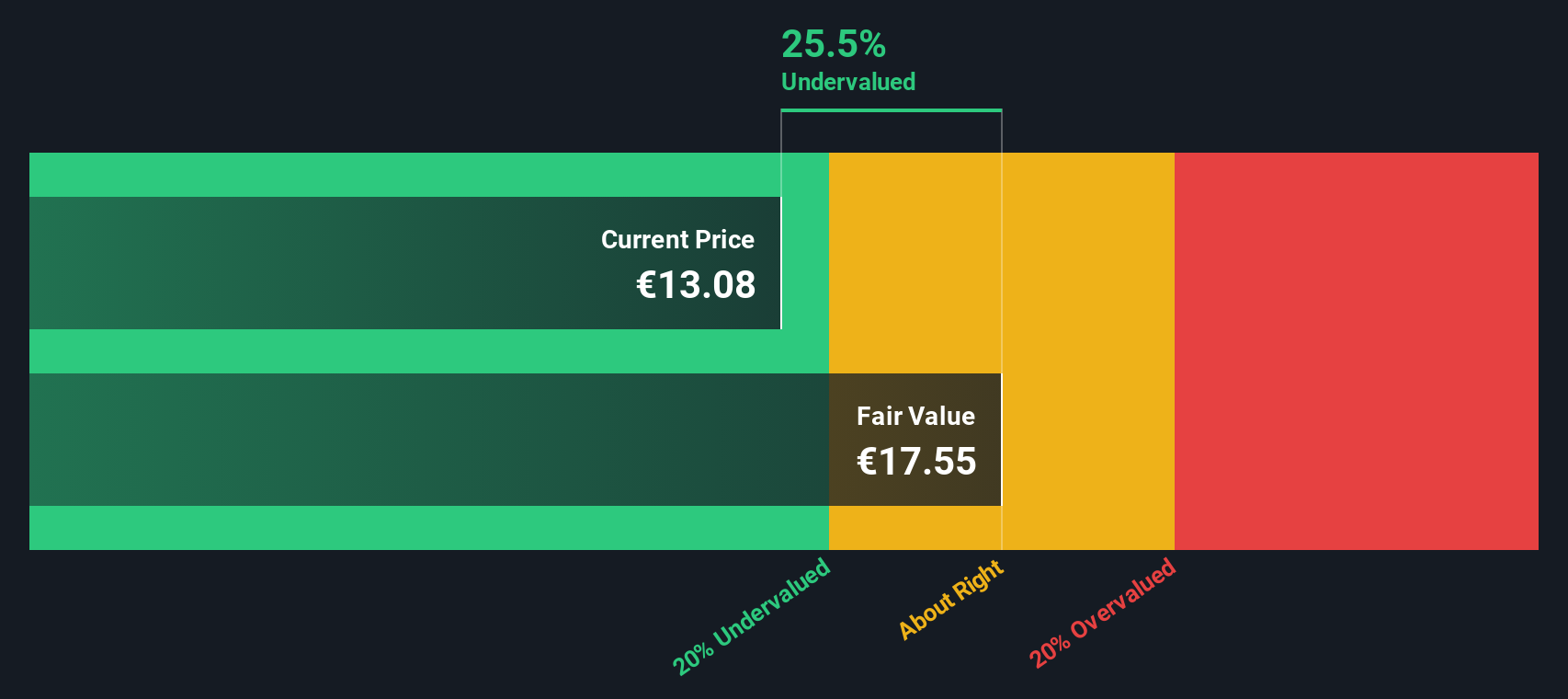

Fiskars Oyj Abp (HLSE:FSKRS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Fiskars Oyj Abp is a consumer goods company that operates through its Vita and Fiskars segments, with a market capitalization of €1.59 billion.

Operations: Fiskars Oyj Abp generates revenue primarily from its Vita and Fiskars segments, with Vita contributing €609.90 million and Fiskars €530.90 million. The company's gross profit margin has shown a notable increase, reaching 47.20% by the end of September 2025 from 44.52% in March 2024, indicating improvements in cost management or pricing strategies over this period.

PE: 38.8x

Fiskars Oyj Abp, a European company with a market cap under €1 billion, is navigating challenges in its Vita business area but shows potential for growth. Recent guidance lowered expected EBIT for 2025 to €75-€85 million due to inventory issues and production scaling. Despite this, Vita's net sales grew by 8% in Q3 2025, indicating recovering demand. Insider confidence is evident as insiders purchased shares recently. The new CEO brings extensive industry experience, aligning with strategic objectives to bolster future prospects.

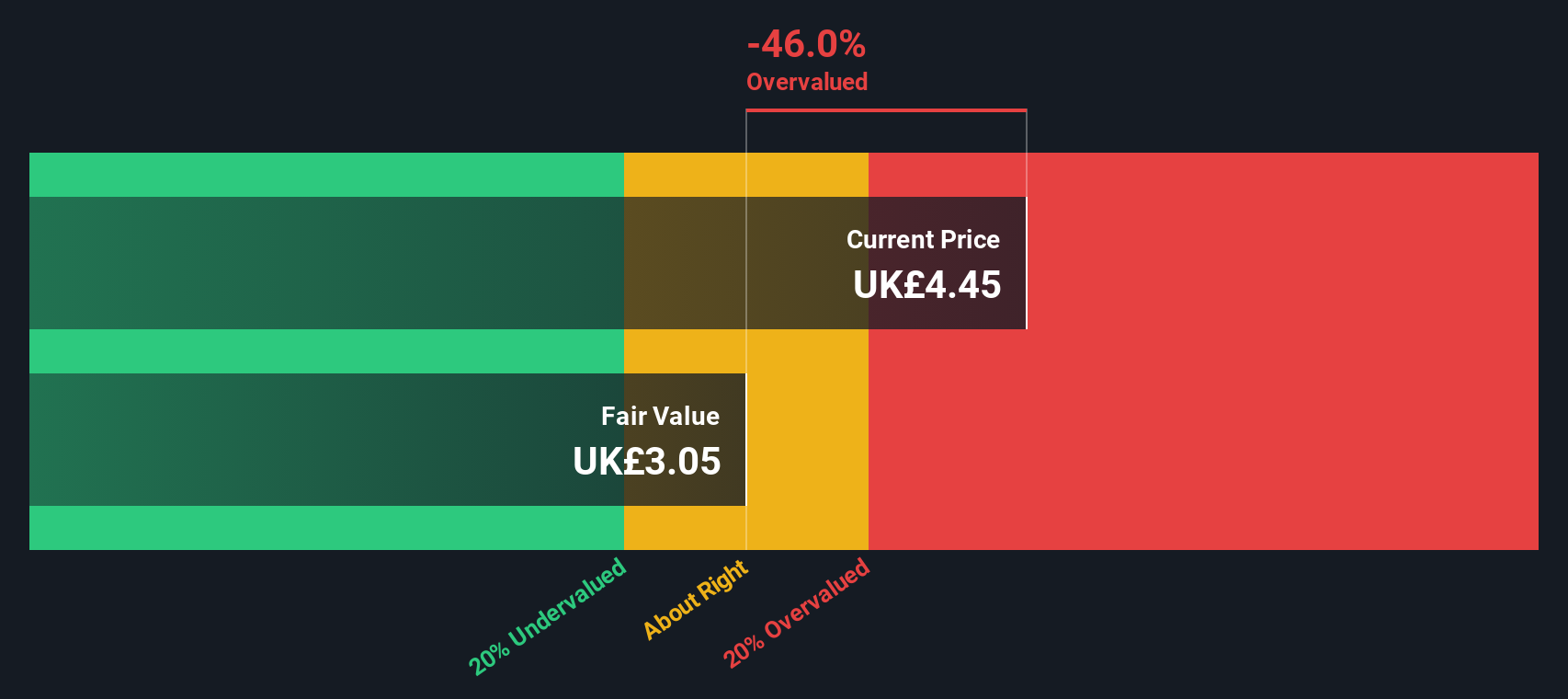

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pinewood Technologies Group specializes in providing innovative software solutions for the automotive retail industry, with a market cap of £2.85 billion.

Operations: Pinewood Technologies Group's revenue primarily comes from its operations, with a notable gross profit margin trend, reaching as high as 89.53% in late 2022. The company has experienced fluctuations in net income margins, with periods of both positive and negative values over the years. Operating expenses have been a significant part of the cost structure, with general and administrative expenses consistently present across financial periods.

PE: 59.0x

Pinewood Technologies Group, a growing player in the tech sector, has been making waves with its addition to the FTSE 250 and FTSE 350 indices as of September 2025. Despite reporting a net loss of £0.7 million for the half-year ending June 2025, compared to a previous profit of £5 million, insider confidence remains strong with recent share purchases. The appointment of two seasoned non-executive directors in October brings strategic expertise to navigate future growth amid high-risk funding challenges from external borrowing sources.

- Get an in-depth perspective on Pinewood Technologies Group's performance by reading our valuation report here.

Learn about Pinewood Technologies Group's historical performance.

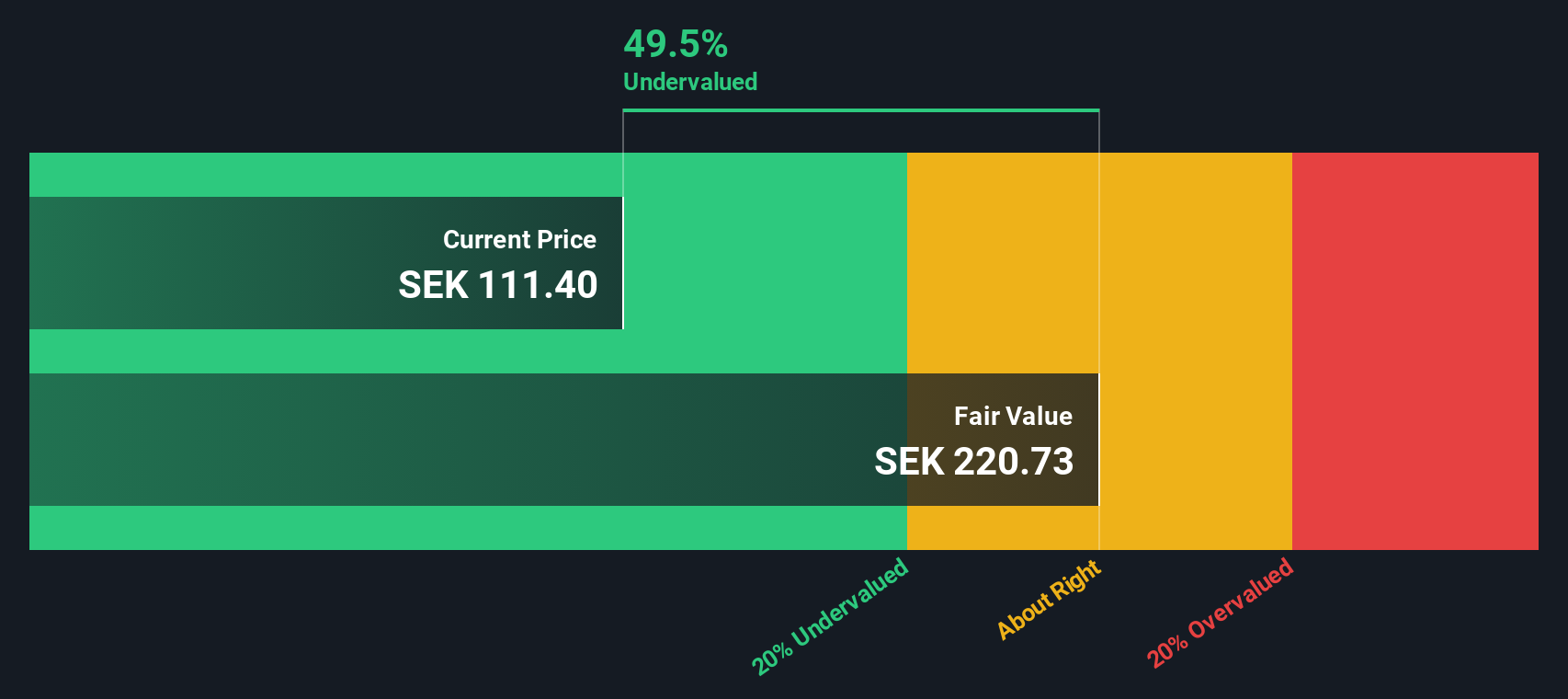

Knowit (OM:KNOW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Knowit is a consultancy firm specializing in IT, management, and digital solutions with a market cap of SEK 5.34 billion.

Operations: The company's revenue primarily comes from its Solutions segment, contributing SEK 3.22 billion, followed by Experience and Insight segments at SEK 1.06 billion and SEK 852 million, respectively. The gross profit margin has shown fluctuations, with recent figures around 14%. Operating expenses are significant, particularly in general and administrative costs which have been consistent at approximately SEK 348 million in recent periods.

PE: 31.6x

Knowit, a tech consultancy firm, recently secured a strategic alliance with Equinor to enhance their Distributed Fiber Optic Sensing platform over three years. This collaboration aims to scale the technology's application across Equinor’s operations, potentially boosting Knowit's market presence. Furthermore, they landed a lucrative NOK 1.1 billion framework agreement with Tet Digital for consultancy services over six years. Despite some revenue decline in recent earnings reports, insider confidence remains high with notable share purchases in recent months, indicating potential growth prospects amidst its small cap status.

- Dive into the specifics of Knowit here with our thorough valuation report.

Evaluate Knowit's historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 72 Undervalued European Small Caps With Insider Buying.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:FSKRS

Fiskars Oyj Abp

Manufactures and markets consumer products for indoor and outdoor living in Europe, the Americas, and the Asia Pacific.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026