Exploring 3 Promising Undervalued Small Caps In European Markets With Insider Action

Reviewed by Simply Wall St

In recent weeks, European markets have experienced a pullback, with the pan-European STOXX Europe 600 Index declining by 1.24%, driven largely by concerns overvaluations in AI-related stocks. As broader market sentiment remains cautious, investors are increasingly looking towards small-cap companies that exhibit strong fundamentals and potential for growth as promising opportunities amidst these conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.8x | 1.5x | 31.31% | ★★★★★★ |

| Bytes Technology Group | 15.8x | 3.8x | 25.87% | ★★★★★☆ |

| Foxtons Group | 10.0x | 0.9x | 43.25% | ★★★★★☆ |

| Boozt | 17.3x | 0.8x | 49.58% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 27.05% | ★★★★★☆ |

| Senior | 24.5x | 0.8x | 26.34% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.9x | 37.76% | ★★★★☆☆ |

| Fastighets AB Trianon | 9.8x | 4.7x | -21.31% | ★★★★☆☆ |

| Pexip Holding | 31.5x | 5.0x | 25.50% | ★★★☆☆☆ |

| Fiskars Oyj Abp | 40.0x | 0.9x | 24.04% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

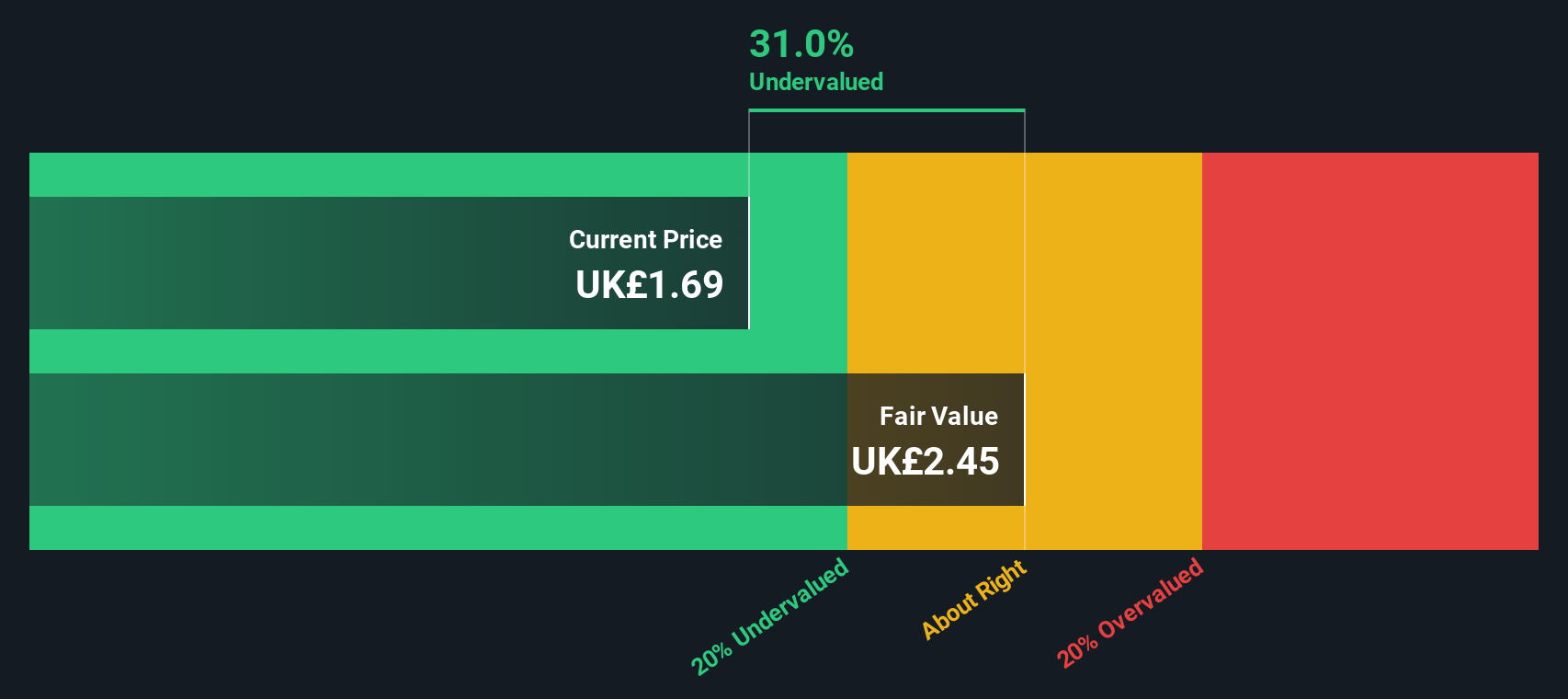

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cairn Homes is a leading Irish homebuilder focused on building and property development, with a market cap of approximately €0.65 billion.

Operations: The primary revenue stream is from building and property development, with a recent figure of €778.20 million. The cost of goods sold (COGS) significantly impacts profitability, as evidenced by the gross profit margin reaching 21.81% in the latest period. Operating expenses include general and administrative costs, which recently amounted to €38.43 million, alongside non-operating expenses of €31.90 million affecting net income outcomes.

PE: 11.8x

Cairn Homes, operating in the European market, shows signs of being undervalued despite recent financial challenges. Their H1 2025 sales dropped to €284 million from €366 million the previous year, with net income decreasing to €32 million from €47 million. However, earnings are forecasted to grow annually by 15%. Insider confidence is evident with share purchases in early 2025. The company also increased its interim dividend by 8% in September 2025, reflecting a commitment to shareholder returns amidst external borrowing risks.

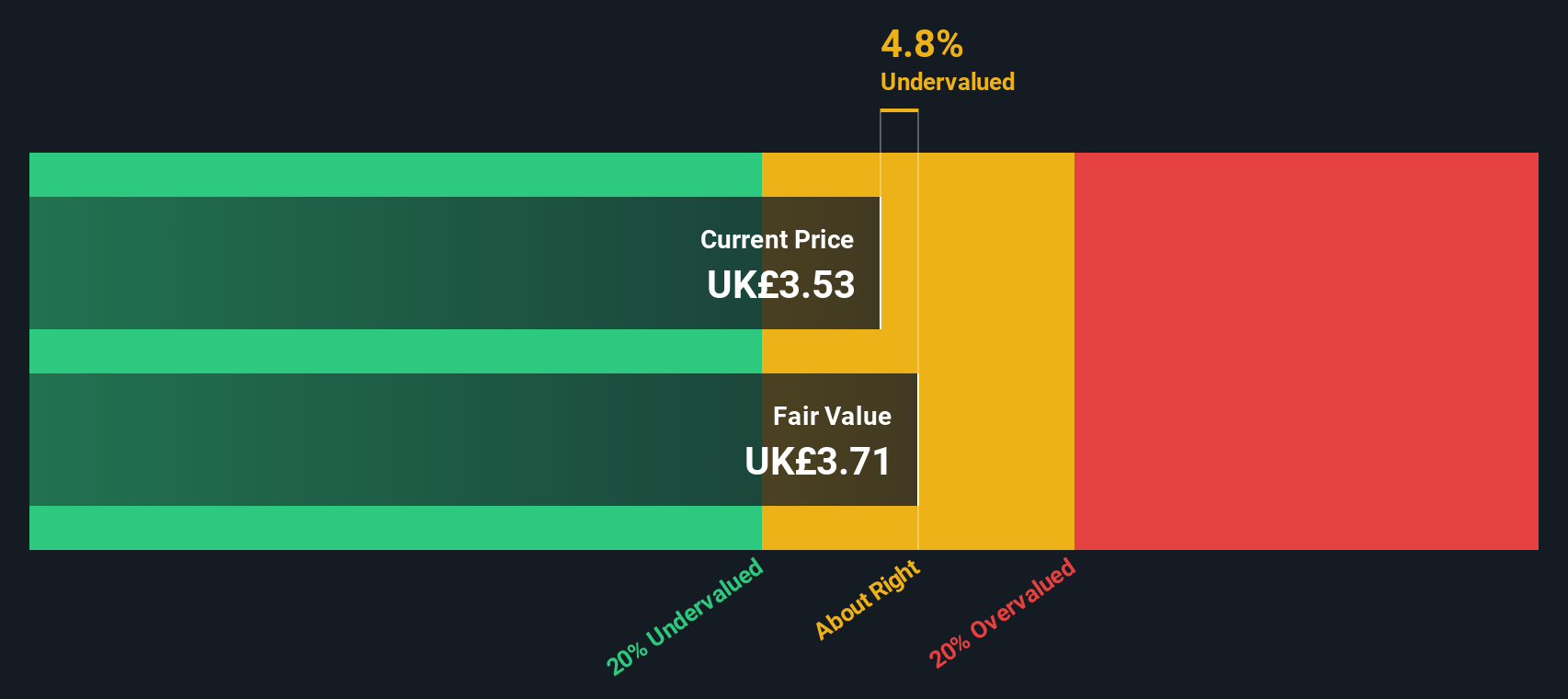

MJ Gleeson (LSE:GLE)

Simply Wall St Value Rating: ★★★★★☆

Overview: MJ Gleeson operates primarily through its Gleeson Homes segment, focusing on building affordable homes, and its Gleeson Land segment, specializing in land promotion, with a market cap of £0.43 billion.

Operations: Gleeson generates revenue primarily from its Gleeson Homes segment, with a smaller contribution from Gleeson Land. The gross profit margin has shown a declining trend, moving from 35.16% in March 2017 to 22.73% in June 2025. Operating expenses have increased over time, impacting the company's net income margins and overall profitability.

PE: 12.8x

MJ Gleeson, a smaller player in the European market, has shown potential despite challenges. For the full year ending June 30, 2025, sales rose to £365.82 million from £345.35 million previously, though net income dipped to £15.82 million from £19.31 million. Insider confidence is evident with recent share purchases by executives during September 2025, suggesting belief in future growth prospects despite current financial pressures and reliance on external borrowing for funding stability.

- Delve into the full analysis valuation report here for a deeper understanding of MJ Gleeson.

Gain insights into MJ Gleeson's historical performance by reviewing our past performance report.

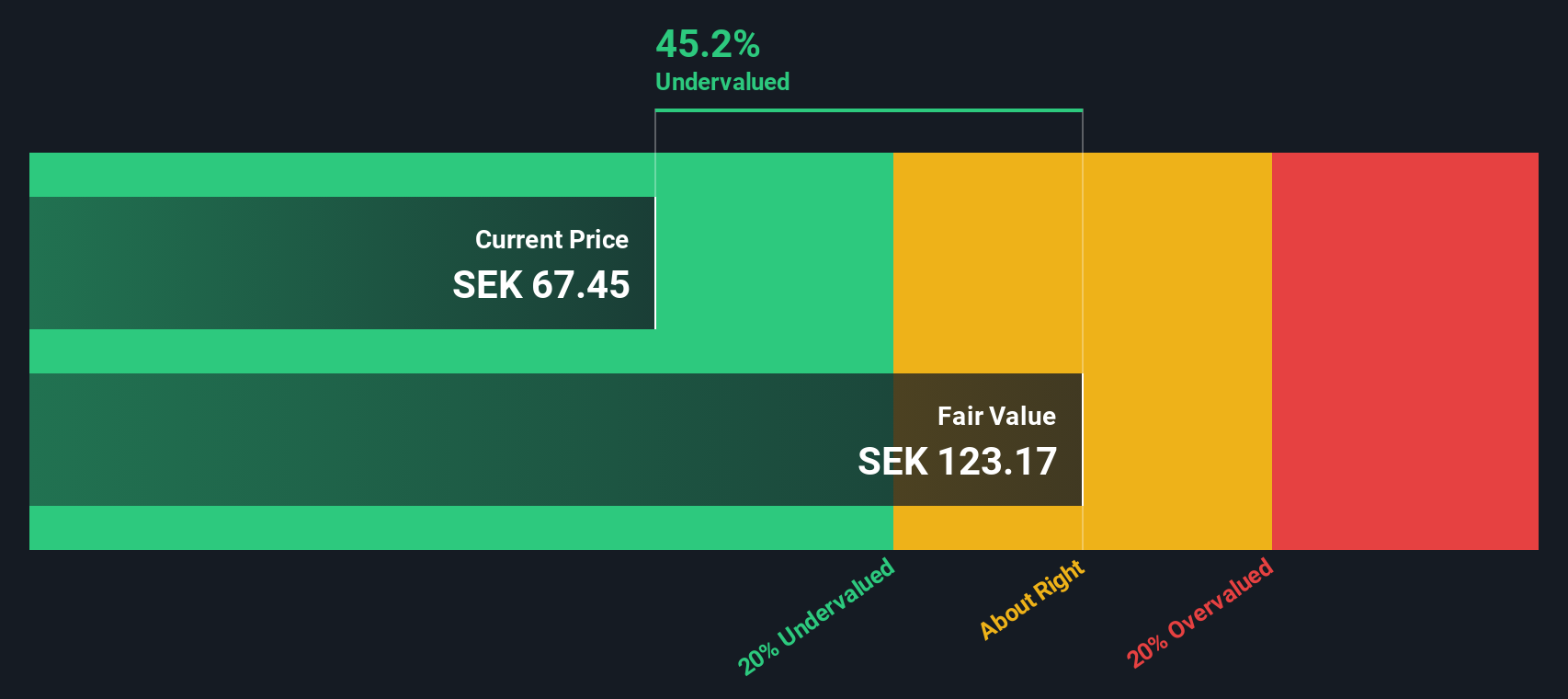

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Rusta operates as a retail company with a focus on home and leisure products, primarily serving markets in Sweden, Norway, and other regions, with a market cap of SEK 5.43 billion.

Operations: The company generates revenue primarily from Sweden, Norway, and other markets. Over recent periods, its net profit margin has shown fluctuations, reaching 4.02% as of July 2025. The cost of goods sold (COGS) consistently represents a significant portion of expenses, while operating expenses are largely driven by sales and marketing efforts.

PE: 23.5x

Rusta's recent expansion is notable, with two new stores in Sweden and Finland as part of an aggressive growth strategy. This move aligns with their plan to open 50-80 new locations over the next three years. Despite a dip in net income to SEK 174 million for Q1 2025, insider confidence remains strong; the CEO acquired 165,000 shares valued at approximately SEK 10.6 million, reflecting a belief in future growth prospects.

- Click to explore a detailed breakdown of our findings in Rusta's valuation report.

Explore historical data to track Rusta's performance over time in our Past section.

Next Steps

- Gain an insight into the universe of 61 Undervalued European Small Caps With Insider Buying by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Engages in the retail of products in home decoration, consumables, seasonal products, leisure, and Do It Yourself (DIY) categories in Sweden, Norway, Finland, and Germany.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives