The European stock market has recently experienced a pullback, with the pan-European STOXX Europe 600 Index ending 1.24% lower amid concerns about overvaluation in artificial intelligence-related stocks. As major indices like Germany’s DAX and France’s CAC 40 have seen declines, investors may find opportunities in stocks that appear to be trading below their estimated fair value, especially those resilient to current market volatility and economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Rusta (OM:RUSTA) | SEK64.45 | SEK126.74 | 49.1% |

| Roche Bobois (ENXTPA:RBO) | €35.60 | €69.78 | 49% |

| Recupero Etico Sostenibile (BIT:RES) | €6.50 | €12.89 | 49.6% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.48 | €4.88 | 49.1% |

| E-Globe (BIT:EGB) | €0.67 | €1.31 | 48.9% |

| Doxee (BIT:DOX) | €3.72 | €7.40 | 49.7% |

| doValue (BIT:DOV) | €2.608 | €5.20 | 49.8% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.85 | 49.9% |

| Bonesupport Holding (OM:BONEX) | SEK198.80 | SEK391.01 | 49.2% |

| Allcore (BIT:CORE) | €1.365 | €2.66 | 48.8% |

Let's dive into some prime choices out of the screener.

Apotea (OM:APOTEA)

Overview: Apotea AB (publ) operates an online pharmacy in Sweden with a market cap of SEK8.99 billion.

Operations: Apotea AB (publ) generates its revenue through its online pharmacy operations in Sweden.

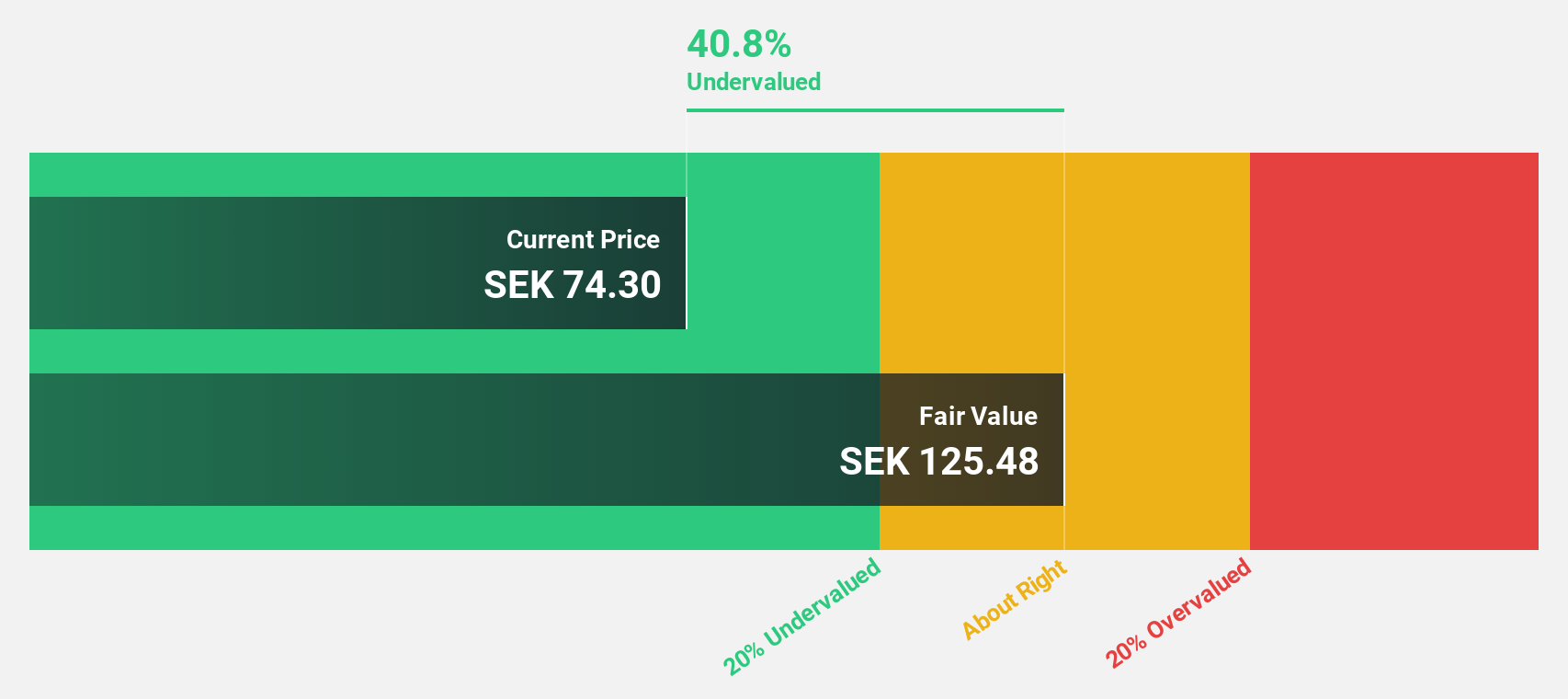

Estimated Discount To Fair Value: 26.3%

Apotea is trading at SEK 86.46, below its estimated fair value of SEK 117.39, highlighting its undervaluation based on cash flows. The company's earnings grew by 36.6% over the past year and are expected to grow by 17.7% annually, outpacing the Swedish market's growth rate of 12.7%. Recent third-quarter results showed increased sales and net income compared to last year, reinforcing Apotea's strong financial position amidst ongoing revenue growth forecasts of 14% per year.

- Upon reviewing our latest growth report, Apotea's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Apotea with our detailed financial health report.

KB Components (OM:KBC)

Overview: KB Components AB (publ) specializes in designing, developing, manufacturing, and selling polymer components for various industries including automotive, medical, and industrial applications with a market cap of SEK2.48 billion.

Operations: KB Components generates revenue from several regions, with SEK120.74 million from Asia, SEK1.18 billion from Europe, and SEK1.59 billion from North America through its operations in the polymer components industry.

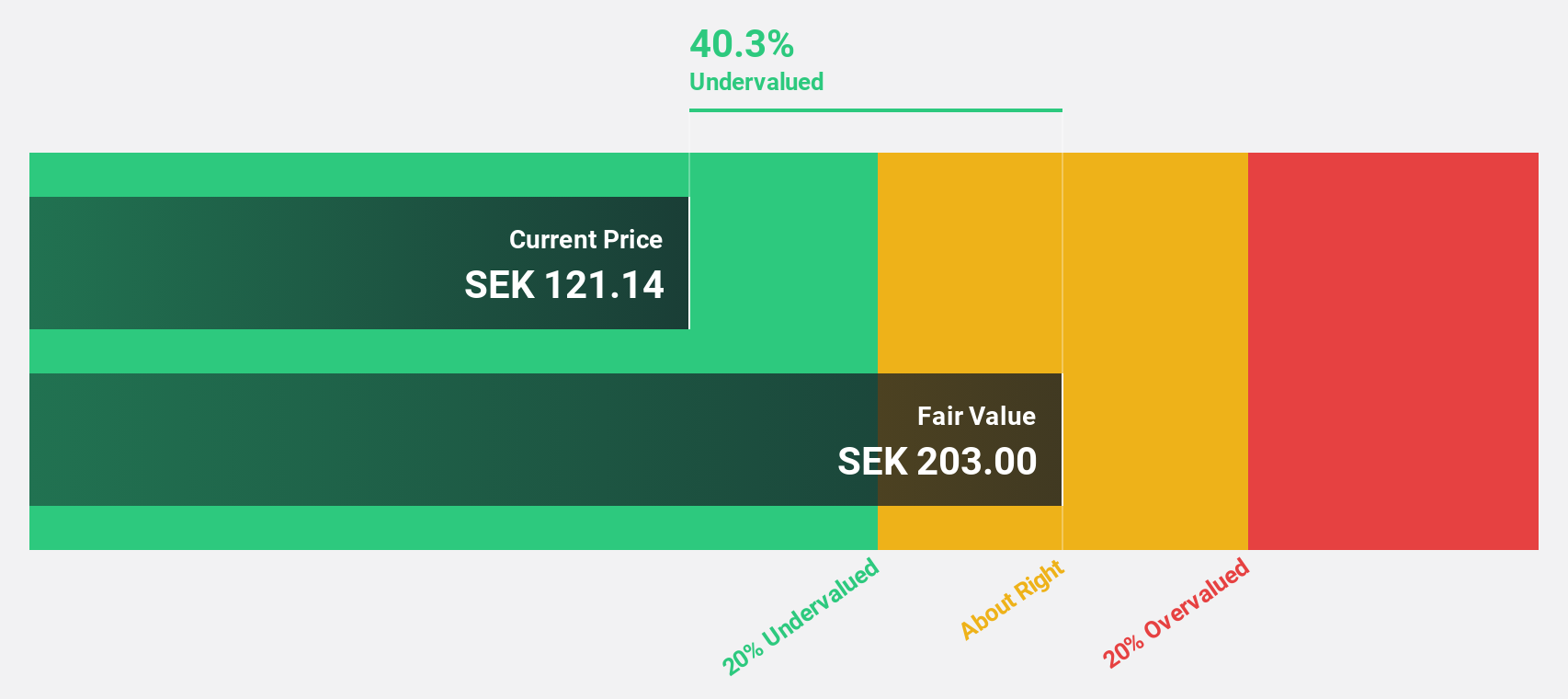

Estimated Discount To Fair Value: 46.4%

KB Components is trading at SEK 44.2, significantly below its estimated fair value of SEK 82.41, indicating substantial undervaluation based on cash flows. The company reported a robust earnings increase of 27.8% over the past year, with forecasts predicting annual profit growth of 21.5%, surpassing the Swedish market's average growth rate. Despite high debt levels, recent leadership changes and strong second-quarter results underscore KB Components' potential for continued financial improvement and revenue growth above market expectations at 6.4% annually.

- The analysis detailed in our KB Components growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in KB Components' balance sheet health report.

Rusta (OM:RUSTA)

Overview: Rusta AB (publ) operates as a retailer offering home decoration, consumables, seasonal products, leisure items, and DIY goods across Sweden, Norway, Finland, and Germany with a market cap of SEK9.86 billion.

Operations: Rusta's revenue is primarily derived from its operations in Sweden (SEK6.99 billion), followed by Norway (SEK2.56 billion) and other markets (SEK2.39 billion).

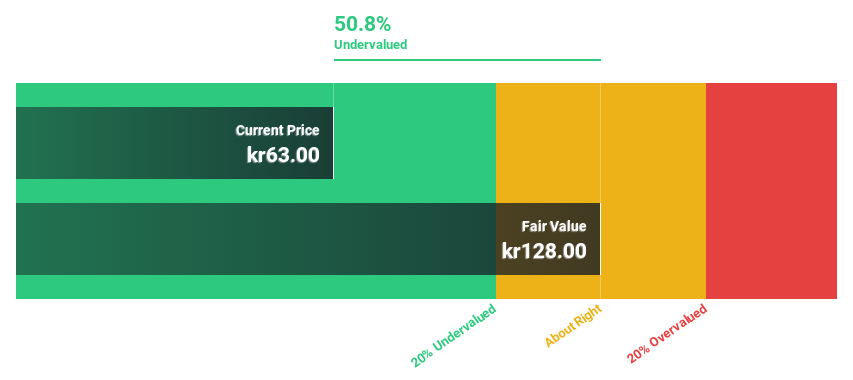

Estimated Discount To Fair Value: 49.1%

Rusta is trading at SEK 64.45, well below its estimated fair value of SEK 126.74, highlighting significant undervaluation based on cash flows. Despite a decline in first-quarter net income to SEK 174 million from SEK 231 million last year, Rusta's earnings are forecast to grow significantly at over 20% annually, outpacing the Swedish market. Recent board changes and an aggressive store expansion strategy across Nordic markets further position Rusta for potential long-term growth.

- Our expertly prepared growth report on Rusta implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Rusta.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 188 Undervalued European Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Engages in the retail of products in home decoration, consumables, seasonal products, leisure, and Do It Yourself (DIY) categories in Sweden, Norway, Finland, and Germany.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives