European Growth Companies With High Insider Ownership December 2025

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the STOXX Europe 600 Index closing 2.35% higher and major single-country indexes also showing gains, investors are increasingly focused on identifying growth opportunities within this buoyant environment. In particular, companies with high insider ownership can be appealing as they often indicate strong management commitment and alignment of interests with shareholders, making them noteworthy candidates for those seeking to capitalize on Europe's current economic climate.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 50.2% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★★☆

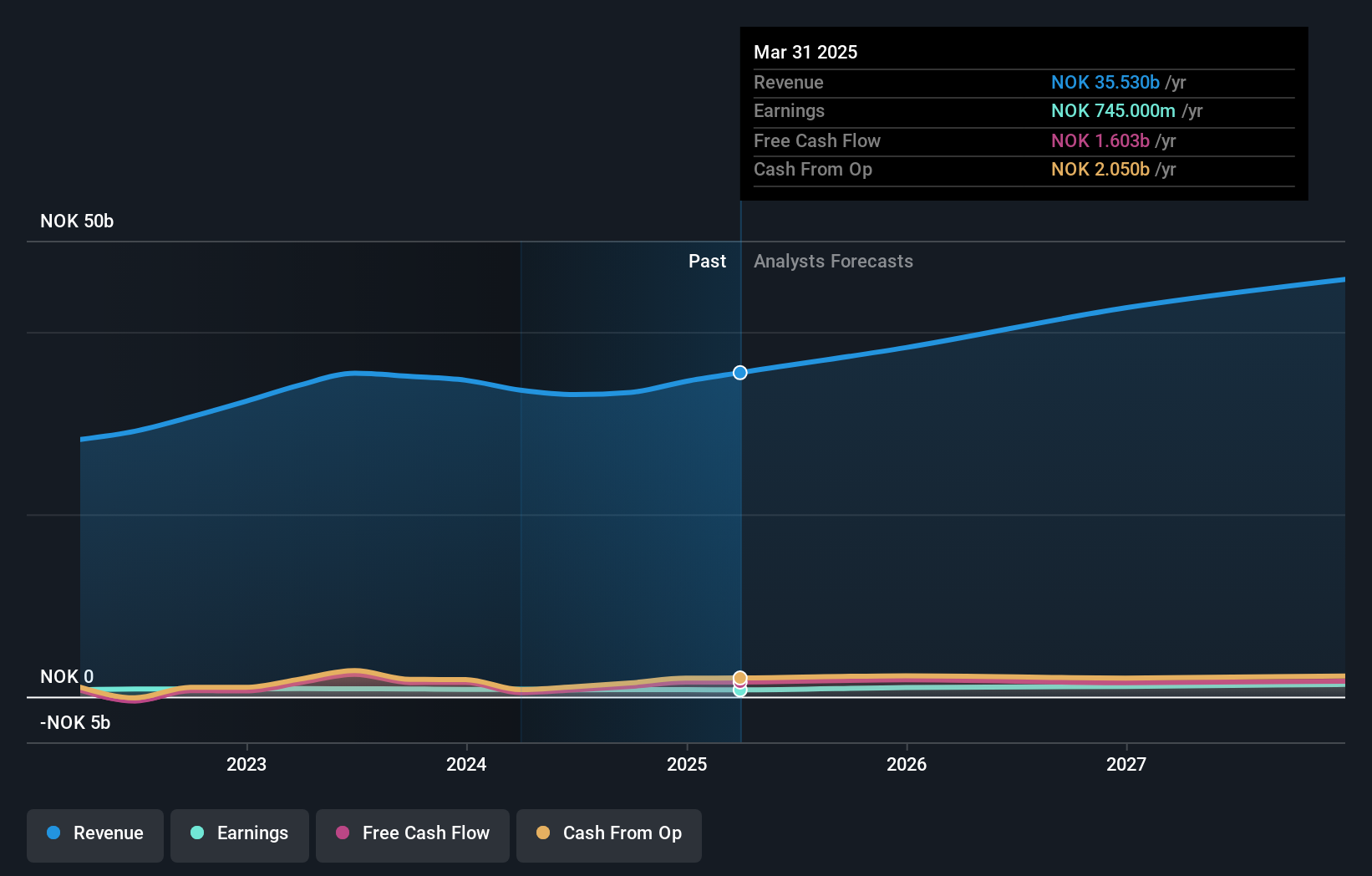

Overview: Atea ASA delivers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK16.56 billion.

Operations: The company's revenue segments include NOK9.27 billion from Norway, NOK13.73 billion from Sweden, NOK8.56 billion from Denmark, NOK3.48 billion from Finland, and NOK1.90 billion from the Baltics, with Group Shared Services contributing an additional NOK11.86 billion.

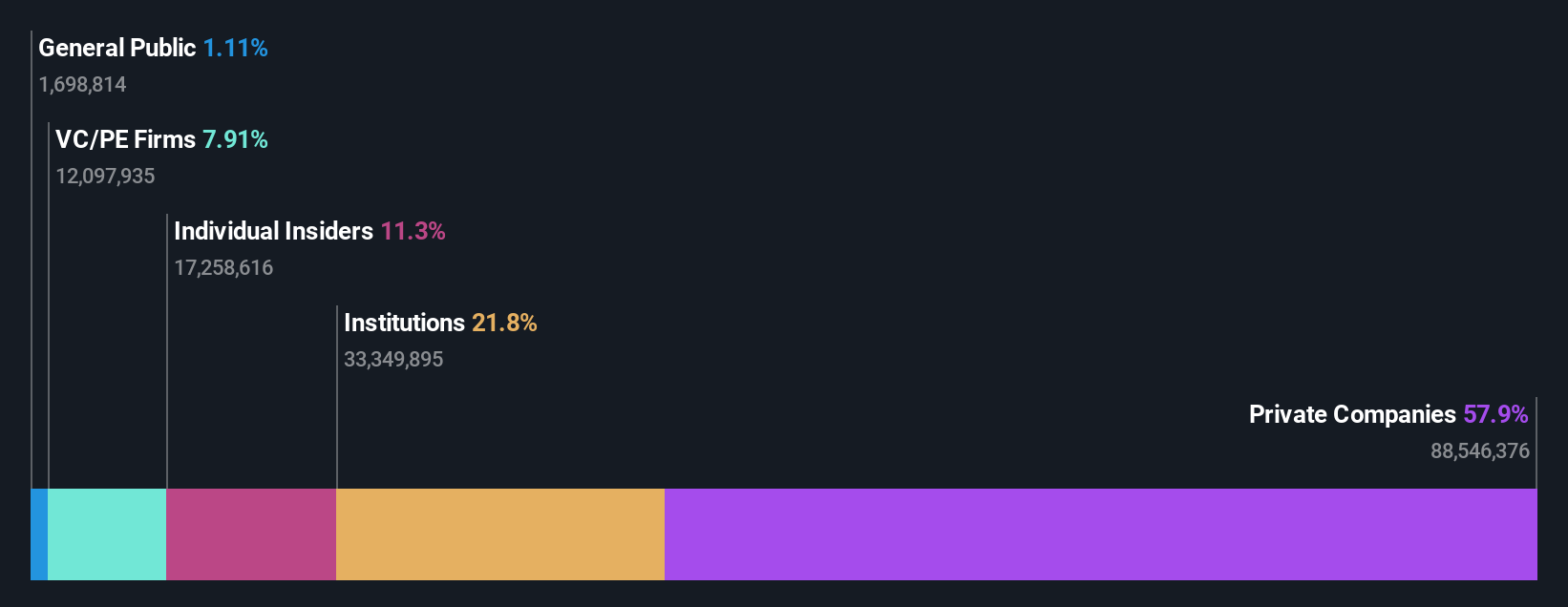

Insider Ownership: 29.1%

Earnings Growth Forecast: 23.4% p.a.

Atea has secured a significant Euro 130 million contract with NATO, boosting its growth prospects. The company reaffirmed its strong earnings guidance for 2025, expecting sales at the high end of NOK 57 billion - NOK 60 billion and EBIT in the mid-range of NOK 1,330 million - NOK 1,450 million. Atea's earnings are projected to grow significantly at 23.4% annually over the next three years, outpacing the Norwegian market's growth rate.

- Take a closer look at Atea's potential here in our earnings growth report.

- Our valuation report here indicates Atea may be undervalued.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) operates as a retailer offering home decoration, consumables, seasonal products, leisure items, and DIY goods across Sweden, Norway, Finland, and Germany with a market capitalization of SEK10.67 billion.

Operations: The company's revenue is segmented into SEK6.99 billion from Sweden, SEK2.55 billion from Norway, and SEK2.39 billion from other markets.

Insider Ownership: 13.5%

Earnings Growth Forecast: 20.5% p.a.

Rusta is experiencing a historically intense expansion phase, having opened six new stores this autumn with plans for up to 80 more in the next three years. Despite recent earnings showing a drop in net income to SEK 174 million, revenue is forecasted to grow faster than the Swedish market at 8.2% annually. Insider activity has been positive with substantial buying and no significant selling, aligning with high insider ownership and an expected annual profit growth of over 20%.

- Dive into the specifics of Rusta here with our thorough growth forecast report.

- Our valuation report unveils the possibility Rusta's shares may be trading at a discount.

Metall Zug (SWX:METN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Metall Zug AG operates through its subsidiaries in medical devices, infection control, technology cluster and infrastructure, and other sectors across Switzerland and globally, with a market cap of CHF360 million.

Operations: The company's revenue segments include Medical Devices generating CHF163.02 million and Investments & Corporate contributing CHF33.45 million.

Insider Ownership: 35.4%

Earnings Growth Forecast: 107.7% p.a.

Metall Zug's growth trajectory is supported by high insider ownership and strategic real estate developments, including the Tech Cluster Zug projects. The recent CHF 220 million syndicated loan agreement provides financial flexibility for these ventures. While earnings are forecast to grow significantly at over 100% annually, revenue growth of 4.8% outpaces the Swiss market average but remains modest compared to higher benchmarks. Despite a low forecasted return on equity and unsustainable dividend coverage, profitability is expected within three years.

- Click here and access our complete growth analysis report to understand the dynamics of Metall Zug.

- Our comprehensive valuation report raises the possibility that Metall Zug is priced higher than what may be justified by its financials.

Next Steps

- Investigate our full lineup of 205 Fast Growing European Companies With High Insider Ownership right here.

- Curious About Other Options? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026