- Sweden

- /

- Specialty Stores

- /

- OM:HM B

Is Recover’s Recycled Cotton Partnership Transforming the Sustainability Narrative for H&M (OM:HM B)?

Reviewed by Sasha Jovanovic

- Recover™ announced in late October 2025 a multi-year agreement with H&M to integrate its recycled cotton fiber, RCotton, into H&M’s product collections as part of their commercial rollout.

- This partnership enables H&M to scale the use of mechanically recycled cotton, reflecting both companies’ commitment to sustainability and reinforcing H&M’s innovation in responsible sourcing for industrial-scale apparel.

- We’ll explore how incorporating Recover™’s recycled cotton could enhance H&M’s sustainability profile and influence its long-term growth strategy.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

H & M Hennes & Mauritz Investment Narrative Recap

To be a shareholder in H&M, you likely need to believe in the company’s ability to turn its sustainability initiatives and digital transformation into improved margins, brand loyalty, and steady growth, even as sales in core regions face pressure. The recent debt financing shows strong investor confidence but does not materially shift the near-term focus, which remains on inventory efficiency and recovering demand in key markets; these areas still represent both the main catalyst and biggest risk for H&M right now.

Among the latest company updates, H&M’s issuance of an oversubscribed EUR 500 million bond at favorable terms stands out. This move underlines robust access to capital and may support ongoing investments in store upgrades, digital platforms, and supply chain optimization, all important factors behind the catalysts investors are watching closely.

However, in contrast, investors should not overlook the impact of rising inventory levels and increased purchasing costs on...

Read the full narrative on H & M Hennes & Mauritz (it's free!)

H & M Hennes & Mauritz's outlook anticipates SEK242.9 billion in revenue and SEK14.3 billion in earnings by 2028. This is based on annual revenue growth of 1.4%, with earnings rising by SEK4.4 billion from the current SEK9.9 billion.

Uncover how H & M Hennes & Mauritz's forecasts yield a SEK147.57 fair value, a 18% downside to its current price.

Exploring Other Perspectives

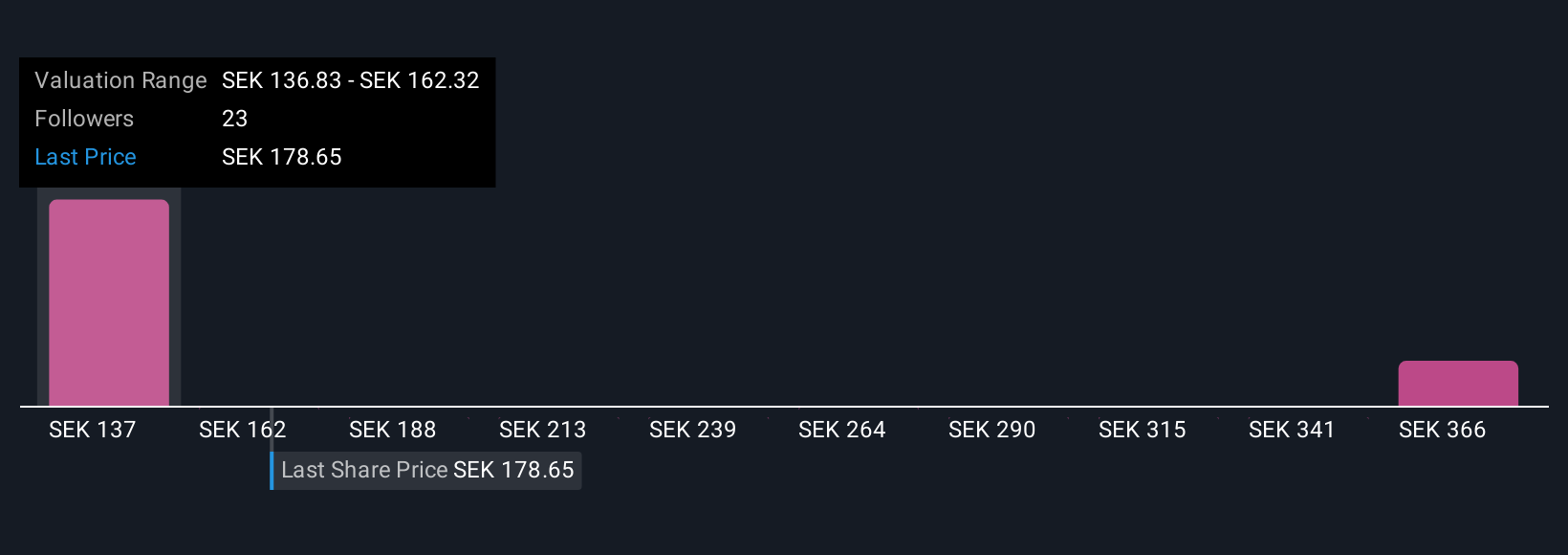

Simply Wall St Community members provided five fair value estimates for H&M, spanning from SEK147.57 to SEK404.13 per share. While many are watching margin recovery as a catalyst for the business, these sharply different views highlight the importance of considering several perspectives before making any investment decisions.

Explore 5 other fair value estimates on H & M Hennes & Mauritz - why the stock might be worth 18% less than the current price!

Build Your Own H & M Hennes & Mauritz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H & M Hennes & Mauritz research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free H & M Hennes & Mauritz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H & M Hennes & Mauritz's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives