3 European Stocks Trading At Estimated Discounts Of Up To 48.2%

Reviewed by Simply Wall St

As the European markets continue to experience upward momentum, with major stock indexes like the STOXX Europe 600 Index posting gains amid expectations of a U.S. Federal Reserve rate cut, investors are closely monitoring opportunities for undervalued stocks. In this environment of steady economic growth and stable inflation forecasts by the European Central Bank, identifying stocks trading at significant discounts can be an attractive strategy for investors seeking value in their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.64 | SEK85.68 | 49.1% |

| Talenom Oyj (HLSE:TNOM) | €3.605 | €7.18 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.46 | 49.4% |

| Lingotes Especiales (BME:LGT) | €5.80 | €11.22 | 48.3% |

| Gofore Oyj (HLSE:GOFORE) | €14.72 | €29.38 | 49.9% |

| Echo Investment (WSE:ECH) | PLN5.54 | PLN10.71 | 48.3% |

| DSV (CPSE:DSV) | DKK1380.00 | DKK2696.01 | 48.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.77 | 49.6% |

| cyan (XTRA:CYR) | €2.28 | €4.41 | 48.3% |

| ATON Green Storage (BIT:ATON) | €2.08 | €4.09 | 49.2% |

Underneath we present a selection of stocks filtered out by our screen.

Agilyx (OB:AGLX)

Overview: Agilyx ASA, along with its subsidiaries, offers plastic waste solutions across Europe, the United States, and the Asia Pacific, with a market cap of NOK2.62 billion.

Operations: The company's revenue segments include $0.95 million from Agilyx and $11.87 million from Cyclyx, with adjustments to remove Cyclyx amounting to -$11.87 million.

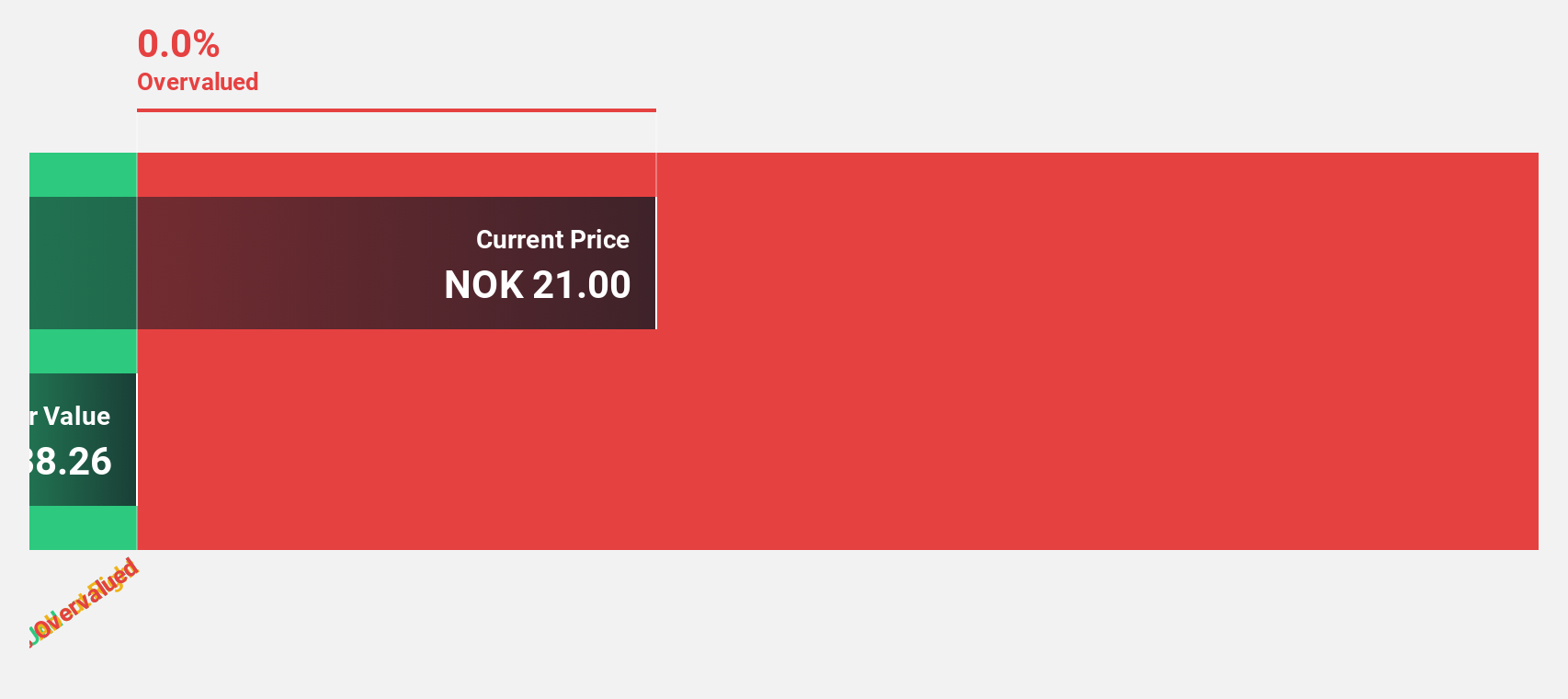

Estimated Discount To Fair Value: 39.4%

Agilyx ASA, trading at NOK23.7, is valued significantly below its estimated fair value of NOK39.09, suggesting it might be undervalued based on cash flows. Despite reporting a net loss of US$11.57 million for H1 2025 and modest sales figures under US$1 million, Agilyx's revenue is projected to grow rapidly at 56.2% annually, outpacing the Norwegian market's growth rate. Additionally, Agilyx has issued Senior Secured Green Bonds to support its environmentally focused initiatives like Styrenyx technology that significantly reduces carbon emissions in styrene production.

- Our expertly prepared growth report on Agilyx implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Agilyx.

Atea (OB:ATEA)

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK16.11 billion.

Operations: The company's revenue segments are as follows: Norway at NOK9.02 billion, Sweden at NOK13.50 billion, Denmark at NOK8.48 billion, Finland at NOK3.55 billion, The Baltics at NOK1.89 billion, and Group Shared Services contributing NOK11.45 billion.

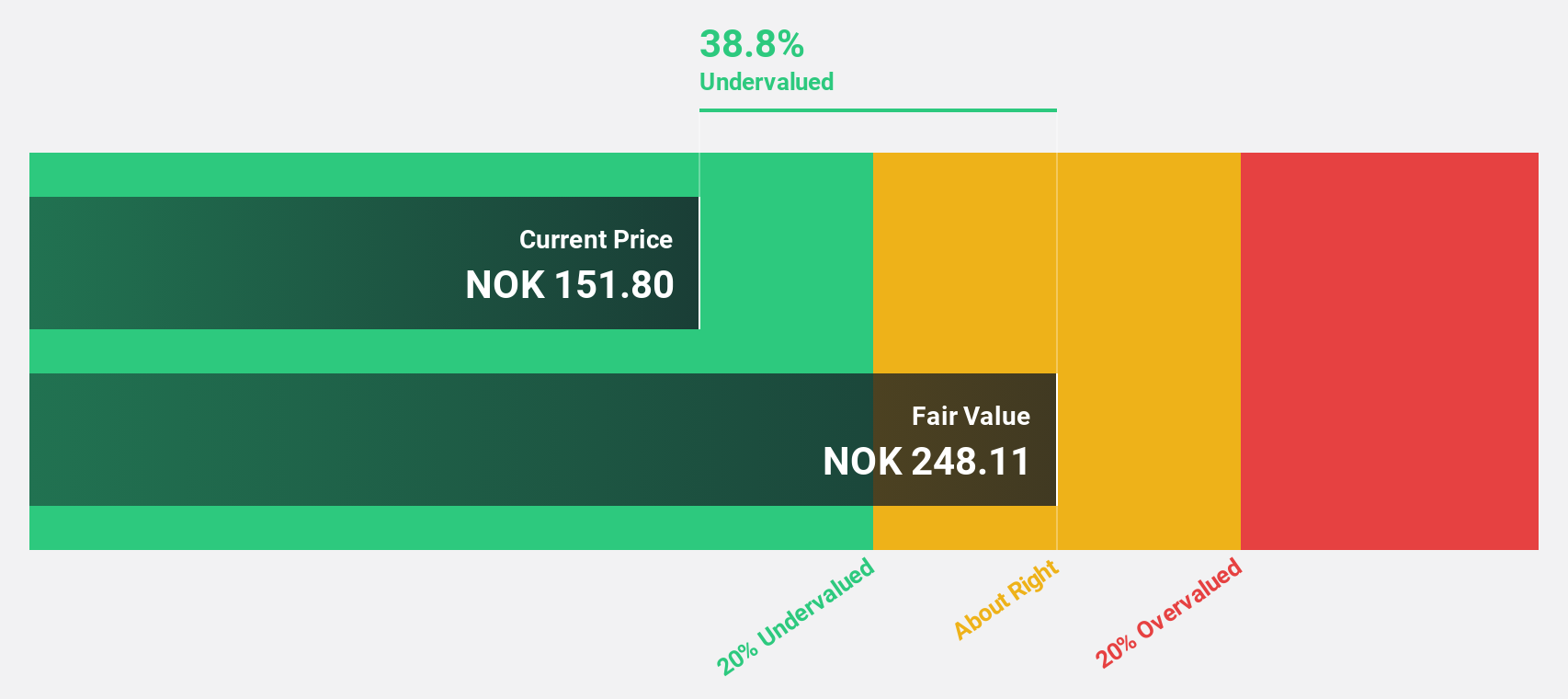

Estimated Discount To Fair Value: 48.2%

Atea ASA, trading at NOK144.4, is considerably below its estimated fair value of NOK278.87, highlighting potential undervaluation based on cash flows. Recent earnings revealed a modest increase in net income to NOK157 million for Q2 2025. Despite a slight dip in six-month net income compared to the previous year, Atea's earnings are forecasted to grow significantly at 20.3% annually over the next three years, surpassing Norwegian market expectations and indicating robust future profitability prospects.

- According our earnings growth report, there's an indication that Atea might be ready to expand.

- Dive into the specifics of Atea here with our thorough financial health report.

BHG Group (OM:BHG)

Overview: BHG Group AB (publ) is a consumer e-commerce company operating in Sweden, Finland, Denmark, Norway, the rest of Europe, and internationally with a market cap of SEK5.09 billion.

Operations: BHG Group AB's revenue segments include Value Home at SEK2.60 billion, Premium Living at SEK2.45 billion, and Home Improvement at SEK5.18 billion.

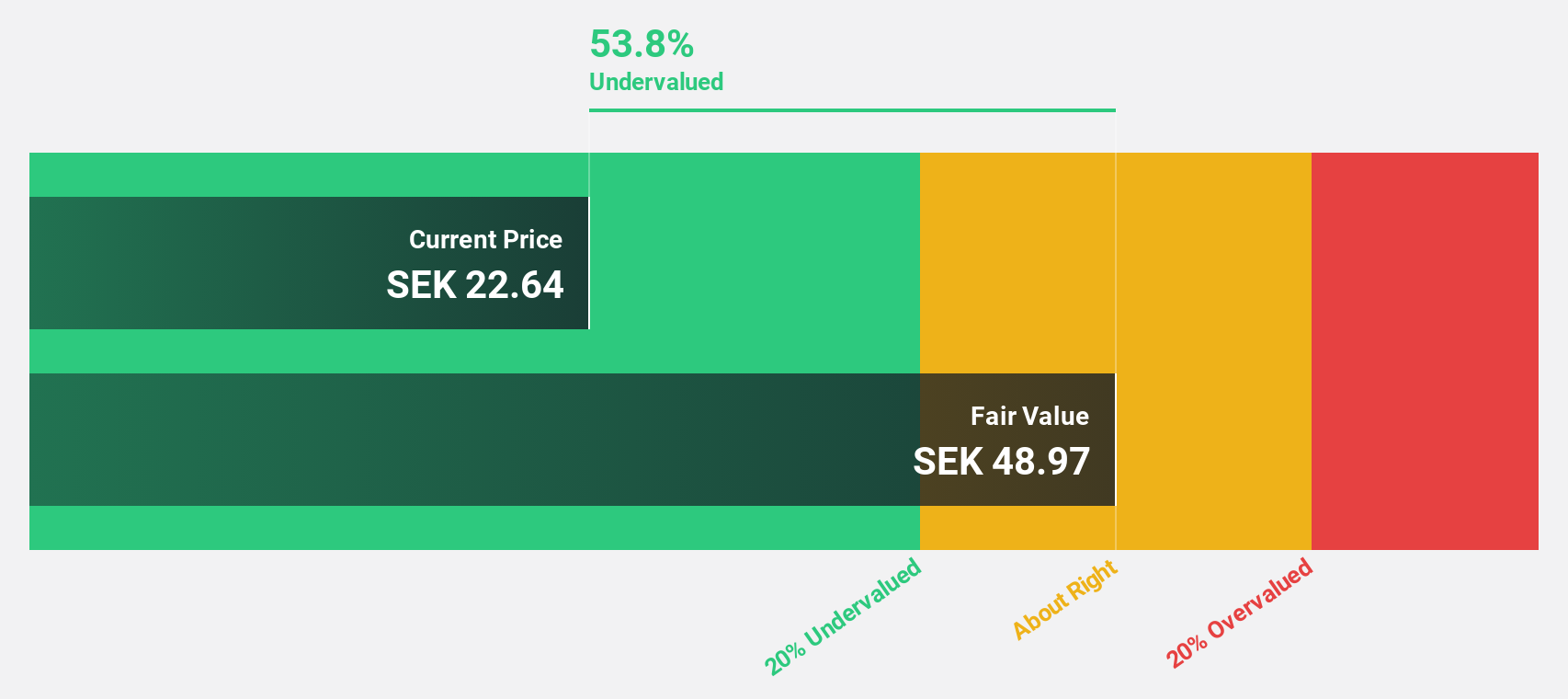

Estimated Discount To Fair Value: 45.2%

BHG Group, with a trading price of SEK28.4, is significantly below its estimated fair value of SEK51.84, suggesting undervaluation based on cash flows. The company reported a net income of SEK75.6 million for Q2 2025, reversing from a net loss the previous year. While BHG's revenue growth forecast at 5.9% annually is modest, earnings are expected to grow substantially at 82.45% per year over the next three years, indicating strong future profitability potential despite low forecasted return on equity.

- Upon reviewing our latest growth report, BHG Group's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of BHG Group stock in this financial health report.

Where To Now?

- Reveal the 215 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives