In 2015 Fredrik Lidjan was appointed CEO of Magnolia Bostad AB (publ) (STO:MAG). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Magnolia Bostad

How Does Fredrik Lidjan's Compensation Compare With Similar Sized Companies?

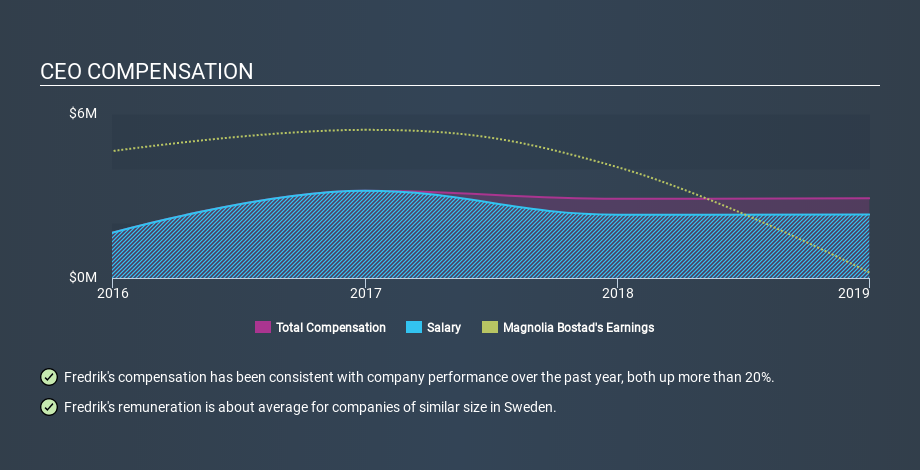

According to our data, Magnolia Bostad AB (publ) has a market capitalization of kr1.8b, and paid its CEO total annual compensation worth kr2.9m over the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at kr2.3m. When we examined a selection of companies with market caps ranging from kr951m to kr3.8b, we found the median CEO total compensation was kr3.6m.

So Fredrik Lidjan receives a similar amount to the median CEO pay, amongst the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context.

You can see, below, how CEO compensation at Magnolia Bostad has changed over time.

Is Magnolia Bostad AB (publ) Growing?

On average over the last three years, Magnolia Bostad AB (publ) has shrunk earnings per share by 51% each year (measured with a line of best fit). In the last year, its revenue is down 69%.

Unfortunately, earnings per share have trended lower over the last three years. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. It could be important to check this free visual depiction of what analysts expect for the future.

Has Magnolia Bostad AB (publ) Been A Good Investment?

With a three year total loss of 47%, Magnolia Bostad AB (publ) would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

Fredrik Lidjan is paid around the same as most CEOs of similar size companies.

After looking at EPS and total shareholder returns, it's certainly hard to argue the company has performed well, since both metrics are down. Suffice it to say, we don't think the CEO is underpaid! Whatever your view on compensation, you might want to check if insiders are buying or selling Magnolia Bostad shares (free trial).

Important note: Magnolia Bostad may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026