- Sweden

- /

- Real Estate

- /

- OM:HUFV A

Hufvudstaden (OM:HUFV A): Assessing Valuation Following Strong Sales and Profit Rebound

Reviewed by Simply Wall St

Hufvudstaden (OM:HUFV A) has released its third quarter results, posting higher sales and a sharp jump in net income compared to last year. This performance includes a swing from a net loss to a profit over nine months.

See our latest analysis for Hufvudstaden.

Hufvudstaden’s upbeat results seem to have sparked renewed investor confidence, reflected in a 9.2% share price return over the past 90 days and a positive 1-year total shareholder return. With momentum clearly building, the recent gains suggest the market is responding to improved fundamentals and the company’s turnaround story.

If the company’s rebound has you thinking broader, now might be the perfect time to explore fast growing stocks with high insider ownership.

But with Hufvudstaden’s shares climbing and results back in the black, investors are left to wonder: Is the stock now attractively undervalued, or has the recent rally already priced in all the future growth?

Price-to-Earnings of 23.4x: Is it justified?

Hufvudstaden’s shares are trading at a price-to-earnings (P/E) ratio of 23.4x, which positions the stock below its peer average but notably higher than the broader industry benchmark.

The P/E ratio measures how much investors are willing to pay per krona of earnings, reflecting market expectations of future profitability and growth. For a real estate company emerging from losses, a higher P/E can signal optimism about future earnings, but it also raises questions about whether these expectations are realistic or already priced in.

While Hufvudstaden appears to offer better value than its direct peers, with the peer average at 34.4x, the stock still looks quite expensive compared to the Swedish Real Estate sector’s average of just 14.7x. On a more granular level, its P/E also sits above the estimated fair ratio of 22.2x. This is a level the market could feasibly move toward if investor sentiment changes direction.

Explore the SWS fair ratio for Hufvudstaden

Result: Price-to-Earnings of 23.4x (ABOUT RIGHT)

However, weaker rental markets or a reversal in recent profit trends could quickly challenge the current optimism around Hufvudstaden’s valuation.

Find out about the key risks to this Hufvudstaden narrative.

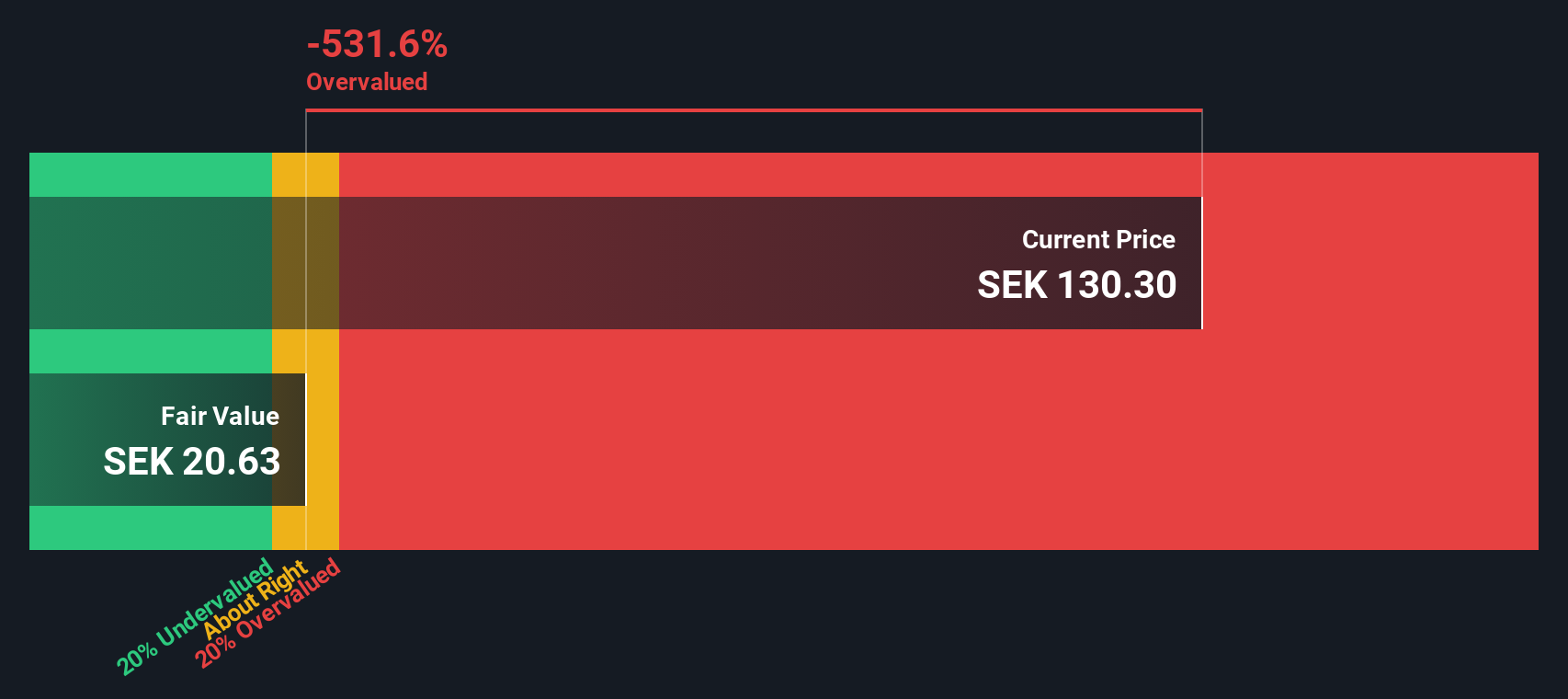

Another View: DCF Model Paints a Different Picture

While peers, sector averages, and the fair ratio offer a mixed take, our DCF model provides a notably more cautious outlook. According to the SWS DCF model, Hufvudstaden’s shares are currently trading well above the estimate of fair value. This suggests the stock may be overvalued based on future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hufvudstaden for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hufvudstaden Narrative

If you have your own view on Hufvudstaden’s numbers or want to dive deeper into the details, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Hufvudstaden research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Winning Opportunities?

Seize the momentum and go beyond a single stock. Simply Wall Street's powerful screener helps you target strategies that match your goals. Don't let great investments pass you by.

- Unlock strong potential returns by tapping into these 882 undervalued stocks based on cash flows, offering genuine value driven by robust fundamentals and attractive cash flow prospects.

- Maximize income with these 14 dividend stocks with yields > 3%, featuring reliable performers delivering healthy yields above the market average for steady portfolio growth.

- Ride the next innovation surge by targeting these 27 AI penny stocks, where companies are harnessing artificial intelligence for disruptive breakthroughs and long-term upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hufvudstaden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUFV A

Hufvudstaden

Engages in the ownership, development, and management of commercial properties in Stockholm and Gothenburg, Sweden.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives