- Sweden

- /

- Real Estate

- /

- OM:CIBUS

Cibus Nordic Real Estate (OM:CIBUS): Valuation Insights Following Belgian Acquisition and Strategic Portfolio Shifts

Reviewed by Simply Wall St

Cibus Nordic Real Estate (OM:CIBUS) recently became the sole owner of One+ NV in Belgium, acquiring five fully-leased retail properties with a strong focus on grocery tenants. The company also launched a 50/50 joint venture with TS33 and sold non-strategic Belgian assets above book value, marking further portfolio shifts.

See our latest analysis for Cibus Nordic Real Estate.

Cibus Nordic Real Estate’s latest moves in Belgium have come during a year marked by wider portfolio optimization, including new partnerships and divestments of non-strategic assets. Despite recent share price softness, with shares down about 7% year-to-date, long-term shareholders have reasons to be upbeat, with a 1-year total return of 1.7% and a notable 39% total return over three years showing resilience and capacity for growth even as market sentiment shifts.

If this kind of strategic repositioning sparks your interest, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Cibus Nordic Real Estate trading around 16 percent below analyst price targets and showing resilient long-term returns, the question is whether the market fully appreciates its growth potential or if a genuine buying opportunity exists.

Most Popular Narrative: 16% Undervalued

The narrative consensus sees Cibus Nordic Real Estate priced attractively versus its peer group, with a fair value implying substantial upside from its most recent close. Investor attention is fixated on the operational shifts and future growth drivers that underpin this potential re-rating.

The strategic focus on necessity-based, grocery-anchored assets ensures defensiveness during economic cycles and leverages demographic trends toward urbanization and stable consumer spending, underpinning occupancy rates and rental stability.

Want to know what’s fueling this bullish narrative? Behind the scenes are forecasts of profit leaps and financial ratios rarely seen in this sector. Earning estimates, margin expansion, and ambitious revenue targets form the backbone. Hungry for the details? See the projections that shape these high expectations.

Result: Fair Value of $197.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demographic stagnation or a shift in consumer preferences toward e-commerce could limit demand for retail properties and create challenges for earnings growth.

Find out about the key risks to this Cibus Nordic Real Estate narrative.

Another View: Is Cibus Nordic Real Estate Overpriced by Market Multiples?

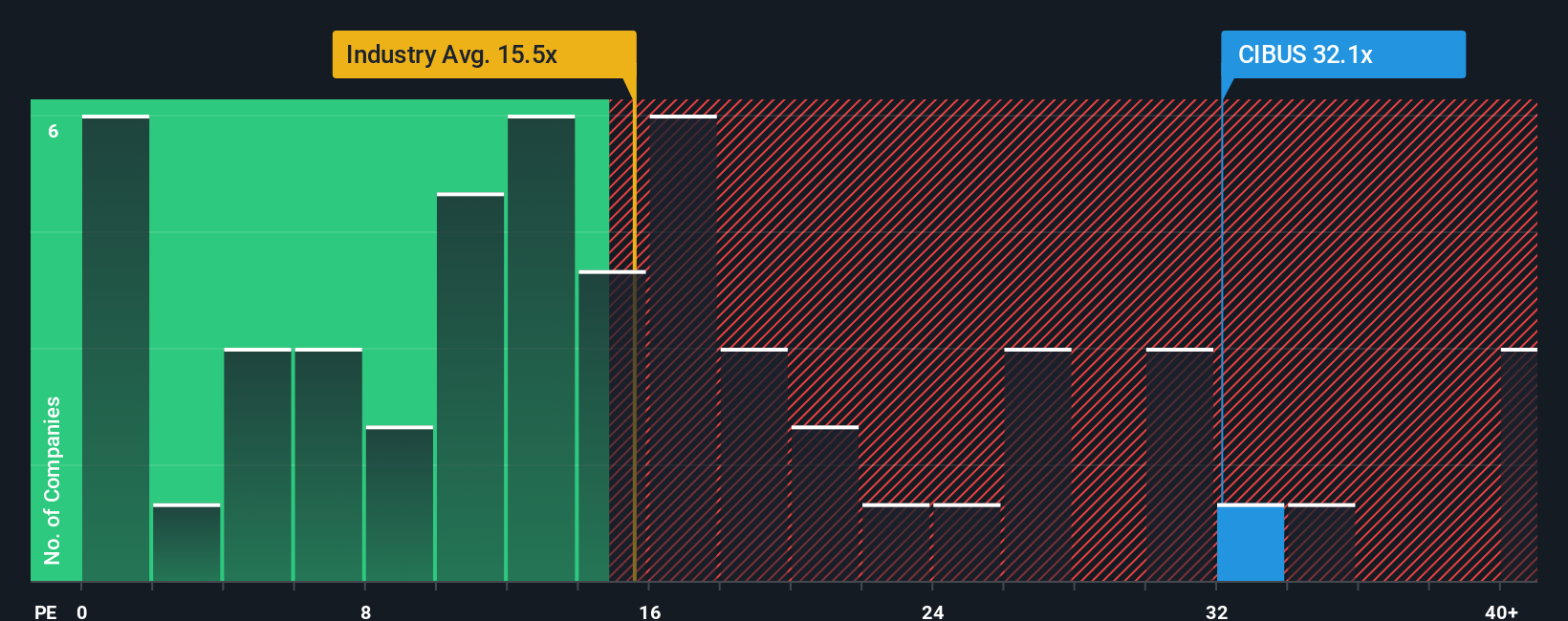

While analysts see Cibus Nordic Real Estate as undervalued, market ratios paint a different picture. The company trades at a price-to-earnings ratio of 31.4x, which is much higher than its peer average of 20.8x, the industry average of 15.1x, and the fair ratio of 22.2x that the market might drift toward. This wide gap suggests that market sentiment is optimistic, but it also exposes investors to the risk of a valuation pullback if growth expectations are not met. Can the company deliver on these high hopes, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cibus Nordic Real Estate Narrative

If you see things differently or want to analyze the figures firsthand, you have the tools to craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Cibus Nordic Real Estate research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Smart Move?

Don't let fresh opportunities slip by, especially when smart investors are already tracking trends the mainstream often misses. Here are three powerful ways you could outsmart the crowd right now:

- Uncover stable yields for your portfolio by checking out these 22 dividend stocks with yields > 3%, which offers attractive returns above 3 percent and proven fundamentals.

- Capitalize on tech trends with these 26 AI penny stocks, tapping into the growth potential of companies at the cutting edge of artificial intelligence innovation.

- Ride the momentum of digital transformation by seizing opportunities with these 81 cryptocurrency and blockchain stocks, making progress in real-world blockchain and crypto solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CIBUS

Cibus Nordic Real Estate

A real estate company listed on Nasdaq Stockholm Mid Cap.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives