- Sweden

- /

- Real Estate

- /

- OM:CATE

Strong Earnings and Acquisition Plans Might Change the Case for Investing in Catena (OM:CATE)

Reviewed by Sasha Jovanovic

- Catena AB reported strong third quarter and nine-month results as of September 30, 2025, with sales reaching SEK 675 million and SEK 1.96 billion, and net income rising sharply compared to the previous year.

- Management highlighted plans for future growth through potential acquisitions in Denmark and Sweden, emphasizing a strategy built on expansion, value-added development, and continued operational strength.

- We’ll examine how Catena’s combination of robust earnings growth and acquisition ambitions could reshape its investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Catena Investment Narrative Recap

To be a shareholder in Catena, you need confidence in its ability to deliver sustainable growth through expanding its logistics property portfolio, even as competition for acquisitions intensifies. The latest news about management targeting new deals in Denmark and Sweden supports the view that acquisitions will remain a short-term catalyst, but also reinforces the risk of increased competition impacting margins, the fundamental dynamics remain largely unchanged in the near term.

Among recent announcements, Catena’s strong third-quarter earnings, sales up to SEK 675 million and net income nearly doubling year-on-year, offer a timely backdrop for its acquisition ambitions. This earnings strength may provide the financial flexibility needed to pursue new opportunities, although the growing competition highlighted in management commentary continues to present a risk to future profitability.

However, investors should be aware that rising competition for acquisitions could mean...

Read the full narrative on Catena (it's free!)

Catena's narrative projects SEK 3.3 billion in revenue and SEK 1.5 billion in earnings by 2028. This requires 10.3% yearly revenue growth and a SEK 0.1 billion earnings increase from the current SEK 1.4 billion.

Uncover how Catena's forecasts yield a SEK510.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

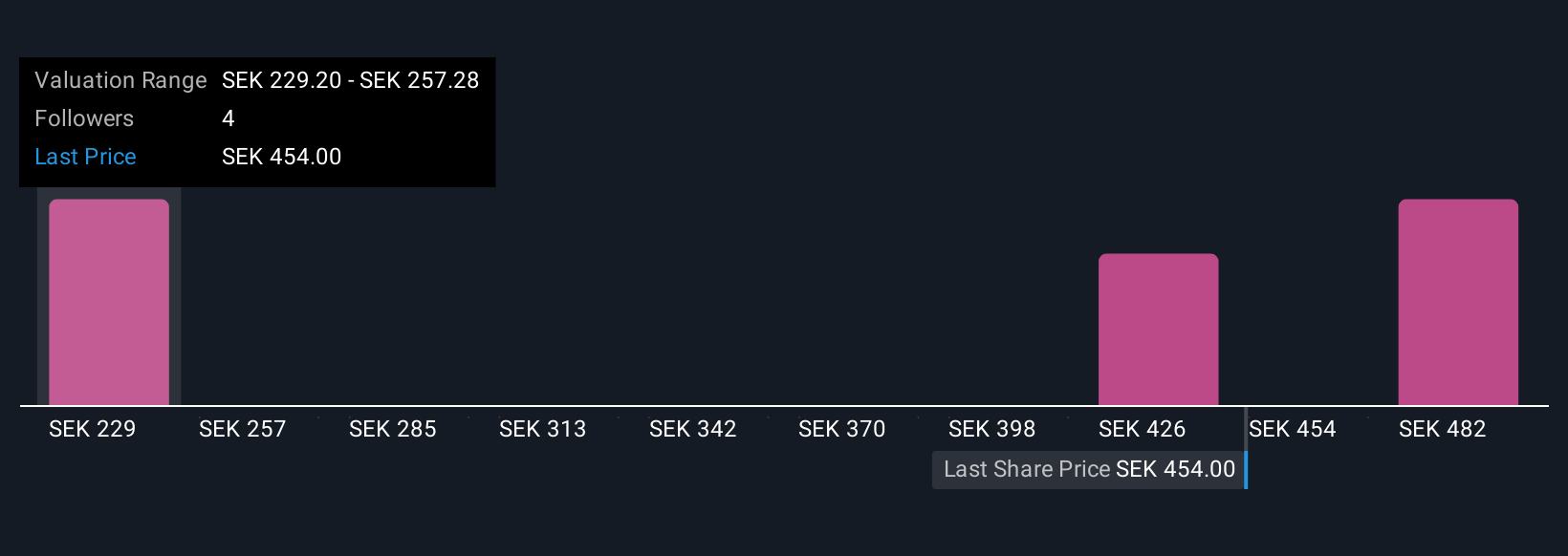

Three retail investors in the Simply Wall St Community see Catena’s fair value ranging widely from SEK 229.20 to SEK 510. While growth through acquisitions excites some, others remain cautious given the heightened competition and potential earnings pressure this creates. Compare these viewpoints to shape your own outlook.

Explore 3 other fair value estimates on Catena - why the stock might be worth as much as 11% more than the current price!

Build Your Own Catena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Catena research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Catena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Catena's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CATE

Catena

Owns, develops, manages, and sells logistics properties in Sweden and Denmark.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives