- Sweden

- /

- Real Estate

- /

- OM:CAST

The Bull Case For Castellum (OM:CAST) Could Change Following Sweeping Executive Restructuring and Cost-Cutting Measures

Reviewed by Sasha Jovanovic

- Earlier today, Castellum announced a major restructuring of its executive management and head office, reducing the executive team from 13 to 10 and eliminating about 60 positions, including both employees and consultants, to improve efficiency and profitability.

- As part of this overhaul, the company will discontinue its employee bonus scheme from 2026, aiming to generate annual cost savings of approximately SEK 50 million and shift its operational structure toward a leaner, more cost-effective model.

- We'll explore how Castellum's pursuit of SEK 50 million in annual cost savings could reshape its outlook and investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Castellum Investment Narrative Recap

For Castellum shareholders, believing in the long-term value of efficient property management amid fluctuating market conditions is key. The latest restructuring, aimed at cost-cutting and slimmer operations, may help support near-term profitability but does not notably alter the main catalyst: leasing and occupancy outcomes in new project developments, particularly the Infinity project, or the biggest risk: increasing vacancy and weak re-leasing spreads in a slow market.

The recent CEO appointment in August 2025 stands out, bringing in Pål Ahlsén to focus on profitability and value creation for Castellum, which aligns closely with this push for efficiency and reduced headcount. Leadership stability and alignment around cost efficiency could be important for navigating the company's income growth prospects as it launches new projects and manages occupancy risks.

However, if occupancy trends worsen further, the risk of negative re-leasing spreads is something investors should...

Read the full narrative on Castellum (it's free!)

Castellum's outlook points to SEK10.1 billion in revenue and SEK6.6 billion in earnings by 2028. This reflects a yearly revenue decline of 0.9% and an earnings increase of SEK3.9 billion from the current SEK2.7 billion.

Uncover how Castellum's forecasts yield a SEK116.78 fair value, a 9% upside to its current price.

Exploring Other Perspectives

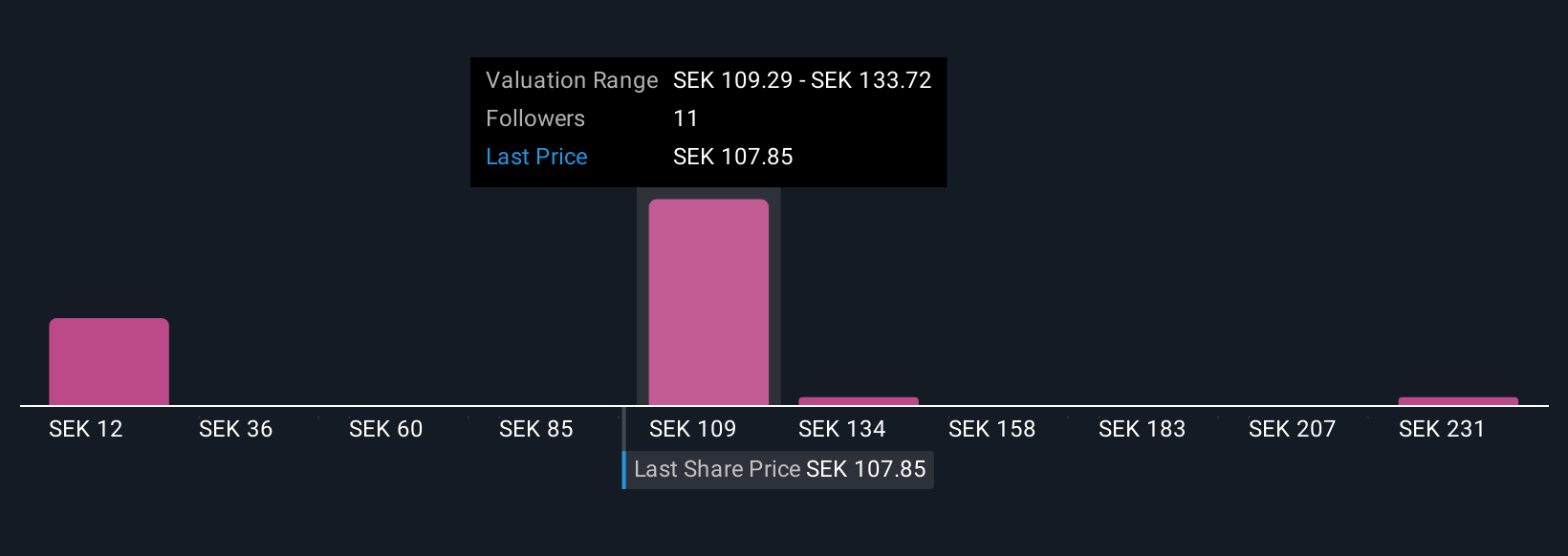

Four community members on Simply Wall St estimate Castellum’s fair value between SEK11.39 and SEK255.86. Opinions vary, especially considering ongoing cost-saving efforts and the potential impact of increasing vacancy on future earnings.

Explore 4 other fair value estimates on Castellum - why the stock might be worth less than half the current price!

Build Your Own Castellum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Castellum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Castellum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Castellum's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CAST

Castellum

Castellum is one of the Nordic region's largest commercial real estate companies, focusing on office and logistics properties in Nordic growth cities.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives