- Sweden

- /

- Real Estate

- /

- OM:CAST

Does Castellum’s Profit Surge Signal a Sustainable Shift in Margins for OM:CAST?

Reviewed by Sasha Jovanovic

- Castellum AB (publ) reported earnings for the third quarter and nine months ended September 30, 2025, showing net income of SEK 858 million for the quarter and SEK 1.05 billion for the nine months, both higher than the previous year despite slightly lower sales.

- The company's substantial increase in profitability, especially the significant jump in net income and basic earnings per share compared to last year, stands out amid largely stable revenue.

- We’ll explore how Castellum’s sharp rise in earnings and net income may alter the outlook for its profit margins and earnings growth.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Castellum Investment Narrative Recap

To be a Castellum shareholder, it's important to trust the company's ability to convert stable revenues into stronger earnings, even – as seen in the recent quarterly results – when sales are slightly down. The sharp rise in net income and profitability may support optimism about near-term earnings growth, though property value trends and the risk of rising vacancies continue to shape the outlook. The latest results don't fully resolve concerns over revenue stability, but the positive earnings trend is an encouraging signal for the main catalyst: sustainable profit margin expansion.

Among recent announcements, the board and CEO changes earlier in 2025 are particularly relevant. With a new CEO focused on profitability, these leadership updates provide important context for the recent jump in earnings and suggest that management remains aligned behind improving margins, a crucial area for Castellum's future performance. Yet, persistent risks from property value write-downs and higher vacancies could still weigh on results...

Read the full narrative on Castellum (it's free!)

Castellum's narrative projects SEK10.1 billion in revenue and SEK6.6 billion in earnings by 2028. This requires a 0.9% annual revenue decline and an earnings increase of SEK3.9 billion from the current SEK2.7 billion.

Uncover how Castellum's forecasts yield a SEK116.78 fair value, a 8% upside to its current price.

Exploring Other Perspectives

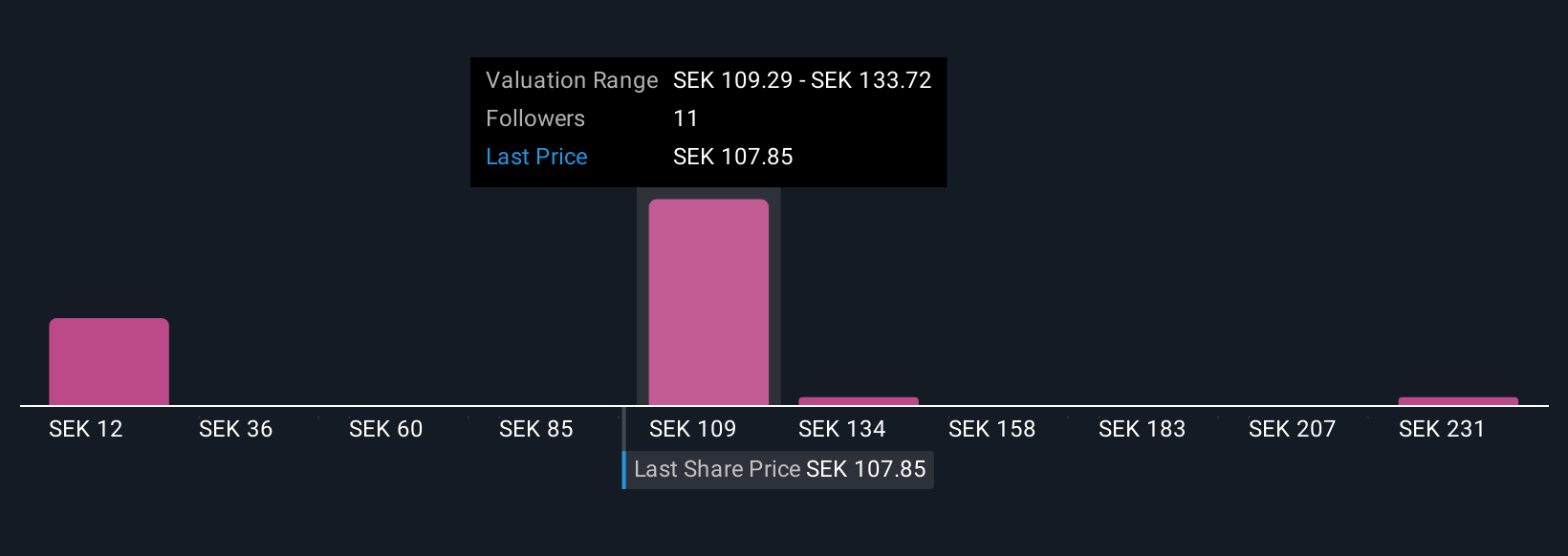

Four perspectives from the Simply Wall St Community value Castellum shares between SEK11.63 and SEK255.86, illustrating a broad range of expectations. These differences highlight why risks such as the continuing decline in property values can have wide implications for shareholder outlook and future returns; explore further viewpoints to inform your research.

Explore 4 other fair value estimates on Castellum - why the stock might be worth less than half the current price!

Build Your Own Castellum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Castellum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Castellum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Castellum's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CAST

Castellum

Castellum is one of the Nordic region's largest commercial real estate companies, focusing on office and logistics properties in Nordic growth cities.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives