There's No Escaping Orexo AB (publ)'s (STO:ORX) Muted Revenues Despite A 29% Share Price Rise

Orexo AB (publ) (STO:ORX) shareholders have had their patience rewarded with a 29% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

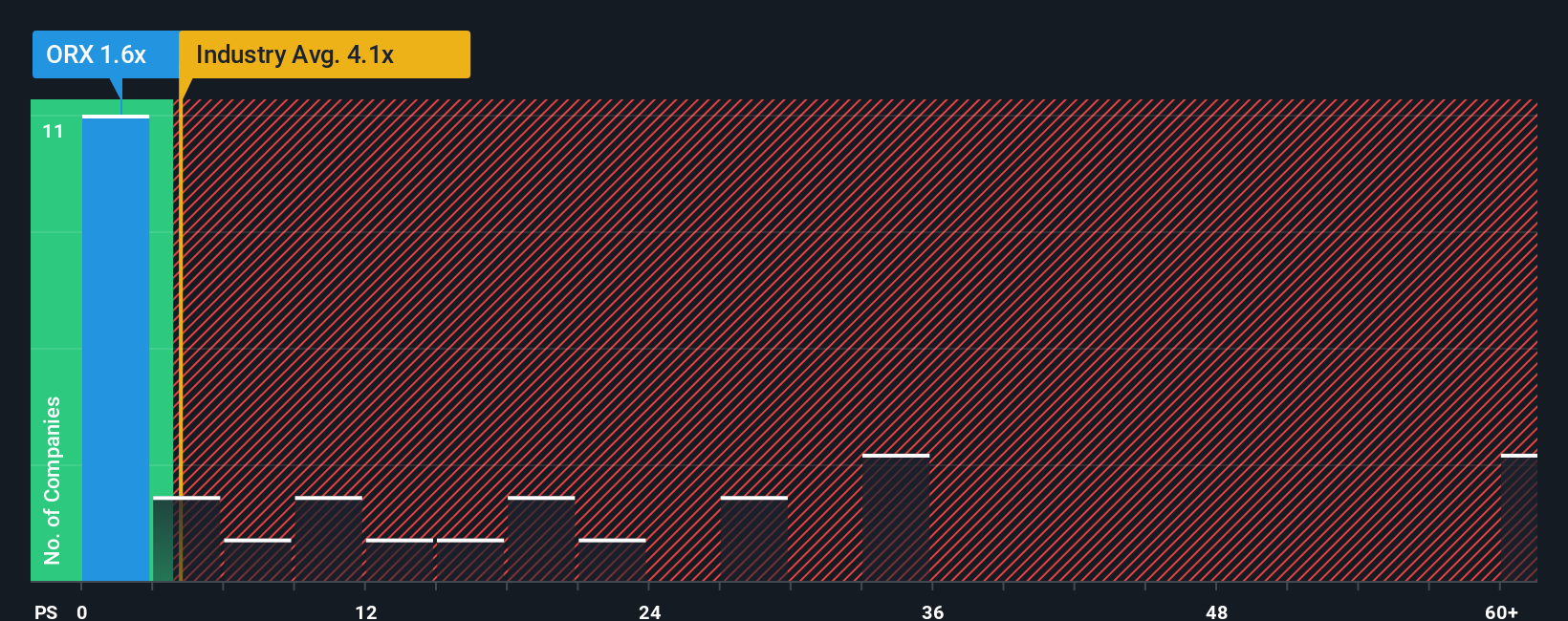

Even after such a large jump in price, Orexo may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.6x, since almost half of all companies in the Pharmaceuticals industry in Sweden have P/S ratios greater than 17.9x and even P/S higher than 35x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Orexo

How Orexo Has Been Performing

While the industry has experienced revenue growth lately, Orexo's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Orexo.How Is Orexo's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Orexo's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.8%. The last three years don't look nice either as the company has shrunk revenue by 6.0% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 4.4% as estimated by the only analyst watching the company. That's not great when the rest of the industry is expected to grow by 52%.

With this information, we are not surprised that Orexo is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Orexo's P/S

Even after such a strong price move, Orexo's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Orexo maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Orexo (1 shouldn't be ignored!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ORX

Orexo

A specialty pharmaceutical company, develops and commercializes pharmaceuticals and digital therapies in the United States, European Union, the United Kingdom, and internationally.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives