Hansa Biopharma (OM:HNSA): Five-Year Losses Worsen as Profitability Targets Face Key Risks

Reviewed by Simply Wall St

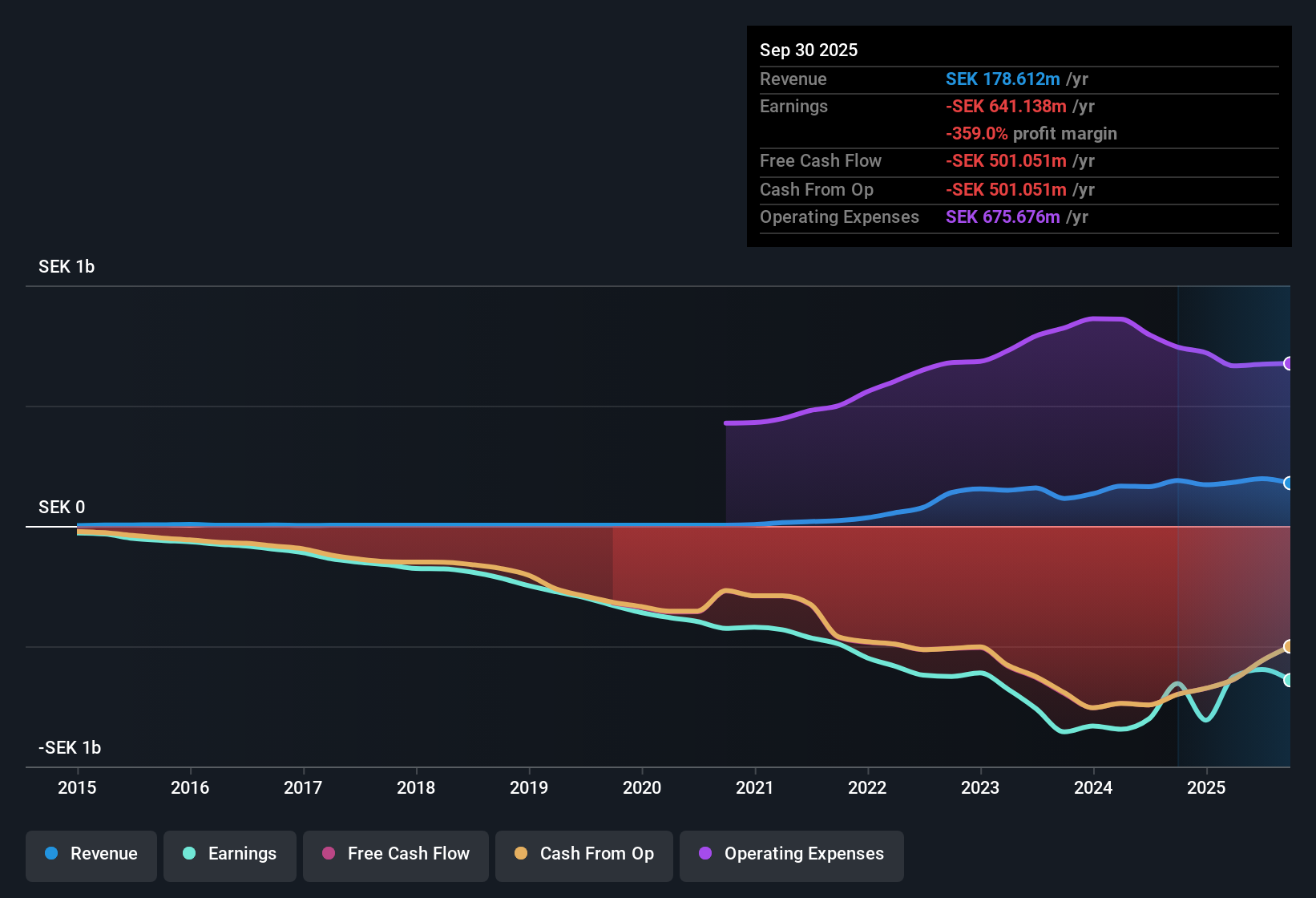

Hansa Biopharma (OM:HNSA) posted another year of widening losses, with net losses expanding at an average annual rate of 11.5% over the past five years, and no sign yet of margin improvement. Shares are currently trading at SEK31.2, considerably below the estimated fair value of SEK503.14, while the company’s price-to-sales ratio of 16.2x stands out against a peer average of 27.1x. Despite ongoing unprofitability, investors are focused on the company’s anticipated revenue growth of 48.4% per year and the prospect of reaching profitability within three years.

See our full analysis for Hansa Biopharma.The next step is to put these headline results side by side with the most influential market narratives to see whether the latest numbers back up or undercut the prevailing stories about Hansa Biopharma.

See what the community is saying about Hansa Biopharma

Margins Climb as Efficiency Measures Take Hold

- Gross margin improved from 35% to 66% year-on-year, fueled by over SEK 60 million in annual cost savings and stronger sales of high-margin products.

- Analysts' consensus view highlights two key points:

- Operational restructuring and efficiency gains provide the company with stronger leverage, potentially accelerating net margin recovery as revenue grows.

- However, the persistence of large net losses keeps the path to profitability in focus, and realization of consensus forecasts will depend on further improvements in cost structure and clinical milestones.

Cash Runway Relies on Pipeline Success

- Hansa's continued negative equity means recent capital raises and debt restructuring are needed to fund operations only into early Q2 2026. This raises questions about financial flexibility if new funding or key trial successes are delayed.

- Analysts' consensus view stresses two major risks:

- Pivotal clinical trial readouts could open up new markets and revenue streams, but failures or postponements may push the company toward further dilution or deep operational cuts.

- Volatile commercial outcomes driven by organ allocation policy changes, as seen in Germany, could lead to unpredictable shifts in near-term revenue and margin outlook.

Valuation Gap Remains Despite Risks

- With shares at SEK31.20, the gap to DCF fair value of SEK503.14 is striking. The company’s price-to-sales ratio of 16.2x sits below the peer average (27.1x) but above the Swedish biotech industry average (9.6x).

- Analysts' consensus view notes two contrasting elements:

- Analyst price target is 92.5, almost triple the current share price, implying confidence that earnings can swing from a SEK596.7 million loss to SEK375.4 million profit within four years.

- Yet, strong upward momentum is contingent on delivering on high-growth assumptions, and ongoing share dilution (expected at 7% per year) could limit per-share upside for existing investors.

- Strong quarterly execution in margins and revenue expansion has turned analyst heads, but conviction depends on Hansa converting its pipeline opportunities into sustained profitability. 📊 Read the full Hansa Biopharma Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hansa Biopharma on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the figures that stands out to you? Share your perspective and shape your own narrative quickly: Do it your way.

A great starting point for your Hansa Biopharma research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Hansa Biopharma’s weak financial position and ongoing net losses put pressure on its ability to fund operations and achieve long-term stability.

If you want more reliable financial health and fewer funding worries, check out solid balance sheet and fundamentals stocks screener (1984 results) to discover companies built on stronger and more resilient balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hansa Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HNSA

Hansa Biopharma

A biopharmaceutical company, engages in development and commercialization of treatments for patients with rare immunological conditions in Sweden, North America, and rest of Europe.

High growth potential and fair value.

Market Insights

Community Narratives