Why Bonesupport Holding (OM:BONEX) Is Down 6.1% After Strong Q3 Earnings and Sales Momentum

Reviewed by Sasha Jovanovic

- Bonesupport Holding AB (publ) recently announced its third quarter and nine-month earnings results for the period ended September 30, 2025, reporting sales of SEK 294.14 million and net income of SEK 34.51 million for the quarter, both up from the prior year.

- An interesting aspect of these results is the sustained year-over-year growth in both sales and earnings per share, highlighting persistent operational momentum and improved profitability across the business.

- We'll explore how continued improvement in net income shapes Bonesupport Holding's investment narrative and future growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Bonesupport Holding Investment Narrative Recap

To be a shareholder in Bonesupport Holding, you need to believe in its ability to maintain strong revenue and earnings growth, anchored by expanding adoption of its bone infection therapies, while navigating regulatory and market access headwinds. The latest quarterly results illustrate positive trends in sales and profitability, but these don’t materially impact the most immediate catalyst: permanent reimbursement increases for CERAMENT G beyond temporary NTAP status. Primary risks, including the potential expiration of NTAP reimbursement and margin pressure from rising expenses, remain crucial for short-term outlooks.

Among recent announcements, the September 2025 presentation of two-year clinical data for CERAMENT G is especially relevant. This positive outcome for single-stage bone infection surgery not only strengthens CERAMENT G’s clinical value proposition, but also directly supports efforts to secure more stable, longer-term reimbursement, which is essential for mitigating future revenue volatility as temporary NTAP support winds down.

By contrast, investors should be aware of the underlying risk if longer-term reimbursement arrangements for CERAMENT G are not secured in time and...

Read the full narrative on Bonesupport Holding (it's free!)

Bonesupport Holding’s outlook anticipates SEK2.6 billion in revenue and SEK843.6 million in earnings by 2028. This is based on analysts’ assumptions of 35.2% annual revenue growth and an earnings increase of SEK695.6 million from current earnings of SEK148.0 million.

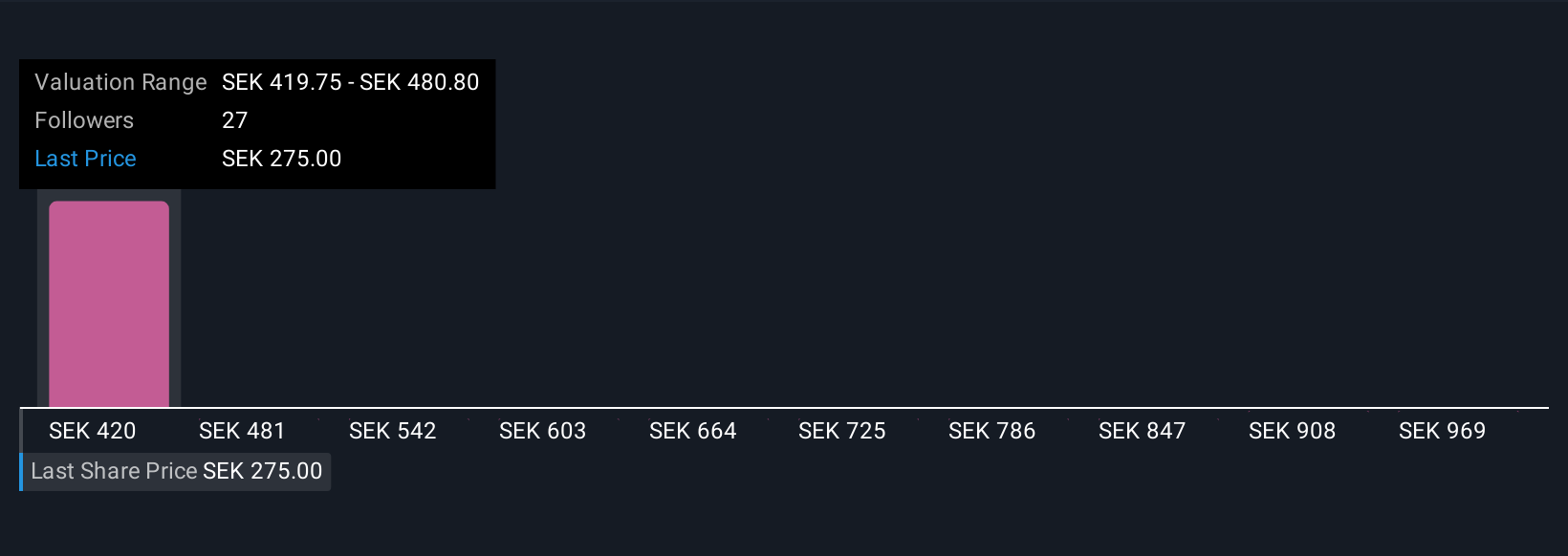

Uncover how Bonesupport Holding's forecasts yield a SEK401.80 fair value, a 81% upside to its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community range sharply from SEK394.47 to SEK1,030.25. Against this backdrop of diverse retail views, keep in mind the business’s dependency on reimbursement sustainability, a factor that could shape future performance in ways analysts and community members weigh very differently.

Explore 5 other fair value estimates on Bonesupport Holding - why the stock might be worth just SEK394.47!

Build Your Own Bonesupport Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bonesupport Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Bonesupport Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bonesupport Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonesupport Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONEX

Bonesupport Holding

An orthobiologics company, develops and sells injectable bio-ceramic bone graft substitutes in Europe, North America, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives