Does Hemnet Group's (OM:HEM) Share Buyback Reflect Strategic Discipline Amid Mixed Quarterly Results?

Reviewed by Sasha Jovanovic

- Hemnet Group AB recently reported third quarter 2025 earnings, with quarterly sales of SEK 366.7 million and net income of SEK 132.4 million, alongside confirming completion of a share buyback tranche totaling 812,500 shares for SEK 223.2 million under its May 2025 program.

- While quarterly figures showed slight declines versus the prior year, the company's nine-month results reflected year-over-year growth in both revenue and profit, highlighting ongoing momentum in its broader business performance.

- We’ll now explore how the buyback completion and mixed quarterly results influence Hemnet’s investment narrative and market outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hemnet Group Investment Narrative Recap

To be a Hemnet Group shareholder, you need to believe in the sustained shift toward digital real estate platforms and Hemnet’s ability to monetize its dominant Swedish position, even as near-term housing market volumes fluctuate. The recent share buyback completion seems unlikely to materially shift the immediate outlook; instead, the biggest short-term catalyst remains a rebound in Swedish property listings, while persistent listing volume declines and long sales cycles continue as the most important risks.

Of the recent company announcements, Hemnet’s third quarter earnings are directly relevant here. Despite modest top-line and earnings declines year-over-year for the quarter, nine-month results showed growth, suggesting Hemnet’s broader business momentum may remain intact if listing activity stabilizes, an underlying catalyst that investors continue to watch closely.

On the other hand, investors should be aware that continued softness in the Swedish property market could...

Read the full narrative on Hemnet Group (it's free!)

Hemnet Group's narrative projects SEK2.6 billion revenue and SEK1.1 billion earnings by 2028. This requires 19.0% yearly revenue growth and a SEK551.8 million earnings increase from SEK548.2 million today.

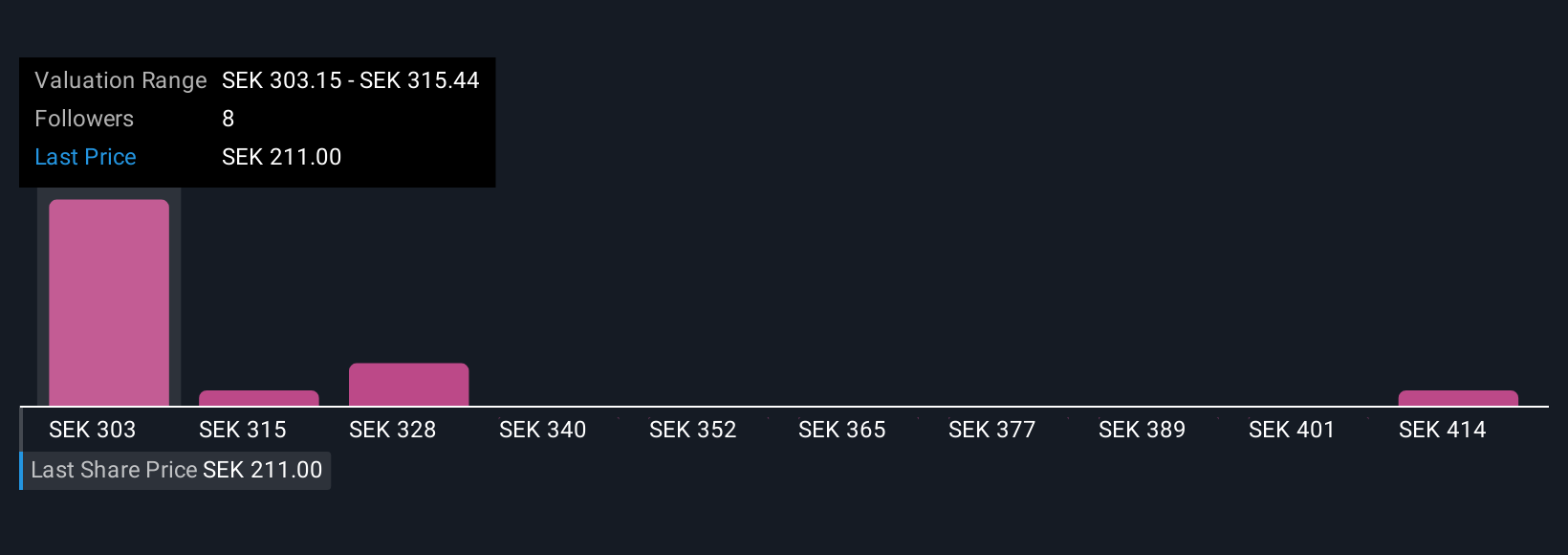

Uncover how Hemnet Group's forecasts yield a SEK303.15 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members value Hemnet between SEK303.15 and SEK426 a share based on four unique analyses. While some expect substantial upside, ongoing softness in Swedish property transactions could mean very different outcomes for profit growth, so compare these opinions to your own expectations.

Explore 4 other fair value estimates on Hemnet Group - why the stock might be worth just SEK303.15!

Build Your Own Hemnet Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hemnet Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Hemnet Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hemnet Group's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hemnet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HEM

High growth potential with solid track record.

Market Insights

Community Narratives