A Look at HEXPOL (OM:HPOL B) Valuation After Reporting Declining Third Quarter Sales and Earnings

Reviewed by Simply Wall St

HEXPOL (OM:HPOL B) released its third quarter results, showing a decline in both sales and net income from the prior year. This earnings dip may prompt investors to reassess expectations for the months ahead.

See our latest analysis for HEXPOL.

HEXPOL’s latest earnings miss arrived as the company eyes new acquisitions and keeps sustainability front and center. After a tough start this year, the stock has begun to stabilize, with recent momentum edging upward, though its year-to-date share price return remains down 16.05%. Total shareholder return over the past year slipped 11.67%, reminding investors that near-term challenges may weigh more heavily than long-term growth plans right now.

If you’re thinking about broadening your search beyond HEXPOL, now is a great moment to see what’s happening with other fast-growing stocks featuring strong insider ownership. Discover fast growing stocks with high insider ownership

Given weaker results but signs of stabilization and a notable discount to analyst targets, investors now face a familiar question: Is HEXPOL trading at a bargain, or is the market already reflecting the company’s outlook for growth?

Most Popular Narrative: 12.4% Undervalued

HEXPOL’s most widely followed narrative places the company’s fair value at SEK 98.75, about 12% above the latest close of SEK 86.55. The value gap suggests strong conviction from analysts, setting the tone for the growth drivers and underlying logic powering the estimate.

Operational efficiency, sustainability focus, and strategic acquisitions are set to boost margins, earnings resilience, and market share through diversification and integration. Overexposure to declining markets, rising input costs, margin pressure, shifting sustainability trends, and intensifying competition could structurally threaten future growth and profitability.

Want to know how HEXPOL’s expansion plans and margin strategy could unlock major upside? The most revealing part lies in future profit projections, margin expansion, and valuation multiples rarely seen for manufacturers. Discover the bold analyst math that powers this price target. Click through for the inside story behind what could drive HEXPOL higher.

Result: Fair Value of $98.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in organic sales or a continued lag in higher-margin segments could quickly challenge bullish forecasts for HEXPOL’s recovery.

Find out about the key risks to this HEXPOL narrative.

Another View: Multiples Versus Market Norms

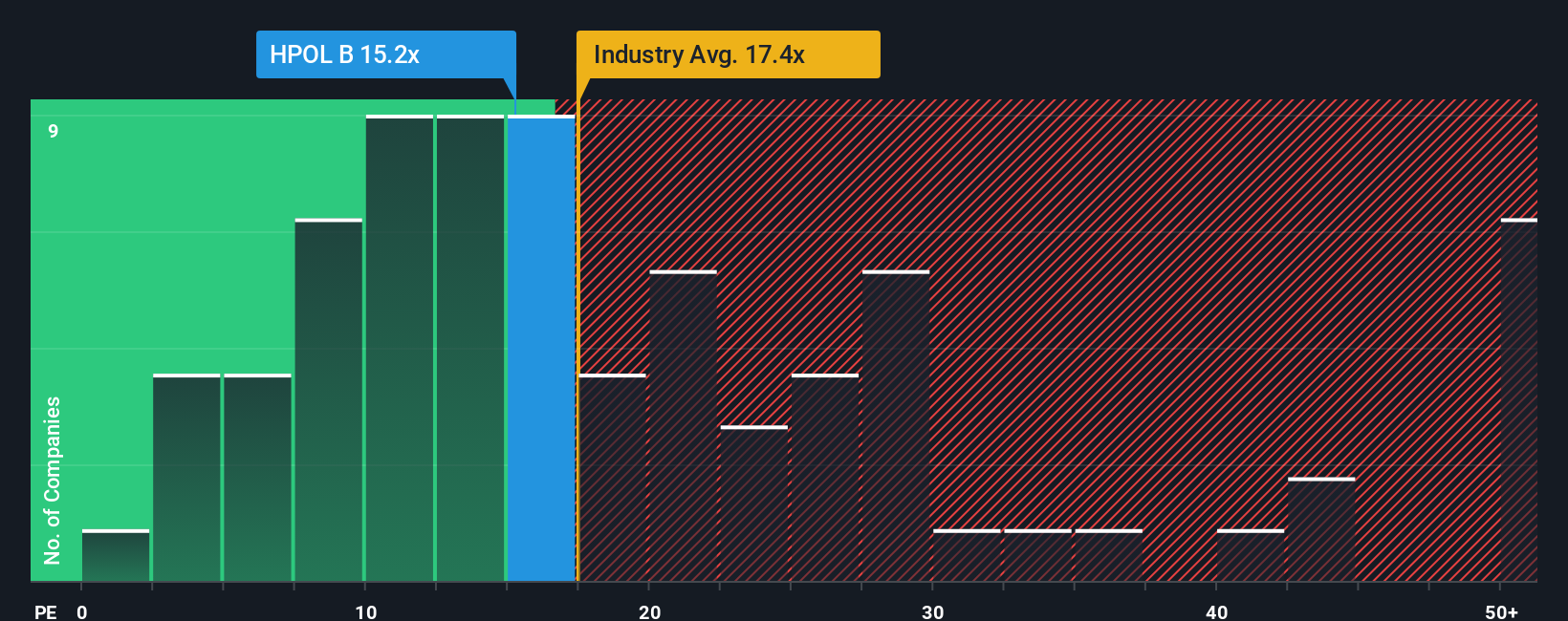

While analysts point to upside based on their growth forecasts, a multiples view paints a more nuanced picture. HEXPOL trades at 15.2 times earnings, making it look cheaper than the European Chemicals sector average of 17.2x and its peers at 20.2x. However, this is still above its fair ratio of 14.1x, which suggests the market sees added risk or uncertainty and might also be ready to reward greater progress. Will investors accept the elevated price, or could the share re-rate to a new norm if targets are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HEXPOL Narrative

If you see the story differently or want to run the numbers your way, you can craft your own HEXPOL narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding HEXPOL.

Looking for More Investment Ideas?

Level up your strategy and make your next move count. Take charge and don’t miss out on exciting opportunities that challenge the status quo.

- Spot undervalued gems across the market by tapping into these 832 undervalued stocks based on cash flows and get ahead before the crowd catches on.

- Capture reliable income streams by checking out these 22 dividend stocks with yields > 3% with yields that consistently exceed expectations and remain steady through volatile markets.

- Supercharge your portfolio’s growth with the innovators at the frontier of artificial intelligence via these 26 AI penny stocks, where tomorrow’s leaders rise today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HEXPOL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HPOL B

HEXPOL

Develops, manufactures, and sells various polymer compounds and engineered gaskets, seals, and wheels in Sweden, rest of Europe, the United States, rest of the Americas, and Asia.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives