- Taiwan

- /

- Tech Hardware

- /

- TWSE:6669

High Growth Tech Stocks to Watch in July 2025

Reviewed by Simply Wall St

As of early July 2025, global markets have been buoyant, with U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs for two consecutive weeks, while smaller-cap indexes such as the S&P MidCap 400 and Russell 2000 have shown notable gains. This robust performance is set against a backdrop of strong job growth in the U.S., resilient economic indicators, and ongoing trade negotiations that could influence future market dynamics. In this environment, identifying high-growth tech stocks involves looking for companies that can capitalize on technological advancements and demonstrate adaptability to evolving market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

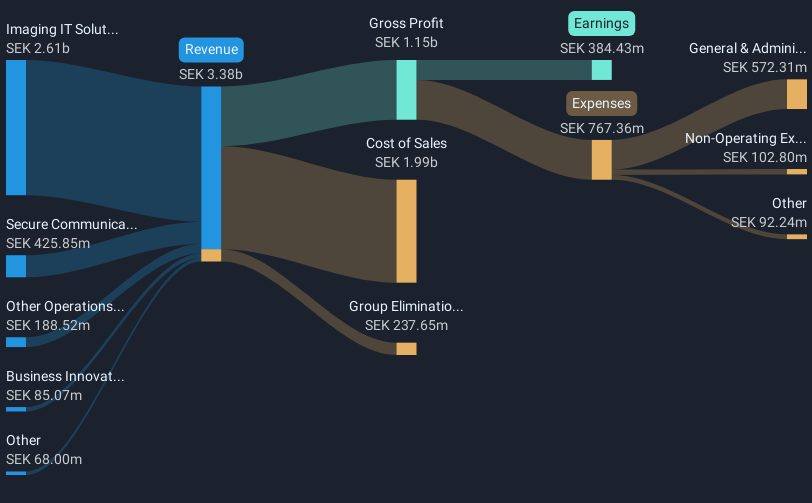

Overview: Sectra AB (publ) offers medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK68.52 billion.

Operations: Sectra generates revenue primarily from Imaging IT Solutions, contributing SEK2.80 billion, and Secure Communications, adding SEK407 million. The company focuses on providing specialized solutions in medical IT and cybersecurity across several European markets.

Sectra's recent strategic expansions and client engagements underscore its robust positioning in the digital pathology and AI-enhanced diagnostics sectors. With a revenue increase to SEK 3,540.26 million from SEK 3,040.57 million year-over-year and an impressive net income growth to SEK 563.37 million from SEK 428.39 million, Sectra demonstrates strong financial health and operational efficiency. The integration of AI through its Sectra Amplifier Service across multiple healthcare systems, including Osler in Canada which serves over 1.3 million people, not only enhances clinical workflows but also solidifies its market presence in North America's expanding healthcare technology sector. This approach is further exemplified by the adoption of Sectra One Cloud by a U.S.-based health system aiming for integrated diagnostics across multiple specialties—a move likely to set new standards in patient care efficiency.

- Unlock comprehensive insights into our analysis of Sectra stock in this health report.

Review our historical performance report to gain insights into Sectra's's past performance.

Wiwynn (TWSE:6669)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wiwynn Corporation is involved in the research, development, design, testing, and sales of semiconductor products and peripheral equipment globally, with a market cap of NT$449.73 billion.

Operations: Wiwynn focuses on the semiconductor sector, generating NT$461.57 billion in revenue from computer hardware sales across key markets including the United States, Europe, and Asia.

Wiwynn Corporation, amidst a flurry of executive and board reshuffles, has demonstrated robust financial growth with first-quarter sales soaring to TWD 170.66 billion from TWD 69.63 billion year-over-year, and net income more than doubling to TWD 9.79 billion. The company's aggressive R&D in AI technologies is evident at Computex 2025, where it unveiled next-generation AI servers and advanced cooling solutions that promise up to a 50X increase in AI factory output for inference models compared to previous platforms. These innovations not only highlight Wiwynn's commitment to maintaining a competitive edge but also position it well within the high-growth tech sector, especially as its revenue is projected to grow by an impressive 22.7% annually.

- Click to explore a detailed breakdown of our findings in Wiwynn's health report.

Explore historical data to track Wiwynn's performance over time in our Past section.

Nemetschek (XTRA:NEM)

Simply Wall St Growth Rating: ★★★★☆☆

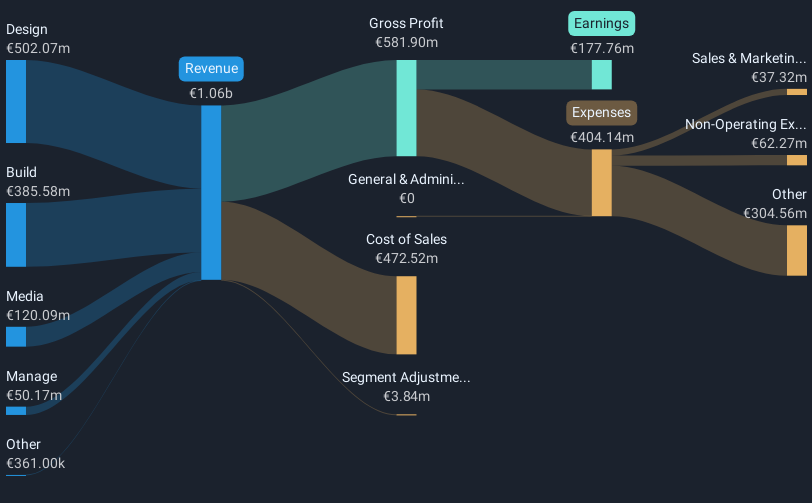

Overview: Nemetschek SE offers software solutions for architecture, engineering, construction, operation, and media industries across various regions globally and has a market capitalization of approximately €14.47 billion.

Operations: The company generates revenue primarily through its Design segment (€502.07 million) and Build segment (€385.58 million), with additional contributions from the Media (€120.09 million) and Manage (€50.17 million) segments.

Nemetschek SE, with a projected annual revenue growth of 12.6%, outpaces the German market's 6.2% increase, showcasing its robust position in software innovation. This growth is complemented by an earnings rise of 18% annually, surpassing the market's 16.5%. At a recent conference, Nemetschek highlighted its strategic initiatives that contributed to a first-quarter revenue surge to EUR 285.89 million from EUR 227.33 million year-over-year and an uptick in net income to EUR 44.88 million from EUR 42.55 million, emphasizing its operational efficiency and strong market presence despite not leading in industry speed where sector growth was at 24.4%. These figures underline Nemetschek’s solid financial health and commitment to maintaining competitiveness through continuous improvement and innovation in high-tech environments.

- Dive into the specifics of Nemetschek here with our thorough health report.

Assess Nemetschek's past performance with our detailed historical performance reports.

Where To Now?

- Navigate through the entire inventory of 751 Global High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wiwynn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6669

Wiwynn

Engages in the research, development, design, testing, and sales of semi products, and peripheral equipment and parts in the United States, Europe, Asia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives