- Sweden

- /

- Hospitality

- /

- OM:BETS B

Betsson And 2 Other Undiscovered Gems In Sweden

Reviewed by Simply Wall St

As global markets continue to navigate economic fluctuations, Sweden's stock market has shown resilience, with the pan-European STOXX Europe 600 Index ending 2.46% higher amid growing hopes for interest rate cuts. This positive sentiment provides a fertile ground for uncovering lesser-known stocks with strong potential. In this context, identifying promising stocks often involves looking at companies that can thrive in changing economic conditions and capitalize on sector-specific opportunities. Here are three such undiscovered gems in Sweden, starting with Betsson.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.11% | 15.30% | ★★★★★★ |

| Firefly | NA | 15.31% | 29.94% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| OEM International | 2.03% | 11.97% | 18.62% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Betsson (OM:BETS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Betsson AB (publ) operates and manages online gaming businesses across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK18.16 billion.

Operations: Betsson AB generates revenue primarily from its Casinos & Resorts segment, which accounted for €1009.20 million.

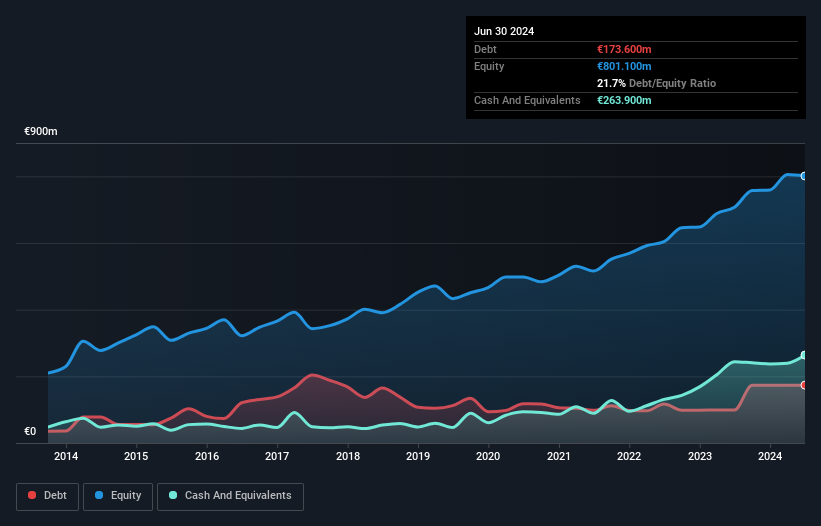

Betsson, a notable player in Sweden's gaming sector, reported Q2 2024 sales of €271.5M, up from €236.8M the previous year. Despite this growth, net income dipped slightly to €45.5M from €50.2M. The company’s debt to equity ratio improved over five years from 25.9% to 21.7%, reflecting prudent financial management. Recent expansions include obtaining online casino and sports betting licenses in Peru, adding to existing licenses in Colombia and Argentina.

- Click to explore a detailed breakdown of our findings in Betsson's health report.

Evaluate Betsson's historical performance by accessing our past performance report.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: engcon AB (publ) designs, produces, and sells excavator tools globally and has a market cap of SEK16.30 billion.

Operations: engcon AB (publ) generates revenue primarily from the sale of construction machinery and equipment, totaling SEK1.54 billion. The company has a market cap of SEK16.30 billion.

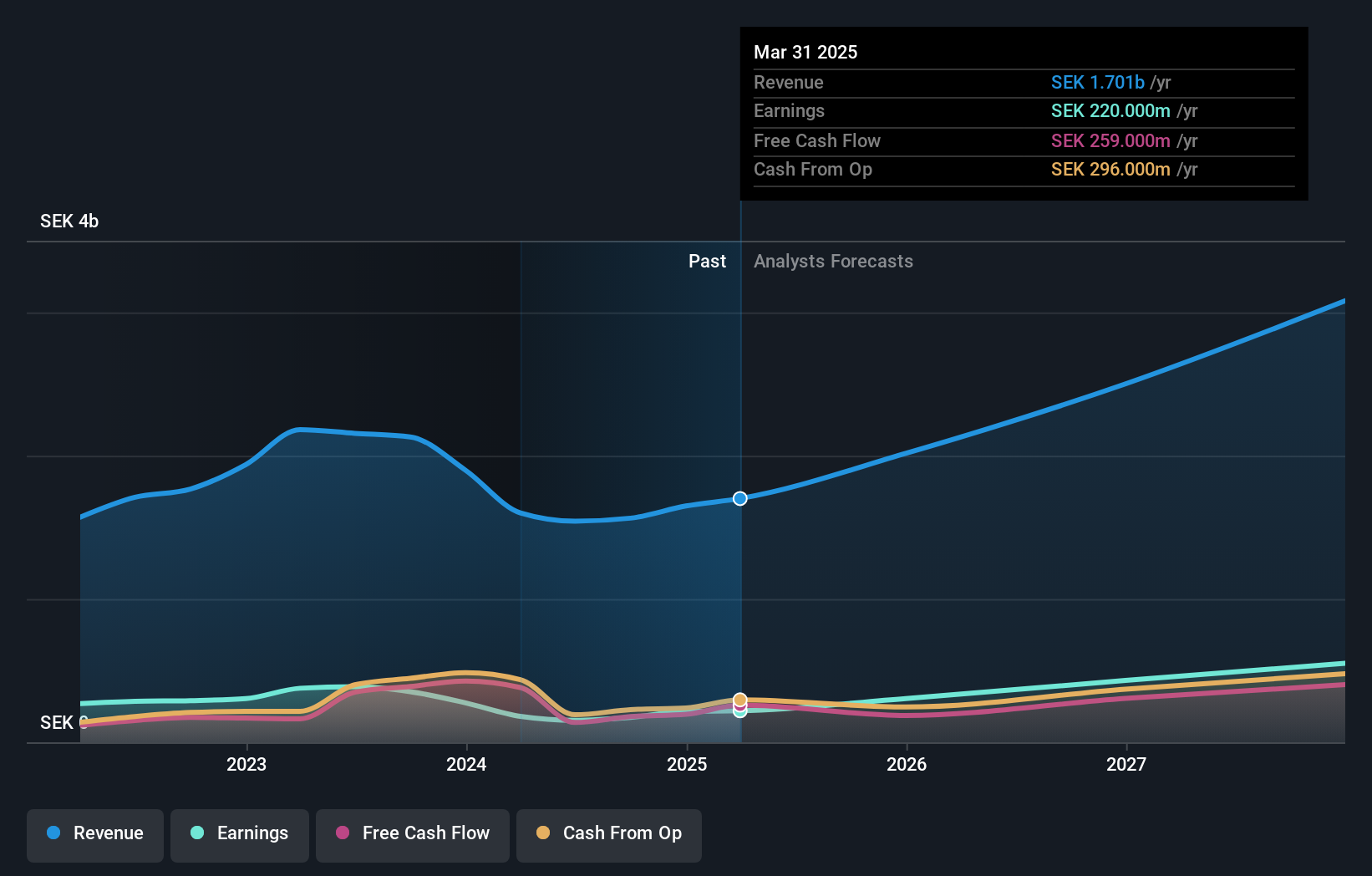

engcon's recent performance highlights its small cap nature, with net income for Q2 2024 at SEK 55 million, down from SEK 83 million the previous year. Sales for the first half of 2024 were SEK 844 million compared to SEK 1.20 billion in the same period last year. Despite a satisfactory net debt to equity ratio of 8.5% and strong interest coverage (20.4x EBIT), profit margins fell to 9.9% from last year's 18%. Earnings are forecasted to grow by nearly 44% annually, indicating potential future growth despite current challenges.

- Unlock comprehensive insights into our analysis of engcon stock in this health report.

Explore historical data to track engcon's performance over time in our Past section.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

Overview: RaySearch Laboratories AB (publ) is a medical technology company that provides software solutions for cancer care across the Americas, Europe, Africa, the Asia-Pacific, and the Middle East with a market cap of SEK5.38 billion.

Operations: RaySearch Laboratories generates revenue primarily through its software solutions for cancer care, with significant contributions from various global regions. The company's market cap stands at SEK5.38 billion.

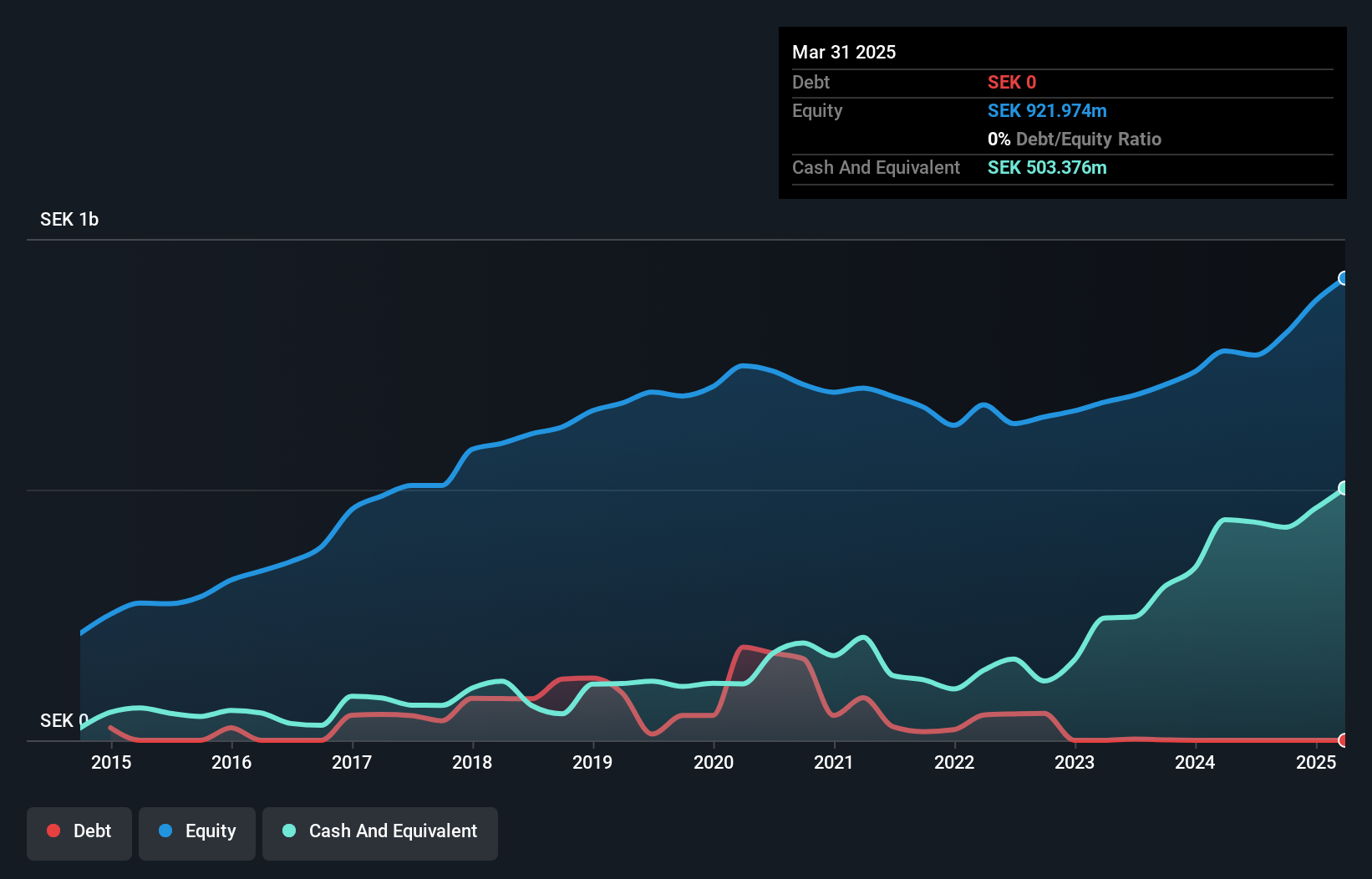

RaySearch Laboratories, a promising player in Sweden's healthcare sector, recently reported Q2 sales of SEK 318.87 million and net income of SEK 61.43 million, up from SEK 239.47 million and SEK 10.92 million respectively a year ago. The company has no debt, with earnings growth at an impressive 187% over the past year compared to the industry’s -2.7%. Trading at 68% below its estimated fair value, RaySearch showcases strong potential for future growth with projected annual earnings increase of nearly 16%.

Key Takeaways

- Click this link to deep-dive into the 54 companies within our Swedish Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business primarily in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.