- Sweden

- /

- Capital Markets

- /

- OM:CS

CoinShares International (OM:CS): Assessing Valuation After Recent Surge in Trading Activity

Reviewed by Kshitija Bhandaru

See our latest analysis for CoinShares International.

CoinShares International’s steady trading volume comes as its 1-year total shareholder return stands at more than 2%, suggesting positive momentum beneath the surface. While recent share price changes have been modest, underlying performance and fundamentals are keeping investors interested.

If this recent activity has you open to new opportunities, now is an excellent time to keep your watchlist fresh and discover fast growing stocks with high insider ownership

With questions swirling around CoinShares International’s valuation, investors are left to wonder if recent momentum signals an undervalued opportunity, or if the market is already factoring in all of the company’s future growth.

Price-to-Earnings of 8.6x: Is it justified?

CoinShares International’s shares trade on a price-to-earnings (P/E) ratio of 8.6x, which stands out as considerably lower than both peers and industry benchmarks. With a last close price of SEK154.6, the stock appears undervalued versus its sector averages.

The price-to-earnings multiple tells investors how much they are paying for every unit of earnings. It is a commonly used benchmark for valuing companies, especially in the diversified financials sector, allowing quick comparisons between stocks.

At 8.6x, CoinShares International’s multiple is much lower than the European Capital Markets industry average of 15.9x and the peer group average of 24.4x. This indicates the market is pricing in far less future growth for CoinShares International than for many of its competitors and may be underestimating its prospects. The current P/E is also well below the estimated fair P/E of 19.7x, suggesting further upside if sentiment shifts.

Explore the SWS fair ratio for CoinShares International

Result: Price-to-Earnings of 8.6x (UNDERVALUED)

However, factors such as revenue growth volatility and discount to analyst price targets could pose challenges to the undervaluation story that investors are watching.

Find out about the key risks to this CoinShares International narrative.

Another View: SWS DCF Model Sheds Light

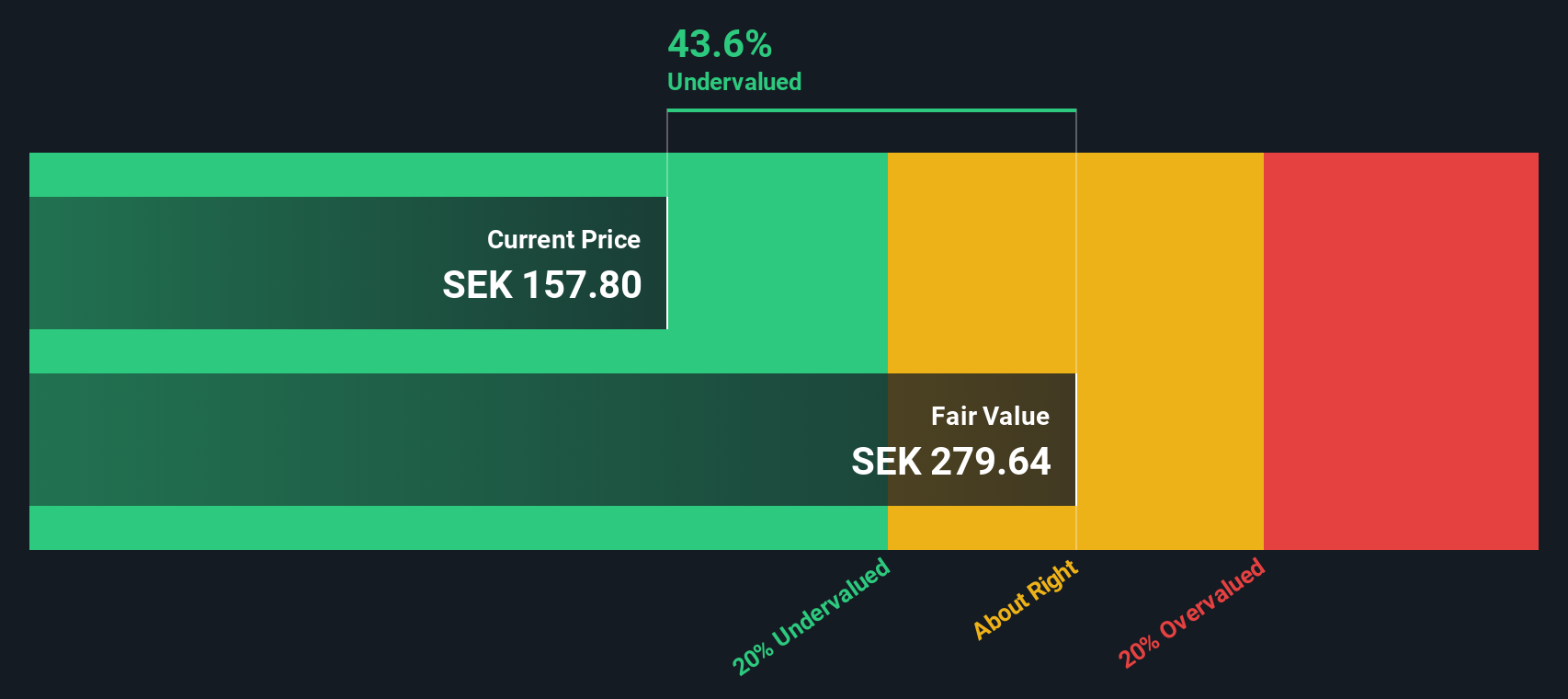

The SWS DCF model offers a different perspective on CoinShares International’s value. According to this model, the stock trades at a discount of more than 44% to estimated fair value, suggesting it could be deeply undervalued. Does this alternative approach reveal hidden upside, or is the market discounting risks that the DCF model overlooks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoinShares International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoinShares International Narrative

If you want to dig deeper or craft a different perspective, you can build your own view in just a few minutes. Start now with Do it your way

A great starting point for your CoinShares International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize this moment to power up your portfolio with fresh investment insights from Simply Wall Street’s powerful screener tools. Don’t let great opportunities slip past you.

- Boost your returns by tapping into these 896 undervalued stocks based on cash flows that are primed to outperform based on impressive cash flow fundamentals.

- Capitalize on the growth of digital finance by checking out these 78 cryptocurrency and blockchain stocks which are innovating in blockchain solutions and cryptocurrency markets.

- Unlock reliable income sources when you access these 19 dividend stocks with yields > 3% offering strong yields and stable payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CS

CoinShares International

Engages in the creating financial products with digital assets and blockchain technology business in Jersey.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives