- Sweden

- /

- Capital Markets

- /

- OM:BURE

The Bull Case For Bure Equity (OM:BURE) Could Change Following Steep Third-Quarter Losses and Revenue Decline

Reviewed by Sasha Jovanovic

- Bure Equity AB recently reported its third-quarter and nine-month results for the period ended September 30, 2025, revealing negative revenue of SEK 203 million for the quarter and a net loss of SEK 217 million, both reversing from strong positive figures a year earlier.

- This sharp turnaround in financial performance highlights significant challenges for the company, as both revenue and profitability saw a very large decline compared to the previous year.

- We'll explore how the steep shift from SEK millions in profit to a notable loss may shape Bure Equity's investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Bure Equity's Investment Narrative?

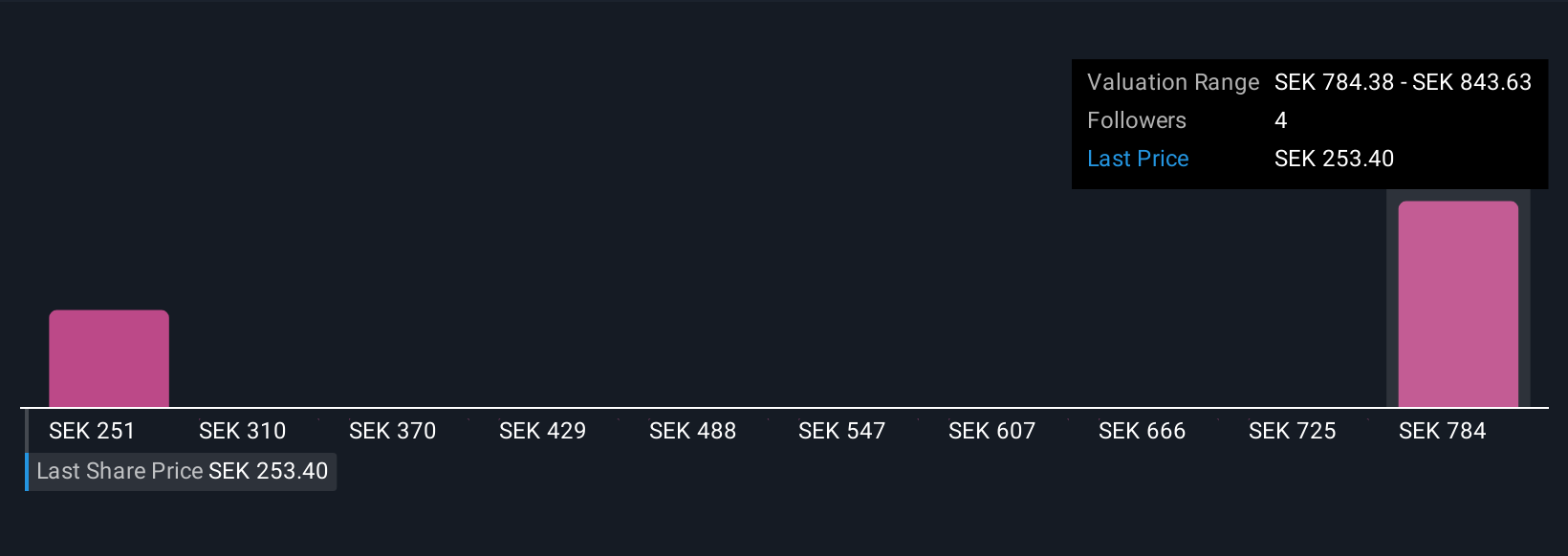

Being a Bure Equity shareholder means taking a long-term view on turnaround potential, even when near-term setbacks become acute. The newly reported SEK 203 million negative revenue and SEK 217 million net loss for Q3 2025 mark a sharp reversal from last year’s strong profits and paint a picture of a business currently facing heavier headwinds than most anticipated. This news resets some of the key near-term drivers: while the company has a seasoned management team and appears to trade well below many fair value estimates, questions around the sustainability of its portfolio, further write-downs, and the underlying causes of negative revenue now move front and centre. The short-term outlook for dividends, and whether management can arrest these losses, becomes the key catalyst and also the biggest risk. For anyone weighing the investment case, the scale and speed of these losses amplify what’s at stake. On the other hand, the risk of further portfolio write-downs is impossible to ignore.

Despite retreating, Bure Equity's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Bure Equity - why the stock might be worth over 3x more than the current price!

Build Your Own Bure Equity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bure Equity research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Bure Equity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bure Equity's overall financial health at a glance.

No Opportunity In Bure Equity?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bure Equity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BURE

Bure Equity

A private equity and venture capital firm specializing in secondary direct, later stage, middle market, mature, buyouts, mid venture, late venture, PIPES, bridge, industry consolidation, recapitalizations, growth capital, special situation and turnarounds.

Flawless balance sheet and good value.

Market Insights

Community Narratives