- Sweden

- /

- Commercial Services

- /

- OM:LOOMIS

Is Loomis’ (OM:LOOMIS) Buyback and Profit Growth Shaping a New Capital Allocation Narrative?

Reviewed by Sasha Jovanovic

- During the past quarter, Loomis AB completed the repurchase of 1,023,200 shares for SEK 399.23 million and reported third-quarter net income of SEK 528 million, up from SEK 481 million a year earlier.

- This combination of share buybacks and higher profitability highlights Loomis' efforts to enhance shareholder returns while delivering improved financial results.

- We will explore how Loomis' increased net income and ongoing buybacks contribute to its broader investment narrative and future outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Loomis Investment Narrative Recap

To own Loomis, one must believe in its ability to adapt legacy cash management to new opportunities in high-security logistics, automation, and digital payments. The recent boost in profitability and buybacks may support near-term sentiment, but they do not materially address the pivotal risk of declining cash-in-transit volumes in core European markets, given ongoing structural changes in payment preferences.

Loomis' Q3 results, showing net income growth to SEK 528 million and increased earnings per share, stand out as most pertinent, reinforcing the catalyst of operational efficiency and margin expansion. While these improvements reflect short-term execution, the underlying challenge remains whether Loomis can generate enough profitable diversification as demand for traditional services softens.

Yet, investors should also weigh the potential impact if digital payment adoption accelerates faster than Loomis' ability to diversify, especially since ...

Read the full narrative on Loomis (it's free!)

Loomis' narrative projects SEK33.0 billion in revenue and SEK3.1 billion in earnings by 2028. This requires 2.6% yearly revenue growth and an earnings increase of SEK1.4 billion from the current SEK1.7 billion.

Uncover how Loomis' forecasts yield a SEK452.67 fair value, a 24% upside to its current price.

Exploring Other Perspectives

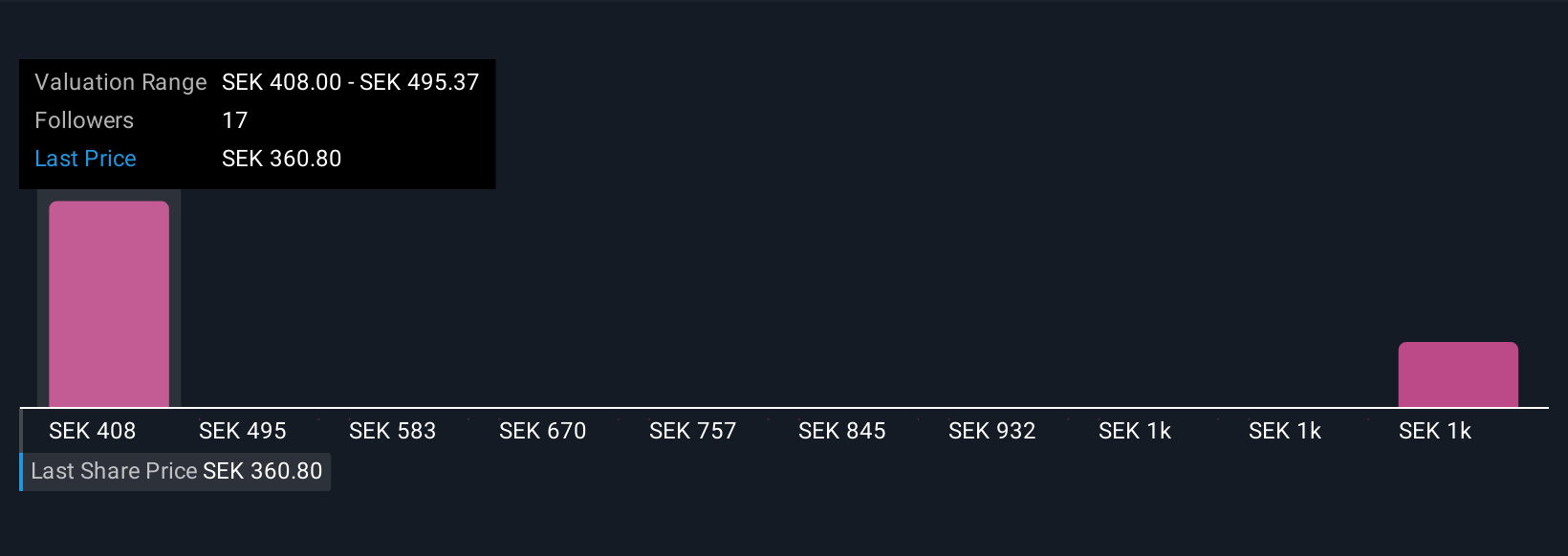

Simply Wall St Community members submitted five fair value estimates for Loomis, from SEK 408 to SEK 1,285,255, highlighting a broad spectrum of opinions. Against this diversity, the current focus on margin expansion speaks to the importance of studying both short-term gains and long-term risks before forming your own view.

Explore 5 other fair value estimates on Loomis - why the stock might be worth just SEK408.00!

Build Your Own Loomis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loomis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Loomis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loomis' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LOOMIS

Loomis

Provides secure payment solutions in the United States, France, Switzerland, Spain, the United Kingdom, Sweden, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives