- Sweden

- /

- Commercial Services

- /

- OM:ITAB

ITAB Shop Concept (OM:ITAB) Margin Drop Challenges Bullish Profit Growth Narratives

Reviewed by Simply Wall St

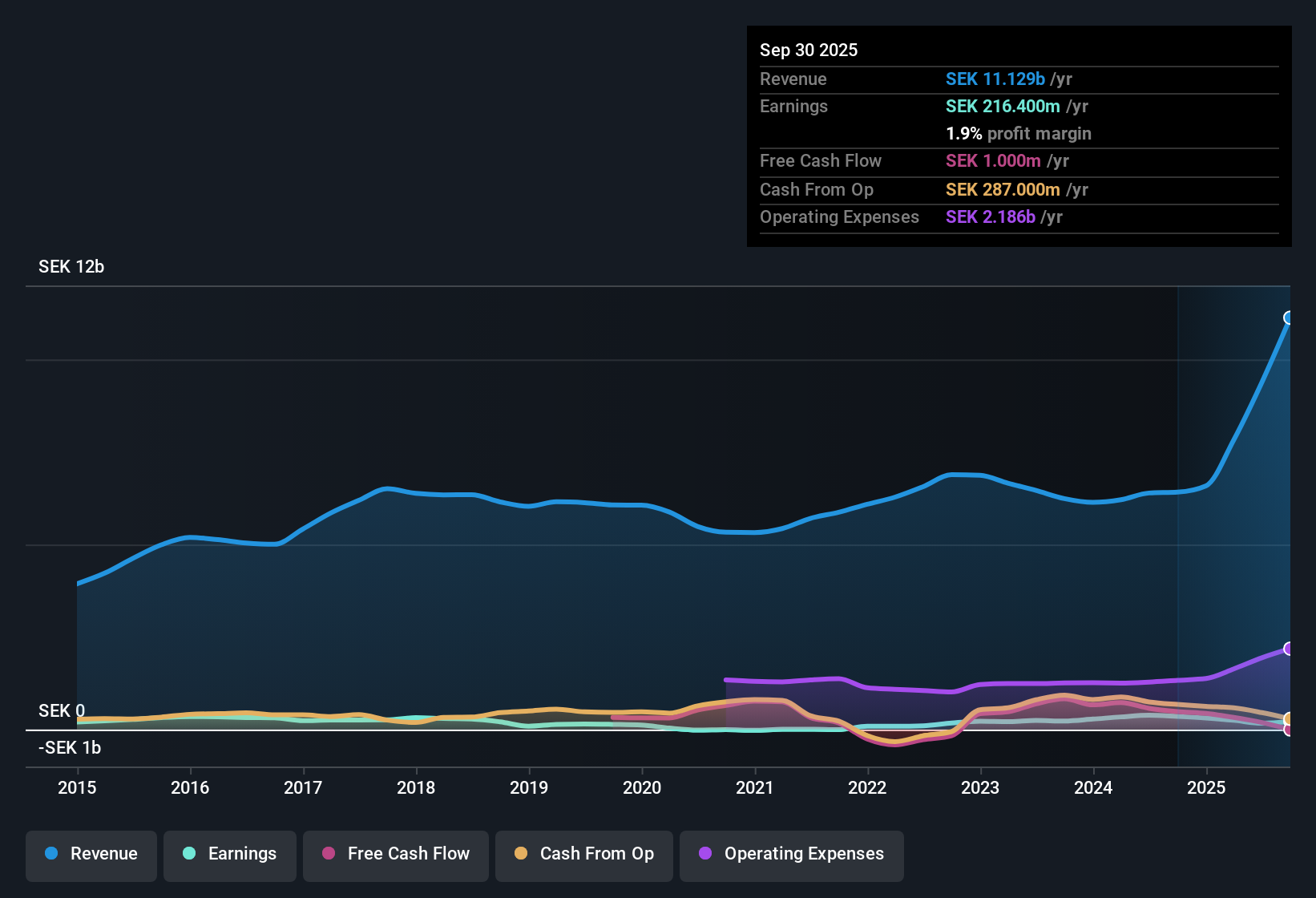

ITAB Shop Concept (OM:ITAB) is forecasting a striking 50.6% earnings growth per year, well above the Swedish market average of 12.9%. Over the last five years, ITAB has averaged annual earnings growth of 44%, but net profit margins have compressed to 1.8% from last year’s 6%. Revenue is expected to rise by 5% annually, outpacing the 3.8% market average, while shares trade at SEK 20.05, considerably below some analyst fair value estimates of SEK 89.5. Notably, the price-to-earnings ratio sits at 30.4x, placing it above both industry and peer averages, and investors are left weighing rapid growth against recent margin pressure and premium valuation.

See our full analysis for ITAB Shop Concept.Next, we compare these headline results with the major narratives shaping market sentiment to see which assumptions still hold water and which need a closer look.

See what the community is saying about ITAB Shop Concept

Analyst Price Target Implies 51% Upside

- The current share price stands at SEK 20.05, well below the analyst price target of SEK 30.33. This signals an implied upside of over 51%.

- According to the analysts' consensus view, the target assumes several big hurdles. Revenues would need to reach SEK 17.4 billion and earnings SEK 1.1 billion by 2028, along with a profit margin boost to 6.2%.

- Achieving these ambitious figures would require ITAB to more than quintuple its earnings from today’s SEK 168.4 million within a few years. At the same time, the price-to-earnings ratio would need to decrease to 10.8x in 2028 compared to the current 30.4x.

- The consensus expects the number of shares outstanding to rise by 6.48% per year. This adds further pressure to lift per-share earnings at a rapid pace for investors to realize that projected upside.

- For investors wondering if this surge is achievable, see how analysts stack the risks and upside in their balanced view. 📊 Read the full ITAB Shop Concept Consensus Narrative.

Margin Recovery Hinges on HMY Integration

- Net profit margin slid from 6% to 1.8% this year, even as sales are expected to rise ahead of the market. This shines a spotlight on the cost and efficiency impacts of absorbing HMY.

- The consensus narrative notes that while management is targeting a return to 6.2% net margins within three years, the shift toward solution-driven business and integration with HMY introduces execution risks that could delay or derail that margin recovery.

- Critics highlight that upfront investments and restructuring costs, especially in new markets like Southern Europe, may weigh heavier and longer on margins than bulls expect.

- At the same time, synergy gains remain a key pillar of the bullish argument. Any shortfall could undermine both confidence and ITAB’s valuation premium.

High PE Ratio Demands Flawless Growth Execution

- ITAB trades at a price-to-earnings multiple of 30.4x, nearly twice the industry average of 14.4x and well above peer group levels at 20.3x. This sets a high bar for the company to deliver on its growth story.

- The consensus narrative contends that for this premium to hold, investors must believe both revenue and profit margins can sharply improve. Recent margin compression and projected share dilution put added pressure on management to execute with precision.

- Any stumble on profitability or delays in capturing synergies from the HMY deal could quickly make this elevated valuation look unsustainable.

- Conversely, bulls see high recurring earnings quality and specialized solutions as justification for the premium. However, the numbers leave little margin for error.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ITAB Shop Concept on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you spot a different story in the figures? Take just a few moments to shape your own view and share it with others. Do it your way.

A great starting point for your ITAB Shop Concept research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

ITAB faces a challenging combination of razor-thin margins, demanding growth expectations, and a lofty valuation that leaves no room for missteps.

Want the odds more in your favor? Focus on stable growth stocks screener (2103 results) to see companies delivering reliable growth and consistent performance, regardless of the market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Develops, manufactures, sells, and installs store concepts for retail chain stores.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives